oled or lcd screen made in china

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

LCD manufacturers are mainly located in China, Taiwan, Korea, Japan. Almost all the lcd or TFT manufacturers have built or moved their lcd plants to China on the past decades. Top TFT lcd and oled display manufactuers including BOE, COST, Tianma, IVO from China mainland, and Innolux, AUO from Tianwan, but they have established factories in China mainland as well, and other small-middium sizes lcd manufacturers in China.

China flat display revenue has reached to Sixty billion US Dollars from 2020. there are 35 tft lcd lines (higher than 6 generation lines) in China,China is the best place for seeking the lcd manufacturers.

The first half of 2021, BOE revenue has been reached to twenty billion US dollars, increased more than 90% than thesame time of 2020, the main revenue is from TFT LCD, AMoled. BOE flexible amoled screens" output have been reach to 25KK pcs at the first half of 2021.the new display group Micro LED revenue has been increased to 0.25% of the total revenue as well.

Established in 1993 BOE Technology Group Co. Ltd. is the top1 tft lcd manufacturers in China, headquarter in Beijing, China, BOE has 4 lines of G6 AMOLED production lines that can make flexible OLED, BOE is the authorized screen supplier of Apple, Huawei, Xiaomi, etc,the first G10.5 TFT line is made in BOE.BOE main products is in large sizes of tft lcd panel,the maximum lcd sizes what BOE made is up to 110 inch tft panel, 8k resolution. BOE is the bigger supplier for flexible AM OLED in China.

As the market forecast of 2022, iPhone OLED purchasing quantity would reach 223 million pcs, more 40 million than 2021, the main suppliers of iPhone OLED screen are from Samsung display (61%), LG display (25%), BOE (14%). Samsung also plan to purchase 3.5 million pcs AMOLED screen from BOE for their Galaxy"s screen in 2022.

Technology Co., Ltd), established in 2009. CSOT is the company from TCL, CSOT has eight tft LCD panel plants, four tft lcd modules plants in Shenzhen, Wuhan, Huizhou, Suzhou, Guangzhou and in India. CSOTproviding panels and modules for TV and mobile

three decades.Tianma is the leader of small to medium size displays in technologyin China. Tianma have the tft panel factories in Shenzhen, Shanhai, Chendu, Xiamen city, Tianma"s Shenzhen factory could make the monochrome lcd panel and LCD module, TFT LCD module, TFT touch screen module. Tianma is top 1 manufactures in Automotive display screen and LTPS TFT panel.

Tianma and BOE are the top grade lcd manufacturers in China, because they are big lcd manufacturers, their minimum order quantity would be reached 30k pcs MOQ for small sizes lcd panel. price is also top grade, it might be more expensive 50%~80% than the market price.

Established in 2005, IVO is located in Kunsan,Jiangshu province, China, IVO have more than 3000 employee, 400 R&D employee, IVO have a G-5 tft panel production line, IVO products are including tft panel for notebook, automotive display, smart phone screen. 60% of IVO tft panel is for notebook application (TOP 6 in the worldwide), 23% for smart phone, 11% for automotive.

Besides the lcd manufacturers from China mainland,inGreater China region,there are other lcd manufacturers in Taiwan,even they started from Taiwan, they all have built the lcd plants in China mainland as well,let"s see the lcd manufacturers in Taiwan:

Chimei Innolux Corporation was the successor company, and it initially preserved the Chimei name. In order to differentiate itself from the ChiMei brand, the company was renamed "Innolux Corporation" in December 2012.

Innolux"s 14 plants in Taiwan possess a complete range of 3.5G, 4G, 4.5G, 5G, 6G, 7.5G, and 8.5G-8.6G production line in Taiwan and China mainland, offering a full range of large/medium/small LCD panels and touch-control screens.including 4K2K ultra-high resolution, 3D naked eye, IGZO, LTPS, AMOLED, OLED, and touch-control solutions,full range of TFT LCD panel modules and touch panels, including TV panels, desktop monitors, notebook computer panels, small and medium-sized panels, and medical and automotive panels.

AUO is the tft lcd panel manufacturers in Taiwan,AUO has the lcd factories in Tianma and China mainland,AUOOffer the full range of display products with industry-leading display technology,such as 8K4K resolution TFT lcd panel, wide color gamut, high dynamic range, mini LED backlight, ultra high refresh rate, ultra high brightness and low power consumption. AUO is also actively developing curved, super slim, bezel-less, extreme narrow bezel and free-form technologies that boast aesthetic beauty in terms of design.Micro LED, flexible and foldable AMOLED, and fingerprint sensing technologies were also developed for people to enjoy a new smart living experience.

Hannstar was found in 1998 in Taiwan, Hannstar display hasG5.3 TFT-LCD factory in Tainan and the Nanjing LCM/Touch factories, providing various products and focus on the vertical integration of industrial resources, creating new products for future applications and business models.

driver, backlight etc ,then make it to tft lcd module. so its price is also more expensive than many other lcd module manufacturers in China mainland.

Maclight is a China based display company, located in Shenzhen, China. ISO9001 certified, as a company that more than 10 years working experiences in display, Maclight has the good relationship with top tft panel manufacturers, it guarantee that we could provide a long term stable supply in our products, we commit our products with reliable quality and competitive prices.

Maclight products included monochrome lcd, TFT lcd module and OLED display, touch screen module, Maclight is special in custom lcd display, Sunlight readable tft lcd module, tft lcd with capacitive touch screen. Maclight is the leader of round lcd display. Maclight is also the long term supplier for many lcd companies in USA and Europe.

If you want tobuy lcd moduleorbuy tft screenfrom China with good quality and competitive price, Maclight would be a best choice for your glowing business.

In recent time, China domestic companies like BOE have overtaken LCD manufacturers from Korea and Japan. For the first three quarters of 2020, China LCD companies shipped 97.01 million square meters TFT LCD. And China"s LCD display manufacturers expect to grab 70% global LCD panel shipments very soon.

BOE started LCD manufacturing in 1994, and has grown into the largest LCD manufacturers in the world. Who has the 1st generation 10.5 TFT LCD production line. BOE"s LCD products are widely used in areas like TV, monitor, mobile phone, laptop computer etc.

TianMa Microelectronics is a professional LCD and LCM manufacturer. The company owns generation 4.5 TFT LCD production lines, mainly focuses on making medium to small size LCD product. TianMa works on consult, design and manufacturing of LCD display. Its LCDs are used in medical, instrument, telecommunication and auto industries.

TCL CSOT (TCL China Star Optoelectronics Technology Co., Ltd), established in November, 2009. TCL has six LCD panel production lines commissioned, providing panels and modules for TV and mobile products. The products range from large, small & medium display panel and touch modules.

Everdisplay Optronics (Shanghai) Co.,Ltd.(EDO) is a company dedicated to production of small-to-medium AMOLED display and research of next generation technology. The company currently has generation 4.5 OLED line.

Established in 1996, Topway is a high-tech enterprise specializing in the design and manufacturing of industrial LCD module. Topway"s TFT LCD displays are known worldwide for their flexible use, reliable quality and reliable support. More than 20 years expertise coupled with longevity of LCD modules make Topway a trustworthy partner for decades. CMRC (market research institution belonged to Statistics China before) named Topway one of the top 10 LCD manufactures in China.

Founded in 2006, K&D Technology makes TFT-LCM, touch screen, finger print recognition and backlight. Its products are used in smart phone, tablet computer, laptop computer and so on.

Established in 2013, Eternal Material Technology is committed to the research, development and manufacturing of electronic materials and providing technical services. EMT is leading the industry with its products of OLED and color photoresist materials.

The Company engages in the R&D, manufacturing, and sale of LCD panels. It offers LCD panels for notebook computers, desktop computer monitors, LCD TV sets, vehicle-mounted IPC, consumer electronics products, mobile devices, tablet PCs, desktop PCs, and industrial displays.

Founded in 2008,Yunnan OLiGHTEK Opto-Electronic Technology Co.,Ltd. dedicated themselves to developing high definition AMOLED (Active Matrix-Organic Light Emitting Diode) technology and micro-displays.

In Topway, we work side by side to help you overcome any technical and none technical challenges that may arise during product design, manufacture or installation. We can even take care of component sourcing and manufacturing for you.

Over the years, with the wider and wider application of LCD screens, more and more brand products have been favored by the people. Together, more and more LCD manufacturers have emerged. Of course, the most popular brands in China are BOE, INNOLUX, CHIMEI, AUO, CSOT, etc. So, Which is the best brand of

It is better to say who is more professional than good or bad. In fact, the above mentioned LCD screen manufacturers are very professional, and the quality is guaranteed. But the most popular must be BOE and INNOLUX, these two panel manufacturers are also obvious to all. They all have multiple distributors, but not every distributor has the best size and price.

SZ XIANHENG TECHNOLOGY CO., LTD. is the agent of AUO, BOE, INNOLUX, SHARP, IVO and Mitsubishi, and other domestic and foreign well-known brands of small and medium-sized LCD display; specializing in customized production of touch screen display, LCD and industrial touch display and other high-tech products. According to the needs of customers, we can provide various LCD products: high-brightness LCD screen, LCD driver board, touch screen, booster board, all kinds of LCD special wires, etc. to produce industrial displays.

What brand of LCD screen is good? If you choose BOE, INNOLUX, CHIMEI, AUO or CSOT, you can buy them from us. 18.5 inch LCD screen, 21.5 inch LCD screen and other small and medium size, our price is the lowest in the industry.

Download "Maeil Business Pulse" from Google Play or App Store for access to up-to-the-minute and around-the-clock news on Korean economy, business, finances, and market-moving topics.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

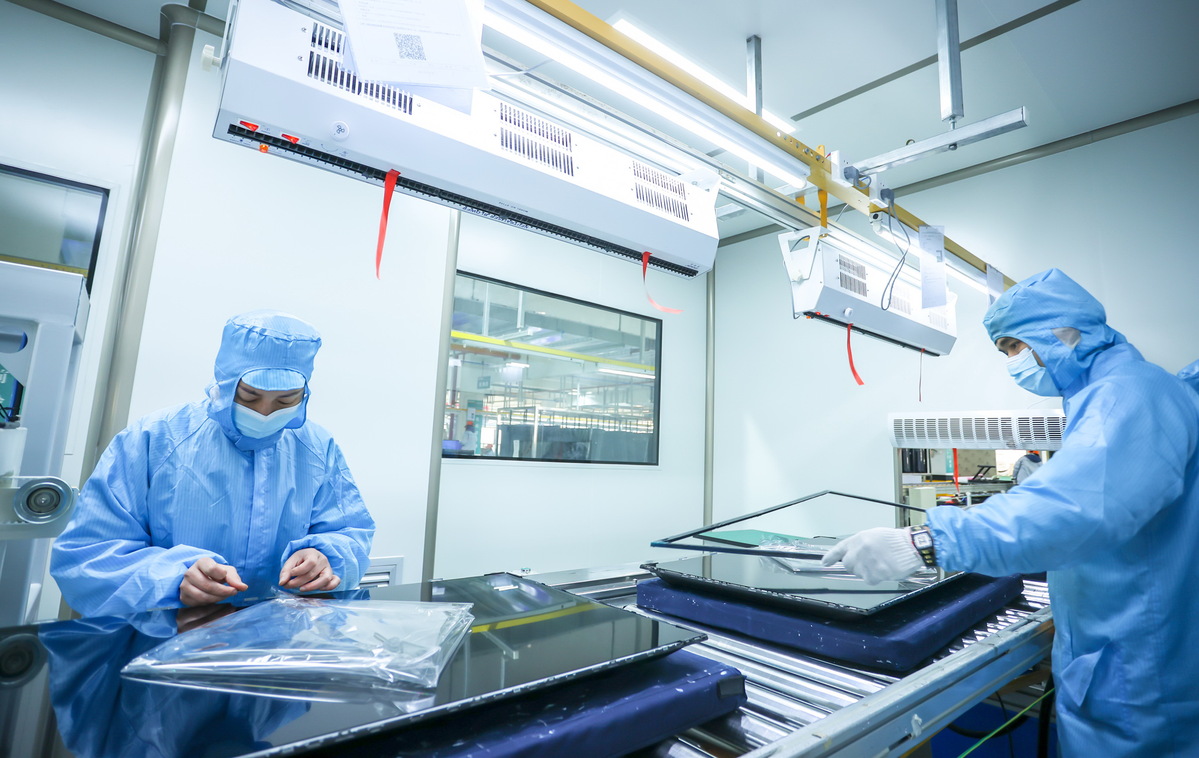

Employees put finishing touches to TV displays at a production facility in Suining, Sichuan province, in November. [Photo by Liu Changsong/For China Daily]

China is set to take a lead in the state-of-the-art organic light-emitting diodes (OLED) semiconductor display technology, which has broad application prospects in the field of high-end smartphones, televisions, wearable devices, augmented reality and virtual reality display segments, industry analysts said.

OLED is a relatively new technology and part of the recent innovations in displays. It has a fast response rate, wide viewing angles, super high-contrast images and richer colors. It is thinner and can be made flexible and foldable, compared with the traditional LCD display panel.

The shipment of OLED panels used in smartphones is expected to rise to about 100 million units in the Chinese market this year from 83 million units last year, as major smartphone makers have ramped up efforts to launch foldable handsets, said Sigmaintell Consulting, a Beijing-based market research firm.

Display panel supplier BOE Technology Group Co Ltd topped the domestic market with OLED panel shipments of 16 million units in the third quarter. It became the world"s second-largest OLED maker next to South Korea"s Samsung Display. Visionox Technology Inc took second place domestically with shipments of 6.3 million units in the third quarter.

China will overtake South Korea to become the biggest OLED manufacturer by 2024, as more Chinese companies have invested heavily in new OLED production lines, said Zhou Hua, chief analyst at CINNO Research, a Chinese flat panel display consultancy firm.

Zhou said that at present, China has become the world"s largest display panel producer, and is foreseen accounting for about 76 percent of global OLED production capacity by 2025.

Li Yaqin, general manager of Sigmaintell, said demand for flexible OLED panels used in foldable smartphones will continue to increase this year on the back of commercial application of 5G technology, and panel makers should further improve their yield rate capacities and reduce production costs.

According to market research company Omdia, OLED panel shipments for smartphones will reach 812 million units globally next year, an increase of 38.8 percent compared with the estimated 585 million units in 2021.

Chinese smartphone makers have increased the number of high-end smartphones integrating flexible active-matrix organic light-emitting diodes, or AMOLED, panels, said Brian Huh, principal analyst of small and medium-sized displays at Omdia.

Xu Fengying, vice-president of Visionox, said AMOLED panels will have wider applications in smartphones, computers, smart wearables, vehicles, virtual reality and augmented reality because of surging demand for flexible display screens.

"The AMOLED market will continue to grow, and the penetration rate of flexible display products is expected to rise," said Zhu Xiujian, general manager of Visionox"s product engineering center, adding the flexible and foldable screens will play a vital role in bolstering the growth of small and medium-sized smartphones.

Chinese television maker Skyworth Group has been producing OLED TVs in partnership with South Korea"s largest panel maker, LG Display, since 2013. Other home appliance manufacturers such as Hisense, Konka, Huawei and Sony have also tapped into the OLED TV market.

OLED TVs will become the future development direction of the TV industry and present an opportunity for TV manufacturers to expand their profit margins, said Wen Jianping, president of Beijing-based market consultancy All View Cloud.

► When the leading Korean players Samsung Display and LG Display exit LCD production, BOE will be the most significant player in the LCD market. Though OLED can replace the LCD, it will take years for it to be fully replaced.

► As foreign companies control evaporation material and machines, panel manufacturers seek a cheaper way to mass-produce OLED panels – inkjet printing.

When mainstream consumer electronics brands choose their device panels, the top three choices are Samsung Display, LG Display (LGD) and BOE (000725:SZ) – the first two from Korea and the third from China. From liquid-crystal displays (LCD) to active-matrix organic light-emitting diode (AMOLED), display panel technology has been upgrading with bigger screen products.

From the early 1990s, LCDs appeared and replaced cathode-ray tube (CRT) screens, which enabled lighter and thinner display devices. Japanese electronics companies like JDI pioneered the panel technology upgrade while Samsung Display and LGD were nobodies in the field. Every technology upgrade or revolution is a chance for new players to disrupt the old paradigm.

The landscape was changed in 2001 when Korean players firstly made a breakthrough in the Gen 5 panel technology – the later the generation, the bigger the panel size. A large panel size allows display manufacturers to cut more display screens from one panel and create bigger-screen products. "The bigger the better" is a motto for panel makers as the cost can be controlled better and they can offer bigger-size products to satisfy the burgeoning middle-class" needs.

LCD panel makers have been striving to realize bigger-size products in the past four decades. The technology breakthrough of Gen 5 in 2002 made big-screen LCD TV available and it sent Samsung Display and LGD to the front row, squeezing the market share of Japanese panel makers.

The throne chair of LCD passed from Japanese companies to Korean enterprises – and now Chinese players are clinching it, replacing the Koreans. After twenty years of development, Chinese panel makers have mastered LCD panel technology and actively engage in large panel R&D projects. Mass production created a supply surplus that led to drops in LCD price. In May 2020, Samsung Display announced that it would shut down all LCD fabs in China and Korea but concentrate on quantum dot LCD (Samsung calls it QLED) production; LGD stated that it would close LCD TV panel fabs in Korea and focus on organic LED (OLED). Their retreats left BOE and China Stars to digest the LCD market share.

Consumer preference has been changing during the Korean fab"s recession: Bigger-or-not is fine but better image quality ranks first. While LCD needs the backlight to show colors and substrates for the liquid crystal layer, OLED enables lighter and flexible screens (curvy or foldable), higher resolution and improved color display. It itself can emit lights – no backlight or liquid layer is needed. With the above advantages, OLED has been replacing the less-profitable LCD screens.

Samsung Display has been the major screen supplier for high-end consumer electronics, like its own flagship cell phone products and Apple"s iPhone series. LGD dominated the large OLED TV market as it is the one that handles large-size OLED mass production. To further understand Korean panel makers" monopolizing position, it is worth mentioning fine metal mask (FMM), a critical part of the OLED RGB evaporation process – a process in OLED mass production that significantly affects the yield rate.

Prior to 2018, Samsung Display and DNP"s monopolistic supply contract prevented other panel fabs from acquiring quality FMM products as DNP bonded with Hitachi Metal, the "only" FMM material provider choice for OLED makers. After the contract expired, panel makers like BOE could purchase FFM from DNP for their OLED R&D and mass production. Except for FFM materials, vacuum evaporation equipment is dominated by Canon Tokki, a Japanese company. Its role in the OLED industry resembles that of ASML in the integrated circuit space. Canon Tokki"s annual production of vacuum evaporation equipment is fewer than ten and thereby limits the total production of OLED panels that rely on evaporation technology.

The shortage of equipment and scarcity of materials inspired panel fabs to explore substitute technology; they discovered that inkjet printing has the potential to be the thing to replace evaporation. Plus, evaporation could be applied to QLED panels as quantum dots are difficult to be vaporized. Inkjet printing prints materials (liquefied organic gas or quantum dots) to substrates, saving materials and breaking free from FMM"s size restriction. With the new tech, large-size OLED panels can theoretically be recognized with improved yield rate and cost-efficiency. However, the tech is at an early stage when inkjet printing precision could not meet panel manufacturers" requirements.

Display and LGD are using evaporation on their OLED products. To summarize, OLED currently adopts evaporation and QLED must go with inkjet printing, but evaporation is a more mature tech. Technology adoption will determine a different track for the company to pursue. With inkjet printing technology, players are at a similar starting point, which is a chance for all to run to the front – so it is for Chinese panel fabs. Certainly, panel production involves more technologies (like flexible panels) than evaporation or inkjet printing and only mastering all required technologies can help a company to compete at the same level.

Presently, Chinese panel fabs are investing heavily in OLED production while betting on QLED. BOE has four Gen 6 OLED product lines, four Gen 8.5 and one Gen 10.5 LCD lines; China Star, controlled by the major appliance titan TCL, has invested two Gen 6 OLED fabs and four large-size LCD product lines.

Remembering the last "regime change" that occurred in 2005 when Korean fabs overtook Japanese" place in the LCD market, the new phase of panel technology changed the outlook of the industry. Now, OLED or QLED could mark the perfect time for us to expect landscape change.

After Samsung Display and LGD ceding from LCD TV productions, the vacant market share will be digested by BOE, China Star and other LCD makers. Indeed, OLED and QLED have the potential to take over the LCD market in the future, but the process may take more than a decade. Korean companies took ten years from panel fab"s research on OLED to mass production of small- and medium-size OLED electronics. Yet, LCD screen cell phones are still available in the market.

LCD will not disappear until OLED/QLED"s cost control can compete with it. The low- to middle-end panel market still prefers cheap LCD devices and consumers are satisfied with LCD products – thicker but cheaper. BOE has been the largest TV panel maker since 2019. As estimated by Informa, BOE and China Star will hold a duopoly on the flat panel display market.

BOE"s performance seems to have ridden on a roller coaster ride in the past several years. Large-size panel mass production like Gen 8.5 and Gen 10.5 fabs helped BOE recognize the first place in production volume. On the other side, expanded large-size panel factories and expenses of OLED product lines are costly: BOE planned to spend CNY 176.24 billion (USD 25.92 billion) – more than Tibet"s 2019 GDP CNY 169.78 billion – on Chengdu and Mianyang"s Gen 6 AMOLED lines and Hefei and Wuhan"s Gen 10.5 LCD lines.

Except for making large-size TVs, bigger panels can cut out more display screens for smaller devices like laptops and cell phones, which are more profitable than TV products. On its first-half earnings concall, BOE said that it is shifting its production focus to cell phone and laptop products as they are more profitable than TV products. TV, IT and cell phone products counted for 30%, 44% and 33% of its productions respectively and the recent rising TV price may lead to an increased portion of TV products in the short term.

Except for outdoor large screens, TV is another driver that pushes panel makers to research on how to make bigger and bigger screens. A research done by CHEARI showed that Chinese TV sales dropped by 10.6% to CNY 128.2 billion from 2018 to 2019. Large-size TV sales increased as a total but the unit price decreased; high-end products like laser TV and OLED TV saw a strong growth of 131.2% and 34.1%, respectively.

The change in TV sales responded to a lifestyle change since the 4G era: people are getting more and more used to enjoy streaming services on portable devices like tablets and smartphones. The ‘disappearing living room" is a phenomenon common for the young generation in Chinese tier-1 cities.

Millions of young white-collars support the co-leasing business in China and breed the six-billion-dollar Ziroom, a unicorn company that provides rental and real estate management services. As apartments can be leased by single rooms instead of the whole apartment, living rooms become a public area while tenants prefer to stay in their private zones – it hints that the bedroom is too small to fit in a TV.

Besides the tier-1 cities" "disappearing living rooms," the mobile Internet gives another reason to explain the declining TV sale in China. Various streaming services and high-speed networks allow people to watch programs wherever and whenever they would like to. However, the change in life does not imply TV will disappear. For families, the living room is still a place for family members to gather and have fun. The growth of high-end TV sales also tells the "living room" economy.

The demand for different products may vary as lifestyles change and panel fabs need to make on-time judgments and respond to the change. For instance, the coming Olympics is a new driving factor to boost TV sales; "smart city" projects around the world will need more screens for data visualization; people will own more screens and better screens when life quality improves. Flexible screens, cost-efficient production process, accessible materials, changing market and all these problems are indeed the next opportunity for the industry.

According to recent reports, LCD display manufacturing has now been taken over by Chinese manufacturers. Display makers like LG, Samsung, and others are now leaving the LCD display market for Chinese brands. These companies are now focusing on the OLED market. However, cheap smartphones will still make use of LCD displays. This means that more companies will now rely on these Chinese brands. According to a recent report, BOE may develop panels for Samsung’s entry-level models. These models will include the Samsung Galaxy A13, Galaxy A23, and other models.

Both Samsung and BOE are world-renowned screen R&D and product manufacturers. Their products are widely used by smartphone manufacturers. However, there are still some differences between the two. In addition to the related business of screen production, Samsung’s smartphones also occupy a considerable share of the market. However, BOE does not have its own smartphone products for the time being. The company focuses on supplying its displays to several mobile phone manufacturers.

As one of the most important screen manufacturers in China, BOE has close ties with various mobile phone manufacturers. This time, it was reported that among the iPhones made by Apple, the screens produced by BOE account for about 20% of the share. Apple is a world-renowned technology company, and it has always been strict with its products. Being able to enter Apple’s supply chain shows that BOE Screen is already very good in quality. Several other major Chinese manufacturers, such as Huawei and Xiaomi, also have many models that use BOE screens.

There is news that BOE is only developing panels for Samsung’s entry-level models. However, according to relevant industry sources, at the end of March, Samsung had proposed to BOE to supply the next-generation flagship smartphone panel. According to reports, both companies are currently discussing technical verification and contract signing. If this is true and goes well, perhaps we will see the appearance of Chinese screens on future Samsung flagship phones.

Samsung originally planned to stop the production of LCD panels by the end of 2020. However, the LCD panel market started to increase prices in the past year or so. This made Samsung’s LCD factory continue to operate for another two years. However, the company originally plans to exit the market at the end of 2022. Nevertheless, the LCD panel market has changed since the end of last year. The price has been falling significantly and it is now on a free fall. By January this year, the average price of a 32 -inch panel was only $ 38, a 64% drop relative to January last year.

AfghanistanAlbaniaAlgeriaAmerican SamoaAndorraAngolaAnguillaAntigua and BarbudaArgentinaArmeniaArubaAscensionAustraliaAustriaAzerbaijanBahamasBahrainBangladeshBarbadosBelarusBelgiumBelizeBeninBermudaBhutanBoliviaBosnia-HercegovinaBotswanaBrazilBritish Indian Ocean TerritoryBruneiBulgariaBurkina FasoBurundiCambodiaCameroonCanadaCape VerdeCayman IslandsCentral African RepublicChadChileChinaChristmas IslandCocos (Keeling) IslandsColombiaComorosCongoCongo, Dem Rep ofCook IslandsCosta RicaCroatiaCubaCyprusCzech RepublicDenmarkDjiboutiDominicaDominican RepublicEast TimorEcuadorEgyptEl SalvadorEquatorial GuineaEritreaEstoniaEthiopiaFalkland IslandsFaroe IslandsFijiFinlandFranceFrench GuianaFrench PolynesiaFrench Southern TerritoriesGabonGambiaGeorgiaGermanyGhanaGibraltarGreeceGreenlandGrenadaGuadeloupeGuamGuatemalaGuineaGuinea-BissauGuyanaHaitiHeard Island and McDonald IsHondurasHungaryIcelandIndiaIndonesiaIranIraqIrelandIsraelItalyIvory CoastJamaicaJapan 曰本JordanKazakhstanKenyaKirgizstanKiribatiKosovoKuwaitLaosLatviaLebanonLeeward IslesLesothoLiberiaLibyaLiechtensteinLithuaniaLuxembourgMacauMacedonia, FYRMadagascarMalawiMalaysiaMaldivesMaliMaltaMarshall IslandsMartiniqueMauritaniaMauritiusMayotteMexicoMicronesia, Fed States ofMoldovaMonacoMongoliaMontenegroMontserratMoroccoMozambiqueMyanmarNamibiaNauruNepalNetherlandsNetherlands AntillesNew CaledoniaNew ZealandNicaraguaNigerNigeriaNorfolk IslandNorth KoreaNorthern Mariana IslandsNorwayOmanPakistanPalauPalestinePanamaPapua New GuineaParaguayPeruPhilippinesPitcairn IslandPolandPortugalPuerto RicoQatarReunionRomaniaRussiaRwandaST MartinSaint HelenaSaint Kitts and NevisSaint LuciaSaint Vincent and GrenadinesSamoaSao Tome and PrincipeSaudi ArabiaSenegalSerbiaSeychellesSierra LeoneSlovakiaSloveniaSolomon IslandsSomaliaSouth AfricaSouth GeorgiaSpainSri LankaSudanSurinameSwazilandSwedenSwitzerlandSyriaTaiwanTajikistanTanzaniaThailandTogoTokelauTongaTrinidad and TobagoTunisiaTurkeyTurkmenistanTurks and Caicos IslandsTuvaluUS Minor Outlying IsUgandaUkraineUnited Arab EmiratesUnited KingdomUruguayUzbekistanVanuatuVenezuelaVietnamVirgin Islands, BritishVirgin Islands, USWallis and FutunaYemenZambiaZimbabwe

RTX TECHNOLOGY CO.,LIMITED was built in 2012, who is a professional distributor of electronic components .Our main business is military and industrial integrated circuit (IC) .For the best service and your most conveniently purchase ,we also offer bill of material list (BOM list ) quote and supply ,include resistors,modules capacitors , transistors, LEDs, connectors ,etc .Our business philosophy is “ Best products ,Best reputation, Best efficiency ,Best service and Reasonable price” since the company established . we gain lots of support and trust for our professionalism and dedication . To be your reliable and convenient purchasing partner is our goal . to be the world-class electronic components distribution partner is our purpose .

According to the Korean media reports, BOE’s OLED screen will give a strong competition to Samsung in the next 2 years. BOE may start shipping the OLED panels to Apple in 2020. According to the South Korean analysts, BOE will ship 45 million OLED panels for the iPhone in 2021.

Samsung will still keep the bulk of iPhone orders, but the orders have dropped last year. Samsung has been the biggest OLED display supplier to Apple’s iPhone in 2017.

It was first suggested back in 2017 that BOE was pitching Apple for OLED orders, with a report in February of this year that Apple was considering this. The idea was boosted by a subsequent report that BOE was investing in the same next-generation OLED tech as Samsung.

Existing iPhone screens have a separate touch-sensitive layer which sits on top of the actual display. But Samsung offers a next-generation design known as touch-integrated flexible OLED panels which, as the name suggests, allow both jobs to be achieved within a single layer.

The Korea Herald today reports that Chinese display manufacturer BOE is investing in the same technology. It has already picked up orders from Huawei and is hoping to do the same with Apple.

Apple likes to diversify its supply-chain, one reason it has supported rescue plans for Japan Display, another potential supplier of OLED screens for future iPhones. So both Chinese-made OLED screens and Japanese ones are likely to be on the cards in the next few years.

The Korean display industry drove Korea’s exports, making Korea a display powerhouse in the world one exporter just 10 years ago. But it has been put into a position to completely lose its power as Korea’s national strategic industry due to a price war initiated by Chinese display makers and a complex global crisis.

LG Display and Samsung Display are struggling to find their ways out of the deterioration of their performance even after withdrawing from production of liquid crystal display (LCD) panels. The high-priced organic light emitting diode (OLED) panel sector regarded as a future growth engine is not growing fast due to the economic downturn. Even in the OLED panel sector, Chinese display makers are within striking distance of Korean display makers, experts say.

On Aug. 30, Display Supply Chain Consultants (DSCC), a market research company, predicted that LCD TV panel prices hit an all-time low in August and that an L-shaped recession will continue in the fourth quarter. According to DSCC, the average price of a 65-inch ultra-high-definition (UHD) panel in August was only US$109, a 62 percent drop from the highest price of US$288 recorded in July in 2021. The average price of a 75-inch UHD panel was only US$218, which was only about half of the highest price of US$410 in July last year. DSCC predicted that the average panel price in the third quarter will fall by 15.7 percent. As Chinese companies’ price war and the effect of stagnation in consumption overlapped, the more LCD panels display makers produce, the more loss they suffer.

As panel prices fell, manufacturers responded by lowering facility utilization rates. DSCC said that the LCD factory utilization rate descended from 87 percent in April to 83 percent in May, 73 percent in June, and 70 percent in July.

Now that the LCD panel business has become no longer lucrative, Korean display makers have shut down their LCD business or shrunk their sizes. In the LCD sector, China has outpaced Korea since 2018. China’s LCD market share reached 50.9 percent in 2021, while that of Korea dropped to 14.4 percent, lower than Taiwan’s 31.6 percent.

Samsung Display already announced its withdrawal from the LCD business in June. Only 10 years have passed since the company was spun off from Samsung Electronics in 2012. LG Display has decided to halt domestic LCD TV panel production until 2023 and reorganize its business structure centering on OLED panels. Its Chinese LCD production line will be gradually converted to produce LCD panels for IT or commercial products. TrendForce predicted that LG Display will stop operating its P7 Plant in the first quarter of next year.

Korean display makers’ waning LCD business led to a situation in which Korea even lost first place in the display industry. Korea with a display market share of 33.2 percent was already overtaken by China with 41.5 percent) in 2021 according to market researcher Omdia and the Korea Display Industry Association. Korea’s market share has never rebounded in for five years since 2017 amid the Korean government’s neglect. Seventeen years have passed since 2004 when Korea overtook Japan to rise to the top of the world in the LCD industry. Korea’s LCD exports amounted to more than US$30 billion in 2014, but fell to US$21.4 billion last year.

A bigger problem is that Korean display makers may lose its leadership in the OLED panel sector although it is still standing at the top spot. While Korea’s OLED market share fell from 98.1 percent in 2016 to 82.8 percent last year, that of China rose from 1.1 percent to 16.6 percent. Considering that the high-end TV market is highly likely to shrink for the time being due to a full-fledged global consumption contraction, some analysts say that the technology gap between Korea and China can be sharply narrowed through this looming TV market slump. According to industry sources, the Chinese government is now focusing on giving subsidies to the development of OLED panel technology rather LCD technology. On the other hand, in Korea, displays were also wiped out from national strategic technology industry items under the Restriction of Special Taxation Act which can receive tax benefits for R&D activities on displays.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

China"s BOE introduced the world"s largest 8K organic light emitting diode (OLED) panel for the first time. China Star Optoelectronics Technology (CSOT), a subsidiary of TCL, also developed a 60-inch large OLED panel for the first time. China"s attacks has begun to break down the strongholds of LG and Samsung, the only companies in the world that mass-produced large OLEDs. In order not to follow in the footsteps of liquid crystal display (LCD) train that allowed China to take the leading spot, government-level support for the display industry is desperately needed.

At the Society for Information Display (SID) 2022 held in San Jose, California, U.S. for three days from the 10th (local time), Chinese display companies poured out a many new next-generation display technologies such as large OLEDs and micro LEDs.

BOE installed a 95-inch 8K OLED panel at the front of the exhibition. This is the first time that BOE has introduced a large-size OLED at an international exhibition.

By releasing the industry"s largest 8K OLED panel, they demonstrated their technological prowess that it can develop large-scale products. However, this product had less than half of LG products with a luminance (brightness) of up to 800 nitro.

An official at BOE said, "We have not yet ironed out a specific plan for large-scale OLED mass production, but at any time we may prepare for mass production."

BOE installed a super-large micro LED at the entrance of the exhibition hall. MicroLED refers to an LED element size of 100 micrometers (㎛) or less. BOE microLED was found to be 90㎛ horizontally and 120㎛ vertically.

CSOT also unveiled a large OLED panel. CSOT introduced a 65-inch 8K OLED panel for the first time. This product was manufactured using inkjet printing process technology. It is a method of printing OLED light emitting material on a substrate like an inkjet printer. CSOT also exhibited a large number of small and medium-sized low-temperature polycrystalline oxide (LTPO) OLED panels for mobile use. It is a stepping stone aimed at entering Apple"s iPhone supply chain.

Experts analyzed that China, which has become the world"s leader in display, is catching up quickly in the large OLED market thanks to aggressive investment and astronomical government support. The Chinese government is providing full support to display companies, including free land support, subsidies for manufacturing facilities, and corporate tax reductions. China is planning to mass-produce large-scale OLEDs from China in just one to two years.

Although there is still a technology gap with South Korean companies in the large OLED market, some point out that it is only a matter of time before China catches up with South Korea.

"The Chinese government is investing enormous benefits and support to provide subsidies when display companies make a deficit," said Jang-hyuk Kwon, a professor of information display at Kyung Hee University. "Our government should also widen the technology gap with full support in the display industry," he added.

China is set to take a lead in the state-of-the-art organic light-emitting diodes (OLED) semiconductor display technology, which has broad application prospects in the field of high-end smartphones, televisions, wearable devices, augmented reality and virtual reality display segments, industry analysts said.

OLED is a relatively new technology and part of the recent innovations in displays. It has a fast response rate, wide viewing angles, super high-contrast images and richer colors. It is thinner and can be made flexible and foldable, compared with the traditional LCD display panel.

The shipment of OLED panels used in smartphones is expected to rise to about 100 million units in the Chinese market this year from 83 million units last year, as major smartphone makers have ramped up efforts to launch foldable handsets, said Sigmaintell Consulting, a Beijing-based market research firm.

Display panel supplier BOE Technology Group Co Ltd topped the domestic market with OLED panel shipments of 16 million units in the third quarter. It became the world"s second-largest OLED maker next to South Korea"s Samsung Display. Visionox Technology Inc took second place domestically with shipments of 6.3 million units in the third quarter.

China will overtake South Korea to become the biggest OLED manufacturer by 2024, as more Chinese companies have invested heavily in new OLED production lines, said Zhou Hua, chief analyst at CINNO Research, a Chinese flat panel display consultancy firm.

Zhou said that at present, China has become the world"s largest display panel producer, and is foreseen accounting for about 76 percent of global OLED production capacity by 2025.

Li Yaqin, general manager of Sigmaintell, said demand for flexible OLED panels used in foldable smartphones will continue to increase this year on the back of commercial application of 5G technology, and panel makers should further improve their yield rate capacities and reduce production costs.

According to market research company Omdia, OLED panel shipments for smartphones will reach 812 million units globally next year, an increase of 38.8 percent compared with the estimated 585 million units in 2021.

Chinese smartphone makers have increased the number of high-end smartphones integrating flexible active-matrix organic light-emitting diodes, or AMOLED, panels, said Brian Huh, principal analyst of small and medium-sized displays at Omdia.

Xu Fengying, vice-president of Visionox, said AMOLED panels will have wider applications in smartphones, computers, smart wearables, vehicles, virtual reality and augmented reality because of surging demand for flexible display screens.

"The AMOLED market will continue to grow, and the penetration rate of flexible display products is expected to rise," said Zhu Xiujian, general manager of Visionox"s product engineering center, adding the flexible and foldable screens will play a vital role in bolstering the growth of small and medium-sized smartphones.

Chinese television maker Skyworth Group has been producing OLED TVs in partnership with South Korea"s largest panel maker, LG Display, since 2013. Other home appliance manufacturers such as Hisense, Konka, Huawei and Sony have also tapped into the OLED TV market.

OLED TVs will become the future development direction of the TV industry and present an opportunity for TV manufacturers to expand their profit margins, said Wen Jianping, president of Beijing-based market consultancy All View Cloud.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey