a si tft lcd panel manufacturer

The most common semiconducting layer is made of amorphous silicon (a-Si). a-Si thin film transistor - liquid crystal display (TFT-LCD) has been the dominant technology for the manufacturing of active matrix TFT-LCD for over 20 years. a-Si is a low cost material in abundant supply.

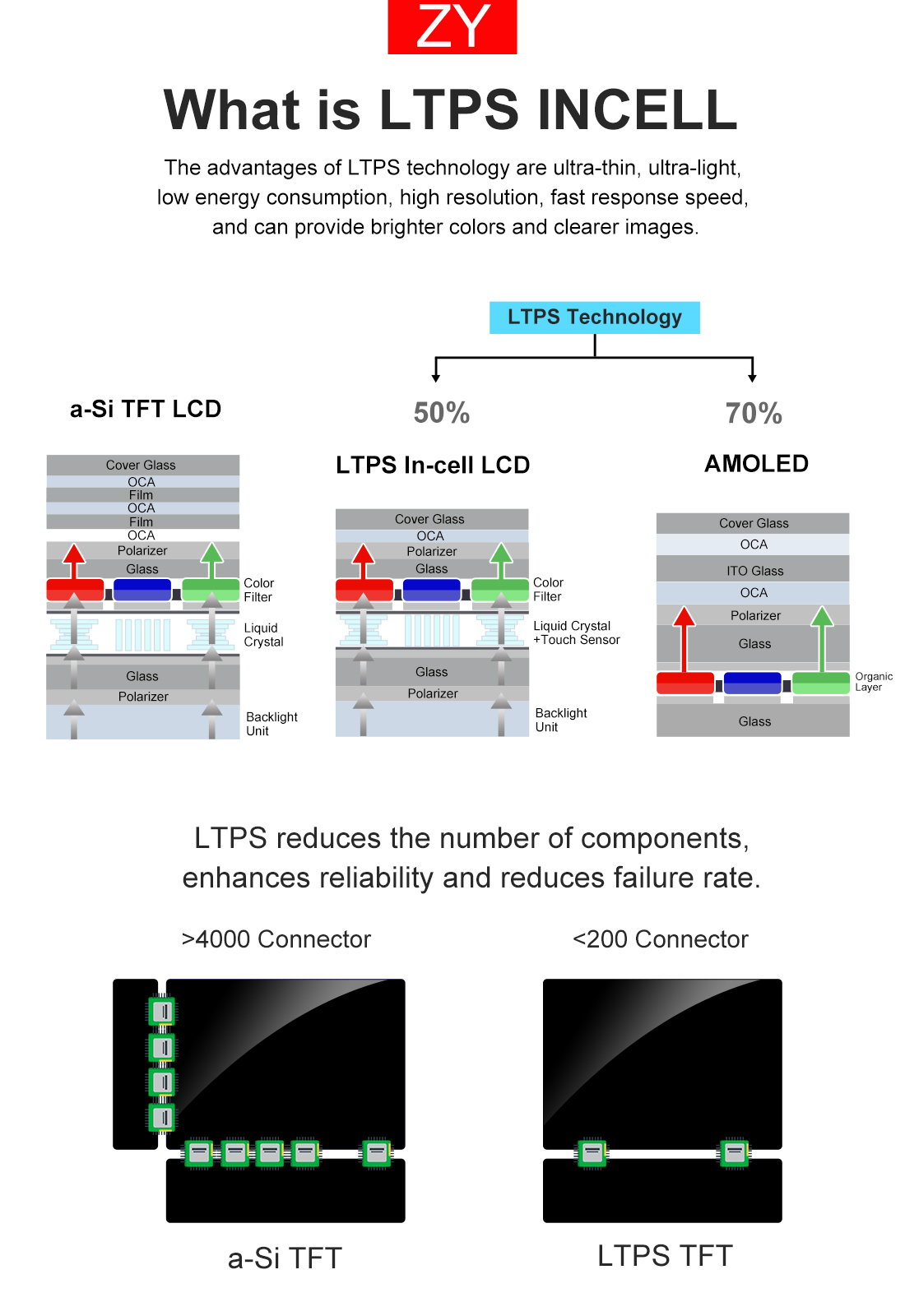

a-Si is a low cost material in abundant supply. However, the electron mobility of a-Si is very low (around 1cm2/Vs) and can’t physically support high refresh rates such as the 240Hz needed for HDTV. Due to their high electron mobility, new materials such as metal oxide (MO) and low temperature polysilicon (LTPS) are now replacing a-Si to manufacture the industry’s two main types of screens: LCD and organic light-emitting diode (OLED) displays.

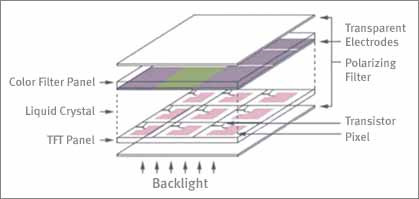

Flat-panel displays are thin panels of glass or plastic used for electronically displaying text, images, or video. Liquid crystal displays (LCD), OLED (organic light emitting diode) and microLED displays are not quite the same; since LCD uses a liquid crystal that reacts to an electric current blocking light or allowing it to pass through the panel, whereas OLED/microLED displays consist of electroluminescent organic/inorganic materials that generate light when a current is passed through the material. LCD, OLED and microLED displays are driven using LTPS, IGZO, LTPO, and A-Si TFT transistor technologies as their backplane using ITO to supply current to the transistors and in turn to the liquid crystal or electroluminescent material. Segment and passive OLED and LCD displays do not use a backplane but use indium tin oxide (ITO), a transparent conductive material, to pass current to the electroluminescent material or liquid crystal. In LCDs, there is an even layer of liquid crystal throughout the panel whereas an OLED display has the electroluminescent material only where it is meant to light up. OLEDs, LCDs and microLEDs can be made flexible and transparent, but LCDs require a backlight because they cannot emit light on their own like OLEDs and microLEDs.

Liquid-crystal display (or LCD) is a thin, flat panel used for electronically displaying information such as text, images, and moving pictures. They are usually made of glass but they can also be made out of plastic. Some manufacturers make transparent LCD panels and special sequential color segment LCDs that have higher than usual refresh rates and an RGB backlight. The backlight is synchronized with the display so that the colors will show up as needed. The list of LCD manufacturers:

Organic light emitting diode (or OLED displays) is a thin, flat panel made of glass or plastic used for electronically displaying information such as text, images, and moving pictures. OLED panels can also take the shape of a light panel, where red, green and blue light emitting materials are stacked to create a white light panel. OLED displays can also be made transparent and/or flexible and these transparent panels are available on the market and are widely used in smartphones with under-display optical fingerprint sensors. LCD and OLED displays are available in different shapes, the most prominent of which is a circular display, which is used in smartwatches. The list of OLED display manufacturers:

MicroLED displays is an emerging flat-panel display technology consisting of arrays of microscopic LEDs forming the individual pixel elements. Like OLED, microLED offers infinite contrast ratio, but unlike OLED, microLED is immune to screen burn-in, and consumes less power while having higher light output, as it uses LEDs instead of organic electroluminescent materials, The list of MicroLED display manufacturers:

Sony produces and sells commercial MicroLED displays called CLEDIS (Crystal-LED Integrated Displays, also called Canvas-LED) in small quantities.video walls.

LCDs are made in a glass substrate. For OLED, the substrate can also be plastic. The size of the substrates are specified in generations, with each generation using a larger substrate. For example, a 4th generation substrate is larger in size than a 3rd generation substrate. A larger substrate allows for more panels to be cut from a single substrate, or for larger panels to be made, akin to increasing wafer sizes in the semiconductor industry.

2015, sold to giantplus and tce photomasks, gen 3 still operated by giantplus, gen 4 line sold to giantplus, equipment sold and line demolished, remainder operated by tce

Cantwell, John; Hayashi, Takabumi (January 4, 2019). Paradigm Shift in Technologies and Innovation Systems. Springer Nature. ISBN 9789813293502 – via Google Books.

"Samsung Display has halted local Gen-8 LCD lines: sources". THE ELEC, Korea Electronics Industry Media. August 16, 2019. Archived from the original on April 3, 2020. Retrieved December 18, 2019.

"TCL to Build World"s Largest Gen 11 LCD Panel Factory". www.businesswire.com. May 19, 2016. Archived from the original on April 2, 2018. Retrieved April 1, 2018.

"Panel Manufacturers Start to Operate Their New 8th Generation LCD Lines". 대한민국 IT포털의 중심! 이티뉴스. June 19, 2017. Archived from the original on June 30, 2019. Retrieved June 30, 2019.

"TCL"s Panel Manufacturer CSOT Commences Production of High Generation Panel Modules". www.businesswire.com. June 14, 2018. Archived from the original on June 30, 2019. Retrieved June 30, 2019.

"Business Place Information – Global Operation | SAMSUNG DISPLAY". www.samsungdisplay.com. Archived from the original on 2018-03-26. Retrieved 2018-04-01.

"Samsung Display Considering Halting Some LCD Production Lines". 비즈니스코리아 - BusinessKorea. August 16, 2019. Archived from the original on April 5, 2020. Retrieved December 19, 2019.

Herald, The Korea (July 6, 2016). "Samsung Display accelerates transition from LCD to OLED". www.koreaherald.com. Archived from the original on April 1, 2018. Retrieved April 1, 2018.

Byeonghwa, Yeon. "Business Place Information – Global Operation – SAMSUNG DISPLAY". Samsungdisplay.com. Archived from the original on 2018-03-26. Retrieved 2018-04-01.

www.etnews.com (30 June 2017). "Samsung Display to Construct World"s Biggest OLED Plant". Archived from the original on 2019-06-09. Retrieved 2019-06-09.

Colantonio, Andrea; Burdett, Richard; Rode, Philipp (2013-08-15). Transforming Urban Economies: Policy Lessons from European and Asian Cities. Routledge. ISBN 9781134622160. Archived from the original on 2019-01-01. Retrieved 2019-06-09.

Shilov, Anton. "LG"s New 55+ inch OLED Plant in China Opens: Over 1m+ per Year". www.anandtech.com. Archived from the original on 2019-09-14. Retrieved 2019-12-18.

www.wisechip.com.tw. "WiseChip History – WiseChip Semiconductor Inc". www.wisechip.com.tw. Archived from the original on 2018-02-17. Retrieved 2018-02-17.

"China"s BOE to have world"s largest TFT-LCD+AMOLED capacity in 2019". ihsmarkit.com. 2017-03-22. Archived from the original on 2019-08-16. Retrieved 2019-08-17.

Shilov, Anton. "JOLED Starts Construction of New Printed OLED Facility". www.anandtech.com. Archived from the original on 2019-06-30. Retrieved 2019-06-30.

Pooler, Michael (29 September 2015). "Subscribe to read". Financial Times. Archived from the original on 2019-10-25. Retrieved 2019-10-25. Cite uses generic title (help)

Samsung Display, one of the leading amorphous silicon (a-Si) TFT LCD manufacturers for the past 20 years, is shutting down its first G7 line, Line 7-1, from as early as the end of July and there are rumors of a few more fab closures to come. Its a-Si TFT LCD footprint is expected to shrink dramatically over the next few years with potentially just one a-Si fab in operation in 2018 to serve its market-leading TV business.

Panasonic LCD is also rumored to be shutting down most or all of its G8.5 line. Based on the near term decline in a-Si TFT LCD capacity, Credit Suisse upgraded AUO and Innolux on this news and their shares surged.

Samsung’s Line 7-1, which began operation in October 2004 and production in May 2005, is rumored to be shutting down from the 30th July through the end of the year. It has a unique glass size (1,870 x 2,200mm), which was the largest in the world at the time of its introduction and is optimized for both 40” and 46” LCD TV panel production. It was also the site of the Samsung-Sony joint venture, S-LCD, established in April 2004. This line enabled Samsung and Sony to rapidly take share from smaller G6 fabs optimized for 32” and 37” panels. During that time, the two companies competed aggressively in retail while establishing 40” and 46” as mainstream sizes. The JV with Sony ended in 2011. S-LCD also built an 8th gen fab that began production in Q3’07, and Samsung built a second G7 line (L7-2) on its own, with even more capacity at over 170,000 substrates per month. L7-2 began production in Q3’08.

Displays are already a weak spot in Samsung’s financial performance. The category caused the device solutions division to be the only one to suffer a loss among all major divisions within Samsung in Q1’16, and its revenues of KRW6 trillion ($5.2 billion) were the lowest in two years. The display division alone posted an operating loss of KRW270 billion ($233 million) in Q1’16 resulting in an operating margin of -4.4%. While Samsung has a number of technology and capacity advantages in OLEDs for mobile displays, its a-Si TFT LCD business has matured and is increasingly becoming commoditized, as new entrants from China with government support are taking share. In addition, most of the a-Si TFT LCD market segments have become stagnant or are in decline, which points to more losses given the growing Chinese competition. On the other hand, OLEDs and flexible OLEDs are poised for rapid growth as they take share. As a result, it makes good business sense for Samsung to exit much of the a-Si TFT LCD market.

Line 7-2, newer and larger than 7-1, is also rumored to be for sale and is expected to be shut down in 2017, but probably depends on profitability. Line 7-2 has been producing 3-4 million 40” panels and 300,000 75” panels annually, as well as monitor panels. Twinstar is also a potential customer for the manufacturing equipment and this line may also be utilized for OLED production in the future.

Samsung is expected to begin shipping for the first OLED iPhone in volume from Q3’17, with input capacity from the modified Line 7 ramping up to between 90,000 and 120,000 substrates per month. Apple is expected to purchase 70 million OLED panels in 2017, according to sources.

That is not all, however. Line 6, Samsung"s last 5th gen line with 1,100 x 1,300mm substrates and around 190,000 substrate per month capacity, is also expected to be shut down, according to industry insiders. That line, which features a-Si and oxide TFT LCD production, has been producing tablet, notebook PC and LCD monitor panels. Those markets have also been hit by stagnant demand, growing competition from China, commoditization and declining margins. This line is expected to be shut down between the end of 2016 and 2017. Line 6 is predicted to be converted to a semiconductor facility, making application processors for smartphones and tablets.

If Samsung closes down Line 6 and Lines 7-1 and 7-2, its a-Si production will be down to just two G8.5 fabs: one in Suzhou, China and one in Tangjong, Korea. The Suzhou fab, ramping to over 100,000 substrates per month, is also rumored to be a candidate for sale with Chinese and Indian TFT LCD suppliers as potential customers. If Samsung licenses its latest a-Si TFT LCD or oxide TFT LCD technology, that would certainly make the sale more attractive. This means Samsung would have just one a-Si TFT LCD fab: Line 8.

I believe Line 8 will be sufficient for Samsung to support its internal TV brand with leading edge panels for the TV market as it has a monthly capacity of 400,000 2,200 x 2,500mm (G8.5) substrates. Samsung’s TV business would likely continue to outsource its low-end panels for its TVs to other LCD manufacturers and focus this fab on higher margin products such as 8k, HDR, QD WCG, etc. I cannot see Samsung abandoning LCD TV panel production until it believes OLEDs are cost effective enough to takeover the mid-range high end of the TV market. This likely means not until OLED materials can be inkjet printed, Samsung is still likely to focus all of its TV panel production on LCDs.

If this occurs as described, Samsung Display"s output of 42" and larger panels would be LCD, and sub-42" would be OLED, although it may not have much production between 15" and 40". This would be an amazing, but expected, transformation given the supply/demand and profitability outlook for the a-Si market.

Panasonic is also following Samsung’s lead. It is expected to reduce the glass input of its G8.5 line from around 50,000 per month to just 10,000 per month by September. Given the limited scale and cost effectiveness of this Japanese factory and the loss of share of Panasonic"s TV brand in many regional TV markets, the company is better off purchasing panels from LG and lower cost Chinese suppliers. Otherwise it would be trying to run a high cost fab in Japan, in a market where commoditization is becoming increasingly common and a large wave of new, lower cost capacity from China is on its way. The company may keep 10,000 of capacity for some period for Panasonic-branded products, but it is hard to imagine operating a fab at just 10,000 per month for long, as the lack of volume will further increase costs relative to other higher volume players.

Interestingly, with both Samsung and Panasonic reducing their a-Si capacity in the near term, Credit Suisse has upgraded its outlook for AUO and Innolux to outperform, and both companies have seen significant share price increases as a result. Credit Suisse indicated that the closure of L7-1 will reduce supply by 12 million 40” panels - or 1/3 of the 40” market - which will tighten supply in the 40”-43” market and produce a better pricing environment. AUO’s earnings per share (EPS) was raised from NT$10.20 to NT$13 ($0.32 - $0.40), while Innolux’s EPS was raised from NT$10.10 to NT$14 ($0.31 - $0.43). Both companies" stock prices have taken off, with AUO’s stock price rising by 22% in the US in three days.

As Japanese and Korean players take more a-Si capacity offline, it will create a better environment for the Taiwanese and Chinese suppliers, enabling the market to better digest all the new capacity being brought online in China. However, there is a tremendous amount of capacity coming and much of this older capacity from Samsung and Panasonic may get sold and reintroduced. As pointed out at SID 2016, by 2019 China is expected to have:

2016 and 2017 are expected to be back-to-back years of over $12 billion in LCD/OLED equipment spending. Unless these fabs struggle with their ramp and their yields, the a-Si market will continue to be oversupplied although conditions should improve in the 40”-43” market in the second half of 2016.

Rather than battle it out with government-subsidized Chinese players, Samsung appears to be accelerating its exit of the increasingly commoditized a-Si TFT LCD market. This should please its shareholders, especially if it can sell all its old equipment and license its a-Si technology for a royalty, but will be harmful to some of its suppliers. It is also likely to protect its TV business by holding onto its most competitive fab, but will increasingly become an OLED company. Interesting questions as a result of these moves include:

Will LG Display follow Samsung’s lead and accelerate the closure of its older a-Si lines, or will it slug it out against the new wave of Chinese capacity?

A couple of days after this article was originally posted, it was claimed - and later denied by a company official - that Samsung will move its a-Si TFT LCD operations out of Samsung Display and into Samsung Electronics. Such a move aligns perfectly with its intention, indicated above, to close its a-Si fabs as in a couple of years its a-Si TFT LCD operations may be limited to providing panels to its TV business. - Ross Young

Ross Young is the CEO and Founder of Display Supply Chain Consultants. He also serves on the Board of Directors of publicly traded touch sensor manufacturer UniPixel and diamond semiconductor developer Akhan Technologies. He previously founded DisplaySearch and served as its CEO from 1996 - 2007 where he launched most of their categories of coverage. He has also held executive positions at Samsung LCD and IMS Research.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

TFT-LCD Panel manufacturer lines from ICS Components are Samsung (SEC), Samsung Mobile Display (SMD), LG Display (LGD), AUO, Chimei-Innolux (CMI), Mitsubishi and Tianma. Our keen knowledge of TFT-LCD industry has helped us develop solutions that answer the needs of our world-wide clients. These solutions allow you to Increase productivity, reduce operating costs, and increase customer satisfaction. ICS offers;

A leading innovator of TFT-LCD technology, LG Display will show a full line-up of Advanced High Performance In-Plane Switching (AH-IPS) products. The AH-IPS panels deliver ultra-high resolution, notable for their superiority in use for smartbooks(tablet PCs) and smartphones.

AH-IPS technology, an advanced form of IPS, has realizes 1.5 to 2 times the resolution of typical LCD panels. This ultra-high resolution becomes particularly valuable when the emphasis is on displaying highly detailed images. The technology also improves display"s color accuracy, which in turn leads to reproduce the original color precisely without color distortion. In addition, it provides greater light transmission which translates into lower power consumption while delivering exceptional picture quality, making it ideal for use in outdoor settings.

Chi Mei originally established in 2003 and publicly listed in 2006, Innolux Display Corp., following its merger with Chi Mei Optoelectronics and TPO Displays Corp., began operating under the name Chimei Innolux Corporation (CMI) in March 2010. With products spanning the full range of TFT-LCD panel modules and LCD display products, including TV panels, desktop monitors and notebook computer panels, AV & mobile panels, desktop monitors and televisions, Chimei Innolux is a world-leading TFT-LCD supplier to cutting-edge information and consumer electronics product makers worldwide.

AU Optronics Corp. (AUO) is a global leader of thin film transistor liquid crystal display panels (TFT-LCD). AUO is able to provide customers with a full range of panel sizes and comprehensive applications, offering TFT-LCD panels in sizes ranging from 1.2 inches to greater than 71 inches. AUO generated NT$467.2 billion in sales revenue in 2010 (US$16 billion) with global operations in Taiwan, Mainland China, Japan, Singapore, South Korea, the U.S., and Europe. Additionally, AUO is the first pure TFT-LCD manufacturer to be successfully listed at the New York Stock Exchange (NYSE). AUO extended its market to the green energy industry in late 2008. The Display and Solar businesses were established respectively as the Company"s two core businesses in October, 2010.

Tianma Micro-electronics Co. was founded in 1983 and in publicly traded on the Shenzhen Stock Exchange (SZ.000050) since 1995. They specialize in the design, manufacturing, and supply of high quality LCD and LCM products. The front to backend operations are completely in-house spanning from Research & Development, Design to Manufacturing, and Production to Sales with 27+ years of experience and strong growth. Affiliated companies within our Tianma Group, include Shenzhen Tianma, Shanghai Tianma, Shanghai AVIC, Chengdu Tianma, and Wuhan Tianma; combined to make up our state-of-the-art STN-LCD, CSTN-LCD, TFT-LCD, AMOLED, and CF production lines. Our branch offices include Tianma USA, Tianma Europe, and Tianma Korea to offer world-class global support.

Tianma supports a wide range of applications in Mobile Phone, MP3/MP4, Automotive, Industrial, Medical, Home Automation, and others. They are fully capable of custom design display to meet customers’ need around the world. They are the leader of small-to-medium size displays in Technology, Quality, Competitive Pricing, and long-term Support.

Asia has long dominated the display module TFT LCD manufacturers’ scene. After all, most major display module manufacturers can be found in countries like China, South Korea, Japan, and India.

However, the United States doesn’t fall short of its display module manufacturers. Most American module companies may not be as well-known as their Asian counterparts, but they still produce high-quality display products for both consumers and industrial clients.

In this post, we’ll list down 7 best display module TFT LCD manufacturers in the USA. We’ll see why these companies deserve recognition as top players in the American display module industry.

STONE Technologies is a leading display module TFT LCD manufacturer in the world. The company is based in Beijing, China, and has been in operations since 2010. STONE quickly grew to become one of the most trusted display module manufacturers in 14 years.

These products are all widely used in various industries such as in medicine, home security, automotive, energy field solar charging, and domestic equipment use.

Now, let’s move on to the list of the best display module manufacturers in the USA. These companies are your best picks if you need to find a display module TFT LCD manufacturer based in the United States:

Planar Systems is a digital display company headquartered in Hillsboro, Oregon. It specializes in providing digital display solutions such as LCD video walls and large format LCD displays.

The company started in 1983 as a corporate spin-off from the American oscilloscope company Tektronix. In 2015, Planar Systems became a subsidiary of the Chinese manufacturer Leyard Optoelectronics.

Planar’s manufacturing facilities are located in Finland, France, and North America. Specifically, large-format displays are manufactured and assembled in Albi, France.

Another thing that makes Planar successful is its relentless focus on its customers. The company listens to what each customer requires so that they can come up with effective display solutions to address these needs.

Microtips Technology is a global electronics manufacturer based in Orlando, Florida. The company was established in 1990 and has grown into a strong fixture in the LCD industry.

Microtips also provides value-added services to all its clients. The company’s Electronic Manufacturing Services team gives product suggestions and shares insights on how clients can successfully manage their projects.

Taiwan and Mainland China are two Asian countries where Microtips set up their manufacturing plants. The factories boast of modern equipment, high-quality raw materials, and stringent quality control measures. Microtips even earned ISO9001 and ISO14001 certifications for excellent quality management.

What makes Microtips a great display module TFT LCD manufacturer in the USA lies in its close ties with all its customers. It does so by establishing a good rapport with its clients starting from the initial product discussions. Microtips manages to keep this exceptional rapport throughout the entire client relationship by:

Displaytech is an American display module TFT LCD manufacturer headquartered in Carlsbad, California. It was founded in 1989 and is part of several companies under the Seacomp group. The company specializes in manufacturing small to medium-sized LCD modules for various devices across all possible industries.

The company also manufactures embedded TFT devices, interface boards, and LCD development boards. Also, Displaytech offers design services for embedded products, display-based PCB assemblies, and turnkey products.

Displaytech makes it easy for clients to create their own customized LCD modules. There is a feature called Design Your Custom LCD Panel found on their site. Clients simply need to input their specifications such as their desired dimensions, LCD configuration, attributes, connector type, operating and storage temperature, and other pertinent information. Clients can then submit this form to Displaytech to get feedback, suggestions, and quotes.

Clients are assured of high-quality products from Displaytech. This is because of the numerous ISO certifications that the company holds for medical devices, automotive, and quality management. Displaytech also holds RoHS and REACH certifications.

A vast product range, good customization options, and responsive customer service – all these factors make Displaytech among the leading LCD manufacturers in the USA.

Products that Phoenix Display offers include standard, semi-custom, and fully-customized LCD modules. Specifically, these products comprise Phoenix Display’s offerings:

Phoenix Display also integrates the display design to all existing peripheral components, thereby lowering manufacturing costs, improving overall system reliability, and removes unnecessary interconnects.

Clients flock to Phoenix Display because of their decades-long experience in the display manufacturing field. The company also combines its technical expertise with its competitive manufacturing capabilities to produce the best possible LCD products for its clients.

True Vision Displays is an American display module TFT LCD manufacturing company located at Cerritos, California. It specializes in LCD display solutions for special applications in modern industries. Most of their clients come from highly-demanding fields such as aerospace, defense, medical, and financial industries.

The company produces several types of TFT LCD products. Most of them are industrial-grade and comes in various resolution types such as VGA, QVGA, XGA, and SXGA. Clients may also select product enclosures for these modules.

All products feature high-bright LCD systems that come from the company’s proprietary low-power LED backlight technology. The modules and screens also come in ruggedized forms perfect for highly-demanding outdoor industrial use.

Slow but steady growth has always been True Vision Display’s business strategy. And the company continues to be known globally through its excellent quality display products, robust research and development team, top-of-the-line manufacturing facilities, and straightforward client communication.

LXD Incorporated is among the earliest LCD manufacturers in the world. The company was founded in 1968 by James Fergason under the name International Liquid Xtal Company (ILIXCO). Its first headquarters was in Kent, Ohio. At present, LXD is based in Raleigh, North Carolina.

All of their display modules can be customized to fit any kind of specifications their clients may require. Display modules also pass through a series of reliability tests before leaving the manufacturing line. As such, LXD’s products can withstand extreme outdoor environments and operates on a wide range of temperature conditions.

LXD has research centers and factories in both the United States and China. The US-based headquarters feature a massive 30,000 square feet of manufacturing and research development centers. Meanwhile, LXD’s Chinese facilities feature a large 5,000 square meters of cleanrooms for manufacturing modular and glass products.

Cystalfontz America is a leading supplier and manufacturer of HMI display solutions. The company is located in Spokane Valley, Washington. It has been in the display solutions business since 1998.

Crystalfontz takes pride in its ISO 9001 certification, meaning the company has effective quality control measures in place for all of its products. After all, providing high-quality products to all customers remains the company’s topmost priority. Hence, many clients from small hobbyists to large top-tier American companies partner with Crystalfontz for their display solution needs.

We’ve listed the top 7 display module TFT LCD manufacturers in the USA. All these companies may not be as well-known as other Asian manufacturers are, but they are equally competent and can deliver high-quality display products according to the client’s specifications. Contact any of them if you need a US-based manufacturer to service your display solutions needs.

We also briefly touched on STONE Technologies, another excellent LCD module manufacturer based in China. Consider partnering with STONE if you want top-of-the-line smart LCD products and you’re not necessarily looking for a US-based manufacturer. STONE will surely provide the right display solution for your needs anywhere you are on the globe.

Offering you a complete choice of products which include Si TFT Active Matrix LCD, 3.5" Active Matrix LCD Panel, 7" Amorphous Transmissive Tft LCD Screen, 6.7" Amorphous Si TFT Color LCD Module, PQ 3Qi-01 is a 10.1" TFT Liquid Crystal Display and TFT LCD Panel 3.45.

A si TFT active matrix LCD of 7"(diagonal dimensions) with a resolution of 800*3(RGB)*480. Features include white LED backlight and VGA and Video input.The signal interface is parallel RGB(1ch,6-bit) with wide range of display colors of 262K.

It features Transmissive type and back-light with six LEDS(Serial type) with support resolution of n 320xRGBx240 (16.7M Color) which includes 24bit parallel RGB Interface (8bit x 3).

A070VW04_V1 is an amorphous transmissive type TFT (Thin Film Transistor) LCD (Liquid crystal Display). This model is composed of TFT-LCD, driver IC, FPC (flexible printed circuit), and backlight unit.

This color LCD module is composed of amorphous silicon thin film transistor liquid crystal display panel structure with driver LSis for driving the TFT array and a backlight.Color (Red,Green,Blue) data signals from a host system e.g. signal generator are modulated into the best form for active matrix system by signal processing board, and sent to the driver LSIs which drive the individual TFT arrays.

This 10.1” TFT Liquid Crystal Display module supports 1024 x RGB x 600 Wide-SVGA (WSVGA) mode and can display 262,144 colors.This module also supports two low power modes: a transflective mode with lower color and a reflective black and white (64 grayscales) mode. In reflective mode the screens shows higher resolution at 3072 x 600 pixels, in transflective mode the color resolution is 1024 x RGB x 600, while the black/white/grey resolution is 3072 x 600. The converter module for the LED backlight is built in.

3.45“ color TFT-LCD panel. The 3.45“ color TFT-LCD panel is designed for camcorder, digital camera application and other electronic products which require high quality flat panel displays. This module follows RoHS.Added features include High Resolution :230,400 Dots (320 RGB x 240) . Image Reversion: Up/Down and Left/Right.

Goregaon West, Mumbai Shop No. 4, A Wing, Neptune CHS, Vasant Galaxy Bangur Nagar, Goregaon West, Goregaon West, Mumbai - 400104, Dist. Mumbai, Maharashtra

Vasai Virar, Dist. Thane C-2, G-18, Floor- Dewan Apt No. 3, Navghar East, Palghar, Maharashtra, 401202, Vasai Virar - 401202, Dist. Thane, Maharashtra

Adyar, Chennai No. 13, F- 3, 2nd Floor, 2nd Main Road, Nehru Nagar, Adyar, H.D.F.C. Bank A.T.M., Ground Floor Near Nalli Silks, Opposite To SBI Indra Nagar Branch, Adyar, Chennai - 600020, Dist. Chennai, Tamil Nadu

Dr. D B Marg, Mumbai Ground Floor, GR- 8, Gandhi Bhuvan, Chunam Lane Grant Road East Grant Road East, Dr. D B Marg, Mumbai - 400007, Dist. Mumbai, Maharashtra

Sahakar nagar, Bengaluru Building Number 216/2, 2nd Floor, 10th Cross, F Block, 14th Main Cantt Sahakar Nagar, Sahakar nagar, Bengaluru - 560092, Dist. Bengaluru, Karnataka

2711P PanelView™ Plus 7 Graphic Terminals are available in standard and performance versions. Our performance versions are available in conformal coat, stainless steel and on-machine (ArmorView™ Plus 7) options, offering flexibility to meet your specific needs.

Panox Display provides free connectors for clients who purchase more than five products from us. Our product range includes connectors from Molex, Kyocera, AXE, AXG, JAE, Hiros, and more.

Panox Display provides a customized cover glass/touch panel service. We supply cover glass from Gorilla, AGC, and Panda, which all have excellent optical performance. We also supply driver ICs from Goodix and Focaltech.

If your applications are directly connected to a PC, a cellphone, or Raspberry Pi, and you have enough space to insert a board to input video, Panox Display can provide customized Controller/Driver boards with input connections for VGA, HDMI, DVI, DP, Type-C video input, MIPI, RGB, LVDS, and eDP.

The functions of our boards include, but are not limited to, adjustment of brightness, sound output, touch interface, extra data transmission, and gyroscope.

A not-for-profit organization, IEEE is the world"s largest technical professional organization dedicated to advancing technology for the benefit of humanity.

A: 27.6 inch lcd screen CLAA276FP01 XN was Strictly tested before shipping.If happen that , pls check all the connect cable again,If still has problems ,we accept exchange or return panel .

We are one of the professional and experienced suppliers of a-si TFT lcd panel CLAA276FP01 XN, offering you the quotation and the price list consultation. Welcome to wholesale the high-end, quality and low price products in stock with us. Good after-sale service and fast delivery are available.

According to LCD (Liquid Crystal Display) technology and LCD materials, mobile phone LCD assemblies can be classified into 2 types: TFT (Thin Flim Transistor) and OLED(Organic Light-Emitting Diode). TFT display needs with backlight, but OLED is light-emitting, each pixel is creating its own light.

For Original iPhone LCD, 5-8 plus and Xr, 11 is TFT, X-13 Pro Max is OLED (except XR and 11). But in mobile phone aftermarket, there are too many different types and different qualities, which makes customers confused.

What is in-cell? What is OGS or " with TP"? What is COF? What is COG? What is OEM? What is FOG? What is Original Change Glass? What is IPS? What is LTPS? What is a-Si?

HTPS with small size, high precision, and high contrast. Most used in magnified display products. Such as projectors, projection TVs, etc. And cannot be used as a mobile phone display, so we don"t talk about it here.

IGZO has 20–50 times the electron mobility than a-Sin. IGZO only has been licensed to Samsung Electronics and Sharp. However, it was Sharp who first implemented IGZO into their smartphones (Aquos Phone Zeta SH-02E), tablets, and 32-inch LCDs. IGZO for mobile phones is only Sharp. Almost all mobile phones on the market didn"t use IGZO.

Because the electrons deflect the liquid crystal molecules through the transistor. Electron mobility fundamentally determines the refresh rates of the TFT device. The smaller mobility, the slower transmission of holes and electrons, and the slower response rate. Can"t physically support high refresh rates.

In order to improve the response performance, can increase transistor size to enhance the migration, but this will lead to the extra TFT device that will occupy the display area pixel area. Therefore, the larger unit transistor area, the single-pixel occupy area is smaller(Pixel Aperture Ratio ), resulting in lower brightness.

Secondly, because the volume cannot be smaller, then the number of pixels per unit area is limited, which means the pixel density is small, which is what we call PPI is low, resulting in low resolution. The image needs to be zoomed, the original image data is lost, and resulting in the blurred image effect.

As we can see electron mobility of a-Si is very low (0.5-1cm2/Vs). But LTPS can deliver a hundred times the mobility than a-Si, and a much higher aperture ratio and PPI is much higher than a-Si resolution.

Compared with LTPS,a-si TFT have those "weakness":a-Si with so much low resolution and low definition. a-Si is 720*1280 with a very blurred display effect.

a-Si with so much bad display performance, but why are there still so many manufacturers producing phone LCDs with a-Si, or why do the customers willing to use a-Si LCD for their phone?

LCDs business has too much competition and wholesalers want to make more profit, they keep pushing suppliers to make LCDs at lower prices. So some of the suppliers start to produce aftermarket phone displays with a-Si to match customers" lower price requirements.

The customers with asymmetric information. End-Users don"t know how to distinguish LCDs qualities. Some of them just chase the price but not quality. That is another reason wholesalers want a lower price.

Now in the market a-Si LCDs for iPhone is TFT with TP but not in-cell. Our ZY a-Si will be in-cell not just TFT with TP. ZY a-Si incell for Xr and 11 ready now, please to get more details.

For more details or questions about in-cell and TFT with TP or about phone LCD display. Please click here to get more information, or Long press and scran the QR code to add me.

IPS (In-Plane Switching) lcd is still a type of TFT LCD, IPS TFT is also called SFT LCD (supper fine tft ),different to regular tft in TN (Twisted Nematic) mode, theIPS LCD liquid crystal elements inside the tft lcd cell, they are arrayed in plane inside the lcd cell when power off, so the light can not transmit it via theIPS lcdwhen power off, When power on, the liquid crystal elements inside the IPS tft would switch in a small angle, then the light would go through the IPS lcd display, then the display on since light go through the IPS display, the switching angle is related to the input power, the switch angle is related to the input power value of IPS LCD, the more switch angle, the more light would transmit the IPS LCD, we call it negative display mode.

The regular tft lcd, it is a-si TN (Twisted Nematic) tft lcd, its liquid crystal elements are arrayed in vertical type, the light could transmit the regularTFT LCDwhen power off. When power on, the liquid crystal twist in some angle, then it block the light transmit the tft lcd, then make the display elements display on by this way, the liquid crystal twist angle is also related to the input power, the more twist angle, the more light would be blocked by the tft lcd, it is tft lcd working mode.

A TFT lcd display is vivid and colorful than a common monochrome lcd display. TFT refreshes more quickly response than a monochrome LCD display and shows motion more smoothly. TFT displays use more electricity in driving than monochrome LCD screens, so they not only cost more in the first place, but they are also more expensive to drive tft lcd screen.The two most common types of TFT LCDs are IPS and TN displays.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey