tft display as face mask manufacturer

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

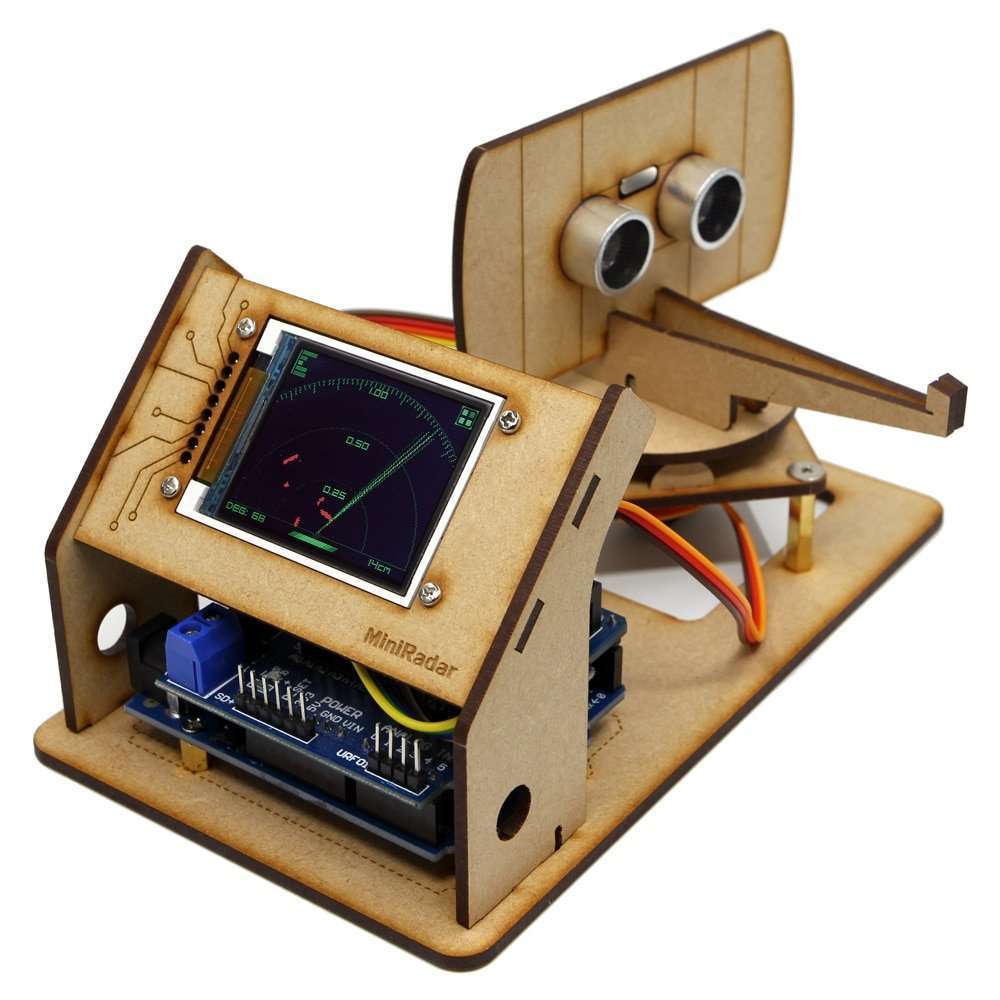

Color TFT LCDs (Thin Film Transistor LCDs) give your product a beautiful appearance with high-resolution, full-color graphics. Our modern, automated LCD factories can create custom TFT displays for extreme temperature functionality, sunlight readability, shock and vibration durability, and more. Whether you need a stand-alone TFT LCD display or fully integrated assembly with touch and cover lens, custom FPC, or custom backlight, our experienced team can develop the right solution for your project.

The researchers began working on this project before mask-wearing became common during the Covid-19 pandemic. Their original intention was to use sensors embedded in masks to measure the effectiveness of mask-wearing in areas with high levels of air pollution. However, once the pandemic started, they realized that such a sensor could have more widespread applications.

With so many different kinds of masks available during the pandemic, the researchers thought this kind of sensor could be useful to help individuals find the best-fitting mask for them. Currently, the only way to measure mask fit is to use a machine called a mask fit tester, which evaluates the mask fit by comparing air particle concentrations inside and outside of the face mask. However, this type of machine is only available in specialized facilities such as hospitals, which use them to evaluate mask fit for health care workers.

The MIT team wanted to create a more user-friendly, portable device to measure mask fit. Dagdeviren’s lab, the Conformable Decoders group, specializes in developing flexible, stretchable electronics that can be worn on the skin or incorporated into textiles to detect signals from the body.

“In this project, we wanted to monitor both biological and environmental conditions simultaneously, such as breathing pattern, skin temperature, human activities, temperature and humidity inside the face mask, and the position of the mask, including whether people are wearing it properly or not,” Kim says. “We also wanted to check the fit quality.”

To integrate their sensors into face masks, the researchers created a device that they call a conformable multimodal sensor face mask (cMaSK). Sensors that measure a variety of parameters are embedded in a flexible polymer frame that can be reversibly attached to the inside of any mask, around the edges.

To measure fit, the cMaSK has 17 sensors around the edge of the mask that measure capacitance, which can be used to determine whether the mask is touching the skin at each of those locations.

The cMaSK interface also has sensors that measure temperature, humidity, and air pressure, which can detect activities such as speaking and coughing. An accelerometer within the device can reveal if the wearer is moving around. All of the sensors are embedded into a biocompatible polymer called polyimide, which is used in medical implants such as stents.

The researchers tested the cMaSK interface in a group of five men and five women. All of the subjects wore surgical masks, and the researchers monitored the readings from the sensors as the participants performed a variety of activities, such as speaking, walking, and running. They also tested the sensors in a variety of temperature conditions.

Using data obtained by the capacitance sensors, the researchers created a machine-learning algorithm to calculate mask fit quality for each subject in the study. These measurements revealed that mask fit was significantly worse for women than men, due to differences in face shape and size. However, the fit for women could be improved slightly by wearing smaller surgical masks. The researchers also found that mask fit quality was low for one of the male subjects who had a beard, which created gaps between the mask and the skin.

To verify their results, the researchers also collaborated with MIT’s Environment, Health, and Safety Office on the design and evaluation of the fit, and found that the fit results for each study participant were very similar to what they found using the cMaSK.

The researchers hope that their findings will encourage mask manufacturers to design masks that fit a variety of face shapes and sizes, especially women’s faces. Dagdeviren’s lab is planning to work on mass production and large-scale deployment of the cMaSK interface.

“We hope to think about ways to design masks and come up with the best fit for individuals,” Dagdeviren says. “We have different sizes for shoes, and you can even customize your shoes. So why can’t you customize and design your mask, for your own health and for societal benefit?”

“Our technology can really help to quantify the social costs of these environmental hazards, and also to measure the benefits of any kind of policy intervention,” Zheng says.

The research was funded by the MIT Media Lab Consortium, the 3M Non-Tenured Faculty Award, and the MIT International Science and Technology Initiative (MISTI) Global Fund.

Overview of Face Shields & Masks — Professional Plastics offers several different PPE Medical Face Shields locally manufactured at our locations across the USA. Each face shield design is unique and developed to meet the needs for our customers for safety, comfort, and price. We offer both limited use face shields, and repeat use face shields for hospital and biomedical settings. We also offer KN95 Masks, N95 Masks, and Surgical General Use Masks. These PPE items are stocked at our 22 locations including New York, Florida, California & Texas. We are capable of manufacturing up to 1,000,000 Face Shields Per Week.

Wholesale Trader of a wide range of products which include Tft Color Pulse Oximeter, N95 face mask 5 ply headloop, Fingertip Pulse Oximeter Led Display, Face Mask 5 Ply Printed And Washable, Colour Tft Touch Screen Handheld Pulse Oximeter and 3 Ply Ultrasonic Face Mask With Nosepin.

Outdoor LED screen, LED display screen, LED screen flexible, LED display, LED light, LED panel, LED strip, LED, outdoor LED display, LED stage curtain screen, bus LED display screen, LED curtain screen, mini LED screen, LED mesh screen, touch screen, LCD screen, projector screen, laptop screen, balcony screen, screen

The N95 respirator is the most common of the seven types of particulate filtering facepiece respirators. This product filters at least 95% of airborne particles but is not resistant to oil-based particles.

NIOSH entered a Memorandum of Understanding (MOU) in 2018 with the Food and Drug Administration (FDA). This MOU granted NIOSH the authority to approve surgical N95 filtering facepiece respirators. Prior to this MOU, both NIOSH and FDA approved and cleared surgical N95s. The Model Number/Product Line in bold text followed by (FDA)indicates these surgical N95 respirators in the table below. NIOSH also provides a table of the surgical N95 respirators approved prior to the MOU. Surgical N95 respirators approved under the MOU do not require FDA’s 510(k) clearance. These NIOSH-approved surgical N95 respirators are only on the Certified Equipment List (CEL).

A respirator labeled as a KN95 respirator is expected to conform to China’s GB2626 standard. NIOSH does not approve KN95 products or any other respiratory protective devices certified to international standards. For more information, view Factors to Consider When Planning to Purchase Respirators from Another Country.

This book provides a broad overview of the manufacturing of flat panel displays, with a particular emphasis on the display systems at the forefront of the current mobile device revolution. It is structured to cover a broad spectrum of topics within the unifying theme of display systems manufacturing. An important theme of this book is treating displays as systems, which expands the scope beyond the technologies and manufacturing of traditional display panels (LCD and OLED) to also include key components for mobile device applications, such as flexible OLED, thin LCD backlights, as well as the manufacturing of display module assemblies.

Flat Panel Display Manufacturing fills an important gap in the current book literature describing the state of the art in display manufacturing for today"s displays, and looks to create a reference the development of next generation displays. The editorial team brings a broad and deep perspective on flat panel display manufacturing, with a global view spanning decades of experience at leading institutions in Japan, Korea, Taiwan, and the USA, and including direct pioneering contributions to the development of displays. The book includes a total of 24 chapters contributed by experts at leading manufacturing institutions from the global FPD industry in Korea, Japan, Taiwan, Germany, Israel, and USA. Provides an overview of the evolution of display technologies and manufacturing

Treats display products as systems with manifold applications, expanding the scope beyond traditional display panel manufacturing to key components for mobile devices and TV applications

Provides a detailed overview of the key unit processes and corresponding manufacturing equipment, including manufacturing test & repair of TFT array panels as well as display module inspection & repair

Introduces key topics in display manufacturing science and engineering, including productivity & quality, factory architectures, and green manufacturing

Flat Panel Display Manufacturing will appeal to professionals and engineers in R&D departments for display-related technology development, as well as to graduates and Ph.D. students specializing in LCD/OLED/other flat panel displays.

1.Stock cargo available. We have enough stock cargo for KF94 face mask. For the order quantity lower than 100000pcs, we can ship the cargo within 3 days. For the large amount order, we can negotiate about the lead time.

3.Good quality products. When you touch the KF94 mask, you can feel it is soft. The material we use is good quality non-woven material and there doesn’t have pungent smell.

4.Warm service. We respect every clients no matter where are they from, we treat the clients as our friends and provide with professional and warm service.

5.One-Stop shopping. For anti COVID-19 products, we think what you need is not only for face masks, but the other related products that is necessary for daily life.

The Covid-19 pandemic has raised a critical question: Why does the United States not have the capacity to manufacture many products for which there is a sudden urgent need — everything from critical care ventilators, N95 face masks, and personal protective equipment to everyday items like over-the-counter pain relievers? Of course, the United States is still a manufacturing powerhouse in many sectors, but it surprises many people that a huge number of everyday basic items have to be imported. The current pandemic-related shortages have fueled calls from political leaders of both parties for U.S. manufacturers to start producing critical supplies domestically. And long before the pandemic, President Trump was pushing U.S. companies to bring back production from overseas.

The issue is complex and defies easy solutions. The challenge lies in a combination of how modern supply networks are structured and the operational metrics applied to manufacturers. Taken together, the United States and other advanced industrial economies have evolved a highly efficient and productive product manufacturing-and-delivery system that provides them with a cornucopia of products at relatively low costs. But inherent in that system are dependencies and expectations that the pandemic has called into question.

The days are long gone when a single vertically-integrated manufacturer like Ford or General Motors could design and manufacture all or most of the subassemblies and components it needs to make a finished product. Technology is just too complicated, and it is impossible to possess all the skills that are necessary in just one place. Consequently, manufacturers have turned to specialists and subcontractors who narrowly focus on just one area — and even those specialists have to rely on many others. And just as the world has come to rely on different regions for natural resources like iron ore or lithium metal, so too has it become dependent on regions where these specialists reside.

Even something as simple as an energy-efficient desk lamp has sophisticated components like LED lights that are made in high-tech factories. Devices like smartphones, medical equipment, and precision instruments contain components whose design and manufacture require a great deal of specialization. The design and manufacture of modern microcircuits involves sophisticated tools, and the people using them need considerable training and experience to operate them successfully.

The dependence on specialists is clear if we look at a typical notebook computer. Companies like Dell and HP rely on a handful of Taiwanese original design manufacturers to do the assembly work, but those assemblers, in turn, depend on multiple subsystem manufacturers.

For example, the display is made up of a number of components. At its heart is a thin-film transistor liquid crystal display (TFT-LCD) panel, which is mated with a backlight assembly and bezel. The TFT-LCD panels are made by a handful of Asian manufacturers in large, capital-intensive factories — the most recent of these cost more than $6 billion each to build and equip. These panel makers, in turn, are dependent on others who supply essential raw materials such as optically flat glass sheets, polarizing films, flexible circuit connectors, display driver chips, and a host of other inputs. The display driver chips are made in semiconductor factories (“fabs”) spread around the world.

Other key subsystems require similarly narrow skill sets. The memory chips are made predominantly by three global specialists in their multi-billion-dollar fabs, and the hard drives by two firms with factories in Thailand, Malaysia, and China. The microprocessor is generally made by either Intel or AMD. Intel produces chips in the United States and other locations, but sends them to Asia to be packaged. AMD has them made in Taiwan.

The long-term trend towards specialization in most fields is increasing because of the very different technological skills and capabilities demanded of firms working on the leading edge. Whether you are making computers, food ingredients, or personal care products, this division of labor helps firms incorporate new technologies and do so more economically than ever before. Specialists are also able to exploit scale economies both in production and design, making it harder for firms who might wish to become self-sufficient to perform those tasks economically.

The end result is that we have many suppliers scattered around the world upon whom manufacturers depend for critical components. Electronic product companies are heavily dependent on suppliers across Asia (primarily China, South Korea, and Japan). Those relying on industrial enzymes might have to turn to Denmark. Indian pharmaceutical makers rely on Chinese suppliers of active pharmaceutical ingredients. Many manufacturers have to rely on precision toolmakers in Germany, Switzerland, or northern Italy or robot makers in Germany or Japan.

Thus, while it might seem appealing for President Trump to invoke the Defense Production Act and force automakers to pivot to manufacturing medical ventilators, it is very difficult for them to ramp up production if key components like pressure sensors or valves are made by an offshore specialist. Even something as simple as an N95 mask made in the United States by 3M uses (according to the label on the box) “globally sourced materials.”

A manufacturer not only has to source all of the components of a product, it also has to scale up production. This task is often taken for granted, but it is part of the really hard work of taking a product to market. The process includes setting up the supply chain for all of the raw materials, designing an assembly process with the appropriate tooling and fixtures, building or securing test equipment, establishing testing and quality procedures, and working through materials handling, staffing, and countless other details.

While there are many firms in the United States that know how to put products into production, their number is much lower than what it used to be. That is because the job of taking a product into manufacturing has increasingly turned into one of sourcing from offshore producers. One manufacturer that had offshored a lot of its production told me, “Operations management leadership has turned into procurement leadership.” Increasingly, the job has been to specify the product for an offshore original-design manufacturer or to transfer the work to a contract manufacturer. In an emergency, when a U.S. company suddenly needs to scale up, the skills are hard to find.

Overall equipment effectiveness (OEE) is the percentage of time that a factory is truly productive. A score of 100% means that you are producing 100% good parts (no defects) as fast as possible and are never stopping production. In practice, most production lines schedule downtime for preventive maintenance or changeovers, so scores of 85% are considered good. But given their focus on OEE, managers are reluctant to install excess capacity. That means they size a factory to handle the expected demand, with some surge capacity but not a lot of excess capacity.

Capital efficiency — how much capital you have deployed in your business — is another thing that is important to shareholders and Wall Street analysts. Nobody wants to pay for idle or underutilized capacity, and in sectors where the capital expenditures for plant and equipment are extraordinarily high (think semiconductors, flat panel displays, automotive assembly, materials processing), investors applaud the outsourcing or offshoring to someone who is willing to invest or to a geography where they can receive subsidies.

Another approach taken by many product companies is subcontracting production work. They might retain a base load of work internally and turn to contract manufacturers or outsourced manufacturing service providers for variable capacity or seasonal needs. This way they can keep their own plants fully loaded. The contracted suppliers, in turn, use demand pooling across multiple clients to smooth out their own workload and try to maximize capacity utilization, which is how they can achieve lower operating costs. But product companies are increasingly expecting their contractors to operate dedicated factories just for them, taking away the demand pooling benefit and forcing those contractors to keep capacity tight. This deprives the overall ecosystem of production flexibility when there is a sudden need.

The desire to avoid capital investments also leads to risk aversion to investing in new manufacturing technologies. I worked with a company that was supplying quantum dot backlighting technology for LCD flat-panel displays. Manufacturers were insistent that any new technologies had to fit into their existing capital-intensive workflows. I also heard a leader of a U.S. Department of Energy R&D group worry about how the extensive battery-manufacturing infrastructure in China had moved so effectively down the cost curve that it made it difficult for a potentially superior new technology from several MIT spinoffs to compete let alone raise the capital for a new production facility. The problem for the United States is exacerbated by countries like China that subsidize the construction and equipping of new production facilities.

When Toyota first designed its Toyota Production System (TPS) in the decades following World War II, one influence was the company’s lack of resources to compete with well-capitalized large automakers in the United States. Its TPS lean production system was truly a revolution in manufacturing and was predicated on minimal inventory that was pulled quickly from suppliers located nearby. It has been replicated around the world in many different industrial sectors.

Efficient transport logistics have lulled major companies into building globally distributed, lean production systems. Pronouncements by industry leaders like Apple’s Tim Cook that inventory is “fundamentally evil” reflect the prevailing view that inventory along the supply chain not only risks obsolescence, it represents cash that is tied up that could be used for better purposes. So as companies have moved from a “Toyota City” model with suppliers clustered in a tight geographical area to supply chains that span the globe connected by dependable and predictable logistics links, firms have continued to squeeze inventory out of their supply chains whenever and wherever possible.

Leaders of product companies go to their plant managers or their outsource manufacturing providers every year and ask for “greater productivity,” which is another way of saying, “I want it cheaper.” Many procurement managers are measured on how much productivity they can deliver every year, and their bonuses are tied to it.

These pressures lead to a race to the bottom in production costs in which product companies have minimal incentives to maintain production locations in high-cost locations or to worry about geographic diversity in production. And that behavior is encouraged by consumers and business end users. If an N95 mask sitting on a rack at Home Depot that is made in China looks equivalent to an adjacent higher-priced one made in the United States, consumers typically opt for the less-expensive one.

But the current pandemic is not the only black swan event of the last 15 years. Arguably there have been several — including the 2008 financial crisis, the 2011 Tohoku East Japan earthquake and tsunami, the flooding in Thailand, and the U.S.–China trade war. The trade war got some firms to relocate some of their production out of China, but movement has been slow, and supplier risk is still largely undiversified.

The pandemic has been and will continue to be a major shock to global supply chains and sourcing strategies. It is as if we suddenly lowered the level of the ocean and exposed all kinds of risks and obstructions that were previously hidden from view. Managers should use the unfolding disruptions to assess their supply strategies and initiate actions that will improve their resilience in the future. Some steps to consider include:

Plan to diversify sources for critical components and materials. This might include geographic diversification, either partnering with the same supplier or using second sources where economically feasible. As an example, Taiwan Semiconductor Manufacturing Company has spread its most important fabs across three science parks in Taiwan. Intel uses multiple fabs across the United States, Ireland, and Israel to produce its microprocessors. Many manufacturers are wary of the expense of duplicate tooling and the challenges in balancing production workloads across multiple sites, but they may wish to reconsider as more weak links are exposed.

Reconsider capacity-planning strategies for strategic commodities like medical supplies. This will likely have to be in collaboration with national governments, which may be willing to subsidize extra capacity by making purchases for a national stockpile. Alternatively, a government might subsidize surge capacity via something like the U.S. Department of Defense’s Trusted Foundry Program or Civil Reserve Air Fleet program.

If our content helps you to contend with coronavirus and other challenges, please consider subscribing to HBR. A subscription purchase is the best way to support the creation of these resources.

These cookies allow us to count visits and traffic sources so we can measure and improve the performance of our site. They help us to know which pages are the most and least popular and see how visitors move around the site. All information these cookies collect is aggregated and therefore anonymous. If you do not allow these cookies we will not know when you have visited our site, and will not be able to monitor its performance.

Our company specializes in developing solutions that arerenowned across the globe and meet expectations of the most demanding customers. Orient Display can boast incredibly fast order processing - usually it takes us only 4-5 weeks to produce LCD panels and we do our best to deliver your custom display modules, touch screens or TFT and IPS LCD displays within 5-8 weeks. Thanks to being in the business for such a noteworthy period of time, experts working at our display store have gained valuable experience in the automotive, appliances, industrial, marine, medical and consumer electronics industries. We’ve been able to create top-notch, specialized factories that allow us to manufacture quality custom display solutions at attractive prices. Our products comply with standards such as ISO 9001, ISO 14001, QC 080000, ISO/TS 16949 and PPM Process Control. All of this makes us the finest display manufacturer in the market.

Without a shadow of a doubt, Orient Display stands out from other custom display manufacturers. Why? Because we employ 3600 specialists, includingmore than 720 engineers that constantly research available solutions in order to refine strategies that allow us to keep up with the latest technologiesand manufacture the finest displays showing our innovative and creative approach. We continuously strive to improve our skills and stay up to date with the changing world of displays so that we can provide our customers with supreme, cutting-edge solutions that make their lives easier and more enjoyable.

Customer service is another element we are particularly proud of. To facilitate the pre-production and product development process, thousands of standard solutions are stored in our warehouses. This ensures efficient order realization which is a recipe to win the hearts of customers who chose Orient Display. We always go to great lengths to respond to any inquiries and questions in less than 24 hours which proves that we treat buyers with due respect.

Choosing services offered by Orient Display equals a fair, side-by-side cooperation between the customer and our specialists. In each and every project, we strive to develop the most appropriate concepts and prototypes that allow us to seamlessly deliver satisfactory end-products. Forget about irritating employee turnover - with us, you will always work with a prepared expert informed about your needs.

In a nutshell, Orient Display means 18% of global market share for automotive touch screen displays, emphasis on innovation, flexibility and customer satisfaction.Don"t wait and see for yourself that the game is worth the candle!

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey