chi mei optoelectronics lcd panel made in china

Production Details Product Name: High quality 9 inch 800*480 lcd display Module AT090TN12 V. 3 Size : 9inch Resolution : 800*480 Condition : NEW in Stocks & Tested ok Application: Industry application Grade: Grade A Type: TFT Backlight: LED Market: All over the world. We are saleing TFT LCD mo dule for the PDA,GPS,game device and mobile phone and it is one of the largest scale and best after-service company in the area of PDA spare parts.

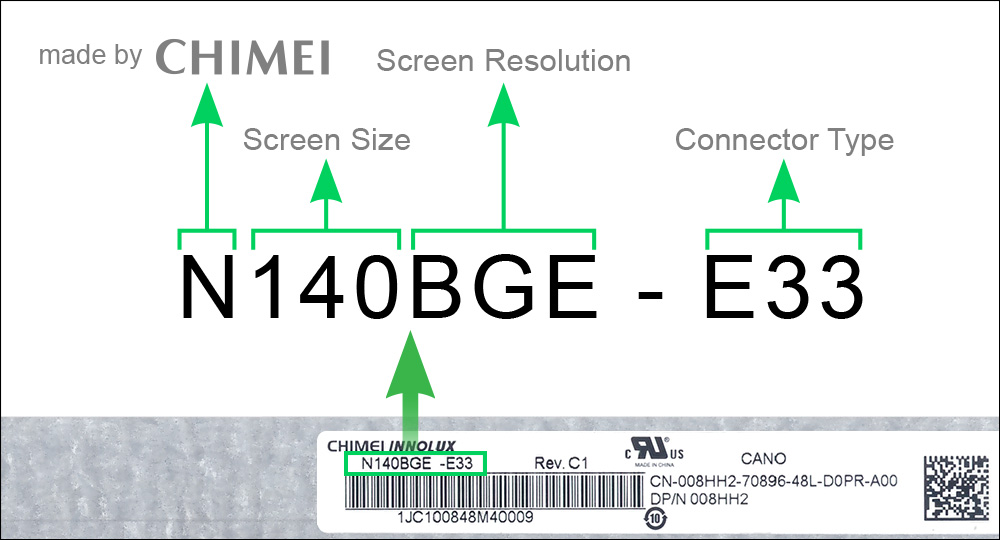

Innolux Chimei lcd panel can be widely used in Automotive Display,car audio, machine control panel, ATM,laptop,medical equipment,smart home and other products.

Our company is a special dealer of Innolux,professional sales of all Innolux lcd screens and modules.Our customers are all over the world, providing the best products and services for all customers.

Innolux is one of the most professional LCD screen manufacturers in the world,belongs to Foxconn Group.Innolux was founded in 2003 and went public in Taiwan in 2006. In March 2010, its merger with Chi Mei Optoelectronics and TPO Displays marked the largest merger in the history of the panel industry.

Chi Mei Optoelectronics Corporation - Company Profile, Information, Business Description, History, Background Information on Chi Mei Optoelectronics Corporation

Mission Statement: Business as a Way to Pursue Fulfillment. Human Man agement and Harmony are the most important and have been the operatin g principles of the whole Chi Mei Group.

Established only in 1998, Chi Mei Optoelectronics Corporation (CMO) i s one of the world"s leading manufacturers of thin-film transistor li quid crystal displays, better known as TFT-LCD flat-panel displays. T he company produces more than 4.5 million flat-panel displays per yea r, and expects to top five million panels annually before 2006. CMO o perates four LCM (liquid crystal display module) plants in Taiwan"s S outhern Taiwan Science Park (STSP). That complex was subsidized by th e Taiwanese government as part of its decision to make LCD displays o ne of the island"s key manufacturing areas. The company"s production operations include a 5.5G (generation) plant for production of 27-inc h displays and a 6.0G plant for production of 32-inch displays. In 20 05, CMO announced its intention to open an LCM plant in mainland Chin a, in part because of a labor shortage in Taiwan. The opening of that plant will help CMO reclaim the industry"s top spot from chief rival AU Optronics. In addition to TFT-LCDs, CMO has been developing its o wn organic light-emitting diode (OLED) display capacity; the company also produces color filters. Chairman and founder Hsu Wen-lung, who s uffered criticism from Beijing because of his support for Taiwan"s in dependence-minded government, stepped down from his position in 2005 as part of the company"s decision to enter the mainland. CMO is liste d on the Taiwan Stock Exchange but remains controlled by Chi Mei Grou p, a petrochemicals conglomerate established by Hsu"s father in 1950.

Few companies so closely mirrored Taiwan"s evolution in the second ha lf of the 20th century as Chi Mei Group and its publicly listed subsi diary Chi Mei Optoelectronics (CMO). Taiwan"s economy was virtually n on-existent at the end of the 1940s, as the newly established governm ent set out to convert itself from a predominantly agrarian base. The country turned toward the industrial sector, investing heavily to be gin producing low-cost, and often low-quality, consumer items. With l ow wages and a vast workforce, Taiwan quickly became a source for dis count goods the world over.

Chi Mei played a major role in this transition. The company originall y focused on the retail sector, and was founded as a small children"s clothing store by Shu-Ho Shi in 1950. Shu chose the name Chi Mei, fr om the Chinese words for "Unique Beauty," for his store. Yet Chi Mei" s focus quickly expanded beyond retail sales.

A number of factors converged in the early 1950s to present a major o pportunity for the company. Taiwan"s interest in developing its indus trial sector, as well as the strong role the government played in dir ecting the country"s economic and corporate policy, created a fertile environment for a new breed of entrepreneurs. At the same time, the development of new plastic technologies had opened up an extraordinar ily large range of production possibilities. The timing for the new m aterials was perfect; the Western world was undergoing a period of su stained economic growth. The booming economies of the West not only c reated unprecedented levels of disposable income, but also steady adv ances in leisure time. Yet another factor came into play in the 1950s and 1960s: with more and more women joining the workforce, families began to shrink in size. Fewer children meant that parents were willi ng to spend more on each individual child, stimulating a surge in dem and for children"s toys. Meanwhile, the use of plastics opened up a w hole new range of potential shapes and colors, introducing one of the most creative eras of toy-making ever known.

Chi Mei entered the children"s toy market in 1953, setting up Chi Mei with its own manufacturing plant. The initial facility was quite mod est, occupying just 26 square meters, manned by four employees. The c ompany began producing toys and other household items, and the words "Made in Taiwan" quickly became ubiquitous throughout the Western wor ld. Shu was joined by son Hsu Wen-lung, who became the driving force behind the company"s conversion into an industrial powerhouse.

By the late 1950s, however, Chi Mei had recognized a greater opportun ity in producing the basic plastics materials themselves. In 1957, th e company launched a research and development effort in order to esta blish its own methods for the production of acrylic sheets. This led to the creation of a new subsidiary, Chi Mei Industrial Co., led by H su Wen-lung. The company built a new industrial complex at Yen Chen T ainan, and launched production in 1960.

Chi Mei brought its acrylic sheets to the export market in 1963. Soon after the company launched production of one of its most successful products, Kibi Board, plywood sheets coated with decorative paper, se aled under a layer of polyester resin. By 1967, the company had devel oped a second, similar product, Mega Board, which differed from Kibi Board in that it was coated with an aminoalkyd resin. By then, too, t he company also had begun to produce buttons, starting in 1964, and q uickly became one of the world"s leading suppliers of buttons.

The success of its finished products enabled Chi Mei to begin its tra nsformation into one of Taiwan"s leading petrochemicals groups toward the end of the 1960s. This effort began in 1965, with the creation o f the company"s first technology transfer joint venture with Mitsubis hi. The following year, Chi Mei launched a new research and developme nt effort to build expertise in the production of expandable polystyr ene (EPS). In 1968, Chi Mei turned to Mitsubishi again for technology , forming a new joint venture for the production of a larger range of polystyrene types, including general purpose polystyrene and high-im pact polystyrene resins.

By the early 1970s, Chi Mei had established its first overseas plant, in the Philippines. The company"s polystyrene operations also became its largest component, topping its acrylic sheets sales by the middl e of the decade. Through the next decade, the company continued to de velop new plastics and petro-chemicals capacity, becoming a leading p roducer of acrylic granulates and acrylic extrusion sheets. Into the 1990s, Chi Mei expanded its technology to include production of TPE r ubber and other plastics. By then, the company had, in large part, ex ited its former finished goods production, dropping buttons in 1982 a nd both the Kibi and Mega Boards in 1985.

By the mid-1990s, however, Taiwan faced increasing competitive pressu re from other emerging, low-cost markets. The country"s relatively hi gh wages meant that it increasingly was unable to compete against the growing industrial strength of the developing markets. The gradual e mergence of mainland China as a low-cost consumer goods producer espe cially promised to transform the industrial landscape on a global sca le.

In recognition of the shifting situation, the Taiwanese government be gan encouraging the transformation of its economy toward higher-end t echnological sectors. Into the mid-1990s, the TFT-LCD market had beco ming one of the most promising of the high-tech growth markets. The d evelopment of new generations of portable telephones, the promise of digital cameras, and the increasing development of portable computers as a consumer and even household appliance, but especially the devel opment of the first generation of LCD-based televisions, encouraged t he Taiwanese government to target that sector for its new technology initiatives.

Another factor played a role in Taiwan"s development as a center for world TFT-LCD production. Liquid crystals had been discovered as earl y as 1888 by Friedrich Reinitzer, a botanist in Austria. Yet the firs t practical application of liquid crystals did not take place until t he late 1960s, when the United States" RCA launched the first display utilizing LCD technology. During the 1970s, however, the center of L CD technology shifted to Japan, and the country emerged as the global center for LCD production. The Japanese jealously guarded their tech nology, maintaining control of the market into the late 1990s.

Yet the collapse of the Japanese economy during the decade left the c ountry"s TFT-LCD manufacturers cash-strapped just at a time when the world saw a surge in demand for TFT-LCD displays. In order to ensure the continued growth in production, the Japanese manufacturers began seeking joint ventures elsewhere, in South Korea and especially Taiwa n. There, the Japanese companies found a ready list of cash-rich comp anies willing to enter TFT-LCD production.

Chi Mei decided to enter the market in 1997, setting up operations fo r the production of color filters, under Chi Mei Electronics (CME), a nd TFT-LCD displays, under Chi Mei Optoelectronics (CMO). By 1998, th e company had signed on its first technology partner, Fujitsu, which entered into an alliance with CME. This was soon followed by the grou p"s first TFT-LCD partnership, again with Fujitsu. By 1999, CMO and F ujitsu had strengthened their partnership to include an agreement to co-develop new large-screen LCD technologies. Chi Mei also began prod uction of LCD monitors, under a new subsidiary set up that year, Arch Technology Inc. By the end of that year, as well, CMO had succeeded in producing 14-inch TFT-LCD panels. This led the company to sign a n ew long-term development supply alliance with Dell Computer.

CMO took over the operations of CME in 2000 as the company geared up its vertical integration model, an important part of its strategy for its future display technologies growth. The company also was gaining expertise in large-sized panels, launching its first 18-inch display panel early the next year.

The year 2001 marked a new milestone for CMO"s development into one o f the world"s leading producers of TFT-LCD panels. In August of that year, the company agreed to take over IBM of Japan"s Yasu Industrial Complex, acquiring not only its Japanese production capacity, but esp ecially its technology. This acquisition led the company to focus on its panel display development, selling off the consumer-oriented Arch Technology.

By 2002, CMO had unveiled its first 30-inch TFT-LCD television displa y. In that year, CMO went public, the first member of the Chi Mei Gro up to do so. By then, CMO had become the motor for Chi Mei"s overall growth, serving as the group"s largest revenue generator.

The maturation of Taiwan"s LCD industry was clearly in place in the e arly 2000s. Not only had the island become the center of worldwide LC D production, boasting most of the world"s top five producers, the co untry also had emerged as a leading technological center. This develo pment was highlighted by CMO"s announcement in 2003 that it had decid ed to develop its own color-filter technology for new generation disp lay panels, becoming the first of the big six Taiwanese producers to set up its own color filter facilities.

CMO launched a new fifth-generation production facility in 2003, and began preparations to open a sixth generation and seventh generation plant at mid-decade. By 2005, the company had developed its expertise in the production of panels up to 32 inches in size. This led the co mpany to reach an agreement with Sony Corporation to sell its 3G plan t in Japan in 2004.

CMO remained the last of the major Taiwanese LCD producers to enter t he mainland Chinese market, in part because of founder and Chairman H su Wen-lung"s open support for Taiwan President Chen Shui-ban. Yet di fficulties in recruiting new workers, especially the lower wages of t he Chinese mainland, left CMO in a vulnerable position vis-à-v is its competitors.

When CMO launched plans to develop production capacity in the mainlan d, however, it found itself in the middle of the political battle bei ng waged between Beijing and Taiwan. After the Chinese government"s n ewspaper, thePeople"s Daily, branded Hsu as "a shameless anti -Chinese bigot," and further indicated that the country would not wel come "these sort of Taiwanese business people," Hsu conceded defeat a nd resigned from his post as chairman of CMO. Then in 2005, Hsu gave a speech in which he publicly stated that Taiwan and the mainland wer e part of "one" China. Soon afterward, CMO received permission to bui ld its first LCD module plant in China. The move was expected to help the company reclaim its title as industry leader, which was captured by rival AU Optronics in August of that year. From toy maker to glob al technological leader, Chi Mei, with its publicly listed subsidiary CMO, had established itself as a quintessential member of Taiwan"s i ndustrial community.

Established only in 1998, Chi Mei Optoelectronics Corporation (CMO) is one of the world"s leading manufacturers of thin-film transistor liquid crystal displays, better known as TFT-LCD flat-panel displays. The company produces more than 4.5 million flat-panel displays per year, and expects to top five million panels annually before 2006. CMO operates four LCM (liquid crystal display module) plants in Taiwan"s Southern Taiwan Science Park (STSP). That complex was subsidized by the Taiwanese government as part of its decision to make LCD displays one of the island"s key manufacturing areas. The company"s production operations include a 5.5G (generation) plant for production of 27-inch displays and a 6.0G plant for production of 32-inch displays. In 2005, CMO announced its intention to open an LCM plant in mainland China, in part because of a labor shortage in Taiwan. The opening of that plant will help CMO reclaim the industry"s top spot from chief rival AU Optronics. In addition to TFT-LCDs, CMO has been developing its own organic light-emitting diode (OLED) display capacity; the company also produces color filters. Chairman and founder Hsu Wen-lung, who suffered criticism from Beijing because of his support for Taiwan"s independence-minded government, stepped down from his position in 2005 as part of the company"s decision to enter the mainland. CMO is listed on the Taiwan Stock Exchange but remains controlled by Chi Mei Group, a petrochemicals conglomerate established by Hsu"s father in 1950.

Few companies so closely mirrored Taiwan"s evolution in the second half of the 20th century as Chi Mei Group and its publicly listed subsidiary Chi Mei Optoelectronics (CMO). Taiwan"s economy was virtually non-existent at the end of the 1940s, as the newly established government set out to convert itself from a predominantly agrarian base. The country turned toward the industrial sector, investing heavily to begin producing low-cost, and often low-quality, consumer items. With low wages and a vast workforce, Taiwan quickly became a source for discount goods the world over.

Chi Mei played a major role in this transition. The company originally focused on the retail sector, and was founded as a small children"s clothing store by Shu-Ho Shi in 1950. Shu chose the name Chi Mei, from the Chinese words for "Unique Beauty," for his store. Yet Chi Mei"s focus quickly expanded beyond retail sales.

A number of factors converged in the early 1950s to present a major opportunity for the company. Taiwan"s interest in developing its industrial sector, as well as the strong role the government played in directing the country"s economic and corporate policy, created a fertile environment for a new breed of entrepreneurs. At the same time, the development of new plastic technologies had opened up an extraordinarily large range of production possibilities. The timing for the new materials was perfect; the Western world was undergoing a period of sustained economic growth. The booming economies of the West not only created unprecedented levels of disposable income, but also steady advances in leisure time. Yet another factor came into play in the 1950s and 1960s: with more and more women joining the workforce, families began to shrink in size. Fewer children meant that parents were willing to spend more on each individual child, stimulating a surge in demand for children"s toys. Meanwhile, the use of plastics opened up a whole new range of potential shapes and colors, introducing one of the most creative eras of toy-making ever known.

Chi Mei entered the children"s toy market in 1953, setting up Chi Mei with its own manufacturing plant. The initial facility was quite modest, occupying just 26 square meters, manned by four employees. The company began producing toys and other household items, and the words "Made in Taiwan" quickly became ubiquitous throughout the Western world. Shu was joined by son Hsu Wen-lung, who became the driving force behind the company"s conversion into an industrial powerhouse.

By the late 1950s, however, Chi Mei had recognized a greater opportunity in producing the basic plastics materials themselves. In 1957, the company launched a research and development effort in order to establish its own methods for the production of acrylic sheets. This led to the creation of a new subsidiary, Chi Mei Industrial Co., led by Hsu Wen-lung. The company built a new industrial complex at Yen Chen Tainan, and launched production in 1960.

Chi Mei brought its acrylic sheets to the export market in 1963. Soon after the company launched production of one of its most successful products, Kibi Board, plywood sheets coated with decorative paper, sealed under a layer of polyester resin. By 1967, the company had developed a second, similar product, Mega Board, which differed from Kibi Board in that it was coated with an aminoalkyd resin. By then, too, the company also had begun to produce buttons, starting in 1964, and quickly became one of the world"s leading suppliers of buttons.

The success of its finished products enabled Chi Mei to begin its transformation into one of Taiwan"s leading petrochemicals groups toward the end of the 1960s. This effort began in 1965, with the creation of the company"s first technology transfer joint venture with Mitsubishi. The following year, Chi Mei launched a new research and development effort to build expertise in the production of expandable polystyrene (EPS). In 1968, Chi Mei turned to Mitsubishi again for technology, forming a new joint venture for the production of a larger range of polystyrene types, including general purpose polystyrene and high-impact polystyrene resins.

By the early 1970s, Chi Mei had established its first overseas plant, in the Philippines. The company"s polystyrene operations also became its largest component, topping its acrylic sheets sales by the middle of the decade. Through the next decade, the company continued to develop new plastics and petrochemicals capacity, becoming a leading producer of acrylic granulates and acrylic extrusion sheets. Into the 1990s, Chi Mei expanded its technology to include production of TPE rubber and other plastics. By then, the company had, in large part, exited its former finished goods production, dropping buttons in 1982 and both the Kibi and Mega Boards in 1985.

By the mid-1990s, however, Taiwan faced increasing competitive pressure from other emerging, low-cost markets. The country"s relatively high wages meant that it increasingly was unable to compete against the growing industrial strength of the developing markets. The gradual emergence of mainland China as a low-cost consumer goods producer especially promised to transform the industrial landscape on a global scale.

In recognition of the shifting situation, the Taiwanese government began encouraging the transformation of its economy toward higher-end technological sectors. Into the mid-1990s, the TFT-LCD market had becoming one of the most promising of the high-tech growth markets. The development of new generations of portable telephones, the promise of digital cameras, and the increasing development of portable computers as a consumer and even household appliance, but especially the development of the first generation of LCD-based televisions, encouraged the Taiwanese government to target that sector for its new technology initiatives.

Another factor played a role in Taiwan"s development as a center for world TFT-LCD production. Liquid crystals had been discovered as early as 1888 by Friedrich Reinitzer, a botanist in Austria. Yet the first practical application of liquid crystals did not take place until the late 1960s, when the United States" RCA launched the first display utilizing LCD technology. During the 1970s, however, the center of LCD technology shifted to Japan, and the country emerged as the global center for LCD production. The Japanese jealously guarded their technology, maintaining control of the market into the late 1990s.

Yet the collapse of the Japanese economy during the decade left the country"s TFT-LCD manufacturers cash-strapped just at a time when the world saw a surge in demand for TFT-LCD displays. In order to ensure the continued growth in production, the Japanese manufacturers began seeking joint ventures elsewhere, in South Korea and especially Taiwan. There, the Japanese companies found a ready list of cash-rich companies willing to enter TFT-LCD production.

Chi Mei decided to enter the market in 1997, setting up operations for the production of color filters, under Chi Mei Electronics (CME), and TFT-LCD displays, under Chi Mei Optoelectronics (CMO). By 1998, the company had signed on its first technology partner, Fujitsu, which entered into an alliance with CME. This was soon followed by the group"s first TFT-LCD partnership, again with Fujitsu. By 1999, CMO and Fujitsu had strengthened their partnership to include an agreement to co-develop new large-screen LCD technologies. Chi Mei also began production of LCD monitors, under a new subsidiary set up that year, Arch Technology Inc. By the end of that year, as well, CMO had succeeded in producing 14-inch TFT-LCD panels. This led the company to sign a new long-term development supply alliance with Dell Computer.

Mission Statement: Business as a Way to Pursue Fulfillment. Human Management and Harmony are the most important and have been the operating principles of the whole Chi Mei Group.

CMO took over the operations of CME in 2000 as the company geared up its vertical integration model, an important part of its strategy for its future display technologies growth. The company also was gaining expertise in large-sized panels, launching its first 18-inch display panel early the next year.

The year 2001 marked a new milestone for CMO"s development into one of the world"s leading producers of TFT-LCD panels. In August of that year, the company agreed to take over IBM of Japan"s Yasu Industrial Complex, acquiring not only its Japanese production capacity, but especially its technology. This acquisition led the company to focus on its panel display development, selling off the consumer-oriented Arch Technology.

By 2002, CMO had unveiled its first 30-inch TFT-LCD television display. In that year, CMO went public, the first member of the Chi Mei Group to do so. By then, CMO had become the motor for Chi Mei"s overall growth, serving as the group"s largest revenue generator.

The maturation of Taiwan"s LCD industry was clearly in place in the early 2000s. Not only had the island become the center of worldwide LCD production, boasting most of the world"s top five producers, the country also had emerged as a leading technological center. This development was highlighted by CMO"s announcement in 2003 that it had decided to develop its own color-filter technology for new generation display panels, becoming the first of the big six Taiwanese producers to set up its own color filter facilities.

CMO launched a new fifth-generation production facility in 2003, and began preparations to open a sixth generation and seventh generation plant at mid-decade. By 2005, the company had developed its expertise in the production of panels up to 32 inches in size. This led the company to reach an agreement with Sony Corporation to sell its 3G plant in Japan in 2004.

CMO remained the last of the major Taiwanese LCD producers to enter the mainland Chinese market, in part because of founder and Chairman Hsu Wen-lung"s open support for Taiwan President Chen Shui-ban. Yet difficulties in recruiting new workers, especially the lower wages of the Chinese mainland, left CMO in a vulnerable position vis-à-vis its competitors.

When CMO launched plans to develop production capacity in the mainland, however, it found itself in the middle of the political battle being waged between Beijing and Taiwan. After the Chinese government"s newspaper, the People"s Daily, branded Hsu as "a shameless anti-Chinese bigot," and further indicated that the country would not welcome "these sort of Taiwanese business people," Hsu conceded defeat and resigned from his post as chairman of CMO. Then in 2005, Hsu gave a speech in which he publicly stated that Taiwan and the mainland were part of "one" China. Soon afterward, CMO received permission to build its first LCD module plant in China. The move was expected to help the company reclaim its title as industry leader, which was captured by rival AU Optronics in August of that year. From toy maker to global technological leader, Chi Mei, with its publicly listed subsidiary CMO, had established itself as a quintessential member of Taiwan"s industrial community.

Key Dates:1950:Shu-Ho Shi sets up the Chi Mei retail store selling children"s clothing in Taiwan.1953:Chi Mei launches industrial production of plastic toys and household goods.1957:Under son Hsu Wen-lung, Chi Mei begins production of acrylic sheeting.1968:The company launches production of polystyrene.1997:The company announces its intention to begin production of TFT-LCD panels.1998:Chi Mei Optoelectronics (CMO) is created.1999:A technology transfer agreement is made with Fujitsu.2001:The company acquires an LCD fab in Japan from IBM.2004:Hsu Wen-lung steps down as chairman after the mainland Chinese government labels him "a shameless anti-Chinese bigot."2005:CMO receives approval to set up production facilities in mainland China.

An executive at the Chi Mei Optoelectronics Corp (奇美光電) said rising TFT-LCD panel prices and the need to secure US$1.5 billion for a state-of-the-art TFT-LCD production facility prompted the company to set July for its Taiwan Stock Market listing.\n"So far we have seen a 25 percent price increase" in standard 15-inch LCD panels, said Jeff Hsu, vice president at Chi Mei, at Merrill Lynch"s 5th Annual Asia Pacific Technology Conference in Taipei yesterday, adding that the steep price rise has not dampened consumer enthusiasm.\nChi Mei is one of the nation"s top four TFT-LCD panel makers, along with Au Optronics Corp (友達光電), Chunghwa Picture Tubes Ltd (中華映管), and HannStar Display Corp (瀚宇彩晶).\nSales of TFT-LCD screens began to take off late last year as falling prices prompted consumers to make the switch to the flat computer displays. \nThe price of an LCD monitor has dropped to about double that of older, more traditional CRT monitors.\nEven computer retail giants like Dell Computer Corp and Compaq Computer Corp have been bundling LCD displays with new computers. \nRising demand, in turn, has sparked price increases by TFT-LCD flat-panel suppliers, boosting local producers.\nThe price per unit for TFT-LCD panels has risen to US$250, and "we think an additional US$20 to US$30 increase is possible," Hsu said.\nChi Mei is projected to end this year as the third largest TFT-LCD flat-panel maker. It plans to list on the local bourse in order to help pay for a new, state-of-the-art "fifth generation" TFT-LCD production facility.\nThe new US$1.5 billion facility is already under construction. The fifth generation production process is expected to cut costs by making the glass plates from which the screens are cut much larger. \nThe company"s Taiwanese competitors have announced plans to build such plants, and industry leaders Samsung Electronics Co and LG.Philips LCD Co have them up and running.\nThe design for Chi Mei"s fifth generation plant will be based on a design that International Business Machines Corp planned to use in Singapore. \nIBM sold its Japanese subsidiary TFT-LCD producer to Chi Mei late last year, and the plans for the fifth generation plant were included in that deal.\nChi Mei is building the new plant in the Tainan Science-based Industrial Park (台南科學園區) and production should begin by the middle of next year.\nThe company also believes its acquisition of IBM-Japan -- in which Chi Mei purchased at an 85 percent stake -- will push it into the top of the industry. \nThe new Japanese plant, renamed IDTech, increases Chi Mei"s production by around 3 million units per year. This year, the company believes it will produce between 7.7 million to 8 million units in all.\nIBM retained a 15 percent stake in IDTech, and took a 1.8 percent stake in Chi Mei itself. \nThe deal gives Chi Mei a strong technology partner for fifth generation technology and beyond. Chi Mei will also produce TFT-LCD panels for IBM on a contract basis.\n"IBM is our investor, our customer, and they are our technology partner as well," Hsu said. Japanese electronics powerhouse Fujitsu is Chi Mei"s other technology partner.\nThe top two TFT-LCD panel makers in the world currently are Samsung and LG.Philips, while Taiwan"s AU Optronics is ranked third, according to the market research group DisplaySearch. \nChi Mei is currently the eighth largest TFT-LCD panel maker.

The nation’s two largest liquid-crystal-display (LCD) panel makers AU Optronics Corp (友達光電) and Chi Mei Optoelectronics Corp (奇美電子) yesterday said they have inked memorandums of understanding (MOUs) with China’s major TV vendors led by TCL Corp as demand from US and European customers dwindles amid the economic downturn.

The cross-strait tie-ups may help Taiwanese LCD panel makers in expanding their customer lineups to China, one of the world’s fastest-growing flat-panel TV markets, and lower their risk in the volatile LCD industry as well, analysts said.

On the back of the news, AU Optronics and Chi Mei stock prices jumped 3.61 percent and 3 percent to NT$24.4 and NT$10.3, respectively, outperforming the benchmark TAIEX index, which inched up 0.76 percent yesterday.

In a company filing to the Taiwan Stock Exchange yesterday, AU Optronics said it would form a strategic partnership with China’s top TV vendors via the building of a TV supply chain. AU Optronics did not provide financial details about the MOU.

“China is certainly an important market for Chi Mei and it is one of few markets with relatively stable growth,” Chi Mei spokesman Denis Chen (陳世賢) told the Taipei Times by telphone.

The companies’ remarks followed a statement by Taiwan Affairs Office Director Wang Yi (王毅) on Dec. 21 in Shanghai that China would buy US$2 billion in flat screen monitors from Taiwanese companies.

Two local business dailies reported yesterday that AU Optronics Chairman Lee Kun-yao (李焜耀) and Chi Mei Optoelectronics Chairman Frank Liao (廖錦祥) would sign the pacts with nine Chinese companies at an industry forum in China yesterday.

The two Chinese-language newspapers — the Commercial Times and the Economic Daily News — said the nine Chinese TV makers include TCL, Haier Group (海爾), Chang-hong Electric Co (長虹電器), Konka Group Co (康佳) and Skyworth Digital Holdings Ltd (創維數碼控股).

“The purchase deal will not provide an immediate boost to Taiwanese panel suppliers in terms of shipments and revenues. But it will bring a positive impact in the long run on the back of China’s sizable TV market,” Roger Yu (游智超), who tracks the LCD industry for Polaris Securities Co (寶來證券), said yesterday.

The US$2 billion orders for Taiwanese panel makers that Beijing has promised may not look enticing at first sight as orders are expected to come in over the next three to five years, Yu said.

But the market potential in China is attractive, Yu said. Orders from Chinese customers could prove vital as they may help local firms offset reduced demand from Japanese and South Korean customers, he said.

Most major Japanese and South Korean TV makers such as Sony Corp and Samsung Electronics Co have shifted production to their own factories, or their panel joint ventures for panel purchases, while cutting orders from Taiwanese suppliers, Yu said.

In 2023, global foundry manufacturer revenue will show a 2-3% decrease due to the uncertainty of the macroeconomic environment and the US-China technology war.

The project, in Foshan"s Nanhai District, was granted permission by the Taiwan authorities late last month, and will be both the largest TFT-LCD factory in the province as well as the largest overseas investment project in Foshan.

CMO, based in Taiwan, is one of the world"s leading TFT-LCD suppliers. Its key products are large-size TFT-LCD panels for laptops, desktop monitors, and televisions.

He said that the Nanhai project will produce 2 million liquid crystal modules (LCM) a month, reaching a gross industrial output value of US$10 billion in the fourth quarter of 2008.

"Guangdong is developing the TFT-LCD industry into a key industry in the 11th Five Year Plan (2006-10) and the Nanhai CMO project is expected to make a tremendous contribution to the development of the industry in the province," noted Tong Xing, vice-governor of Guangdong.

The senior official said the province"s strategy to develop the TFT-LCD industry is based on demand generated by the sustained development of the TV and computer industries in Guangdong.

Guangdonghas long been China"s key manufacturing base for TVs and computers, and TVs made in the province account for 47 per cent of the nation"s total.

"The TV industry in the province needs to be upgraded with the latest technological developments, including TFT-LCD, to guarantee sustained development," said Tong.

CHIMEI Corporation (Chinese: 奇美實業; pinyin: Qíměi Shíyè; CMC) is a Taiwan-based performance materials company. It has long been known as the world’s largest vendor of ABS resins. It has factories in Tainan, Zhenjiang and Zhangzhou. It also produces advanced polymer materials, synthetic rubbers, and specialty chemicals.

CHIMEI Corporation is part of a privately held holding company called the CHIMEI Group, which has numerous subsidiaries. One of them is Chi Mei Optoelectronics (CMO), which was founded in 1997 as a subsidiary of Chi Mei Corporation. Chi Mei Group was the largest shareholder in publicly listed CMO. The new Chinese: 奇美電子, CMI) is the world"s No. 2 and Taiwan"s No. 1 largest maker of TFT-LCD panelsWestinghouse Digital Electronics. Though CEO Douglas Woo has maintained the confidentiality of the ownership of the private Westinghouse licensee, they admit a significant vertically integrated relationship exists between the two.

The company was founded by Shi Wen-long in 1960 as Chi Mei Industrial Company Ltd., the first acrylic sheet manufacturer in Taiwan; it was renamed CHIMEI Corporation in 1992.

In 2001, the CHIMEI Group along with IBM Japan set up International Display Technology, which it subsequently sold to Sony in 2005.price fixing conspiracy with respect to sales of TFT-LCDs between 2001 and 2006.

TAIPEI, Oct 20 (Reuters) - Taiwan is mulling easing controls on the technologies its flat-panel makers can use in their China operations, as South Korean and Japanese rivals have stepped up investments there, the Commercial Times reported on Tuesday. LCD panel makers, including AU Optronicsand Chi Mei Optoelectronics, will be able to use any technologies in mainland production as long as they use more advanced technologies in Taiwan, the Chinese-language paper said, citing unnamed government officials.

“We think the evaluation standard should be that technology and production they have in Taiwan exceeds that in China,” it quoted economics minister Shih Yen-shiang as saying in response to questions from lawmakers.

LCD panel makers in Japan and South Korea have said they would invest in more advanced 7.5th- and 8.5th- generation technologies in China, posing a threat to Taiwan companies, the paper said.

Taiwan President Ma Ying-jeou told Reuters on Monday the island had not considered allowing the island’s LCD firms to make large panels on the mainland for now, saying it would only cautiously export its technology expertise to China. [ID:nTP169514]

In late September, Shih said the ministry would allow chip makers and flat-panel firms to invest more in China, including using more advanced process technology for chips and allowing LCD firms to make large panels there, but gave no timetable. [ID:nTP321454]

Taiwanese firms such as AU, TSMCand UMC, have urged the government to allow them to invest in China or use more advanced technologies to help cut costs and compete with global rivals.

It offers television, desktop monitors and notebook computer, audio and video, and mobile panels. It also offers glass, film, and one glass capacitive touch panels. Originally established in 2003 and publicly listed in 2006. The company merged with Chi Mei Optoelectronics and Toppoly Optoelectronics in March 2010, in what was the largest merger in the flat panel display industry. Chimei Innolux Corporation was the successor company, and it initially preserved the Chimei name. In order to differentiate itself from the ChiMei brand, the company was renamed "Innolux Corporation" in December 2012.

Innolux"s 14 plants in Taiwan possess a complete range of 3.5G, 4G, 4.5G, 5G, 6G, 7.5G, and 8.5G-8.6G production line, making it the world"s total display solutions provider offering a full range of large/medium/small LCD panels and touch-control screens.Innolux offers advanced display integration solutions employing innovative, differentiated technology, including 4K2K ultra-high resolution, 3D naked eye, IGZO, LTPS, AMOLED, OLED, and touch-control solutions. Innolux is active in drafting specifications, and is a market trend leader. Its all-inclusive product lines span the full range of TFT LCD panel modules and touch panels, including TV panels, desktop monitors, notebook computer panels, small and medium-sized panels, and medical and automotive panels. The world"s leading manufacturer of TFT-LCD displays, Innolux supplies customers that include many of the world"s leading information and consumer electronics manufacturers.

After its creation in a three-in-one merger, in order to increase its integration and synergy, Innolux has made in Taiwan its R&D center, is training core technical manpower, and is increasing its capacity in order to better serve the needs of its many customers worldwide. Compared with conventional panel manufacturers only bearing responsibility for panel production, Innolux provides access to an integrated product manufacturing and supply chain, and provides customers complete solutions based on its panel expertise, vertical integration, and innovative business methods. Apart from its extensive TFT-LCD experience and superlative quality, Innolux is applying its advanced management skills to the perfection of process technologies and components.

Innolux"s employees worldwide number more than 56,000, and its production sites and sales locations span the globe. With its major TFT plants located in Zhunan and Tainan, both in Taiwan, Innolux has also established overseas module plants in the Chinese cities of Ningbo, Nanjing, Foshan, and Shanghai. Innolux"s extensive global presence allows it to quickly provide a full range of services to its customers, reducing logistics and manpower costs, while achieving the environmental objectives of energy conservation and reduced carbon emissions. Innolux"s unique intelligent management platform has not only enhanced the company"s management capabilities, but also provides customers with prompt, accurate delivery information. This is just one of the ways we are constantly striving to boost customer satisfaction.

Innolux is rooted in Taiwan, but has global ambitions. As a leader in the global optoelectronics industry chain, Innolux has many responsibilities and duties. It is actively recruiting and training R&D talent in order to consolidate its prominent status in the industry. Innolux is striving to realize the apex in human visual enjoyment, and relies on its "inimitable competitiveness" to ensure corporate sustainability and provide the greatest possible satisfaction and benefit to shareholders, customers, employees, and all of society.

LCD manufacturers are mainly located in China, Taiwan, Korea, Japan. Almost all the lcd or TFT manufacturers have built or moved their lcd plants to China on the past decades. Top TFT lcd and oled display manufactuers including BOE, COST, Tianma, IVO from China mainland, and Innolux, AUO from Tianwan, but they have established factories in China mainland as well, and other small-middium sizes lcd manufacturers in China.

China flat display revenue has reached to Sixty billion US Dollars from 2020. there are 35 tft lcd lines (higher than 6 generation lines) in China,China is the best place for seeking the lcd manufacturers.

The first half of 2021, BOE revenue has been reached to twenty billion US dollars, increased more than 90% than thesame time of 2020, the main revenue is from TFT LCD, AMoled. BOE flexible amoled screens" output have been reach to 25KK pcs at the first half of 2021.the new display group Micro LED revenue has been increased to 0.25% of the total revenue as well.

Established in 1993 BOE Technology Group Co. Ltd. is the top1 tft lcd manufacturers in China, headquarter in Beijing, China, BOE has 4 lines of G6 AMOLED production lines that can make flexible OLED, BOE is the authorized screen supplier of Apple, Huawei, Xiaomi, etc,the first G10.5 TFT line is made in BOE.BOE main products is in large sizes of tft lcd panel,the maximum lcd sizes what BOE made is up to 110 inch tft panel, 8k resolution. BOE is the bigger supplier for flexible AM OLED in China.

Technology Co., Ltd), established in 2009. CSOT is the company from TCL, CSOT has eight tft LCD panel plants, four tft lcd modules plants in Shenzhen, Wuhan, Huizhou, Suzhou, Guangzhou and in India. CSOTproviding panels and modules for TV and mobile

three decades.Tianma is the leader of small to medium size displays in technologyin China. Tianma have the tft panel factories in Shenzhen, Shanhai, Chendu, Xiamen city, Tianma"s Shenzhen factory could make the monochrome lcd panel and LCD module, TFT LCD module, TFT touch screen module. Tianma is top 1 manufactures in Automotive display screen and LTPS TFT panel.

Tianma and BOE are the top grade lcd manufacturers in China, because they are big lcd manufacturers, their minimum order quantity would be reached 30k pcs MOQ for small sizes lcd panel. price is also top grade, it might be more expensive 50%~80% than the market price.

Panda electronics is established in 1936, located in Nanjing, Jiangshu, China. Panda has a G6 and G8.6 TFT panel lines (bought from Sharp). The TFT panel technologies are mainly from Sharp, but its technology is not compliance to the other tft panels from other tft manufactures, it lead to the capacity efficiency is lower than other tft panel manufacturers. the latest news in 2022, Panda might be bougt to BOE in this year.

Established in 2005, IVO is located in Kunsan,Jiangshu province, China, IVO have more than 3000 employee, 400 R&D employee, IVO have a G-5 tft panel production line, IVO products are including tft panel for notebook, automotive display, smart phone screen. 60% of IVO tft panel is for notebook application (TOP 6 in the worldwide), 23% for smart phone, 11% for automotive.

Besides the lcd manufacturers from China mainland,inGreater China region,there are other lcd manufacturers in Taiwan,even they started from Taiwan, they all have built the lcd plants in China mainland as well,let"s see the lcd manufacturers in Taiwan:

Chimei Innolux Corporation was the successor company, and it initially preserved the Chimei name. In order to differentiate itself from the ChiMei brand, the company was renamed "Innolux Corporation" in December 2012.

Innolux"s 14 plants in Taiwan possess a complete range of 3.5G, 4G, 4.5G, 5G, 6G, 7.5G, and 8.5G-8.6G production line in Taiwan and China mainland, offering a full range of large/medium/small LCD panels and touch-control screens.including 4K2K ultra-high resolution, 3D naked eye, IGZO, LTPS, AMOLED, OLED, and touch-control solutions,full range of TFT LCD panel modules and touch panels, including TV panels, desktop monitors, notebook computer panels, small and medium-sized panels, and medical and automotive panels.

AUO is the tft lcd panel manufacturers in Taiwan,AUO has the lcd factories in Tianma and China mainland,AUOOffer the full range of display products with industry-leading display technology,such as 8K4K resolution TFT lcd panel, wide color gamut, high dynamic range, mini LED backlight, ultra high refresh rate, ultra high brightness and low power consumption. AUO is also actively developing curved, super slim, bezel-less, extreme narrow bezel and free-form technologies that boast aesthetic beauty in terms of design.Micro LED, flexible and foldable AMOLED, and fingerprint sensing technologies were also developed for people to enjoy a new smart living experience.

Hannstar was found in 1998 in Taiwan, Hannstar display hasG5.3 TFT-LCD factory in Tainan and the Nanjing LCM/Touch factories, providing various products and focus on the vertical integration of industrial resources, creating new products for future applications and business models.

driver, backlight etc ,then make it to tft lcd module. so its price is also more expensive than many other lcd module manufacturers in China mainland.

Maclight is a China based display company, located in Shenzhen, China. ISO9001 certified, as a company that more than 10 years working experiences in display, Maclight has the good relationship with top tft panel manufacturers, it guarantee that we could provide a long term stable supply in our products, we commit our products with reliable quality and competitive prices.

Maclight products included monochrome lcd, TFT lcd module and OLED display, touch screen module, Maclight is special in custom lcd display, Sunlight readable tft lcd module, tft lcd with capacitive touch screen. Maclight is the leader of round lcd display. Maclight is also the long term supplier for many lcd companies in USA and Europe.

If you want tobuy lcd moduleorbuy tft screenfrom China with good quality and competitive price, Maclight would be a best choice for your glowing business.

Over the years, with the wider and wider application of LCD screens, more and more brand products have been favored by the people. Together, more and more LCD manufacturers have emerged. Of course, the most popular brands in China are BOE, INNOLUX, CHIMEI, AUO, CSOT, etc. So, Which is the best brand of

It is better to say who is more professional than good or bad. In fact, the above mentioned LCD screen manufacturers are very professional, and the quality is guaranteed. But the most popular must be BOE and INNOLUX, these two panel manufacturers are also obvious to all. They all have multiple distributors, but not every distributor has the best size and price.

SZ XIANHENG TECHNOLOGY CO., LTD. is the agent of AUO, BOE, INNOLUX, SHARP, IVO and Mitsubishi, and other domestic and foreign well-known brands of small and medium-sized LCD display; specializing in customized production of touch screen display, LCD and industrial touch display and other high-tech products. According to the needs of customers, we can provide various LCD products: high-brightness LCD screen, LCD driver board, touch screen, booster board, all kinds of LCD special wires, etc. to produce industrial displays.

What brand of LCD screen is good? If you choose BOE, INNOLUX, CHIMEI, AUO or CSOT, you can buy them from us. 18.5 inch LCD screen, 21.5 inch LCD screen and other small and medium size, our price is the lowest in the industry.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey