lcd panel production in stock

The upstream materials or components of the LCD panel industry mainly include liquid crystal materials, glass substrates, polarizing lenses, and backlight LEDs (or CCFL, which accounts for less than 5% of the market).

The middle reaches is the main panel factory processing and manufacturing, through the glass substrate TFT arrays and CF substrate, CF as upper and TFT self-built perfusion liquid crystal and the lower joint, and then put a polaroid, connection driver IC and control circuit board, and a backlight module assembling, eventually forming the whole piece of LCD module. The downstream is a variety of fields of application terminal-based brand, assembly manufacturers. At present, the United States, Japan, and Germany mainly focus on upstream raw materials, while South Korea, Taiwan, and the mainland mainly seek development in mid-stream panel manufacturing.

With the successive production of the high generation line in mainland China, the panel production capacity and technology level have been steadily improved, and the industrial competitiveness has been gradually enhanced. Nowadays, the panel industry is divided into three parts: South Korea, mainland China, and Taiwan, and mainland China is expected to become the no.1 in the world in 2019.

In the past decade, China’s panel display industryhas achieved leapfrog development, and the overall size of the industry has ranked among the top three in the world. Chinese mainland panel production capacity is expanding rapidly, although Japanese panel manufacturers master a large number of key technologies, gradually lose the price competitive advantage, compression panel production capacity. Panel production is concentrated in South Korea, Taiwan, and China, which is poised to become the world’s largest producer of LCD panels.

Up to 2016, BOE‘s global market share continued to increase: smartphone LCD, tablet PC display, and laptop display accounted for the world’s first market share, and display screen increased to the world’s second, while TV LCD remained the world’s third. In LCD TV panels, Chinese panel makers have accounted for 30 percent of global shipments to 77 million units, surpassing Taiwan’s 25.5 percent market share for the first time and ranking second only to South Korea.

In terms of the area of shipment, the area of board shipment of JD accounted for only 8.3% in 2015, which has been greatly increased to 13.6% in the first half of 2016, while the area of shipment of hu xing optoelectronics in the first half of 2015 was only 5.1%, which has reached 7.8% in the first half of 2016. The panel factories in mainland China are expanding their capacity at an average rate of double-digit growth and transforming it into actual shipments and areas of shipment. On the other hand, although the market share of South Korea, Japan, and Taiwan is gradually decreasing, some South Korean and Japanese manufacturers have been inclined to the large-size HD panel and AMOLED market, and the production capacity of the high-end LCD panel is further concentrated in mainland China.

Domestic LCD panel production line capacity gradually released, overlay the decline in global economic growth, lead to panel makers from 15 in the second half began, in a low profit or loss, especially small and medium-sized production line, the South Korean manufacturers take the lead in transformation strategy, closed in medium and small size panel production line, South Korea’s 19-panel production line has shut down nine, and part of the production line is to research and development purposes. Some production lines are converted to LTPS production lines through process conversion. Korean manufacturers are turning to OLED panels in a comprehensive way, while Japanese manufacturers are basically giving up the LCD panel manufacturing business and turning to the core equipment and materials side. In addition to the technical direction of the research and judgment, more is the LCD panel business orders and profits have been severely compressed, Korean and Japanese manufacturers have no desire to fight. Since many OLED technologies are still in their infancy in mainland China, it is a priority to move to high-end panels such as OLED as soon as possible. Taiwanese manufacturers have not shut down factories on a large scale, but their advantages in LCD technology and OLED technology have been slowly eroded by the mainland.

STONE provides a full range of 3.5 inches to 15.1 inches of small and medium-size standard quasi TFT LCD module, LCD display, TFT display module, display industry, industrial LCD screen, under the sunlight visually highlight TFT LCD display, industrial custom TFT screen, TFT LCD screen-wide temperature, industrial TFT LCD screen, touch screen industry. The TFT LCD module is very suitable for industrial control equipment, medical instruments, POS system, electronic consumer products, vehicles, and other products.STONE provides a full range of 3.5 inches to 15.1 inches of small and medium-size standard quasi TFT LCD module, LCD display, TFT display module, display industry, industrial LCD screen, under the sunlight visually highlight TFT LCD display, industrial custom TFT screen, TFT LCD screen-wide temperature, industrial TFT LCD screen, touch screen industry. The TFT LCD module is very suitable for industrial control equipment, medical instruments, POS system, electronic consumer products, vehicles, and other products.

LG Display, a major Korean display maker, is expected to stop producing liquid-crystal display (LCD) panels for TV by the end of this year at the earliest, industry sources said Monday, amid falling profitability and fierce competition from Chinese rivals.

LCD TV Panel Market Size is projected to Reach Multimillion USD by 2027, In comparison to 2021, at unexpected CAGR during the Forecast Period 2022-2028.

Considering the economic change due to COVID-19 and Russia-Ukraine War Influence, LCD TV Panel accounted for % of the global market of LCD TV Panel in 2022.

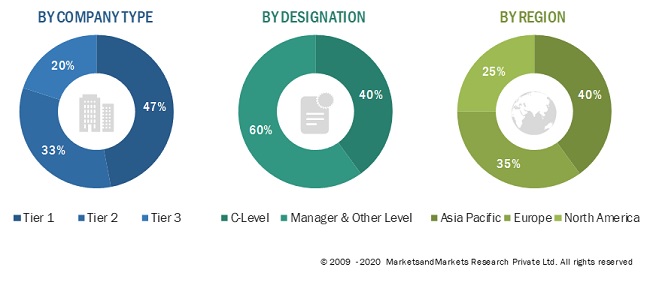

This LCD TV Panel Market Report offers analysis and insights based on original consultations with important players such as CEOs, Managers, Department Heads of Suppliers, Manufacturers, Distributors, etc.

The Global LCD TV Panel Market is anticipated to rise at a considerable rate during the forecast period, between 2022 and 2027. In 2021, the market is growing at a steady rate and with the rising adoption of strategies by key players, the market is expected to rise over the projected horizon.

LCD displays utilize two sheets of polarizing material with a liquid crystal solution between them. An electric current passed through the liquid causes the crystals to align so that light cannot pass through them. Each crystal, therefore, is like a shutter, either allowing light to pass through or blocking the light. LCD panel is the key components of LCD display. And the price trends of LCD panel directly affect the price of liquid crystal displays. LCD panel consists of several components: Glass substrate, drive electronics, polarizers, color filters etc. Only LCD panel applied for TV will be counted in this report

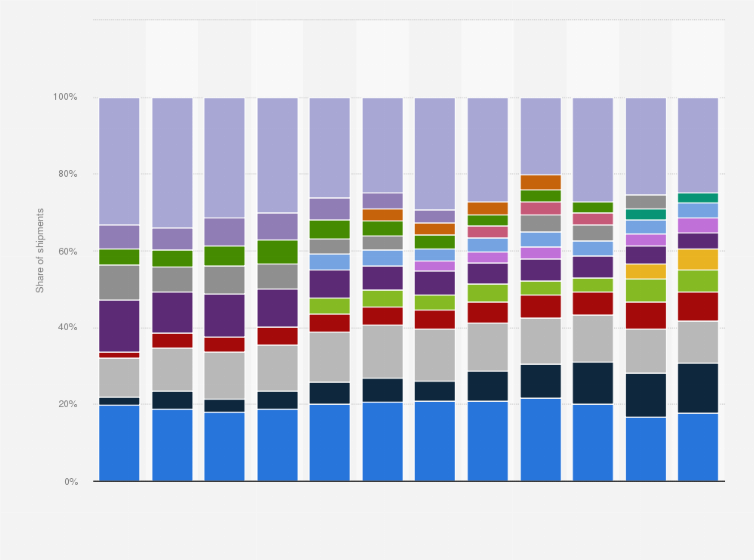

Samsung Display, LG Display, Innolux Crop and AUO captured the top four revenue share spots in the LCD TV Panel market in 2015. Samsung Display dominated with 22.11 percent revenue share, followed by LG Display with 19.72 percent revenue share and Innolux Crop Display with 19.30 percent revenue share.

The global LCD TV Panel market is valued at USD 51130 million in 2019. The market size will reach USD 59640 million by the end of 2026, growing at a CAGR of 2.2% during 2021-2026.

LCD TV Panel market is segmented by Size, and by Application. Players, stakeholders, and other participants in the global LCD TV Panel market will be able to gain the upper hand as they use the report as a powerful resource. The segmental analysis focuses on production capacity, revenue and forecast by Size and by Application for the period 2016-2027.

The report focuses on the LCD TV Panel market size, segment size (mainly covering product type, application, and geography), competitor landscape, recent status, and development trends. The report considers key geographic segments and describes all the favorable conditions driving the market growth.

Geographically, the Major Regions Covered in LCD TV Panel Market Report Are:To comprehend LCD TV Panel market dynamics across major global regions. ● North America(United States, Canada)

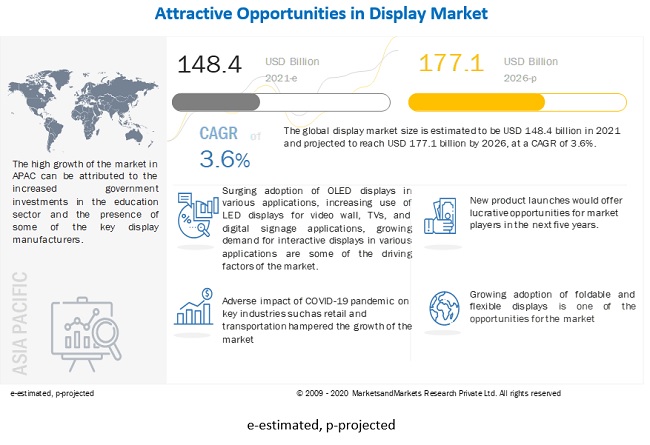

The global TFT-LCD display panel market attained a value of USD 181.67 billion in 2022. It is expected to grow further in the forecast period of 2023-2028 with a CAGR of 5.2% and is projected to reach a value of USD 246.25 billion by 2028.

The current global TFT-LCD display panel market is driven by the increasing demand for flat panel TVs, good quality smartphones, tablets, and vehicle monitoring systems along with the growing gaming industry. The global display market is dominated by the flat panel display with TFT-LCD display panel being the most popular flat panel type and is being driven by strong demand from emerging economies, especially those in Asia Pacific like India, China, Korea, and Taiwan, among others. The rising demand for consumer electronics like LCD TVs, PCs, laptops, SLR cameras, navigation equipment and others have been aiding the growth of the industry.

TFT-LCD display panel is a type of liquid crystal display where each pixel is attached to a thin film transistor. Since the early 2000s, all LCD computer screens are TFT as they have a better response time and improved colour quality. With favourable properties like being light weight, slim, high in resolution and low in power consumption, they are in high demand in almost all sectors where displays are needed. Even with their larger dimensions, TFT-LCD display panel are more feasible as they can be viewed from a wider angle, are not susceptible to reflection and are lighter weight than traditional CRT TVs.

The global TFT-LCD display panel market is being driven by the growing household demand for average and large-sized flat panel TVs as well as a growing demand for slim, high-resolution smart phones with large screens. The rising demand for portable and small-sized tablets in the educational and commercial sectors has also been aiding the TFT-LCD display panel market growth. Increasing demand for automotive displays, a growing gaming industry and the emerging popularity of 3D cinema, are all major drivers for the market. Despite the concerns about an over-supply in the market, the shipments of large TFT-LCD display panel again rose in 2020.

North America is the largest market for TFT-LCD display panel, with over one-third of the global share. It is followed closely by the Asia-Pacific region, where countries like India, China, Korea, and Taiwan are significant emerging market for TFT-LCD display panels. China and India are among the fastest growing markets in the region. The growth of the demand in these regions have been assisted by the growth in their economy, a rise in disposable incomes and an increasing demand for consumer electronics.

The report gives a detailed analysis of the following key players in the global TFT-LCD display panel Market, covering their competitive landscape, capacity, and latest developments like mergers, acquisitions, and investments, expansions of capacity, and plant turnarounds:

Alibaba.com offers 36030 stock lcd panel products. About 15% % of these are lcd modules, 8%% are digital signage and displays, and 1%% are mobile phone lcds.

A wide variety of stock lcd panel options are available to you, You can also choose from original manufacturer, odm and agency stock lcd panel,As well as from tft, ips, and standard.

China is the leader in producing LCD display panels, with a forecast capacity share of 56 percent in 2020. China"s share is expected to increase in the coming years, stabilizing at 69 percent from 2023 onwards.Read moreLCD panel production capacity share from 2016 to 2025, by countryCharacteristicChinaJapanSouth KoreaTaiwan-----

DSCC. (June 8, 2020). LCD panel production capacity share from 2016 to 2025, by country [Graph]. In Statista. Retrieved December 24, 2022, from https://www.statista.com/statistics/1056470/lcd-panel-production-capacity-country/

DSCC. "LCD panel production capacity share from 2016 to 2025, by country." Chart. June 8, 2020. Statista. Accessed December 24, 2022. https://www.statista.com/statistics/1056470/lcd-panel-production-capacity-country/

DSCC. (2020). LCD panel production capacity share from 2016 to 2025, by country. Statista. Statista Inc.. Accessed: December 24, 2022. https://www.statista.com/statistics/1056470/lcd-panel-production-capacity-country/

DSCC. "Lcd Panel Production Capacity Share from 2016 to 2025, by Country." Statista, Statista Inc., 8 Jun 2020, https://www.statista.com/statistics/1056470/lcd-panel-production-capacity-country/

DSCC, LCD panel production capacity share from 2016 to 2025, by country Statista, https://www.statista.com/statistics/1056470/lcd-panel-production-capacity-country/ (last visited December 24, 2022)

A liquid-crystal display (LCD) is a flat-panel display or other electronically modulated optical device that uses the light-modulating properties of liquid crystals. Liquid crystals do not emit light directly, instead using a backlight or reflector to produce images in color or monochrome. LCDs are available to display arbitrary images (as in a general-purpose computer display) or fixed images with low information content, which can be displayed or hidden, such as preset words, digits, and seven-segment displays, as in a digital clock. They use the same basic technology, except that arbitrary images are made up of a large number of small pixels, while other displays have larger elements. LCDs can either be normally on (positive) or off (negative), depending on the polarizer arrangement. For example, a character positive LCD with a backlight will have black lettering on a background that is the color of the backlight, and a character negative LCD will have a black background with the letters being of the same color as the backlight. Optical filters are added to white on blue LCDs to give them their characteristic appearance.

LCDs are used in a wide range of applications, including LCD televisions, computer monitors, instrument panels, aircraft cockpit displays, and indoor and outdoor signage. Small LCD screens are common in portable consumer devices such as digital cameras, watches, calculators, and mobile telephones, including smartphones. LCD screens are also used on consumer electronics products such as DVD players, video game devices and clocks. LCD screens have replaced heavy, bulky cathode ray tube (CRT) displays in nearly all applications. LCD screens are available in a wider range of screen sizes than CRT and plasma displays, with LCD screens available in sizes ranging from tiny digital watches to very large television receivers. LCDs are slowly being replaced by OLEDs, which can be easily made into different shapes, and have a lower response time, wider color gamut, virtually infinite color contrast and viewing angles, lower weight for a given display size and a slimmer profile (because OLEDs use a single glass or plastic panel whereas LCDs use two glass panels; the thickness of the panels increases with size but the increase is more noticeable on LCDs) and potentially lower power consumption (as the display is only "on" where needed and there is no backlight). OLEDs, however, are more expensive for a given display size due to the very expensive electroluminescent materials or phosphors that they use. Also due to the use of phosphors, OLEDs suffer from screen burn-in and there is currently no way to recycle OLED displays, whereas LCD panels can be recycled, although the technology required to recycle LCDs is not yet widespread. Attempts to increase the lifespan of LCDs are quantum dot displays, which offer similar performance as an OLED display, but the Quantum dot sheet that gives these displays their characteristics can not yet be recycled.

Since LCD screens do not use phosphors, they rarely suffer image burn-in when a static image is displayed on a screen for a long time, e.g., the table frame for an airline flight schedule on an indoor sign. LCDs are, however, susceptible to image persistence. The LCD screen is more energy-efficient and can be disposed of more safely than a CRT can. Its low electrical power consumption enables it to be used in battery-powered electronic equipment more efficiently than CRTs can be. By 2008, annual sales of televisions with LCD screens exceeded sales of CRT units worldwide, and the CRT became obsolete for most purposes.

The first half of 2022 has passed quietly. Under the impact of multiple factors such as geopolitical conflicts, global hyperinflation, and demand overdraft, the global TV panel market has ushered in the darkest moment.

The end demand in the global TV market continues to be sluggish, brands are deeply controlling their inventory, the prices of LCD TV panels have fallen below the cash cost, and panel makers have also started the largest production cut in history. In 22H2, there are still relatively large uncertainties in the end market. The key to stabilize supply and demand in the global LCD TV panel market in 22H2 is whether the adjustment of panel maker capacity can catch up with the decline of the demand for brand panel purchasing.

The seasonal index showed an "L" shape, and demand will remain weak in 22H2.The annual seasonal index of the global LCD TV panel market usually presents a "V"-shaped characteristic, but the seasonal index of panel shipments in 2022 appears to be an "L"-shaped. The peak season in 22H2 is not prosperous, and demand will still be weak.

• Q1: Affected by factors such as high inflation, high shipping costs, and demand overdraft in the end market, the retail performance was not as good as expected, and the demand for large-size panels of top brands was sluggish; Second-tier makers started the first round of bargain hunting and stocking, which drove the number of panel shipments in Q1 to a record high in Q1 and became the peak of the year.

• Q2: The Russian-Ukrainian war broke out, and the demand in the European market uncontrollably declined. Brand purchasing demand shrank to a new low in the past ten years than expected. Large-size demand continued to deteriorate, and small-size demand also declined. Panel shipments decreased rapidly in Q2.

• Q3: Samsung suspended panel purchases and is expected to continue its inventory control strategy in Q3. At the same time, pessimism spreads and affects the purchasing confidence of other brands, and panel shipments in Q3 may not be prosperous in the peak season.

• Q4: As shipping costs continue to fall, panel prices decline to a low level, and brand inventory tends to be healthy, it is expected that the stocking demand for top brand panels, especially large-size demand, is expected to resume growth in Q4, but there is no strong recovery in end consumption. It is difficult to expect a strong recovery in shipments.

According to Sigmaintell"s data, the global LCD TV panel shipment is expected to be 260 million in 2022, of which 68 million were shipped in Q1, accounting for 26.5% of the annual shipment; From Q2 to Q4, it is expected that the quarterly shipment level will fluctuate around 62 million pieces, and the seasonal index is difficult to exceed 25%, and the seasonal index has an obvious "L" shape.

The large-scale size was hindered, and the average size and area decreased YOY.The upgrade and iteration of the generation line drive the process of large-size, which is the main trend of the development of the global TV panel market. However, the average size of the global LCD TV panel market will decline for the first time in 2022. The main reasons are as follows:

Third, panel prices drive makers to be more aggressive in stocking small sizes. The 32-inch panel with high price elasticity is the most typical, and the second-tier market demand, such as OEM/ODMs and distributors, occupies half of its shipments. When the price of the panel fell to a relatively low level, the enthusiasm of the second-tier makers was ignited, and the stocking behavior of the second-tier makers pushed up the 32-inch shipment level of the panel maker.

According to Sigmaintell"s data, the overall average size in 2022 is 47.7 inches, a decrease of 0.8 inches YOY. In the first three quarters, due to the sluggish demand for large sizes and the high level of 32-inch shipments, the average size is lower than that in 2021. It is expected that with the advent of the "11.11" promotion season in China, the inventory of brands and channels in the North American market tends to be healthy, and the logistics and panel costs will further decline. It is expected to drive the recovery of large-size demand, thereby promoting the global average size of LCD TV panels to increase to 49.3 inches in Q4, a significant increase of 2 inches from the previous quarter.

The OLED panel market is also difficult to survive alone, falling into the dual dilemma of loss expectations and shrinking volumes.In the background of high global inflation, especially the decline in demand in Europe and North America, the demand for OLED TV panels has been hit hard. First, high inflation has had a severe impact on the demand for entry-level OLED TVs. Secondly, the impact of the price difference of LCD panels has intensified, the price of OLED TV panels has remained high for a long time, and the profits of TV brands have been squeezed, which has led to more conservative strategies and further suppressed demand. Finally, Samsung Electronics suspended the launch of WOLED products in 2022, which has caused a heavy blow to LGD"s annual OLED TV panel shipments. Affected by the above factors, the shipment of WOLED panels in 2022 will be much lower than expected, with high inventories starting from the first quarter and gradually reducing the UT of the G8.5 OLED panel production line in South Korea from the second quarter. The reduction in the UT is accompanied by an increase in costs, and the WOLED panel business may fall into the dual dilemma of loss expectations and shrinking volumes. Overall, according to Sigmaintell’s data, with the support of SDC QD Display panels, the global OLED TV panel shipments in 2022 will be 8.88 million units, an increase of 15.0% YoY, which is lower than expected.

As LCD TV panel prices have fallen below cash costs; panel makers are under enormous pressure to lose money. It is difficult to expect the recovery of end demand in the short term, and panel makers have started the production cut, but each maker has different strategies.

BOE passively reduced production, mainly reducing the capacity of G10.5 and G8.6.Thanks to the advantages of balanced development of multiple categories, the profit of IT panels can still provide a certain guarantee for a high UT and stable operation to BOE. However, after global brands such as Samsung Electronics and LG Electronics made clear their strategy of continuing to control inventory in Q3, the demand situation was not optimistic, and passive production cuts were initiated. Among them, the UT of G8.6 and G10.5 lines has been lowered to a certain extent.

CSOT, the pace of production cut is steadily progressing, mainly reducing the supply of 65-inch and 75-inch panels.CSOT is very dependent on two major customers: Samsung and TCL. Samsung"s procurement strategy adjustment has put enormous pressure on CSOT, and it has reduced production since June. CSOT "s capacity adjustment is mainly focused on the supply of 65-inch and 75-inch panels.

HKC"s ramp-up slowed down, and production expansion was delayed.Affected by the decline in demand, HKC faces greater shipping resistance and inventory pressure. HKC has also gradually started capacity control since June, which is mainly reflected in the slowdown of the new H4 and H5 lines. It is expected that the UT will remain at a low level in Q3.

Taiwan"s panel makers have differentiated strategies and are oriented to operating profit.For Taiwan panel makers, once the price of LCD TV panels hits the red line of cost and drags down profit performance, they will accelerate the contraction of the TV business. AUO has adjusted its capacity since the beginning of Q2. As the demand for various applications continues to decline, the adjustment range of UT gradually spreads from G6 to G8.5. Innolux"s UT adjustment is relatively conservative, mainly reflected in the further control of the 50-inch supply and the transfer of TV capacity to IT, and the supply of TV panels continues to decline.

South Korean panel makers have withdrawn some capacity, and the competitiveness of LCD TV panels has weakened.The cost competitiveness of LCD TV panels of Korean makers is low. As panel prices fall uncontrollably, they will more resolutely implement production control. SDC has closed all of its LCD TV panel production lines and started to maintain inventory shipments in June; The LGD G7.5 line has been gradually reduced since May, and the capacity of Guangzhou"s G8.5 line has also been controlled.

Overall, as panel makers have started to cut production, it has had a certain adjustment effect on the global supply of LCD TV panels. According to Sigmaintell’s data, in Q2, the global LCD TV panel supply area decreased by 1.4% YoY and 2.9% MoM. It is expected that the global LCD TV panel supply area will further decline by 7.3% YoY in Q3. However, in Q3, panel demand fell into a deep destocking cycle, and the decline in panel procurement demand was still higher than the reduction in panel maker production. The global LCD TV panel supply and demand situation are still not optimistic.

In Q3, the two major South Korean brands still strictly controlled their inventory, so the purchasing strategies of Chinese brands also fell into conservative expectations. According to Sigmaintell’s data, the global top 9 TV panel brand purchase demand is expected to be less than 35 million units in Q3, the lowest level in the past five years. On the supply side, although top panel makers have initiated passive production cuts, the reduction in capacity still cannot keep up with the decline in demand. According to Sigmaintell"s data, the global LCD TV panel market S/D ratio will reach 8.6% in Q3, and the supply and demand will continue to be in excess. It is expected that panel prices will maintain a downward trend at a low level.

The price of LCD TV panels continues to decline, while the prices of other types of panels also show an accelerated downward trend. So the pressure on panel makers to lose money increased sharply. However, the global economic and political environment is still unstable, and high inflation may not be effectively alleviated in the short term. Therefore, it is difficult to expect a strong recovery in the global TV market demand. At this dark moment, how can TV panel makers get out of the dilemma? When will supply and demand return to balance? When will panel prices stop declining? Sigmaintell believes that in the short term, it is necessary to increase the scale of production cut. At the same time, since cost is the core competitiveness, cost reduction and efficiency improvement should be actively promoted.

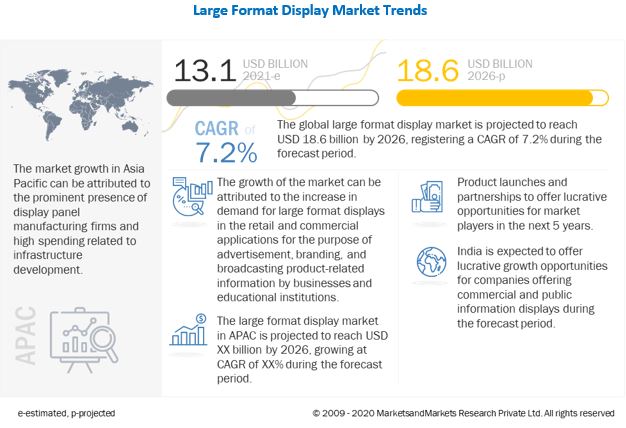

The industrial and public displays market has been growing from 7.6% of total market share in 2020 to 8.5% in 2021, and is expected to grow to 8.7% in 2022. Chinese panel makers have taken the lead for industrial display, in which Tianma tops the first place with 37% share in 2022, followed by BOE, AUO, Innolux and Truly, according to Omdia.

Global factors have had a major impact on LCD panel demand in 2022, causing industry players to expect demand to remain weak through the first half of 2023. Taiwan-based LCD panel makers such as AU Optronics (AUO) and Innolux are making moves to boost their market share by targeting smart markets and creating value-added services.

Though demand for LCD panels has nosedived in 2022, automotive displays will drive global LCD panel output value to continually increase to over US$70 billion in 2030, according to DIGITIMES Research director Tony Huang.

LCD panel maker AUO has disclosed it has cooperated with VFX (visual effects) specialist Renovatio Pictures to set up an LED virtual studio at Central Motion Picture"s film studio in Taipei to provide integrated services consisting of shooting scenes and stages, content production, technical counseling and rental equipment.

Electronic paper (e-paper) maker E Ink Holdings has started volume production of E Ink Gallery 3, the latest in-house-developed e-paper with full color gamut, according the company.

While global sales of smartphones have decreased, global shipments of smartphone-use flexible OLED panels keep increasing but those of rigid OLED panels have slipped, according to industry sources.

As global demand for XR (extended reality) headsets is expected to take off in 2023, microLED panels tend to surpass LCD and OLED panels to become mainstream, specifically for XR devices, according to South Korea-based Money Today.

LCD panel maker Innolux has reported consolidated revenue of NT$16.182 billion (US$529.25 million) for November, growing 3.61% sequentially but slipping 39.15% on year.

LG Display (LGD) will bring to an end production of LCD panels at its P7 plant in Paju, northern South Korea, sooner in mid-December 2022 or later at the end of the month, and thus end production of all LCD panels in South Korea, according to South Korea-based TheElec.

Chinese panel makers including BOE, TCL CSOT, and Visionox have been acting keenly to expand AMOLED capacities, following the footsteps of Korea-based Samsung Display and LG Display, according to DIGITIMES Research"s latest study.

JET Optoelectronics, one of the top-three makers of rear seat entertainment systems worldwide, is building a new production site in Kaohsiung, southern Taiwan, aiming at boosting its annual revenue to over NT$10 billion (US$330 million) in three years from NT$3 billion currently.

Global OLED Technology (GOT), LG Display"s (LGD) subsidiary that owns and licenses OLED technology patents, sent warning to China-based panel maker BOE Technology against infringing on such patents in the first half of 2022, according to South Korea-based media The Elec.

LCD panel maker AUO has announced its consolidated revenue in November reached NT$17.48 billion (US$571.26 million), up by 1.7% month-over-month but down 43.4% year-over-year.

As the display industry stays in stagnation, Taiwan-based PMOLED panel makers, including Ritdisplay and Wisechip Semiconductor, have been venturing into new business segments.

PMOLED (passive matrix OLED) panel maker Ritdisplay has stepped into battery business by establishing subsidiary battery maker Ritwin and investing in Welltech Energy, and expects the battery business to mainly drive business growth in the future, according to the company.

Sales promotion of TVs at the Double 11 (November 11) online shopping festival in the China market and the Black Friday & Cyber Monday shopping festival in the US market has helped TV vendors lower inventory levels and, in turn, is conducive to a rebound in demand for TV-use LCD panels, according to president James Yang for TFT-LCD panel maker Innolux and president Frank Ko for fellow maker AUO.

In both LCD and OLED displays, producing these cells – which are highly complex – is by far the most difficult element of the production process. Indeed, the complexity of these cells, combined with the levels of investment needed to achieve expertise in their production, explains why there are less than 30 companies in the whole world that can produce them. China, for instance, has invested more than 300 billion yuan (approximately $45 billion USD) in just one of these companies – BOE – over the past 14 years.

Panox Display has been involved in the display industry for many years and has built strong and long-term partner relationships with many of the biggest OLED and LCD panel manufacturers. As a result, we are able to offer our clients guaranteed access to display products from the biggest manufacturers.

LG Display was, until 2021, the No. 1 display panel manufacturer in the world. Owned by LG Group and headquartered in Seoul, South Korea, it has R&D, production, and trade institutions in China, Japan, South Korea, the United States, and Europe.

Founded in 2001, AUO – or AU Optronics – is the world’s leading TFT-LCD panel manufacturer (with a 16% market share) that designs, develops, and manufactures the world’s top three liquid crystal displays. With panels ranging from as small as 1.5 inches to 46 inches, it boasts one of the world"s few large-, medium -and small-sized product lines.

AUO offers advanced display integration solutions with innovative technologies, including 4K2K ultra-high resolution, 3D, ultra-thin, narrow bezel, transparent display, LTPS, OLED, and touch solutions. AOU has the most complete generation production line, ranging from 3.5G to 8.5G, offering panel products for a variety of LCD applications in a range of sizes, from as small as 1.2 inches to 71 inches.

Now Sharp is still top 10 TV brands all over the world. Just like BOE, Sharp produce LCDs in all kinds of size. Including small LCD (3.5 inch~9.1 inch), medium LCD (10.1 ~27 inch), large LCD (31.5~110 inch). Sharp LCD has been used on Iphone series for a long time.

Beside those current LCDs, the industrial LCD of Sharp is also excellent and widely used in public facilities, factories, and vehicles. The Sharp industrial LCD, just means solid, high brightness, super long working time, highest stability.

Truly Semiconductors is a wholly owned subsidiary of the Hong Kong-listed company Truly International Holdings. Founded in 1991, and headquartered in Hong Kong, the company’s production base is located in the beautiful coastal city of Shanwei City in Guangdong Province, China.

Since its establishment, Truly Semiconductors has focused on researching, developing, and manufacturing liquid crystal flat panel displays. Now, after twenty years of development, it is the biggest small- and medium-sized flat panel display manufacturer in China.

Truly’s factory in Shanwei City is enormous, covering an area of 1 million square meters, with a net housing area of more than 100,000 square meters. It includes five LCD production lines, one OLED production line, three touch screen production lines, and several COG, LCM, MDS, CCM, TAB, and SMT production lines.

Its world-class production lines produce LCD displays, liquid crystal display modules (LCMs), OLED displays, resistive and capacitive touch screens (touch panels), micro camera modules (CCMs), and GPS receiving modules, with such products widely used in the smartphone, automobile, and medical industries. The LCD products it offers include TFT, TN, Color TN with Black Mark (TN type LCD display for onboard machines), STN, FSTN, 65K color, and 262K color or above CSTN, COG, COF, and TAB modules.

In its early days, Innolux attached great importance to researching and developing new products. Mobile phones, portable and mounted DVD players, digital cameras, games consoles, PDA LCDs, and other star products were put into mass production and quickly captured the market, winning the company considerable market share.

Looking forward to the future, the group of photoelectric will continue to deep LCD display field, is committed to the development of plane display core technology, make good use of global operations mechanism and depth of division of labor, promise customers high-quality products and services, become the world"s top display system suppliers, in 2006 in the global mobile phone color display market leader, become "Foxconn technology" future sustained rapid growth of the engine.

Founded in June 1998, Hannstar specializes in producing thin-film transistor liquid crystal display panels, mainly for use in monitors, notebook displays and televisions. It was the first company in Taiwan to adopt the world’s top ultra-wide perspective technology (AS-IPS).

The company has three LCD factories and one LCM factory. It has acquired state-of-the-art TFT-LCD manufacturing technology, which enables it to achieve the highest efficiency in the mass production of thin-film transistor liquid crystal display production technology. Its customers include many of the biggest and most well-known electronics companies and computer manufacturers in Taiwan and overseas.

TCL CSOT – short for TCL China Star Optoelectronics Technology (TCL CSOT) – was founded in 2009 and is an innovative technology enterprise that focuses on the production of semiconductor displays. As one of the global leaders in semiconductor display market, it has bases in Shenzhen, Wuhan, Huizhou, Suzhou, Guangzhou, and India, with nine panel production lines and five large modules bases.

TCL CSOT actively produces Mini LED, Micro LED, flexible OLED, printing OLED, and other new display technologies. Its product range is vast – including large, medium, and small panels and touch modules, electronic whiteboards, splicing walls, automotive displays, gaming monitors, and other high-end display application fields – which has enabled it to become a leading player in the global panel industry.

In the first quarter of 2022, TCL CSOT’s TV panels ranked second in the market, 55 inches, 65 " and 75 inches second, 8K, 120Hz first, the first, interactive whiteboard and digital sign plate; LTPS flat panel, the second, LTPS and flexible OLED fourth.

EDO (also known as EverDisplay Optonics) was founded in October 2012 and focuses on the production of small- and medium-sized high-resolution AMOLED semiconductor display panels.

The company opened its first production line – a 4.5-generation low-temperature polysilicon (LTPS) AMOLED mass production line – in 2014, which started mass producing AMOLED displays in November 2014.

In order to ramp up production output, the company began construction of a 6th-generation AMOLED production line in December 2016, with a total investment of 27.3 billion yuan (almost $4 billion USD). The line, which has a production capacity of 30,000 glass substrates per month, produces flexible and rigid high-end AMOLED displays for use in smartphones, tablet pens, vehicle displays, and wearable devices.

Tianma Microelectronics was founded in 1983 and listed on the Shenzhen Stock Exchange in 1995. It is a high-tech enterprise specializing in the production of liquid crystal displays (LCD) and liquid crystal display modules (LCM).

After more than 30 years of development, it has grown into a large publicly listed company integrating LCD research and development, design, production, sales, and servicing. Over the years, it has expanded by investing in the construction of STN-LCD, CSTN-LCD, TFT-LCD and CF production lines and module factories across China (with locations in Shenzhen, Shanghai, Chengdu, Wuhan and Xiamen), as well R&D centers and offices in Europe, Japan, South Korea and the United States.

JDI (Japan Display Inc.) was established on November 15, 2011, as a joint venture between the Industrial Innovation Corporation, Sony, Hitachi, and Toshiba. It is dedicated to the production and development of small-sized displays. It mainly produces small- and medium-sized LCD display panels for use in the automotive, medical, and industrial fields, as well as personal devices including smartphones, tablets, and wearables.

Although Sony’s TVs use display panels from TCL CSOT (VA panel), Samsung. Sony still produces the world’s best micro-OLED display panels. Sony has many micro OLED model such as 0.23 inch, 0.39 inch, 0.5 inch, 0.64 inch, 0.68 inch, 0.71 inch. Panox Display used to test and sell many of them, compare to other micro OLED manufacuturers, Sony`s micro OLEDs are with the best image quality and highest brightness (3000 nits max).

Flat-panel displays are thin panels of glass or plastic used for electronically displaying text, images, or video. Liquid crystal displays (LCD), OLED (organic light emitting diode) and microLED displays are not quite the same; since LCD uses a liquid crystal that reacts to an electric current blocking light or allowing it to pass through the panel, whereas OLED/microLED displays consist of electroluminescent organic/inorganic materials that generate light when a current is passed through the material. LCD, OLED and microLED displays are driven using LTPS, IGZO, LTPO, and A-Si TFT transistor technologies as their backplane using ITO to supply current to the transistors and in turn to the liquid crystal or electroluminescent material. Segment and passive OLED and LCD displays do not use a backplane but use indium tin oxide (ITO), a transparent conductive material, to pass current to the electroluminescent material or liquid crystal. In LCDs, there is an even layer of liquid crystal throughout the panel whereas an OLED display has the electroluminescent material only where it is meant to light up. OLEDs, LCDs and microLEDs can be made flexible and transparent, but LCDs require a backlight because they cannot emit light on their own like OLEDs and microLEDs.

Liquid-crystal display (or LCD) is a thin, flat panel used for electronically displaying information such as text, images, and moving pictures. They are usually made of glass but they can also be made out of plastic. Some manufacturers make transparent LCD panels and special sequential color segment LCDs that have higher than usual refresh rates and an RGB backlight. The backlight is synchronized with the display so that the colors will show up as needed. The list of LCD manufacturers:

Organic light emitting diode (or OLED displays) is a thin, flat panel made of glass or plastic used for electronically displaying information such as text, images, and moving pictures. OLED panels can also take the shape of a light panel, where red, green and blue light emitting materials are stacked to create a white light panel. OLED displays can also be made transparent and/or flexible and these transparent panels are available on the market and are widely used in smartphones with under-display optical fingerprint sensors. LCD and OLED displays are available in different shapes, the most prominent of which is a circular display, which is used in smartwatches. The list of OLED display manufacturers:

MicroLED displays is an emerging flat-panel display technology consisting of arrays of microscopic LEDs forming the individual pixel elements. Like OLED, microLED offers infinite contrast ratio, but unlike OLED, microLED is immune to screen burn-in, and consumes less power while having higher light output, as it uses LEDs instead of organic electroluminescent materials, The list of MicroLED display manufacturers:

LCDs are made in a glass substrate. For OLED, the substrate can also be plastic. The size of the substrates are specified in generations, with each generation using a larger substrate. For example, a 4th generation substrate is larger in size than a 3rd generation substrate. A larger substrate allows for more panels to be cut from a single substrate, or for larger panels to be made, akin to increasing wafer sizes in the semiconductor industry.

"Samsung Display has halted local Gen-8 LCD lines: sources". THE ELEC, Korea Electronics Industry Media. August 16, 2019. Archived from the original on April 3, 2020. Retrieved December 18, 2019.

"TCL to Build World"s Largest Gen 11 LCD Panel Factory". www.businesswire.com. May 19, 2016. Archived from the original on April 2, 2018. Retrieved April 1, 2018.

"Panel Manufacturers Start to Operate Their New 8th Generation LCD Lines". 대한민국 IT포털의 중심! 이티뉴스. June 19, 2017. Archived from the original on June 30, 2019. Retrieved June 30, 2019.

"TCL"s Panel Manufacturer CSOT Commences Production of High Generation Panel Modules". www.businesswire.com. June 14, 2018. Archived from the original on June 30, 2019. Retrieved June 30, 2019.

"Samsung Display Considering Halting Some LCD Production Lines". 비즈니스코리아 - BusinessKorea. August 16, 2019. Archived from the original on April 5, 2020. Retrieved December 19, 2019.

Herald, The Korea (July 6, 2016). "Samsung Display accelerates transition from LCD to OLED". www.koreaherald.com. Archived from the original on April 1, 2018. Retrieved April 1, 2018.

"China"s BOE to have world"s largest TFT-LCD+AMOLED capacity in 2019". ihsmarkit.com. 2017-03-22. Archived from the original on 2019-08-16. Retrieved 2019-08-17.

Our company specializes in developing solutions that arerenowned across the globe and meet expectations of the most demanding customers. Orient Display can boast incredibly fast order processing - usually it takes us only 4-5 weeks to produce LCD panels and we do our best to deliver your custom display modules, touch screens or TFT and IPS LCD displays within 5-8 weeks. Thanks to being in the business for such a noteworthy period of time, experts working at our display store have gained valuable experience in the automotive, appliances, industrial, marine, medical and consumer electronics industries. We’ve been able to create top-notch, specialized factories that allow us to manufacture quality custom display solutions at attractive prices. Our products comply with standards such as ISO 9001, ISO 14001, QC 080000, ISO/TS 16949 and PPM Process Control. All of this makes us the finest display manufacturer in the market.

Customer service is another element we are particularly proud of. To facilitate the pre-production and product development process, thousands of standard solutions are stored in our warehouses. This ensures efficient order realization which is a recipe to win the hearts of customers who chose Orient Display. We always go to great lengths to respond to any inquiries and questions in less than 24 hours which proves that we treat buyers with due respect.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey