lcd panel manufacturers market share 2018 for sale

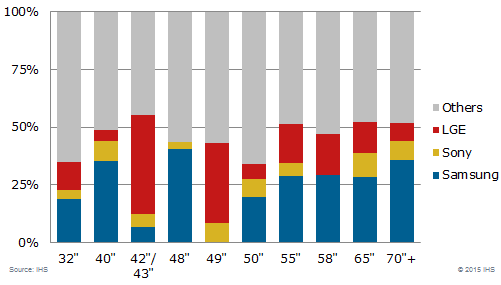

The global LCD TV (Liquid Crystal Display Television) market was dominated by Samsung and remained so in 2021 with a market share of over 19 percent by sales volume. LG Electronics takes second place with close to 13 percent in the same year, to beat TLC, one of the well-established brands in this segment.Read moreMarket share of leading LCD TV manufacturers worldwide from 2019 to 2021, by sales volumeCharacteristic202120202019----

TCL. (March 11, 2022). Market share of leading LCD TV manufacturers worldwide from 2019 to 2021, by sales volume [Graph]. In Statista. Retrieved December 24, 2022, from https://www.statista.com/statistics/1266996/global-leading-manufacturers-lcd-tv-market-share-sales-volume/

TCL. "Market share of leading LCD TV manufacturers worldwide from 2019 to 2021, by sales volume." Chart. March 11, 2022. Statista. Accessed December 24, 2022. https://www.statista.com/statistics/1266996/global-leading-manufacturers-lcd-tv-market-share-sales-volume/

TCL. (2022). Market share of leading LCD TV manufacturers worldwide from 2019 to 2021, by sales volume. Statista. Statista Inc.. Accessed: December 24, 2022. https://www.statista.com/statistics/1266996/global-leading-manufacturers-lcd-tv-market-share-sales-volume/

TCL. "Market Share of Leading Lcd Tv Manufacturers Worldwide from 2019 to 2021, by Sales Volume." Statista, Statista Inc., 11 Mar 2022, https://www.statista.com/statistics/1266996/global-leading-manufacturers-lcd-tv-market-share-sales-volume/

TCL, Market share of leading LCD TV manufacturers worldwide from 2019 to 2021, by sales volume Statista, https://www.statista.com/statistics/1266996/global-leading-manufacturers-lcd-tv-market-share-sales-volume/ (last visited December 24, 2022)

In 2019 and 2020, BOE was the leading manufacturer in the monitor display panel market, holding 25 and 26 percent of the market, respectively. LG Display, the South Korean panel maker, ranked second, with a 21 percent share. The market share of another South Korean company, Samsung Display, was forecast to drop to one percent in 2021.Read moreMonitor display panel market share worldwide from 2019 to 2021, by supplierCharacteristicLGDBOESDCINXAUOCECCSOTHKC---------

TrendForce. (January 11, 2021). Monitor display panel market share worldwide from 2019 to 2021, by supplier [Graph]. In Statista. Retrieved December 24, 2022, from https://www.statista.com/statistics/1124858/global-display-panel-vendor-monitor/

TrendForce. "Monitor display panel market share worldwide from 2019 to 2021, by supplier." Chart. January 11, 2021. Statista. Accessed December 24, 2022. https://www.statista.com/statistics/1124858/global-display-panel-vendor-monitor/

TrendForce. (2021). Monitor display panel market share worldwide from 2019 to 2021, by supplier. Statista. Statista Inc.. Accessed: December 24, 2022. https://www.statista.com/statistics/1124858/global-display-panel-vendor-monitor/

TrendForce. "Monitor Display Panel Market Share Worldwide from 2019 to 2021, by Supplier." Statista, Statista Inc., 11 Jan 2021, https://www.statista.com/statistics/1124858/global-display-panel-vendor-monitor/

TrendForce, Monitor display panel market share worldwide from 2019 to 2021, by supplier Statista, https://www.statista.com/statistics/1124858/global-display-panel-vendor-monitor/ (last visited December 24, 2022)

The global TFT-LCD display panel market attained a value of USD 181.67 billion in 2022. It is expected to grow further in the forecast period of 2023-2028 with a CAGR of 5.2% and is projected to reach a value of USD 246.25 billion by 2028.

The current global TFT-LCD display panel market is driven by the increasing demand for flat panel TVs, good quality smartphones, tablets, and vehicle monitoring systems along with the growing gaming industry. The global display market is dominated by the flat panel display with TFT-LCD display panel being the most popular flat panel type and is being driven by strong demand from emerging economies, especially those in Asia Pacific like India, China, Korea, and Taiwan, among others. The rising demand for consumer electronics like LCD TVs, PCs, laptops, SLR cameras, navigation equipment and others have been aiding the growth of the industry.

TFT-LCD display panel is a type of liquid crystal display where each pixel is attached to a thin film transistor. Since the early 2000s, all LCD computer screens are TFT as they have a better response time and improved colour quality. With favourable properties like being light weight, slim, high in resolution and low in power consumption, they are in high demand in almost all sectors where displays are needed. Even with their larger dimensions, TFT-LCD display panel are more feasible as they can be viewed from a wider angle, are not susceptible to reflection and are lighter weight than traditional CRT TVs.

The global TFT-LCD display panel market is being driven by the growing household demand for average and large-sized flat panel TVs as well as a growing demand for slim, high-resolution smart phones with large screens. The rising demand for portable and small-sized tablets in the educational and commercial sectors has also been aiding the TFT-LCD display panel market growth. Increasing demand for automotive displays, a growing gaming industry and the emerging popularity of 3D cinema, are all major drivers for the market. Despite the concerns about an over-supply in the market, the shipments of large TFT-LCD display panel again rose in 2020.

North America is the largest market for TFT-LCD display panel, with over one-third of the global share. It is followed closely by the Asia-Pacific region, where countries like India, China, Korea, and Taiwan are significant emerging market for TFT-LCD display panels. China and India are among the fastest growing markets in the region. The growth of the demand in these regions have been assisted by the growth in their economy, a rise in disposable incomes and an increasing demand for consumer electronics.

The report gives a detailed analysis of the following key players in the global TFT-LCD display panel Market, covering their competitive landscape, capacity, and latest developments like mergers, acquisitions, and investments, expansions of capacity, and plant turnarounds:

*At Expert Market Research, we strive to always give you current and accurate information. The numbers depicted in the description are indicative and may differ from the actual numbers in the final EMR report.

The market for equipment to manufacture LCD and OLED displays for smartphones and TVs grew 28% in 2018 following a growth of 33% in 2017. Applied Materials" (NASDAQ:AMAT) revenues grew 36%. A key driver for AMAT"s strong performance was the sale of equipment to Chinese LCD manufacturers BOE Technology and China Star Optoelectronics Technology to manufacture 10.5G panels for the production of 75-inch LCD TVs.

While the 10.5G market will be strong again in 2019, AMAT will face headwinds in sectors that utilize equipment for the production of smaller displays, primarily smartphones.

During Applied Materials’ recent Q1 earnings call, CEO Gary Dickerson noted: "In display, weakness in emerging markets is also impacting the timing of customers’ investment plans. We see some TV factory projects pushing out of year and into 2020. As a result, we now believe our display equipment revenue in 2019 will decline by about a third from 2018"s record levels. We also expect revenue in the second fiscal quarter to be significantly lower than our average run rate for the year."

Figure 1 shows market shares among the top five equipment companies. AMAT’s market share increased from 29% to 30%. Lithography equipment supplier Nikon (OTCPK:NINOY) increased 1% while competitor Canon (CAJ) decreased 1%. The biggest gainer was deposition company Tokyo Electron (OTCPK:TOELY), which gained 4% at the expense of fellow Japanese deposition equipment supplier Ulvac, which dropped 5%.

Providing more granularity, market share growth ofAMAT and Nikon is primarily attributed to the investments by BOE in its 10.5G LCD. Both equipment companies are the only suppliers of equipment (AMAT for deposition and Nikon for lithography) that can fabricate the large 10.5G panels. So even though AMAT is a deposition company, its tool, acquired about 20 years ago from the acquisition of AKT, is the only one on the market big enough to accommodate 10.5G panels.

The display market can be segmented into three general segments – (1) LCD panels for TVs, (2) OLED panels for smartphones, and (3) LCD panels for Smartphones. Each of these has its own headwinds and tailwinds, which are impacting capital equipment expenditures. These issues I detail below. There are numerous ways to segment this industry, but I am detailing this segmentation for this article.

A driving force for 10.5G plant construction is that a 10.5G mother glass is 1.8 times larger than an 8.5G one in area and can be cut into six 75-inch panels. In comparison, a 7.5G glass substrate can be cut into only two 75-inch TV panels. Thus, there is a significant cost benefit of moving to the larger substrates.

AMAT’s deposition tools are used to form the backplane for LCD displays. The company’s deposition tools are the only ones capable of uniform coating of panels this size, which measure 3370mm x 2940mm. AMAT’s equipment can deposit various materials for the backplane.

Shown in Table 1 are the number of 10.5G panels being manufactured through 2018, with forecasts for panel production in 2019 and 2020, according to The Information Network’s report “OLED and LCD Markets: Technology, Directions and Market Analysis.”

10.5G represented a strong tailwind for AMAT and Nikon in 2018. For example, Nikon sold 13, 10.5G lithography systems in CY2018 representing 18% of systems sold. This compares to only one 10.5G system sold in CY2017.

BOE Technology’s first 10.5G fab, located in Hefei, entered volume production in the first half of 2018. China Star Optoelectronics Technology (CSOT) plans to build to kick off commercial operations of its 10.5G plant in March 2019, having installed equipment in 2018. Capex spends by these companies for these plants provided a significant portion of AMAT"s revenues for 2018.

For 2019, BOE’s second 10.5G line, to be located in Wuhan, is slated for volume production in 2020, with equipment installation in mid-2019. Sharp (OTCPK:SHCAY) will start equipment install at its new 10.5G LCD plant in Guangzhou in early 2019, with plans to kick off the first phase of the facility in Aug 2019 and to begin volume production in October 2019. LG Display (LPL) is building its 10.5G OLED P10 fab in Paju, Korea, but volume production is now scheduled at the beginning of 2021. Originally, the company planned to install equipment in 3Q 2018, but it may be pushed back to the beginning of 2020. With an oversupply of 10.5G panels as a result of BOE and CSOT production, display manufacturers are closely monitoring the market.

In addition to 10.5G mother glass for TVs, most LCD TVs are made using 8G glass. In 2018, LCD panel shipments increased 9% while TV area increased 11%, meaning that the average size of a TV is increasing. While some of the increase was due to shipments from BOE’s 10.5G plant, 8G plants were responsible for most of the growth. LG Display, for example, which makes LCD TVs from 8G mother glass, witnessed a 21% increase in area shipments, whereas Innolux, also without a 10.5G plant, reported an increase of 17% in area shipments. BOE, with both 8G and 10.5G plants, reported an area shipment increase of 17%.

I am neutral on AMAT in the OLED panel for smartphones. There are two issues. One is that AMAT’s equipment used in the production of OLEDs is being supplanted by competitor’s differentiating technology.

A second factor contributing to my neutral stance for AMAT in this OLED market is a sluggish smartphone market – the largest application for 6G OLED panels. Investment was minimal in 2018 as shown in Table 3. Also tied to sluggish smartphone sales is product distinction. Rigid OLED panels are not significantly better than lower-cost LTPS-LCD panels. With the capacity built up through 2018, utilization rates averaged 60%.

Table 4 presents The Information Network’s forecast of 6G OLED panel output to 2020. Again, panel output only increased 32,000 panels per month in 2018, but is expected to increase 138,000 panels per month in 2019, followed by a more moderate growth of 121,000 panels per month in 2020.

Flexible smartphones will drive the 6G market in 2019 and 2020. Samsung Electronics (OTCPK:SSNLF) introduced its Galaxy Fold and Huawei its Mate X in February 2018. Details of the two smartphones are described here. A significant difference between the two is the display.

In addition to the two, there are several other smartphone manufacturers that will introduce foldable models in the next two years. These include Oppo, Motorola (MSI), LG, Xiaomi (OTCPK:XIACF), and even Apple (AAPL).

I am bearish for AMAT on LCD panels for smartphones. Table 2 illustrates the drop in 6G plant expansion in 2018 showing Nikon’s lithography system sales by panel generation in 2017 and 2018. 6G systems dropped from 42 units in 2017 to 18 in 2018

Although flexible OLED has been gaining market share in the smartphone market in the last few years for its thinner form factor, higher performance, and differentiating design, the high utilization rates of 90% is minimizing the need for plant expansion and resulting in an oversupply of 20% for LCDs. Combined, these contribute to a 20% discount in LCD cost per smartphone compared to a rigid OLED display. Tianma is the top supplier of LTPS TFT-LCDs for smartphones with shipments of 149 million units in 2018, an increase of 49% YoY.

High-end smartphones like Apple"s current iPhone XS and iPhone XS Max use OLED screens to deliver better image quality, faster pixel response times. The XR uses an LCD display. It is likely we will see a similar lineup in 2019 - a continuation of both the iPhone XS and XR devices, with rumors suggesting 5.8 and 6.5-inch OLED iPhones along with a 6.1-inch LCD iPhone.

AMAT capitalized on the size of its deposition tools to generate strong revenue growth in the 10.5G market. In the other segments of the display production market (6G and 8G), its deposition tools for backplane and OLED encapsulation do not offer any advantages over competitors. In fact, the company is losing share to better technology.

The primary claim for AMAT"s display tools is its size. If 6G LCD factory expansion is dropping and 10.5G factories make panels with better economies of scale than 8G factories to make TVs, then it is only a matter of time before a competitor makes equipment that can deposit the backplanes on 10.5G panels.

Sigmaintell Research of China has released its summary of the global LCD TV panel market in the first half of 2018. Trade friction between big countries and political and economic upheaval is on the rise, while Chinese economic growth is slowing down.

In addition, the fluctuation of the exchange rate has impacted the performance of the major TV markets. Sell-in was lower than expected but the volume of shipments pushed by panel manufacturers still increased considerably compared with the same period last year.

In the first half of 2018, shipments of LCD TV panels reached 135 million units, a decrease of 3.7% compared to the second half of 2017 but an increase of 10.6% from the first half of 2017. Analysts also say that the trend to larger sizes continues to slow.

Driven by the World Cup, overseas market demand continues to strengthen, which has led to a significant increase in small and medium-size panel shipments. According to Sigmaintell, in the first half of 2018, 32" panel sell-in grew by 25% over the same period in 2017, accounting for 32% of total global LCD TV panel sales.

Sell-in of 39" - 45" sizes increased by 11% year-on-year, accounting for 24.4% of the total. In contrast, sell-in of 65" panels decreased by 4%. While the proportion of small-size products increased, the proportion of large sizes was not significantly improved. In the first half of the year, the global average size of LCD TV panels actually dropped to 43.6", a decrease of 0.1". In the second quarter of 2018, it dropped further to 43.3".

Therefore, the growth of average panel size is lower than expected, which analysts say is one of the important factors in the imbalance of supply and demand within the LCD market during the first half of the year.

As a result of their continuous expansion of production capacity, the overall competitiveness and market share of Chinese manufacturers has increased significantly. In the first half of 2018, BOE, LG and Innolux were the top-three panel makers respectively, with Samsung fourth and CSOT fifth.

In the first half of 2018, BOE shipped 25.84 million units. This year, the company"s 8.5G line in Fuqing, China reached full capacity and the world"s first 10.5G line commenced mass production.

LG shipped 23.72 million LCD TV panels in the first half of 2018, a decrease of 3.4% over the same period in 2017. However, it ranked first in terms of shipment size. The company continues to drive large-sizes and maintains a leading position in large and high-end products in sizes such as 55”, 65” and 75”.

Due to the declining profitability of LCD TV panels, LG has accelerated investment in OLED TV panels. Its OLED production line in Guangzhou, China was officially approved and its Paju P10 facility in South Korea is exclusively producing OLED TV panels. At the same time, the repurposing of 8.5G LCD capacity to OLED is also being accelerated.

Samsung is focusing on large-size, high-end products. The scale of 65" panel production continues to expand and the company also commenced mass production of 8K TV panel during the second quarter. Its overall shipments were relatively stable, ranking fourth, while the company ranked second after LG in terms of shipment by area.

CSOT"s total shipment volume reached 19.1 million in the first half, an increase of 5.6% year-on-year, ranking fifth in terms of amount and area of shipments. In the second quarter, the company"s product structure was adjusted, with output of 32” panels reduced and supply of 43” panels increased.

Affected by the capacity expansion of Chinese manufacturers, AU Optronics" market share has dropped to less than 10% and the company"s investment is relatively conservative. In the second half of this year, 8.5G capacity expansion will usher in mass production.

Among other panel makers, HKC"s 8.6G line is almost operating at full capacity. Shipments have been maintained steadily, with a focus on 32" panels. CEC"s two new 8.6G lines have begun mass production, but shipment growth is slow. Meanwhile, Sharp"s panel production line maintained high productivity.

Since the second quarter of 2017, panel prices have dropped. In the first half of this year, the TV market was not performing well and panel prices continued to decline in June, with prices coming close to cost, which caused panel factories to suffer.

Prices of 32" panels have fallen, opening up the price difference between adjacent sizes. The supply and demand imbalance in the second quarter of this year caused 32" panel prices to plummet rapidly. According to Sigmaintell, in the first half of 2018, the price of 32” panels decreased by 31%, or almost 40% compared to their peak price point in 2017.

For 39.5" - 43" sizes, promotion isn"t active and demand is weak. BOE"s 8.5G line in Fuqing, China has led to an increase in the supply of 43" panels and a substantial decline in their price. As for 49" - 50", new 8.6G lines have greatly enriched 50" panel supply resources. Price is relatively positive, even with the 49" price inversion, causing demand to shift from 49” to 50”.

55” is still the "golden child" of the large sizes. Demand continues to be strong and price declines are smaller than those of other sizes. According to Sigmaintell, in the first half of 2018, the price of 55” panels decreased by 16.1%, and nearly 30.5% compared to their peak price point in 2017.

As for 65”, prices began to fall in June 2017. Thanks in part to the smooth production of BOE"s 10.5G line, supply of 65” panels has been greatly increased. In the second quarter of 2018, 65" panel prices declined by about 25%.

Panel prices rapidly fell below total cost in the second quarter of 2018, causing panel makers to face severe profitability challenges. However, through positive price strategies, panel manufacturers have increased shipment growth and reduced inventory.

Panel makers will have the opportunity to achieve phased business improvement through strategic adjustment but with the continued release of new production capacity, they will face serious competition in the future.

Sigmaintell says panel manufacturers should actively seek to reduce costs, but with the tight supply of key components such as ICs, the scope for product cost reduction is limited. Therefore, it is more important to continuously upgrade technology to enhance overall competitiveness and reduce risk.

[Introduction]: This paper analyzes the competitive pattern of the panel display industry from both supply and demand sides. On the supply side, the optimization of the industry competition pattern by accelerating the withdrawal of Samsung’s production capacity is deeply discussed. Demand-side focuses on tracking global sales data and industry inventory changes.

Since April 2020, the display device sector rose 4.81%, ranking 11th in the electronic subsectors, 3.39 percentage points behind the SW electronic sector, 0.65 percentage points ahead of the Shanghai and Shenzhen 300 Index. Of the top two domestic panel display companies, TCL Technology is up 11.35 percent in April and BOE is up 4.85 percent.

Specific to the panel display plate, we still do the analysis from both ends of supply and demand: supply-side: February operating rate is insufficient, especially panel display module segment grain rate is not good, limited capacity to boost the panel display price. Since March, effective progress has been made in the prevention and control of the epidemic in China. Except for some production lines in Wuhan that have been delayed, other domestic panels show that the production lines have returned to normal. In South Korea, Samsung announced recently that it would accelerate its withdrawal from all LCD production lines. This round of output withdrawal exceeded market expectations both in terms of pace and amplitude. We will make a detailed analysis of it in Chapter 2.

Demand-side: We believe that people spend more time at home under the epidemic situation, and TV, as an important facility for family entertainment, has strong demand resilience. In our preliminary report, we have interpreted the pick-up trend of domestic TV market demand in February, which also showed a good performance in March. At present, the online market in China maintains a year-on-year growth of about 30% every week, while the offline market is still weak, but its proportion has been greatly reduced. At present, people are more concerned about the impact of the epidemic overseas. According to the research of Cinda Electronics Industry Chain, in the first week, after Italy was closed down, local TV sales dropped by about 45% from the previous week. In addition, Media Markt, Europe’s largest offline consumer electronics chain, also closed in mid-March, which will affect terminal sales to some extent, and panel display prices will continue to be under pressure in April and May. However, we believe that as the epidemic is brought under control, overseas market demand is expected to return to the pace of China’s recovery.

From a price perspective, the panel shows that prices have risen every month through March since the bottom of December 19 reversed. However, according to AVC’s price bulletin of TV panel display in early April, the price of TV panel display in April will decrease slightly, and the price of 32 “, 39.5 “, 43 “, 50 “and 55” panels will all decrease by 1 USD.65 “panel shows price down $2; The 75 “panel shows the price down by $3.The specific reasons have been described above, along with the domestic panel display production line stalling rate recovery, supply-side capacity release; The epidemic spread rapidly in Europe and the United States, sports events were postponed, local blockades were gradually rolled out, and the demand side declined to a certain extent.

Looking ahead to Q2, we think prices will remain under pressure in May, but prices are expected to pick up in June as Samsung’s capacity is being taken out and the outbreak is under control overseas. At the same time, from the perspective of channel inventory, the current all-channel inventory, including the inventory of all panel display factories, has fallen to a historical low. The industry as a whole has more flexibility to cope with market uncertainties. At the same time, low inventory is also the next epidemic warming panel show price foreshadowing.

In terms of valuation level, due to the low concentration and fierce competition in the panel display industry in the past ten years, the performance of sector companies is cyclical to a certain extent. Therefore, PE, PB, and other methods should be comprehensively adopted for valuation. On the other hand, the domestic panel shows that the leading companies in the past years have sustained large-scale capital investment, high depreciation, and a long period of poor profitability, leading to the inflated TTM PE in the first half of 2014 to 2017. Therefore, we will display the valuation level of the sector mainly through the PB-band analysis panel in this paper.

In 2017, due to the combined impact of panel display price rise and OLED production, the valuation of the plate continued to expand, with the highest PB reaching 2.8 times. Then, with the price falling, the panel shows that PB bottomed out at the end of January 2019 at only 1.11 times. From the end of 2019 to February, the panel shows that rising prices have driven PB all the way up, the peak PB reached 2.23 times. Since entering March, affected by the epidemic, in the short term panel prices under pressure, the valuation of the plate once again fell back to 1.62 times. In April, the epidemic situation in the epidemic country was gradually under control, and the valuation of the sector rebounded to 1.68 times.

We believe the sector is still at the bottom of the stage as Samsung accelerates its exit from LCD capacity and industry inventories remain low. Therefore, once the overseas epidemic is under control and the domestic demand picks up, the panel shows that prices will rise sharply. In addition, the plate will also benefit from Ultra HD drive in the long term. Panel display plate medium – and long-term growth logic is still clear. Coupled with the optimization of the competitive pattern, industry volatility will be greatly weakened. The current plate PB compared to the historical high has sufficient space, optimistic about the plate leading company’s investment value.

1). share market, in April in addition to Zhiyun shares, Tiantong shares, Yizhi technology fell, the rest of the stock plate rose, precision test electronics, Lebao high-tech and TCL technology rose larger, reaching 22.38%, 11.45%, and 11.35% respectively.

In the overseas market, benefiting from the control of the epidemic in Japan and South Korea, all stocks except UDC rose. Among them, Innolux Optoelectronics, Finetek, AU Optoelectronics rose more than 10%.

Revenue at Innolux and AU Optronics has been sluggish for several months and improved in March. Since the third quarter of 2017, Innolux’s monthly revenue growth has been negative, while AU Optronics has only experienced revenue growth in a very few months.AU Optronics recorded a record low revenue in January and increased in February and March. Innolux’s revenue returned to growth in March after falling to its lowest in recent years in February. However, because the panel display manufacturers in Taiwan have not put in new production capacity for many years, the production process of the existing production line is relatively backward, and the competitiveness is not strong.

On March 31, Samsung Display China officially sent a notice to customers, deciding to terminate the supply of all LCD products by the end of 2020.LGD had earlier announced that it would close its local LCDTV panel display production by the end of this year. In the following, we will analyze the impact of the accelerated introduction of the Korean factory on the supply pattern of the panel display industry from the perspective of the supply side.

The early market on the panel display plate is controversial, mainly worried about the exit of Korean manufacturers, such as LCD display panel price rise, or will slow down the pace of capacity exit as in 17 years. And we believe that this round of LCD panel prices and 2017 prices are essentially different, the LCD production capacity of South Korean manufacturers exit is an established strategy, will not be transferred because of price warming. Investigating the reasons, we believe that there are mainly the following three factors driving:

(1) Under the localization, scale effect, and aggregation effect, the Chinese panel leader has lower cost and stronger profitability than the Japanese and Korean manufacturers. In terms of cost structure, according to IHS data, material cost accounts for 70% of the cost displayed by the LCD panel, while depreciation accounts for 17%, so the material cost has a significant impact on it. At present, the upstream LCD, polarizer, PCB, mold, and key target material line of the mainland panel display manufacturers are fully imported into the domestic, effectively reducing the material cost. In addition, at the beginning of the factory, manufacturers not only consider the upstream glass and polarizer factory but also consider the synergy between the downstream complete machine factory, so as to reduce the labor cost, transportation cost, etc., forming a certain industrial clustering effect. The growing volume of shipments also makes the economies of scale increasingly obvious. In the long run, the profit gap between the South Korean plant and the mainland plant will become even wider.

(2) The 7 and 8 generation production lines of the Korean plant cannot adapt to the increasing demand for TV in average size. Traditionally, the 8 generation line can only cut the 32 “, 46 “, and 60” panel displays. In order to cut the other size panel displays economically and effectively, the panel display factory has made small adjustments to the 8 generation line size, so there are the 8.5, 8.6, 8.6+, and 8.7 generation lines. But from the cutting scheme, 55 inches and above the size of the panel display only part of the generation can support, and the production efficiency is low, hindering the development of large size TV. Driven by the strong demand for large-size TV, the panel display generation line is also constantly breaking through. In 2018, BOE put into operation the world’s first 10.5 generation line, the Hefei B9 plant, with a designed capacity of 120K/ month. The birth of the 10.5 generation line is epoch-making. It solves the cutting problem of large-size panel displays and lays the foundation for the outbreak of large-size TV. From the cutting method, one 10.5 generation line panel display can effectively cut 18 43 inches, 8 65 inches, 6 75 inches panel display, and can be more efficient in hybrid mode cutting, with half of the panel display 65 inches, the other half of the panel display 75 inches, the yield is also guaranteed. Currently, there are a total of five 10.5 generation lines in the world, including two for domestic panel display companies BOE and Huaxing Optoelectronics. Sharp has a 10.5 generation line in Guangzhou, which is mainly used to produce its own TV. Korean manufacturers do not have the 10.5 generation line. In the context of the increasing size of the TV, Korean manufacturers are obviously at a disadvantage in competitiveness.

(3) As the large-size OLED panel display technology has become increasingly mature, Samsung and LGD hope to transfer production to large-size OLED with better profit prospects as soon as possible. Apart from the price factor, the reason why South Korean manufacturers are exiting LCD production is more because the large-size OLED panel display technology is becoming mature, and Samsung and LGD hope to switch to large-size OLED production as soon as possible, which has better profit prospects. At present, there are three major large-scale OLED solutions including WOLED, QD OLED, and printed OLED, while there is only WOLED with a mass production line at present.

According to statistics, shipments of OLED TVs totaled 2.8 million in 2018 and increased to 3.5 million in 2019, up 25 percent year on year. But it accounted for only 1.58% of global shipments. The capacity gap has greatly limited the volume of OLED TV.LG alone consumes about 47% of the world’s OLED TV panel display capacity, thanks to its own capacity. Other manufacturers can only purchase at a high price. According to the industry chain survey, the current price of a 65-inch OLED panel is around $800-900, while the price of the same size LCD panel is currently only $171.There is a significant price difference between the two.

Samsung and LGD began to shut down LCD production lines in Q3 last year, leading to the recovery of the panel display sector. Entering 2020, the two major South Korean plants have announced further capacity withdrawal planning. In the following section, we will focus on its capacity exit plan and compare it with the original plan. It can be seen that the pace and magnitude of Samsung’s exit this round is much higher than the market expectation:

(1) LGD: LGD currently has three large LCD production lines of P7, P8, and P9 in China, with a designed capacity of 230K, 240K, and 90K respectively. At the CES exhibition at the beginning of this year, the company announced that IT would shut down all TV panel display production capacity in South Korea in 2020, mainly P7 and P8 lines, while P9 is not included in the exit plan because IT supplies IT panel display for Apple.

(2) Samsung: At present, Samsung has L8-1, L8-2, and L7-2 large-size LCD production lines in South Korea, with designed production capacities of 200K, 150K, and 160K respectively. At the same time in Suzhou has a 70K capacity of 8 generation line.

This round of capacity withdrawal of South Korean plants began in June 2019. Based on the global total production capacity in June 2019, Samsung will withdraw 1,386,900 square meters of production capacity in 2019-2020, equivalent to 9.69% of the global production capacity, according to the previous two-year withdrawal expectation. In 2021, 697,200 square meters of production capacity will be withdrawn, which is equivalent to 4.87% of the global production capacity, and a total of 14.56% will be withdrawn in three years. After the implementation of the new plan, Samsung will eliminate 2.422 million square meters of production capacity by the end of 2020, equivalent to 16.92 percent of the global capacity. This round of production plans from the pace and range are far beyond the market expectations.

Global shipments of TV panel displays totaled 281 million in 2019, down 1.06 percent year on year, according to Insight. In fact, TV panel display shipments have been stable since 2015 at between 250 and 300 million units. At the same time, from the perspective of the structure of sales volume, the period from 2005 to 2010 was the period when the size of China’s TV market grew substantially. Third-world sales also leveled off in 2014. We believe that the sales volume of the TV market has stabilized and there is no big fluctuation. The impact of the epidemic on the overall demand may be more optimistic than the market expectation.

In contrast to the change in volume, we believe that the core driver of the growth in TV panel display demand is actually the increase in TV size. According to the data statistics of Group Intelligence Consulting, the average size of TV panel display in 2014 was 0.47 square meters, equivalent to the size of 41 inches screen. In 2019, the average TV panel size is 0.58 square meters, which is about the size of a 46-inch screen. From 2014 to 2019, the average CAGR of TV panel display size is 4.18%. Meanwhile, the shipment of TV in 2019 also increased compared with that in 2014. Therefore, from 2014 to 2019, the compound growth rate of the total area demand for TV panel displays is 6.37%.

It is assumed that 4K screen and 8K screen will accelerate the penetration and gradually become mainstream products in the next 2-3 years. The pace of screen size increase will accelerate. We have learned through industry chain research that the average size growth rate of TV will increase to 6-8% in 2020. Driven by the growth of the average size, the demand area of global TV panel displays is expected to grow even if TV sales decline, and the upward trend of industry demand remains unchanged.

Meanwhile, the global LCDTV panel display demand will increase significantly in 2021, driven by the recovery of terminal demand and the continued growth of the average TV size. In 2021, the whole year panel display will be in a short supply situation, the mainland panel shows that both males will enjoy the price elasticity.

This paper analyzes the competition pattern of the panel display industry from both supply and demand sides. On the supply side, the optimization of the industry competition pattern by accelerating the withdrawal of Samsung’s production capacity is deeply discussed. Demand-side focuses on tracking global sales data and industry inventory changes. Overall, we believe that the current epidemic has a certain impact on demand, and the panel shows that prices may be under short-term pressure in April or May. But as Samsung’s exit from LCD capacity accelerates, industry inventories remain low. So once the overseas epidemic is contained and domestic demand picks up, the panel suggests prices will surge. We are firmly optimistic about the A-share panel display plate investment value, maintain the industry “optimistic” rating. Suggested attention: BOE A, TCL Technology.

The Liquid Crystal Display (LCD)-enabled electronic devices, such as television, mobile phones and others, is creating potential opportunities for the LCD panel market. In the past couple of years, LCD panels have gained popularity owing to their advanced properties that include less power consumption, compact size and low price.

Moreover, over the past two decades, the LCD technology of has made impressive progress. The electronic displays available at present make use of a wide variety of active LCD panels. The LCD panel market is one of the significantly growing markets due to the increasing demand for LCD displays & low power consumption electronic goods, as well as increase in the demand for touch-enabled displays.

An LCD panel is designed to project on-screen information. At present, LCD panels are suited with high-mobility electronic equipment. LCDs with improved video quality are gaining momentum in all developed and developing economies. These factors are projected to propel the global LCD panel market.

The major growth drivers of the LCD panel market include an increase in the demand for energy-efficient electronic products as well as for larger and 4K televisions. Furthermore, growth in the demand for energy-efficient electronic devices is surging the global LCD panel market.

Demand for high-quality screens, coupled with improving standards of living and inflating disposable income, are among key factors boosting the LCD Panel market. In addition, increase in the adoption of consumer electronic devices is projected to drive the global LCD panel market.

However, one of the major challenges of the LCD panel market are the higher cost and thickness of the display of these devices as compared to other modules. The LCD panel market is expected to witness sluggish and unpredictable growth owing to a quantitative decline in the number of LCD displays.

Moreover, financial uncertainty and macroeconomic situations around the world, such as fluctuating currency exchange rates and economic difficulties, are some of the major factors hindering the growth of the LCD panel market. However, increased competition from alternative technologies and LCD panel complex structure is likely to limit the growth of the LCD panel market.

At present, North America holds the largest market share for the LCD panel market due an increase in the demand for consumer electronic devices. Due to the presence of key LCD panel manufacturers in China and Japan, Asia Pacific is expected to become the prominent region for the LCD panel market.

In addition, the unorganized market of LCD panels in China, Japan and India is creating a competitive environment for global LCD panel manufacturers. Moreover, Europe is the fastest-growing market for LCD panels due to an increase in the adoption of consumer electronics devices. The demand for LCD panels has risen dramatically over the past 12 months globally. The usage of LCD displays in various industries in these regions is boosting the LCD panel market.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

Due to an increase in the demand for large LCD displays, the large size LCD panel sub-segment is expected to register double-digit growth rate in the global market. In addition, due to an increase in the demand for portable electronic devices, the small size LCD panel sub-segment is projected to be the most attractive market sub-segment of the global LCD panel market.

The smart phones and tablets sub-segment held the largest market share for the LDC panel market in 2017, and the wearable devices sub-segment is expected to grow with a high CAGR during the forecast period.

technologies such as OLED, Micro-LED, QLED and LED have modernized different types of display panels such as Flexible Panels, Transparent Panels, Foldable Panels

solutions also augment the market growth. These aforementioned factors would positively influence the Display Industry Outlook during the forecast period.

industry verticals are driving the segment’s growth in the Display Market. OLED displays are brighter, feature higher contrast and broader viewing angles, respond faster

the global market for Displays with a market share of 41% in 2022. The region is also analyzed to have significant growth over the forecast period. Growing

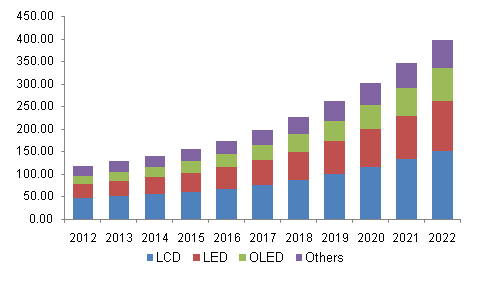

The global flat panel display market was valued at $116.80 billion in 2018, and is projected to reach $189.60 billion by 2026, registering a CAGR of 6.10% from 2019 to 2026. Flat panel display is electronics viewing technology that projects information such as images, videos, texts, or other visual material. Flat panel displays are far lighter and thinner than traditional Cathode Ray Tube (CRT) television sets. These display screens utilize numerous technologies such as Light-Emitting Diode (LED), Liquid Crystal Display (LCD), Organic Light-Emitting Diode (OLED), and others. Also, it is mostly used in consumer electronic devices such as TV, laptops, tablets, laptops, smart watches, and others.

The emergence of advanced technologies offers enhanced visualizations in several industry verticals, which include consumer electronics, retail, sports & entertainment, transportation, and others. Also, flexible flat panel display technologies witness popularity at a high pace. In addition, display technologies, such OLED, have gained increased importance in products such as televisions, smart wearables, smartphones, and other devices. Moreover, smartphone manufacturers plan to incorporate flexible OLED displays to attract consumers. Furthermore, the flat panel display market is also in the process of producing energy saving devices, primarily in wearable devices.

The major factors that drive the flat panel display market include growth in vehicle display technology in the automotive sector, increase in demand for OLED display devices in smartphones and tablets, and rise in adoption of interactive touch-based devices in the education sector. However, high cost of latest display technologies such as transparent display and quantum dot displays, and stagnant growth of desktop PCs, notebooks, and tablets hinder the flat panel display market growth. Furthermore, upcoming applications in flexible flat panel display devices are expected to create lucrative growth opportunities for the global flat panel display market.

The flat panel display market is segmented into technology, application, industry vertical, and region. By technology, it is classified into OLED, quantum dots, LED, LCD, and others. By application, it is categorized into smartphone & tablet, smart wearables, television & digital signage, PC & laptop, vehicle display, and others. By industry vertical, it is divided into healthcare, retail, BFSI, military & defense, automotive, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The significant impacting factors in the global flat panel display industry include high demand for vehicle display technology in the 0automotive sector, Increase in demand for OLED display devices in smartphones and tablets, Rise in adoption of interactive touch-based devices in education sector, high cost of new display technologies, stagnant growth of desktop PCs, notebook, and tablets, surge in adoption of flexible flat panel display. Each of these factors is anticipated to have a definite impact on the flat panel display market size during the forecast period.

Organic LEDs are emerging type of display technology. This technology removes the need of separate backlighting. The display panels based on this technology are thinner than other technologies that are integrated in display devices. This technology is widely used in smartphones which boast OLED screen and are rapidly becoming more prevalent. Major player like Apple, Oppo, Vivo, LG, and Xiaomi also stared using OLED displays from last few years. In addition, when in low light ambient conditions at room, an OLED can achieve higher contrast ratio than other technology.

In recent years, the number of devices with touch sensors has risen exponentially as touch-based devices are easier to access. The touch-based devices require a display panel to operate which, in turn, helps in the growth of display devices. The demand for interactive displays in schools, institutions, and universities has increased around the world. These displays are useful for learning and teaching purposes such as efficient interaction in classrooms, student accomplishments, and overall productivity. Interactive display offers numerous advantages such as increased level of engagement between students and teachers, allowing students with physical disability learn better, bring flexibility in learning, saves teaching cost, and allows students to save lessons for further review. Also, interactive flat panel display allows teachers to share text, video, and audio files with students easily.

The latest display technologies such as transparent display and quantum dot displays are relatively high in cost due to its complex design. Hence, most of the latest display technologies are integrated in premium devices, which are not affordable. This factor is expected to restrict the flat panel display market growth.

The current flat panel display market is focused on developing new technologies and products primarily for large-sized displays and high-resolution images. The flat panel display market in future is expected to concentrate on flexible displays. Flexible displays are thin, light, and less prone to breakage compared to conventional displays. Therefore, flexible displays are expected to replace current display devices as well as create new ones. These factors are expected to create lucrative flat panel display market opportunities globally.

Key Benefits for Flat Panel Display Market:This study comprises an analytical depiction of the global flat panel display market share with current trends and future estimations to depict the imminent investment pockets.

Key Market Players AU OPTRONICS CORP., CRYSTAL DISPLAY SYSTEMS LTD, E INK HOLDINGS INC, JAPAN DISPLAY INC., LG DISPLAY, NEC CORPORATION, PANASONIC CORPORATION, SAMSUNG ELECTRONICS CO. LTD., SONY CORPORATION, SHARP CORPORATION

With the evolutionary changes in consumer electronics from past few years, the demand for the electronic parts is increasing rapidly. LCD display modules are electronically modulated optical device or flat-panel display and use the light-modulating properties of liquid crystals.

LCD display modules display arbitrary image or fixed images and low content information. The information can be displayed or kept hidden including digits, preset words, and seven-segment displays, as in a digital clock.

Increasing production of electronic devices such as aircraft cockpit displays, computer monitors, LCD televisions, indoor and outdoor signage and instrument panels is responsible for the increasing demand for the LCD display module. Manufacturers of the LCD display modules are focusing on developing innovative products to attract more customers to increase the revenue generation by sales of displays.

Manufacturers of the LCD display modules are coming up with the product innovations such as background display colors, character sizes, number of rows, and others and these features are fueling the increasing integration of the LCD display modules.

Constant advancements in the LCD display modules and improvement in the functionality of displays is the primary factor driving the growth of the LCD display module market.

The manufacturers are also focusing on the delivering a LCD display modules are per the end user requirements as these displays are primarily used for the consumer electronic devices which are produced in bulk quantity.

The increasing production of small electronic devices such as cameras, watches, calculators, clocks, mobile telephones, DVD players, clocks, and other devices is creating a huge demand from manufacturers of these products for the LCD display modules as per their product requirements.

On the other hand, availability of LCD display modules at low prices due to the entry of new players from developing countries, shortage of electronic components is a significant challenge for the established players in this market.

The global vendors for LCD Display Module include RAYSTAR OPTRONICS, INC., WINSTAR Display Co., Ltd., Newhaven Display International, Inc., Sharp Microelectronics, 4D Systems, ELECTRONIC ASSEMBLY GmbH, Kyocera International, Inc., Displaytech, and others. LCD display manufacturers are coming up with the new features and more advanced functionalities of the displays for sustaining in the global competition.

In February 2018, Displaytech, LCD display module manufacturer released DT070CTFT, a 7 inch 800 x 480 TFT display. The company is offering LCD displays with a resistive touch as well as a capacitive touch panel.

The global market for LCD Display Module is divided on the basis of regions into North America, Latin America, Western Europe, Eastern Europe, the Asia Pacific Excluding Japan, Japan, China, and Middle East & Africa. Among these regions, the countries such as Taiwan, South Korea, and China holds major market share in terms of revenue generation from the sale of LCD display module because of the higher presence of manufacturers for these displays as well as the dense presence of the consumer electronics manufacturers.

North America, Western Europe is the second largest market for the LCD display module due to increasing demand from consumer electronics manufacturers. MEA region is expected to grow at moderate CAGR.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

technologies such as OLED, Micro-LED, QLED and LED have modernized different types of display panels such as Flexible Panels, Transparent Panels, Foldable Panels

solutions also augment the market growth. These aforementioned factors would positively influence the Display Industry Outlook during the forecast period.

industry verticals are driving the segment’s growth in the Display Market. OLED displays are brighter, feature higher contrast and broader viewing angles, respond faster

the global market for Displays with a market share of 41% in 2022. The region is also analyzed to have significant growth over the forecast period. Growing

Global 4K display market was valued at USD 70.65 billion in 2021, and it is expected to attain a value of USD 304.35 billion by 2028 with a CAGR of 23.20% over the prediction period (2022–2028).

Westford, USA, Sept. 27, 2022 (GLOBE NEWSWIRE) -- 4K Display Market has become extremely popular in recent years, as users have come to appreciate their high-resolution quality. 4K displays offer a much higher resolution than the current mainstream displays, which is why they are so appealing to consumers. Today, 4K displays are not just for TV, Desktop and Laptop usage anymore. Companies are now starting to install 4K displays in their Commercial Locations such as Hospitals, Schools, and Airports. Manufacturers are also producing them in large quantity and selling them at an exponential rate.

The growing demand for 4K display market is raising expectations about the next big thing in display technology. With improvements in resolution and color, 4K displays are already transforming how we view content. With prices dropping and more content being created in 4K, the demand for these screens only continues to grow.

Currently, 2160p (4K) displays are dominant in the 4K display market. But this is only the beginning—as technology improves, SkyQuest’s analyst predict that UHD (3840x2160) displays will become prevalent by 2020.

Why are 4K Displays So Effective? There are many benefits of using 4K displays over traditional displays: - They Offer Higher Resolution: When it comes to resolution, 4K Displays consistently deliver smoother lines and sharper pictures than traditional displays. This means that graphics and images look smoother and more realistic than ever before in the 4K display market.

Global shipments of 4K display were totaled at 127.4 million units in 2021 and is projected to reach 405 million by 2028. Moreover, OLED and QLED TV shipments continue to dominate with a share of above 58%. The global 4K display market revenue is forecast to grow at a CAGR of 23.20% through 2028.

In terms of application areas, gaming continues to be an early adopter of 4K displays with gaming mic and headsets releasing in Q4/2021 with more devices set to release in 2022. In addition, commercial buildings are starting to upgrade their signage systems from HD to 4K for added clarity and detail especially for high dynamic range (HDR) content, which is projected to add fuel to the growth of the 4K display market.

These findings in the 4K display market confirm that 4KTV is becoming the must-have television technology for enthusiasts who want the best possible images. However, it is not just ultra-high-definition televisions that are gaining popularity among consumers; Our research shows that sales of 3D TVs are growing as well. In fact, we expect 4K 3DTV penetration to reach 50% by 2025, up from just 44% at present. This is due to the increasing popularity of premium viewing platforms such as Netflix, Hulu, and Amazon Prime Video that support 4K content.

4K displays are becoming increasingly popular as consumers in the 4K display market become more demanding for better picture quality. This is especially true for video and gaming as 4K offers a sharper image than traditional HD displays.

The top five global brands in the 4K display market namely Samsung, Sony, Hisense, TCL, and LG are holding over 55% share of the global 4K display market. With Samsung leading the pack with a market share of over 19%. The top three global brands generated revenues that were greater than their combined total from 2018–2021.

In addition to QLEDs, Samsung, a largest player in 4K display market, also offers other types of 4K displays, including quoted LCD panels and WQHD+ AMOLED panels. But QLEDs continue to dominate the market because they can offer “significantly higher resolution and brightness levels as well as better color performance than any other type of panel.”

It seems like Korean brands are dominating not only in terms of sales but also in terms of R&D and innovation in the 4K display market. We will have to see how this competitive landscape will shift in coming years as newer brands are launching their products in the market.

SkyQuest Technology is leading growth consulting firm providing market intelligence, commercialization and technology services. It has 450+ happy clients globally.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey