china tft lcd panel industry overview factory

According to a recently released report by SEMI, thin-film transitor-LCD manufacturing capacity in China is expected to show 35 percent growth in 2007 and 50 percent growth in 2008, as new fab capacity begins to come online.

The report also predicts that investment in display production facilities will cool for the rest of the world, but China may eventually account for 20 to 30 percent of the total world market.

At present, China has two fifth generation (G5) TFT-LCD fabs in production, one coming online, one existing G5 fab expansion, one G1 plant and three Chinese-owned G2-G3 lines in Korea.

“To date, there has been very little production of TFT-LCD materials or components in China,” said Mark Ding, president of SEMI China. “However, the influx of both Chinese and foreign-owned companies that are beginning to establish these local facilities is helping to significantly grow this market, and will ultimately help establish China as a global panel making market center of TFT-LCD materials and components.”

SEMI is an industry association for companies that provide equipment, materials and services used to manufacture semiconductors, displays, nano-scaled structures, micro-electromechanical systems and related technologies.

In recent time, China domestic companies like BOE have overtaken LCD manufacturers from Korea and Japan. For the first three quarters of 2020, China LCD companies shipped 97.01 million square meters TFT LCD. And China"s LCD display manufacturers expect to grab 70% global LCD panel shipments very soon.

BOE started LCD manufacturing in 1994, and has grown into the largest LCD manufacturers in the world. Who has the 1st generation 10.5 TFT LCD production line. BOE"s LCD products are widely used in areas like TV, monitor, mobile phone, laptop computer etc.

TianMa Microelectronics is a professional LCD and LCM manufacturer. The company owns generation 4.5 TFT LCD production lines, mainly focuses on making medium to small size LCD product. TianMa works on consult, design and manufacturing of LCD display. Its LCDs are used in medical, instrument, telecommunication and auto industries.

TCL CSOT (TCL China Star Optoelectronics Technology Co., Ltd), established in November, 2009. TCL has six LCD panel production lines commissioned, providing panels and modules for TV and mobile products. The products range from large, small & medium display panel and touch modules.

Established in 1996, Topway is a high-tech enterprise specializing in the design and manufacturing of industrial LCD module. Topway"s TFT LCD displays are known worldwide for their flexible use, reliable quality and reliable support. More than 20 years expertise coupled with longevity of LCD modules make Topway a trustworthy partner for decades. CMRC (market research institution belonged to Statistics China before) named Topway one of the top 10 LCD manufactures in China.

Founded in 2006, K&D Technology makes TFT-LCM, touch screen, finger print recognition and backlight. Its products are used in smart phone, tablet computer, laptop computer and so on.

Established in 2013, Eternal Material Technology is committed to the research, development and manufacturing of electronic materials and providing technical services. EMT is leading the industry with its products of OLED and color photoresist materials.

The Company engages in the R&D, manufacturing, and sale of LCD panels. It offers LCD panels for notebook computers, desktop computer monitors, LCD TV sets, vehicle-mounted IPC, consumer electronics products, mobile devices, tablet PCs, desktop PCs, and industrial displays.

LCD manufacturers are mainly located in China, Taiwan, Korea, Japan. Almost all the lcd or TFT manufacturers have built or moved their lcd plants to China on the past decades. Top TFT lcd and oled display manufactuers including BOE, COST, Tianma, IVO from China mainland, and Innolux, AUO from Tianwan, but they have established factories in China mainland as well, and other small-middium sizes lcd manufacturers in China.

China flat display revenue has reached to Sixty billion US Dollars from 2020. there are 35 tft lcd lines (higher than 6 generation lines) in China,China is the best place for seeking the lcd manufacturers.

The first half of 2021, BOE revenue has been reached to twenty billion US dollars, increased more than 90% than thesame time of 2020, the main revenue is from TFT LCD, AMoled. BOE flexible amoled screens" output have been reach to 25KK pcs at the first half of 2021.the new display group Micro LED revenue has been increased to 0.25% of the total revenue as well.

Established in 1993 BOE Technology Group Co. Ltd. is the top1 tft lcd manufacturers in China, headquarter in Beijing, China, BOE has 4 lines of G6 AMOLED production lines that can make flexible OLED, BOE is the authorized screen supplier of Apple, Huawei, Xiaomi, etc,the first G10.5 TFT line is made in BOE.BOE main products is in large sizes of tft lcd panel,the maximum lcd sizes what BOE made is up to 110 inch tft panel, 8k resolution. BOE is the bigger supplier for flexible AM OLED in China.

Technology Co., Ltd), established in 2009. CSOT is the company from TCL, CSOT has eight tft LCD panel plants, four tft lcd modules plants in Shenzhen, Wuhan, Huizhou, Suzhou, Guangzhou and in India. CSOTproviding panels and modules for TV and mobile

three decades.Tianma is the leader of small to medium size displays in technologyin China. Tianma have the tft panel factories in Shenzhen, Shanhai, Chendu, Xiamen city, Tianma"s Shenzhen factory could make the monochrome lcd panel and LCD module, TFT LCD module, TFT touch screen module. Tianma is top 1 manufactures in Automotive display screen and LTPS TFT panel.

Tianma and BOE are the top grade lcd manufacturers in China, because they are big lcd manufacturers, their minimum order quantity would be reached 30k pcs MOQ for small sizes lcd panel. price is also top grade, it might be more expensive 50%~80% than the market price.

Panda electronics is established in 1936, located in Nanjing, Jiangshu, China. Panda has a G6 and G8.6 TFT panel lines (bought from Sharp). The TFT panel technologies are mainly from Sharp, but its technology is not compliance to the other tft panels from other tft manufactures, it lead to the capacity efficiency is lower than other tft panel manufacturers. the latest news in 2022, Panda might be bougt to BOE in this year.

Established in 2005, IVO is located in Kunsan,Jiangshu province, China, IVO have more than 3000 employee, 400 R&D employee, IVO have a G-5 tft panel production line, IVO products are including tft panel for notebook, automotive display, smart phone screen. 60% of IVO tft panel is for notebook application (TOP 6 in the worldwide), 23% for smart phone, 11% for automotive.

Besides the lcd manufacturers from China mainland,inGreater China region,there are other lcd manufacturers in Taiwan,even they started from Taiwan, they all have built the lcd plants in China mainland as well,let"s see the lcd manufacturers in Taiwan:

Innolux"s 14 plants in Taiwan possess a complete range of 3.5G, 4G, 4.5G, 5G, 6G, 7.5G, and 8.5G-8.6G production line in Taiwan and China mainland, offering a full range of large/medium/small LCD panels and touch-control screens.including 4K2K ultra-high resolution, 3D naked eye, IGZO, LTPS, AMOLED, OLED, and touch-control solutions,full range of TFT LCD panel modules and touch panels, including TV panels, desktop monitors, notebook computer panels, small and medium-sized panels, and medical and automotive panels.

AUO is the tft lcd panel manufacturers in Taiwan,AUO has the lcd factories in Tianma and China mainland,AUOOffer the full range of display products with industry-leading display technology,such as 8K4K resolution TFT lcd panel, wide color gamut, high dynamic range, mini LED backlight, ultra high refresh rate, ultra high brightness and low power consumption. AUO is also actively developing curved, super slim, bezel-less, extreme narrow bezel and free-form technologies that boast aesthetic beauty in terms of design.Micro LED, flexible and foldable AMOLED, and fingerprint sensing technologies were also developed for people to enjoy a new smart living experience.

Hannstar was found in 1998 in Taiwan, Hannstar display hasG5.3 TFT-LCD factory in Tainan and the Nanjing LCM/Touch factories, providing various products and focus on the vertical integration of industrial resources, creating new products for future applications and business models.

driver, backlight etc ,then make it to tft lcd module. so its price is also more expensive than many other lcd module manufacturers in China mainland.

Maclight is a China based display company, located in Shenzhen, China. ISO9001 certified, as a company that more than 10 years working experiences in display, Maclight has the good relationship with top tft panel manufacturers, it guarantee that we could provide a long term stable supply in our products, we commit our products with reliable quality and competitive prices.

Maclight products included monochrome lcd, TFT lcd module and OLED display, touch screen module, Maclight is special in custom lcd display, Sunlight readable tft lcd module, tft lcd with capacitive touch screen. Maclight is the leader of round lcd display. Maclight is also the long term supplier for many lcd companies in USA and Europe.

If you want tobuy lcd moduleorbuy tft screenfrom China with good quality and competitive price, Maclight would be a best choice for your glowing business.

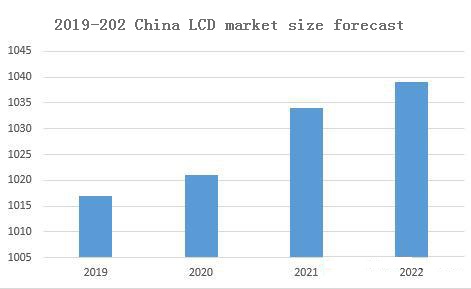

China"s electronics manufacturing industry earned 13 trillion yuan in 2017. But growth in the consumer electronics industry has slowed in the past two years, as shipments of mobile phones and computers have slowed, and demand for liquid crystal displays has slowed.The following display industry data statistical analysis.

China"s electronics manufacturing industry earned 13 trillion yuan in 2017, according to an analysis of the display industry.In terms of hardware product manufacturing, the output of mobile phones, computers and color TV sets in China reached 1.92 billion, 310 million and 170 million respectively. The market demand scale of consumer electronics products is increasing, and China is playing an increasingly important role in the global LCD industry.

In the early stage of LCD development, as an important LCD panel demand market, China has been in a state of "lack of core and screen" for a long time. Because LCD panels account for a very high proportion of the cost of LCD display, domestic LCD TV, computer and other manufacturers are forced to spend huge sums of money to purchase LCD panels and other key components from manufacturers in South Korea, Taiwan and Japan.

Through the statistical analysis of the display industry data, although the LCD industry in China develops rapidly, the scale of the industry is growing, and the localization is constantly improved, the self-sufficiency rate of the LCD panel is still low, and the product is more dependent on the outside, which affects the long-term development of the domestic LCD industry to some extent. With the increasing demand for LCD in electronic information industry, China"s existing enterprises have been putting into production the LCD panel product line, and the industry"s production capacity has been constantly improved.

As Chinese panel makers ceaseless effort, coupled with policy support, liquid crystal display (LCD) industry in China in recent years the rapid development of our country has gradually become the important production base of LCD panel, mainland LCD panel production has been occupying weight status, independent core technology of rapid growth, the global influence growing industry, its self-sufficiency rate of LCD panel will gradually improve, import tends to decline.From 2012 to 2017, the import volume of China"s LCD panel has been declining, which was us $30.13 billion in 2017, down 5.4% year-on-year.

Through statistical analysis of display industry data, it can be seen from the market competition of domestic LCD brands that the scale of domestic LCD enterprises is relatively small, most of which focus on the production of medium and low-end products, while high-end products are concentrated in well-known enterprises. Domestic LCD brands are represented by boe, tianma, huaxing optoelectronics, longteng, vercino and CLP panda. Domestic brands are strengthening their competitiveness in their respective fields.

Our country TFT LCD display export advantage gradually loses, also because our country liquid crystal display export is still in the low-end product primarily, the technical content is relatively low, is difficult to cope with the market competition.Although China has become the world"s top three LCD panel production base, local manufacturers are still weak in technology, especially in high-end products from South Korea, Japan, Taiwan and other places to import LCD panels.In the development of new technology, the technology gap with Japan and South Korea and Taiwan enterprises is still relatively large, on the whole is still in the stage of technology catch-up.

According to IMARC Group’s latest report, titled “TFT LCD Panel Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2022-2027”, the global TFT LCD panel market size reached US$ 157 Billion in 2021. Looking forward, IMARC Group expects the market to reach US$ 207.6 Billion by 2027, exhibiting a growth rate (CAGR) of 4.7% during 2022-2027.

A thin-film-transistor liquid-crystal display (TFT LCD) panel is a liquid crystal display that is generally attached to a thin film transistor. It is an energy-efficient product variant that offers a superior quality viewing experience without straining the eye. Additionally, it is lightweight, less prone to reflection and provides a wider viewing angle and sharp images. Consequently, it is generally utilized in the manufacturing of numerous electronic and handheld devices. Some of the commonly available TFT LCD panels in the market include twisted nematic, in-plane switching, advanced fringe field switching, patterned vertical alignment and an advanced super view.

The global market is primarily driven by continual technological advancements in the display technology. This is supported by the introduction of plasma enhanced chemical vapor deposition (PECVD) technology to manufacture TFT panels that offers uniform thickness and cracking resistance to the product. Along with this, the widespread adoption of the TFT LCD panels in the production of automobiles dashboards that provide high resolution and reliability to the driver is gaining prominence across the globe. Furthermore, the increasing demand for compact-sized display panels and 4K television variants are contributing to the market growth. Moreover, the rising penetration of electronic devices, such as smartphones, tablets and laptops among the masses, is creating a positive outlook for the market. Other factors, including inflating disposable incomes of the masses, changing lifestyle patterns, and increasing investments in research and development (R&D) activities, are further projected to drive the market growth.

The competitive landscape of the TFT LCD panel market has been studied in the report with the detailed profiles of the key players operating in the market.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Main listed companies in the panel industry: BOE (000725. SZ), shentianma (000050), Huaying Technology (2.310, 0.05, 2.21%) (000536), Longteng Optoelectronics (6.570, 0.08, 1.23%) (688055), Hehui Optoelectronics (2.950, 0.02, 0.68%) (688538), etc

From the perspective of industrial chain, panel industry can be divided into upstream basic materials, midstream panel manufacturing and downstream end products. Among them, the upstream basic materials include: glass substrate, color film, polarizer, liquid crystal, target, etc; Midstream panel manufacturing includes: array, cell and module; Downstream end products include: TV, computer, mobile phone and other consumer electronics

The value chain of LCD products forms a "smile curve", that is, the gross profit margin of the LCD industry chain presents a U-shape. The high gross profit margin on the left is the upstream basic materials (more than 40% gross profit margin), the low gross profit margin in the middle is the midstream panel manufacturing (10-20% gross profit margin), and the high gross profit margin on the right is the downstream terminal products (20-30% gross profit margin)

With the strong support of the Chinese government for the development of the panel industry and the rapid development of China"s downstream industrial chain in recent years, the development of China"s TFT-LCD industry has been driven. Major domestic panel manufacturers have set up production lines, among which enterprises represented by BOE have further arranged and expanded production in the high-generation industrial line. IHS data show that the global TFT-LCD output value has reached 131.5 billion US dollars in 2020; CCID data show that China accounts for 50% of the global TFT-LCD output value. According to the comprehensive calculation of the two, China"s TFT-LCD output value has reached US $65.75 billion in 2020

in recent years, Chinese mainland LCD panel industry has been rising rapidly, and TFT-LCD shipments are increasing year by year. Among them, the TFT-LCD large panel growth rate is faster. In 2020, the shipment volume of large size TFT-LCD in mainland China was 266 million, down 7.16% compared with the same period last year. p>

According to sigmaintell"s prediction, in 2022, the top 5 enterprises with TFT-LCD capacity above G5 in the world will be Chinese enterprises. With its price and capital advantages, BOE has rapidly expanded in the Chinese market, becoming the manufacturer with the highest share of TFT-LCD market in China, with a global market share of about 28.9%; Followed by Huaxing optoelectronics and qunchuang, with market shares of more than 10%, accounting for 16% and 11.5% respectively; The market shares of Youda and Huike were 9.9% and 9.1% respectively

Overall, TFT-LCD in China is developing well. Although the panel shipment decreased slightly due to the epidemic in 2020, the price of the panel industry continued to rise and the scale of the industry increased. In the long run, after the global epidemic, the panel supply capacity will be further improved, and the LCD panel price may be reduced in the future

For more industry-related data, please refer to the analysis report on production and marketing demand and investment forecast of China"s Panel Industry issued by the prospective industry research institute. Meanwhile, the prospective industry research institute also provides industrial big data, industrial research, industrial chain consultation, industrial map, industrial planning, park planning, industrial investment attraction, IPO fund-raising feasibility study, IPO business and technology writing IPO working paper consultation and other solutions

More in-depth industry analysis can be found in the forward looking economist app. You can also interact with 500 + economists / senior industry researchers

The global TFT-LCD display panel market attained a value of USD 164 billion in 2020. It is expected to grow further in the forecast period of 2022-2027 with a CAGR of 5.2% and is projected to reach a value of USD 223 billion by 2026.

The current global TFT-LCD display panel market is driven by the increasing demand for flat panel TVs, good quality smartphones, tablets, and vehicle monitoring systems along with the growing gaming industry. The global display market is dominated by the flat panel display with TFT-LCD display panel being the most popular flat panel type and is being driven by strong demand from emerging economies, especially those in Asia Pacific like India, China, Korea, and Taiwan, among others. The rising demand for consumer electronics like LCD TVs, PCs, laptops, SLR cameras, navigation equipment and others have been aiding the growth of the industry.

TFT-LCD display panel is a type of liquid crystal display where each pixel is attached to a thin film transistor. Since the early 2000s, all LCD computer screens are TFT as they have a better response time and improved colour quality. With favourable properties like being light weight, slim, high in resolution and low in power consumption, they are in high demand in almost all sectors where displays are needed. Even with their larger dimensions, TFT-LCD display panel are more feasible as they can be viewed from a wider angle, are not susceptible to reflection and are lighter weight than traditional CRT TVs.

The global TFT-LCD display panel market is being driven by the growing household demand for average and large-sized flat panel TVs as well as a growing demand for slim, high-resolution smart phones with large screens. The rising demand for portable and small-sized tablets in the educational and commercial sectors has also been aiding the TFT-LCD display panel market growth. Increasing demand for automotive displays, a growing gaming industry and the emerging popularity of 3D cinema, are all major drivers for the market. Despite the concerns about an over-supply in the market, the shipments of large TFT-LCD display panel again rose in 2020.

North America is the largest market for TFT-LCD display panel, with over one-third of the global share. It is followed closely by the Asia-Pacific region, where countries like India, China, Korea, and Taiwan are significant emerging market for TFT-LCD display panels. China and India are among the fastest growing markets in the region. The growth of the demand in these regions have been assisted by the growth in their economy, a rise in disposable incomes and an increasing demand for consumer electronics.

The report gives a detailed analysis of the following key players in the global TFT-LCD display panel Market, covering their competitive landscape, capacity, and latest developments like mergers, acquisitions, and investments, expansions of capacity, and plant turnarounds:

Chinese display panel makers accounted for nearly half of the share in the global liquid crystal display TV panel market in the first half of this year, dominating the industry.

Beijing-based market researcher Sigmaintell Consulting said shipments of LCD TV panels worldwide totaled 140 million pieces in the year"s first half, up 3.6 percent compared with the same period a year ago.

The supply of TV panels though has surpassed demand due to the slowdown in the global economy and weaker consumer purchasing power. Manufacturers are facing severe challenges from falling panel prices, the Sigmaintell report said.

The shipment of BOE"s LCD TV panels stood at 27.6 million in the Jan-June period while LG Display followed with 22.7 million, down 4.5 percent year-on-year. Innolux Display Group was in third place, having shipped 21.9 million units.

Shenzhen China Star Optoelectronics Technology Co Ltd, a subsidiary of consumer electronics giant TCL Corp, ranked fourth, shipping 19.3 million pieces of TV panels. Chinese panel makers accounted for a 45.8 percent share in the global LCD TV panel market.

Sigmaintell estimated that the gap between supply and demand would widen further, and the panel market may face a long-term risk of oversupply. The industry may have to undergo a reshuffle given fierce market competition, it said.

The panel makers must reduce costs, optimize their internal structures, promote technological innovation and explore more innovative applications, the report by the consultancy said.

Separately, BOE"s Gen 10.5 TFTLCD production line has entered operation in Hefei, Anhui province. The plant will produce high-definition LCD screens of 65 inches and above.

"China"s semiconductor display industry has taken large steps forward in the past decade, changing the display industry"s global competitive landscape. China has transformed into the world"s largest consumer market and manufacturing base for display terminals, with huge market potential," said BOE Vice-President Zhang Yu.

CSOT also announced in November last year that its Gen 11 TFT-LCD and active-matrix OLED production line had officially began operation. The project will produce 43-inch, 65-inch and 75-inch liquid crystal display screens.

TCL founder and chairman Li Dongsheng said China will likely take the lead in the semiconductor display sector across the world within the next three to five years.

"China will play an active and vital role in prompting the development of the semiconductor display industry, which has a high entry threshold and needs high investment," Li said.

China is expected to replace South Korea as the world"s largest flat-panel display producer in 2019, a report from the China Video Industry Association and the China Optics and Optoelectronics Manufacturers Association said.

"The average size of TV panels is likely to increase 1.4 inches in 2019. The 65-inch dimension will become the most popular size of TV," Li Yaqin, general manager of Sigmaintell, said while adding the 65-inch TV will become the mainstream screen in people"s living rooms in the future.

Compared with traditional LCD display panels, OLED has a fast response rate, wide viewing angles, high-contrast images and richer colors. It is thinner and can be made flexible.

"The penetration rate of such TVs in China is relatively low, while such type of TV has become the representative of high-end TVs in the United States, Europe, Japan and other countries," said Park Changhyuk, general manager of LG Display China"s promotion unit.

The reason for LCD Display flashing screen: shielding coil; Signal interference; Hardware; Refresh frequency setting; Monitor time is too long; Too high...

Large-area TFT LCD panel shipments decreased by 10% Month on Month (MoM) and 5% Year on Year (YoY) in April, to 74.1million units, representing historically low shipment performance since May 2020. Omdia defines large-area TFT LCD displays as larger than 9 inches.

"With continued ramifications from the pandemic, demand for IT panels for monitors and notebook PCs remained strong in 4Q21. But as the market became saturated starting in 2022, IT panel shipments started slowing in 1Q22 and early 2Q22," said Robin Wu, Principal Analyst for Large Area Display & Production, Omdia.

Wu said that notebook panel shipments decreased 21% MoM in April, to 18.2 million units, or a 33% decrease from a peak of 27.3 million units in November 2021.

While TV panel prices have decreased noticeably since 3Q21, TV LCD panel shipments increased to a peak of 23.4 million in December 2021, driven by low prices. But rising inflation, the Ukraine crisis and continued lockdowns in China have slowed demand. As a result, TV panel shipments posted a 9% MoM decline in April, to 21.7million units.

Many TV panel prices have fallen below manufacturing cost, and panel makers began to lose money in their TV panel business starting in 4Q21. But Chinese panel makers, the biggest capacity owners, still haven"t reduced their fab utilization. With no sign of demand recovery in 2Q22 or even 3Q22, the supply/demand situation is unlikely to see improvement, Wu said.

"IT LCD panels could still deliver positive cash flow for panel makers. But with prices dropping dramatically, panel makers will soon start to lose money in their IT panel business," Wu said. "Maybe only then will panel makers reduce their glass input and the overall supply/demand situation will return to balance."

About OmdiaOmdia is a leading research and advisory group focused on the technology industry. With clients operating in over 120 countries, Omdia provides market-critical data, analysis, advice, and custom consulting.

As part of Omdia’s small/medium displays practice, Joy covers displays under 9 inches in size utilized in smartphones, tablets, wearables, and automotive displays. Her research touches areas such as the AMOLED ecosystem, new trends in smartphone panel displays, and the supply chain in China for smartphone displays.

Joy brings 17 years of experience to the subjects she covers. She worked previously at BOE, the giant Chinese display manufacturer, as a product manager for medical and industrial displays. She started her career at Tianma Group as an LCD module design engineer, then became manager of product design and development. She transferred to the marketing department as an analyst for mobile phone displays and then for automotive displays. Joy has a bachelor’s degree in automation from Beihang University, a major public research institution in China. She also holds a master’s degree in business management from Renmin University of China.

David Hsieh is a noted expert in research and analysis of the TFT LCD, and LCD TV value chain for Mainland China and Taiwan. As head of the Displays team, he oversees the division’s end-to-end research on displays, covering the supply chain, materials and components, supply-and-demand dynamics, pricing and cost modeling, revenue and shipment forecasts, and emerging technologies.

In an earlier stint at DisplaySearch, he led the company’s primary research and forecasting on the global display market while concurrently serving as vice president of the greater China market. David also worked at HannStar Display, a leading manufacturer of TFT LCD panels, as a key account manager, production planner, and production engineer for the HannStar TFT LCD module line.

Prior to working at Omdia, Jeff was an engineer at Chunghwa Picture Tubes, where he led TV panel development projects and promoted products. He worked at Samsung Electronics Taiwan, winning the annual best sales award while handling HP’s monitor business account, and was a procurement manager at Benq for monitor panel and TV set purchasing and panel price trend analysis. Jeff joined DisplaySearch in 2010 as a value chain analyst for the tablet, notebook PC, monitor, and public display supply chain. Jeff graduated from Taiwan’s National Cheng Kung University with a degree in environmental engineering and holds an MBA from National Chengchi University in Taiwan.

As part of Omdia’s displays practice, Jay focuses on researching AMOLED panel display technology and the associated markets. He covers the emerging technologies, process development, and product trends related to AMOLED displays.

Prior to being an analyst, Jay worked at EverDisplay Optronics, the AMOLED manufacturing plant, for 6 years. He served as the R&D manager for 3 years and was responsible for multiple projects. Jay has solid experience in the AMOLED and flexible display industries and a keen awareness of technological progress. He holds a PhD in materials science from South China University of Technology in Guangdong, China.

Robin Wu covers large-sized displays, including the production strategies of display manufacturers and investment flows in the industry. He joined the Omdia (previously IHS Markit) in 2014, where he served as an analyst for PCs and TFT LCDs, specializing in trend analysis of China"s PC, monitor, and display panel markets.

He was also the vice chairman of the VESA monitor task group in 2010, and he has been tracking monitor and panel standardization concerns since early 2009. Robin worked previously at IBM/Lenovo, spending nearly seven years on its monitor and LCD business, delivering the company’s industry leading green ThinkVision products while also managing panel sourcing and qualifications. He was also the industry liaison, building strong relationships with leading PC monitor OEMs in China. Robin has a bachelor"s degree in mechanics and electronics, as well as a master"s degree in microelectromechanical systems from Huazhong University of Science and Technology, a key national university in China.

Deborah Yang is a noted expert with over 14 years of experience in research and analysis of the flat panel display supply chain across the world. She works in the display team, responsible for the display and OEM supply chain research, including covering the display industry dynamics, pricing trends, and business relations and strategy in the Omdia technology group.

Deborah Yang previously worked at IHS Markit, following its acquisition of DisplaySearch, as director of Taiwan and China display market research. Prior to DisplaySearch, Deborah spent more than 10 years at Royal Phillips Electronics. There, she held the position of business intelligence manager in the flat panel purchasing department of the Philips CE Business Group. Deborah received an award for her role as senior market analyst at Philips and was a nominee for the Royal Philips Electronics PD PBE Best Practice Award. She holds a Master of Business Administration from Preston University, Wyoming, US, and a bachelor"s degree in economics from SooChow University, Taiwan.

Peter is an expert in research and analysis of large area displays (TVs, monitors, notebooks, and tablets), covering TFT, LCD, and OLED marketing, technology, and panel strategy. His analysis of supply capacity, product specifications, pricing, and short-term and long-term forecasts bring value to both panel makers and brand customers.

Before starting his analyst career with DisplaySearch, Calvin Hsieh had more than a decade of experience crafting strategies and managing product lines at leading display and system organizations across the globe. He joined DisplaySearch as the director for touch panel market and TV electronics in 2007, which was acquired by IHS Markit in 2014. He joined the Omdia from IHS Markit in 2019 and continues to lead the research of emerging display-based user interface including technology, market, and supply chain. Calvin Hsieh has a master"s degree with a focus on human–computer interaction and user interface from National Chiao Tung University, Taiwan.

Prior to her role, Stacy served as the manager of the market intelligence department of Delta Electronics Group and led the team to provide market insights to the senior management team. She was also a senior analyst responsible for the large area display market at iSuppli. During her tenure, she established a comprehensive industry network and delivered several speeches. She was awarded the iSuppli Idol Award in 2008. She holds a master"s degree in international marketing from the University of Strathclyde in the UK and a bachelor"s degree in business administration from National Chengchi University in Taiwan.

Linda Lin covers large-sized thin-film-transistor LCD panels and is in charge of survey reports covering manufacturers and vendors in the notebook panel supply chain. With her many years of experience, Linda has developed first-rate relationships throughout her extensive network of contacts and connections in the display industry.

Linda previously worked at LCD market research firm WitsView, leading research on panels and downstream products, including monitors and TVs. At the Market Intelligence & Consulting Institute, Taiwan’s chief information and communications technology market research group, she oversaw regional research for South and East Asia. It was during this time that Linda decided to make large-sized displays her main focus. Linda has a master’s degree in business administration from National Yunlin University of Science and Technology in Taiwan.

Nick is an expert in research and analysis of the TFT LCD and OLED TV and monitor display value chain for mainland China, Taiwan, Japan, and South Korea. He covers the supply chain of panels, materials, and components; supply and demand; pricing trends and costs; procurement forecasts; and investment information.

Prior to joining Omdia (formerly IHS Markit) in 2010, Nick worked for LG Display as a product strategy planner in China. He also spent some time with a local Chinese television manufacturer, studying products suitable for the Chinese market.

Nick is a graduate of Jilin University in China and has a bachelor’s degree in electronic engineering. He is a fluent speaker of Chinese, Korean, Japanese, and English.

Queenie Jiang is a research analyst in the Displays team at Omdia and based in Shanghai, China. She covers display components research with a specific focus on China; she analyzes the market, prices, supply chains, and technologies.

Queenie joined the company in 2013. Before becoming an analyst, Queenie was a marketing manager at Omdia, where she spent seven years in the Components and Devices pillar. Prior to joining Omdia (formerly IHS Markit), Queenie worked in the project development team at Trina Solar. She holds a bachelor’s degree in Korean from Yangzhou University, China, and Yeungnam University, South Korea.

Jerry Kang is responsible for the OLED display market analysis at IHS. His main focus is the AMOLED panel and the next generation display market including flexible and transparent display with AMOLED.

With more than 10 years of industry experience, Jerry is known for his professional analysis and strategic insights on the technology and market for OLED display. He is frequently quoted in media, and is invited to speak at major conferences worldwide.

Prior to joining IHS in 2011, Jerry worked as an OLED development engineer at Samsung SDI and Samsung Mobile Display, in charge of operational circuit designing for OLED and LCD.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey