china tft lcd panel industry overview in stock

The global TFT-LCD display panel market attained a value of USD 164 billion in 2020. It is expected to grow further in the forecast period of 2022-2027 with a CAGR of 5.2% and is projected to reach a value of USD 223 billion by 2026.

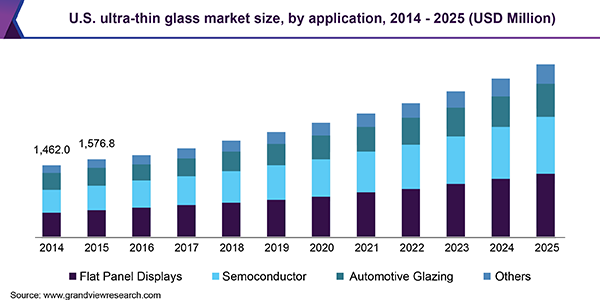

The current global TFT-LCD display panel market is driven by the increasing demand for flat panel TVs, good quality smartphones, tablets, and vehicle monitoring systems along with the growing gaming industry. The global display market is dominated by the flat panel display with TFT-LCD display panel being the most popular flat panel type and is being driven by strong demand from emerging economies, especially those in Asia Pacific like India, China, Korea, and Taiwan, among others. The rising demand for consumer electronics like LCD TVs, PCs, laptops, SLR cameras, navigation equipment and others have been aiding the growth of the industry.

TFT-LCD display panel is a type of liquid crystal display where each pixel is attached to a thin film transistor. Since the early 2000s, all LCD computer screens are TFT as they have a better response time and improved colour quality. With favourable properties like being light weight, slim, high in resolution and low in power consumption, they are in high demand in almost all sectors where displays are needed. Even with their larger dimensions, TFT-LCD display panel are more feasible as they can be viewed from a wider angle, are not susceptible to reflection and are lighter weight than traditional CRT TVs.

The global TFT-LCD display panel market is being driven by the growing household demand for average and large-sized flat panel TVs as well as a growing demand for slim, high-resolution smart phones with large screens. The rising demand for portable and small-sized tablets in the educational and commercial sectors has also been aiding the TFT-LCD display panel market growth. Increasing demand for automotive displays, a growing gaming industry and the emerging popularity of 3D cinema, are all major drivers for the market. Despite the concerns about an over-supply in the market, the shipments of large TFT-LCD display panel again rose in 2020.

North America is the largest market for TFT-LCD display panel, with over one-third of the global share. It is followed closely by the Asia-Pacific region, where countries like India, China, Korea, and Taiwan are significant emerging market for TFT-LCD display panels. China and India are among the fastest growing markets in the region. The growth of the demand in these regions have been assisted by the growth in their economy, a rise in disposable incomes and an increasing demand for consumer electronics.

The report gives a detailed analysis of the following key players in the global TFT-LCD display panel Market, covering their competitive landscape, capacity, and latest developments like mergers, acquisitions, and investments, expansions of capacity, and plant turnarounds:

According to IMARC Group’s latest report, titled “TFT LCD Panel Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2022-2027”, the global TFT LCD panel market size reached US$ 157 Billion in 2021. Looking forward, IMARC Group expects the market to reach US$ 207.6 Billion by 2027, exhibiting a growth rate (CAGR) of 4.7% during 2022-2027.

A thin-film-transistor liquid-crystal display (TFT LCD) panel is a liquid crystal display that is generally attached to a thin film transistor. It is an energy-efficient product variant that offers a superior quality viewing experience without straining the eye. Additionally, it is lightweight, less prone to reflection and provides a wider viewing angle and sharp images. Consequently, it is generally utilized in the manufacturing of numerous electronic and handheld devices. Some of the commonly available TFT LCD panels in the market include twisted nematic, in-plane switching, advanced fringe field switching, patterned vertical alignment and an advanced super view.

The global market is primarily driven by continual technological advancements in the display technology. This is supported by the introduction of plasma enhanced chemical vapor deposition (PECVD) technology to manufacture TFT panels that offers uniform thickness and cracking resistance to the product. Along with this, the widespread adoption of the TFT LCD panels in the production of automobiles dashboards that provide high resolution and reliability to the driver is gaining prominence across the globe. Furthermore, the increasing demand for compact-sized display panels and 4K television variants are contributing to the market growth. Moreover, the rising penetration of electronic devices, such as smartphones, tablets and laptops among the masses, is creating a positive outlook for the market. Other factors, including inflating disposable incomes of the masses, changing lifestyle patterns, and increasing investments in research and development (R&D) activities, are further projected to drive the market growth.

The competitive landscape of the TFT LCD panel market has been studied in the report with the detailed profiles of the key players operating in the market.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Dublin, Sept. 27, 2021 (GLOBE NEWSWIRE) -- The "Global TFT LCD Display Panel Market Report and Forecast 2021-2026" report has been added to ResearchAndMarkets.com"s offering.

The global TFT-LCD display market attained a value of approximately USD 164 billion in 2020. Aided by use of TFT-LCD displays in automotive, the market is projected to further grow at a CAGR of 5.2% between 2021-2026 to reach USD 223 billion by 2026.

TFT-LCD display is a kind of liquid crystal display where each pixel is attached to a film transistor to improve colour quality, as each pixel on a TFT-LCD is attached to a transistor. TFT is deployed in all computer screens television screens since the start of century, because the technology offers better response time and improved colour quality than older technologies and prevents distortion of image. With favourable properties like light weight, slim, and high-resolution features, and due to the small size of each transistor, they consume less power owing to which TFT-LCD displays find applications in nearly every electronic device with a display including smartphones, television screens, computers, and PCs.

The market demand for TFT-LCD display can be attributed to increasing deployment of TFT-LCD display in average and large sized flat panel TVs in the household sector. The growing demand for slim, high resolution smart phones among the younger generation, owing to the work from home trends is further invigorating market growth. Other electronic devices like PCs and desktops that deploy TFT-LCD display for better screen resolution, sharp, and vibrant colours are supporting the market growth.

Due to the rapidly expanding industrialisation and a subsequent rise in disposable incomes, especially in emerging economies of the Asia-Pacific region like India and China, the market demand for personal vehicles equipped with LCD displays for specific functions and entertainment purposes is positively impacting the market growth of TFT-LCD displays. Furthermore, transportation vehicles like aeroplanes, trains, and, buses are emerging as users of TFT-LCD displays, aided by government spending on public transport. Therefore, a rising demand for TFT-LCD displays from the automotive sector is providing lucrative industrial growth opportunities.

The report looks into the market shares, plant turnarounds, capacities, investments, and mergers and acquisitions, among other major developments of the key players in the industry.

Global TFT LCD Display Modules Market Report (114 Pages) provides exclusive vital statistics, data, information, trends and competitive landscape details in this niche sector.

Due to the COVID-19 pandemic and Russia-Ukraine War Influence, the global market for TFT LCD Display Modules estimated at USD million in the year 2022, is projected to reach a revised size of USD million by 2028, growing at a growing CAGR during the forecast period 2022-2028.

The USA market for TFT LCD Display Modules is estimated to increase from USD million in 2022 to reach USD million by 2028, at a growing CAGR during the forecast period of 2023 through 2028.

The China market for TFT LCD Display Modules is estimated to increase from USD million in 2022 to reach USD million by 2028, at a growing CAGR during the forecast period of 2023 through 2028.

The Europe market for TFT LCD Display Modules is estimated to increase from USD million in 2022 to reach USD million by 2028, at a growing CAGR during the forecast period of 2023 through 2028.

The global key manufacturers of TFT LCD Display Modules include Panasonic Corporation, Schneider Electric, Siemens AG, LG Display, HannStar Display Corporation, AU Optronics Corp., Chi Mei Corporation, SAMSUNG Display and SHARP CORPORATION, etc. In 2021, the global top five players had a share approximately % in terms of revenue.

In terms of production side, this report researches the TFT LCD Display Modules production, growth rate, market share by manufacturers and by region (region level and country level), from 2017 to 2022, and forecast to 2028.

In terms of sales side, this report focuses on the sales of TFT LCD Display Modules by region (region level and country level), by company, by Type and by Application. from 2017 to 2022 and forecast to 2028.

This report aims to provide a comprehensive presentation of the global market for TFT LCD Display Modules, with both quantitative and qualitative analysis, to help readers develop business/growth strategies, assess the market competitive situation, analyze their position in the current marketplace, and make informed business decisions regarding TFT LCD Display Modules.

The TFT LCD Display Modules market size, estimations, and forecasts are provided in terms of output/shipments (K Units) and revenue (USD millions), considering 2021 as the base year, with history and forecast data for the period from 2017 to 2028. This report segments the global TFT LCD Display Modules market comprehensively. Regional market sizes, concerning products by types, by application, and by players, are also provided. The influence of COVID-19 and the Russia-Ukraine War were considered while estimating market sizes.

Global markets are presented by TFT LCD Display Modules type, along with growth forecasts through 2028. Estimates on production and value are based on the price in the supply chain at which the TFT LCD Display Modules are procured by the manufacturers.

This report also outlines the market trends of each segment and consumer behaviors impacting the TFT LCD Display Modules market and what implications these may have on the industry"s future. This report can help to understand the relevant market and consumer trends that are driving the TFT LCD Display Modules market.

The readers in the section will understand how the TFT LCD Display Modules market scenario changed across the globe during the pandemic, post-pandemic and Russia-Ukraine War. The study is done keeping in view the changes in aspects such as demand, consumption, transportation, consumer behavior, supply chain management, export and import, and production. The industry experts have also highlighted the key factors that will help create opportunities for players and stabilize the overall industry in the years to come.

Reasons to Buy This Report: ● This report will help the readers to understand the competition within the industries and strategies for the competitive environment to enhance the potential profit. The report also focuses on the competitive landscape of the global TFT LCD Display Modules market, and introduces in detail the market share, industry ranking, competitor ecosystem, market performance, new product development, operation situation, expansion, and acquisition. etc. of the main players, which helps the readers to identify the main competitors and deeply understand the competition pattern of the market.

● This report will help stakeholders to understand the global industry status and trends of TFT LCD Display Modules and provides them with information on key market drivers, restraints, challenges, and opportunities.

The market has been segmented into various major geographies, including North America, Europe, Asia-Pacific, South America. Detailed analysis of major countries such as the USA, Germany, the U.K., Italy, France, China, Japan, South Korea, Southeast Asia, and India will be covered within the regional segment.

Chapter 2:Detailed analysis of TFT LCD Display Modules manufacturers competitive landscape, price, output and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 3:Production/output, value of TFT LCD Display Modules by region/country. It provides a quantitative analysis of the market size and development potential of each region in the next six years.

Chapter 4:Consumption of TFT LCD Display Modules in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and capacity of each country in the world.

Chapter 10:Introduces the market dynamics, latest developments of the market, the driving factors and restrictive factors of the market, the challenges and risks faced by manufacturers in the industry, and the analysis of relevant policies in the industry.

According to a recently released report by SEMI, thin-film transitor-LCD manufacturing capacity in China is expected to show 35 percent growth in 2007 and 50 percent growth in 2008, as new fab capacity begins to come online.

The report also predicts that investment in display production facilities will cool for the rest of the world, but China may eventually account for 20 to 30 percent of the total world market.

At present, China has two fifth generation (G5) TFT-LCD fabs in production, one coming online, one existing G5 fab expansion, one G1 plant and three Chinese-owned G2-G3 lines in Korea.

“To date, there has been very little production of TFT-LCD materials or components in China,” said Mark Ding, president of SEMI China. “However, the influx of both Chinese and foreign-owned companies that are beginning to establish these local facilities is helping to significantly grow this market, and will ultimately help establish China as a global panel making market center of TFT-LCD materials and components.”

SEMI is an industry association for companies that provide equipment, materials and services used to manufacture semiconductors, displays, nano-scaled structures, micro-electromechanical systems and related technologies.

Global Thin Film Transistor (TFT) Display Market, By Technology (Plasma Display (PDP), Organic Light Emitting Diode (OLED), Other), Type (Twisted Nematic, In-Plane Switching, Advanced Fringe Field Switching, Multi-Domain Vertical Alignment, Advanced Super View, Cell Technology), Panel Type (A_MVA, ASV, MVA, S_PVA, P-IPS), End Use (Domestic Use, Industrial Use) – Industry Trends and Forecast to 2029

Global Thin Film Transistor (TFT) Display Market was valued at USD 270.26 million in 2021 and is expected to reach USD 968.64 million by 2029, registering a CAGR of 17.30% during the forecast period of 2022-2029. Twisted Nematic accounts for the largest type segment in the respective market owing to its low cost. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

A thin-film-transistor display refers to a form of LCD that uses TFT technology for enhancing image quality including addressability and contrast. These displays are commonly utilized in mobile phones, handheld video game systems, projectors, computer monitors, television screens, navigation systems and personal digital assistants.

Technology (Plasma Display (PDP), Organic Light Emitting Diode (OLED), Other), Type (Twisted Nematic, In-Plane Switching, Advanced Fringe Field Switching, Multi-Domain Vertical Alignment, Advanced Super View, Cell Technology), Panel Type (A_MVA, ASV, MVA, S_PVA, P-IPS), End Use (Domestic Use, Industrial Use)

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA).

Panasonic Corporation (Japan), LG Display Co., Ltd (South Korea), HannStar Display Corporation (Taiwan), AU Optronics Corp. (Taiwan), Chi Mei Corporation. (Taiwan), SAMSUNG (South Korea), SHARP CORPORATION (Japan), Schneider Electric (France), Siemens (Germany), Mitsubishi Electric Corporation (Japan), SONY INDIA. (India), FUJITSU (Japan), Chunghwa Picture Tubes, LTD. (Taiwan), Barco.(Belgium), BOE Technology Group Co., Ltd. (China), Innolux Corporation (Taiwan), Advantech Co., Ltd (Taiwan), among others.

The increase in the smartphone and tablet proliferation acts as one of the major factors driving the growth of thin film transistor (TFT) display market. Technological advancements are leading a radical shift from traditional slow, bulky and imprecise resistive mono touch to highly sensitive multi-touch capacitive screen have a positive impact on the industry.

The increase in application areas of large e thin film transistor (TFT) display due to the advantages offered by these paper displays in terms of user experience, manufacturing cost, readability, and energy consumption further influence the market.

Additionally, rapid urbanization, change in lifestyle, surge in investments and increased consumer spending positively impact the thin film transistor (TFT) display market.

On the other hand, high cost associated with the manufacturing is expected to obstruct market growth. Also, lack of awareness and low refresh rate are projected to challenge the thin film transistor (TFT) display market in the forecast period of 2022-2029.

This thin film transistor (TFT) display market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on thin film transistor (TFT) display market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

The COVID-19 has impacted thin film transistor (TFT) display market. The limited investment costs and lack of employees hampered sales and production of electronic paper (e-paper) display technology. However, government and market key players adopted new safety measures for developing the practices. The advancements in the technology escalated the sales rate of the thin film transistor (TFT) display as it targeted the right audience. The increase in sales of devices such as smart phones and tablets across the globe is expected to further drive the market growth in the post-pandemic scenario.

The thin film transistor (TFT) display market is segmented on the basis of technology, type, panel type and end-use. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

The thin film transistor (TFT) display market is analysed and market size insights and trends are provided by country, technology, type, panel type and end-use as referenced above.

The countries covered in the thin film transistor (TFT) display market report are U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA).

North America dominates the thin film transistor (TFT) display market because of the introduction of advanced technology along with rising disposable income of the people within the region.

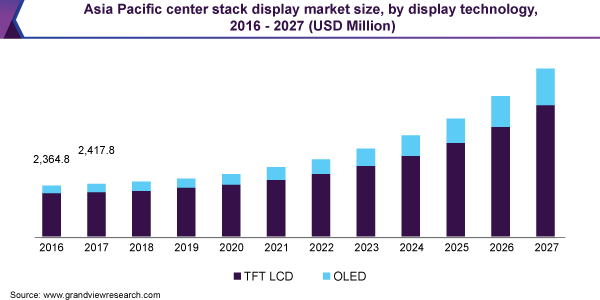

Asia-Pacific is expected to witness significant growth during the forecast period of 2022 to 2029 because of the rise in demand for consumer electronics, and semiconductor manufacturing industry in the region.

The thin film transistor (TFT) display market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies" focus related to thin film transistor (TFT) display market.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

(April 30, 2019) – With Chinese panel makers accelerating the mass production of large thin-film transistor (TFT) liquid crystal display (LCD) TV panels faster than expected, they accounted for 33.9 percent of the 60-inch and larger LCD TV panel shipments in the first quarter of 2019. Their market share has expanded nearly 10 times from 3.6 percent in just over a year, according to business information provider

South Korean panel makers still accounted for the largest share in the 60-inch and larger LCD TV panel shipments, with a 45.1 percent share in the first quarter. However, Chinese panel makers’ share in the large LCD TV panel market is expected to continue to grow.

“When BOE’s B9 10.5G fab started its mass production in the first quarter of 2018, the industry expected that its full ramp-up would take quite a time due to a learning curve,” said

BOE accounted for 29 percent of the total 60-inch and larger LCD TV panel shipments in the first quarter of 2019. It is estimated that the B9 10.5G fab has reached its maximum capacity of 120,000 sheets in the first quarter of 2019.

ChinaStar also started to mass produce large LCD panels at its T6 10.5G fab in the first quarter. CEC-Panda and CHOT ramped up mass production at their 8.6G fabs to the maximum design capacity in the first quarter. Foxconn/Sharp is forecast to begin mass production at their Guangzhou 10.5G fab in the second half of 2019.

“As both Chinese and South Korean panel suppliers are focusing on large LCD TV panels, competition between them will become more intense, pressuring the price of large LCD TV panels even further throughout 2019,” Wu said.

by IHS Markit, shipments of larger than 9-inch TFT-LCD panels reached 178.3 million units in the first quarter of 2019, down 1 percent from a year ago. By area, the shipment increased by 6.7 percent to 49.1 million square meters during the same period.

BOE led the unit shipments of large TFT-LCD panels with a 24.6 percent share in the first quarter of 2019, followed by LG Display (18.8 percent) and Innolux (16 percent). By area shipments, LG Display accounted for the largest share of 20 percent, followed by BOE (19.9 percent) and Samsung Display (14.1 percent).

IHS Markit provides information on the entire range of large display panels shipped worldwide and regionally, including monthly and quarterly revenues and shipments by display area, application, size and aspect ratio of each supplier.

(April 30, 2019) – With Chinese panel makers accelerating the mass production of large thin-film transistor (TFT) liquid crystal display (LCD) TV panels faster than expected, they accounted for 33.9 percent of the 60-inch and larger LCD TV panel shipments in the first quarter of 2019. Their market share has expanded nearly 10 times from 3.6 percent in just over a year, according to business information provider

South Korean panel makers still accounted for the largest share in the 60-inch and larger LCD TV panel shipments, with a 45.1 percent share in the first quarter. However, Chinese panel makers’ share in the large LCD TV panel market is expected to continue to grow.

“When BOE’s B9 10.5G fab started its mass production in the first quarter of 2018, the industry expected that its full ramp-up would take quite a time due to a learning curve,” said

BOE accounted for 29 percent of the total 60-inch and larger LCD TV panel shipments in the first quarter of 2019. It is estimated that the B9 10.5G fab has reached its maximum capacity of 120,000 sheets in the first quarter of 2019.

ChinaStar also started to mass produce large LCD panels at its T6 10.5G fab in the first quarter. CEC-Panda and CHOT ramped up mass production at their 8.6G fabs to the maximum design capacity in the first quarter. Foxconn/Sharp is forecast to begin mass production at their Guangzhou 10.5G fab in the second half of 2019.

“As both Chinese and South Korean panel suppliers are focusing on large LCD TV panels, competition between them will become more intense, pressuring the price of large LCD TV panels even further throughout 2019,” Wu said.

by IHS Markit, shipments of larger than 9-inch TFT-LCD panels reached 178.3 million units in the first quarter of 2019, down 1 percent from a year ago. By area, the shipment increased by 6.7 percent to 49.1 million square meters during the same period.

BOE led the unit shipments of large TFT-LCD panels with a 24.6 percent share in the first quarter of 2019, followed by LG Display (18.8 percent) and Innolux (16 percent). By area shipments, LG Display accounted for the largest share of 20 percent, followed by BOE (19.9 percent) and Samsung Display (14.1 percent).

IHS Markit provides information on the entire range of large display panels shipped worldwide and regionally, including monthly and quarterly revenues and shipments by display area, application, size and aspect ratio of each supplier.

Introduction: Global LCD industry shift and automotive intelligence together to promote the rapid development of China’s LCD panel industry, which will bring a continuous increase in demand for backlight modules, China’s backlight module industry has greater potential for development.

LCD panel backlight module consists of a backlight light source, light guide, optical film, and a plastic frame, which is an important component of LCD display panel. As the backlight module has technology-intensive and labor-intensive attributes, with abundant high-skilled labor advantage China is attracting the global LCD panel industry to the domestic rapid transfer.

From LCD application to the present, the global LCD panel industry capacity transfer has gone through three periods, 2000 Japan dominated the global LCD industry; 2000 – 2010, Japan’s production capacity to South Korea and Taiwan; 2010 to the present, Japanese manufacturers gradually withdraw from the LCD panel industry, production capacity began to transfer to mainland China, so far, mainland China LCD production capacity has occupied the global half of the world.

In recent years, South Korea’s Samsung and LG display will shift their business focus to OLED, and will gradually shut down their LCD production lines and withdraw from the LCD panel industry; at the time of South Korean manufacturers’ withdrawal, domestic enterprises are stepping up new construction to expand LCD production capacity.

BOE, Huaxing photoelectric, Huike, CEC in 2020 – 2021, a total of eight 7 generation LCD production lines completed and put into operation, and domestic panel manufacturers have further expansion plans, the next few years domestic LCD production capacity will continue to increase.

LCD panel manufacturers tend to choose the nearby supporting module suppliers for the safety of the key component supply chain and cost reduction considerations. LCD panel production capacity transfer to China will bring opportunities to domestic backlight module manufacturers and drive the development of the domestic backlight module industry.

The future of the car will pay more attention to the human driving experience, to the intelligent development, which will bring the increasing demand for car display. On the one hand, the number of car displays gradually increased, for example, the instrument panel, rearview mirror, central control platform more to display the way, the passenger and rear position with entertainment display. On the other hand, the car display is constantly to a large screen, multi-screen development, especially in high-end models, the large display has become standard, for example, Tesla Model S screen size of 17 inches, Mercedes-Benz A-class car configuration of two 10.5-inch display.

At the same time, there is also a huge demand for new cars in China. Although China’s car sales have reached 25 million, the current per capita car ownership in China is only a quarter of the developed countries, the future potential for new car demand is still very large. Therefore, China’s car display market growth potential is large, which will directly drive the domestic backlight module demand continues to increase.

According to the terminal application size, backlight module can be divided into large, medium, and small size, of which small size backlight module is mainly used in smartphones, wearable devices, and other terminals, the medium size used in notebook computers, tablet PCs, car screens and other terminals, the large size is mainly used in LCD TV.

From the industry development trend, smartphone display is transitioning to OLED, LCD TV market is gradually saturated, the future of large size and small size backlight module market potential is relatively small; and the future of the car display market potential is huge, by the backlight module manufacturers are unanimously optimistic, are currently accelerating the layout ( see Table 2 ). Focusing on the traditional medium-sized backlight module field, Hanbo Hi-Tech and Weishi Electronics have significant advantages in core technology patents, downstream customer resources, process experience accumulation, production costs, etc., and have more development advantages in the future.

The current global LCD display panel industry is rapidly moving to China, which brings development opportunities to China’s backlight module industry. In addition, automotive intelligence will also bring a continuous increase in demand for medium-sized car displays, the first to enter the field of medium-sized backlight module manufacturers with its customer resources, core technology, scale efficiency, and other advantages will be more beneficial.

Demand for LTPS TFT LCD shipments rose 30 percent in September 2015 to reach 51.6 million units, due to strong demand from Apple and Chinese brands. Total smartphone panel shipments grew 4 percent month over month to reach 160 million units in September 2015. While amorphous silicon (a-Si) thin-film transistor (TFT) liquid-crystal display (LCD) panels continue to lead the smartphone display market, low-temperature polysilicon (LTPS) TFT LCD panel shipment share is growing, according to IHS Inc., a of critical information and insight.

“TFT-LCD, based on a-Si substrate, has been the leading panel technology for mobile phones because it is easy to manufacture and costs less to produce than other display technologies. However, since Apple adopted LTPS for its popular iPhones, demand for the new technology has continued to increase,” said Brian Huh, senior analyst for IHS Technology. “While LTPS panels cost greater, they boast lower power consumption and higher resolution compared to a-Si LCD panels. Greater demand for higher definition screens, especially in China, has also increased the adoption of LTPS LCD mobile phone displays.”

Based on the latest information in the IHS Smartphone Display Shipment Tracker,the market share for the a-Si TFT LCD panel fell 10 percent month over month, but the panel still comprised the majority of smartphone display shipments, reaching 79.6 million in September 2015. Active-matrix organic light-emitting diode (AMOLED) panel shipments grew 7 percent to reach just 25 million units.

As a point of differentiation in the smartphone display market, Samsung Electronics adopted AMOLED-based LTPS displays in 2009. At that time Samsung Display was not looking to expand its customer base because Samsung Electronics digested almost all of the company’s AMOLED capacity. However as Samsung Electronics’ AMOLED smartphone business began to decline last year, Samsung Display has been expanding its customer lineup. “Since the end of last year, Samsung Display has been actively and aggressively promoting AMOLED displays to other electronics companies, especially in China, and AMOLED panel shipments for Chinese brands have increased remarkably since September,” Huh said.

The department of ICT Applications Research was founded in 1996 and since then has become a research powerhouse for a wide range of industries including semiconductor, 5G telecommunications, broadband internet, automotive technology, IoT, artificial intelligence, VR/AR, biometric identification and industry 4.0. TRI has an accurate grasp on the newest trends in critical regional markets, such as Europe, America, Japan, Korea, China, and Taiwan, providing customized services to meet industry demand as well as dynamic research reports and analyses.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey