china tft lcd panel industry overview price

The global TFT-LCD display panel market attained a value of USD 164 billion in 2020. It is expected to grow further in the forecast period of 2022-2027 with a CAGR of 5.2% and is projected to reach a value of USD 223 billion by 2026.

The current global TFT-LCD display panel market is driven by the increasing demand for flat panel TVs, good quality smartphones, tablets, and vehicle monitoring systems along with the growing gaming industry. The global display market is dominated by the flat panel display with TFT-LCD display panel being the most popular flat panel type and is being driven by strong demand from emerging economies, especially those in Asia Pacific like India, China, Korea, and Taiwan, among others. The rising demand for consumer electronics like LCD TVs, PCs, laptops, SLR cameras, navigation equipment and others have been aiding the growth of the industry.

TFT-LCD display panel is a type of liquid crystal display where each pixel is attached to a thin film transistor. Since the early 2000s, all LCD computer screens are TFT as they have a better response time and improved colour quality. With favourable properties like being light weight, slim, high in resolution and low in power consumption, they are in high demand in almost all sectors where displays are needed. Even with their larger dimensions, TFT-LCD display panel are more feasible as they can be viewed from a wider angle, are not susceptible to reflection and are lighter weight than traditional CRT TVs.

The global TFT-LCD display panel market is being driven by the growing household demand for average and large-sized flat panel TVs as well as a growing demand for slim, high-resolution smart phones with large screens. The rising demand for portable and small-sized tablets in the educational and commercial sectors has also been aiding the TFT-LCD display panel market growth. Increasing demand for automotive displays, a growing gaming industry and the emerging popularity of 3D cinema, are all major drivers for the market. Despite the concerns about an over-supply in the market, the shipments of large TFT-LCD display panel again rose in 2020.

North America is the largest market for TFT-LCD display panel, with over one-third of the global share. It is followed closely by the Asia-Pacific region, where countries like India, China, Korea, and Taiwan are significant emerging market for TFT-LCD display panels. China and India are among the fastest growing markets in the region. The growth of the demand in these regions have been assisted by the growth in their economy, a rise in disposable incomes and an increasing demand for consumer electronics.

The report gives a detailed analysis of the following key players in the global TFT-LCD display panel Market, covering their competitive landscape, capacity, and latest developments like mergers, acquisitions, and investments, expansions of capacity, and plant turnarounds:

According to IMARC Group’s latest report, titled “TFT LCD Panel Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2022-2027”, the global TFT LCD panel market size reached US$ 157 Billion in 2021. Looking forward, IMARC Group expects the market to reach US$ 207.6 Billion by 2027, exhibiting a growth rate (CAGR) of 4.7% during 2022-2027.

A thin-film-transistor liquid-crystal display (TFT LCD) panel is a liquid crystal display that is generally attached to a thin film transistor. It is an energy-efficient product variant that offers a superior quality viewing experience without straining the eye. Additionally, it is lightweight, less prone to reflection and provides a wider viewing angle and sharp images. Consequently, it is generally utilized in the manufacturing of numerous electronic and handheld devices. Some of the commonly available TFT LCD panels in the market include twisted nematic, in-plane switching, advanced fringe field switching, patterned vertical alignment and an advanced super view.

The global market is primarily driven by continual technological advancements in the display technology. This is supported by the introduction of plasma enhanced chemical vapor deposition (PECVD) technology to manufacture TFT panels that offers uniform thickness and cracking resistance to the product. Along with this, the widespread adoption of the TFT LCD panels in the production of automobiles dashboards that provide high resolution and reliability to the driver is gaining prominence across the globe. Furthermore, the increasing demand for compact-sized display panels and 4K television variants are contributing to the market growth. Moreover, the rising penetration of electronic devices, such as smartphones, tablets and laptops among the masses, is creating a positive outlook for the market. Other factors, including inflating disposable incomes of the masses, changing lifestyle patterns, and increasing investments in research and development (R&D) activities, are further projected to drive the market growth.

The competitive landscape of the TFT LCD panel market has been studied in the report with the detailed profiles of the key players operating in the market.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Large-area TFT LCD panel shipments decreased by 10% Month on Month (MoM) and 5% Year on Year (YoY) in April, to 74.1million units, representing historically low shipment performance since May 2020. Omdia defines large-area TFT LCD displays as larger than 9 inches.

"With continued ramifications from the pandemic, demand for IT panels for monitors and notebook PCs remained strong in 4Q21. But as the market became saturated starting in 2022, IT panel shipments started slowing in 1Q22 and early 2Q22," said Robin Wu, Principal Analyst for Large Area Display & Production, Omdia.

Wu said that notebook panel shipments decreased 21% MoM in April, to 18.2 million units, or a 33% decrease from a peak of 27.3 million units in November 2021.

While TV panel prices have decreased noticeably since 3Q21, TV LCD panel shipments increased to a peak of 23.4 million in December 2021, driven by low prices. But rising inflation, the Ukraine crisis and continued lockdowns in China have slowed demand. As a result, TV panel shipments posted a 9% MoM decline in April, to 21.7million units.

Many TV panel prices have fallen below manufacturing cost, and panel makers began to lose money in their TV panel business starting in 4Q21. But Chinese panel makers, the biggest capacity owners, still haven"t reduced their fab utilization. With no sign of demand recovery in 2Q22 or even 3Q22, the supply/demand situation is unlikely to see improvement, Wu said.

"IT LCD panels could still deliver positive cash flow for panel makers. But with prices dropping dramatically, panel makers will soon start to lose money in their IT panel business," Wu said. "Maybe only then will panel makers reduce their glass input and the overall supply/demand situation will return to balance."

About OmdiaOmdia is a leading research and advisory group focused on the technology industry. With clients operating in over 120 countries, Omdia provides market-critical data, analysis, advice, and custom consulting.

Dublin, Sept. 27, 2021 (GLOBE NEWSWIRE) -- The "Global TFT LCD Display Panel Market Report and Forecast 2021-2026" report has been added to ResearchAndMarkets.com"s offering.

The global TFT-LCD display market attained a value of approximately USD 164 billion in 2020. Aided by use of TFT-LCD displays in automotive, the market is projected to further grow at a CAGR of 5.2% between 2021-2026 to reach USD 223 billion by 2026.

TFT-LCD display is a kind of liquid crystal display where each pixel is attached to a film transistor to improve colour quality, as each pixel on a TFT-LCD is attached to a transistor. TFT is deployed in all computer screens television screens since the start of century, because the technology offers better response time and improved colour quality than older technologies and prevents distortion of image. With favourable properties like light weight, slim, and high-resolution features, and due to the small size of each transistor, they consume less power owing to which TFT-LCD displays find applications in nearly every electronic device with a display including smartphones, television screens, computers, and PCs.

The market demand for TFT-LCD display can be attributed to increasing deployment of TFT-LCD display in average and large sized flat panel TVs in the household sector. The growing demand for slim, high resolution smart phones among the younger generation, owing to the work from home trends is further invigorating market growth. Other electronic devices like PCs and desktops that deploy TFT-LCD display for better screen resolution, sharp, and vibrant colours are supporting the market growth.

Due to the rapidly expanding industrialisation and a subsequent rise in disposable incomes, especially in emerging economies of the Asia-Pacific region like India and China, the market demand for personal vehicles equipped with LCD displays for specific functions and entertainment purposes is positively impacting the market growth of TFT-LCD displays. Furthermore, transportation vehicles like aeroplanes, trains, and, buses are emerging as users of TFT-LCD displays, aided by government spending on public transport. Therefore, a rising demand for TFT-LCD displays from the automotive sector is providing lucrative industrial growth opportunities.

The report looks into the market shares, plant turnarounds, capacities, investments, and mergers and acquisitions, among other major developments of the key players in the industry.

Global Thin Film Transistor (TFT) Display Market, By Technology (Plasma Display (PDP), Organic Light Emitting Diode (OLED), Other), Type (Twisted Nematic, In-Plane Switching, Advanced Fringe Field Switching, Multi-Domain Vertical Alignment, Advanced Super View, Cell Technology), Panel Type (A_MVA, ASV, MVA, S_PVA, P-IPS), End Use (Domestic Use, Industrial Use) – Industry Trends and Forecast to 2029

Global Thin Film Transistor (TFT) Display Market was valued at USD 270.26 million in 2021 and is expected to reach USD 968.64 million by 2029, registering a CAGR of 17.30% during the forecast period of 2022-2029. Twisted Nematic accounts for the largest type segment in the respective market owing to its low cost. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

A thin-film-transistor display refers to a form of LCD that uses TFT technology for enhancing image quality including addressability and contrast. These displays are commonly utilized in mobile phones, handheld video game systems, projectors, computer monitors, television screens, navigation systems and personal digital assistants.

Technology (Plasma Display (PDP), Organic Light Emitting Diode (OLED), Other), Type (Twisted Nematic, In-Plane Switching, Advanced Fringe Field Switching, Multi-Domain Vertical Alignment, Advanced Super View, Cell Technology), Panel Type (A_MVA, ASV, MVA, S_PVA, P-IPS), End Use (Domestic Use, Industrial Use)

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA).

Panasonic Corporation (Japan), LG Display Co., Ltd (South Korea), HannStar Display Corporation (Taiwan), AU Optronics Corp. (Taiwan), Chi Mei Corporation. (Taiwan), SAMSUNG (South Korea), SHARP CORPORATION (Japan), Schneider Electric (France), Siemens (Germany), Mitsubishi Electric Corporation (Japan), SONY INDIA. (India), FUJITSU (Japan), Chunghwa Picture Tubes, LTD. (Taiwan), Barco.(Belgium), BOE Technology Group Co., Ltd. (China), Innolux Corporation (Taiwan), Advantech Co., Ltd (Taiwan), among others.

The increase in the smartphone and tablet proliferation acts as one of the major factors driving the growth of thin film transistor (TFT) display market. Technological advancements are leading a radical shift from traditional slow, bulky and imprecise resistive mono touch to highly sensitive multi-touch capacitive screen have a positive impact on the industry.

The increase in application areas of large e thin film transistor (TFT) display due to the advantages offered by these paper displays in terms of user experience, manufacturing cost, readability, and energy consumption further influence the market.

Additionally, rapid urbanization, change in lifestyle, surge in investments and increased consumer spending positively impact the thin film transistor (TFT) display market.

On the other hand, high cost associated with the manufacturing is expected to obstruct market growth. Also, lack of awareness and low refresh rate are projected to challenge the thin film transistor (TFT) display market in the forecast period of 2022-2029.

This thin film transistor (TFT) display market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on thin film transistor (TFT) display market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

The COVID-19 has impacted thin film transistor (TFT) display market. The limited investment costs and lack of employees hampered sales and production of electronic paper (e-paper) display technology. However, government and market key players adopted new safety measures for developing the practices. The advancements in the technology escalated the sales rate of the thin film transistor (TFT) display as it targeted the right audience. The increase in sales of devices such as smart phones and tablets across the globe is expected to further drive the market growth in the post-pandemic scenario.

The thin film transistor (TFT) display market is segmented on the basis of technology, type, panel type and end-use. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

The thin film transistor (TFT) display market is analysed and market size insights and trends are provided by country, technology, type, panel type and end-use as referenced above.

The countries covered in the thin film transistor (TFT) display market report are U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA).

North America dominates the thin film transistor (TFT) display market because of the introduction of advanced technology along with rising disposable income of the people within the region.

Asia-Pacific is expected to witness significant growth during the forecast period of 2022 to 2029 because of the rise in demand for consumer electronics, and semiconductor manufacturing industry in the region.

The thin film transistor (TFT) display market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies" focus related to thin film transistor (TFT) display market.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

The new report by Expert Market Research titled, ‘Global TFT-LCD Display Panel Market Size, Share, Price, Trends, Growth, Report and Forecast 2021-2026’, gives an in-depth analysis of the globalTFT-LCD display panel market, assessing the market based on its segments like size, application and major regions like North America, Europe, Asia Pacific, Latin America, Middle East and Africa. The report tracks the latest trends in the industry and studies their impact on the overall market. It also assesses the market dynamics, covering the key demand and price indicators, along with analysing the market based on the SWOT and Porter’s Five Forces models.

The current worldwide TFT-LCD display panel market is being driven by rising demand for flat panel TVs, high-quality smartphones, tablets, and car monitoring systems, as well as the expanding gaming industry. The flat panel display dominates the global display industry, with TFT-LCD display panels being the most popular flat panel type and is being driven by significant demand from growing nations, particularly those in Asia Pacific such as India, China, Korea, and Taiwan, among others. The increased demand for consumer electronics such as LCD TVs, PCs, laptops, SLR cameras, navigation devices, and others has aided the industry’s growth.

TFT-LCD displays are a type of liquid crystal display in which each pixel is connected to a thin film transistor. TFT has been used in all LCD computer screens since the early 2000s because it has a faster response time and greater colour fidelity. They are in high demand in practically all sectors where displays are required due to their advantageous qualities like as light weight, slimness, high resolution, and low power consumption. TFT-LCD display panels, despite their bigger dimensions, are more practical since they can be viewed from a broader angle, are not prone to reflection, and are lighter in weight than classic CRT TVs.

The global TFT-LCD display panel market is being pushed by rising household demand for average and large-sized flat-screen televisions, as well as rising desire for small, high-resolution smart phones with large screens. The growing demand for portable and small-sized tablets in the educational and commercial sectors has also contributed to the growth of the TFT-LCD display panel market. Expanding demand for vehicle displays, a thriving gaming industry, and the growing popularity of 3D movies are all important market drivers. Despite concerns about market oversupply, shipments of large TFT-LCD display panels increased again in 2020.

With more than one-third of the global share, North America is the largest market for TFT-LCD display panels. It is closely followed by the Asia-Pacific area, which includes nations such as India, China, Korea, and Taiwan, which are key rising markets for TFT-LCD display panels. China and India are two of the region’s fastest developing economies. The expansion of demand in these regions has been aided by the expansion of their economies, an increase in disposable incomes, and an increase in desire for consumer electronics.

EMR customises syndicated reports according to clients’ requirements and expectations. The company is active across over 15 prominent industry domains, including food and beverages, chemicals and materials, technology and media, consumer goods, packaging, agriculture, and pharmaceuticals, among others.

Over 3000 EMR consultants and more than 100 analysts work very hard to ensure that clients get only the most updated, relevant, accurate and actionable industry intelligence so that they may formulate informed, effective and intelligent business strategies and ensure their leadership in the market.

China"s electronics manufacturing industry earned 13 trillion yuan in 2017. But growth in the consumer electronics industry has slowed in the past two years, as shipments of mobile phones and computers have slowed, and demand for liquid crystal displays has slowed.The following display industry data statistical analysis.

China"s electronics manufacturing industry earned 13 trillion yuan in 2017, according to an analysis of the display industry.In terms of hardware product manufacturing, the output of mobile phones, computers and color TV sets in China reached 1.92 billion, 310 million and 170 million respectively. The market demand scale of consumer electronics products is increasing, and China is playing an increasingly important role in the global LCD industry.

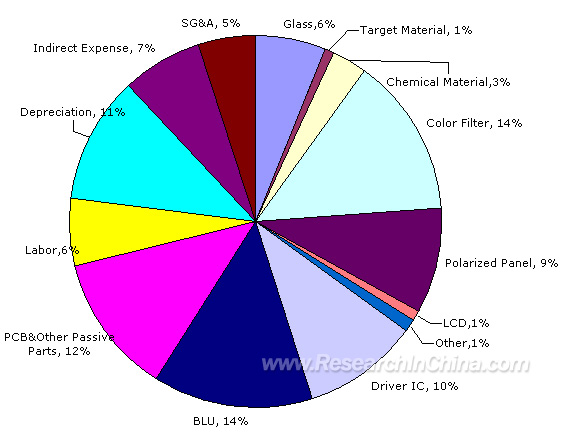

In the early stage of LCD development, as an important LCD panel demand market, China has been in a state of "lack of core and screen" for a long time. Because LCD panels account for a very high proportion of the cost of LCD display, domestic LCD TV, computer and other manufacturers are forced to spend huge sums of money to purchase LCD panels and other key components from manufacturers in South Korea, Taiwan and Japan.

Through the statistical analysis of the display industry data, although the LCD industry in China develops rapidly, the scale of the industry is growing, and the localization is constantly improved, the self-sufficiency rate of the LCD panel is still low, and the product is more dependent on the outside, which affects the long-term development of the domestic LCD industry to some extent. With the increasing demand for LCD in electronic information industry, China"s existing enterprises have been putting into production the LCD panel product line, and the industry"s production capacity has been constantly improved.

As Chinese panel makers ceaseless effort, coupled with policy support, liquid crystal display (LCD) industry in China in recent years the rapid development of our country has gradually become the important production base of LCD panel, mainland LCD panel production has been occupying weight status, independent core technology of rapid growth, the global influence growing industry, its self-sufficiency rate of LCD panel will gradually improve, import tends to decline.From 2012 to 2017, the import volume of China"s LCD panel has been declining, which was us $30.13 billion in 2017, down 5.4% year-on-year.

Through statistical analysis of display industry data, it can be seen from the market competition of domestic LCD brands that the scale of domestic LCD enterprises is relatively small, most of which focus on the production of medium and low-end products, while high-end products are concentrated in well-known enterprises. Domestic LCD brands are represented by boe, tianma, huaxing optoelectronics, longteng, vercino and CLP panda. Domestic brands are strengthening their competitiveness in their respective fields.

Our country TFT LCD display export advantage gradually loses, also because our country liquid crystal display export is still in the low-end product primarily, the technical content is relatively low, is difficult to cope with the market competition.Although China has become the world"s top three LCD panel production base, local manufacturers are still weak in technology, especially in high-end products from South Korea, Japan, Taiwan and other places to import LCD panels.In the development of new technology, the technology gap with Japan and South Korea and Taiwan enterprises is still relatively large, on the whole is still in the stage of technology catch-up.

Reports available on Research Reports World incorporate a comprehensive research statistics of all aspects of the market that offer you a thorough business intelligence. Gaining an in-depth predicative and competitive analysis of the market aids your business in dominating the market and that is what we aspire towards. Industry Reports provide you various industry-centric reports that aid your business in augmenting its growth. The reports we sell are integrated with market analysis data of the key players, leading market segments and latest market trends across the globe.

Global TFT LCD Display Modules Market Report (114 Pages) provides exclusive vital statistics, data, information, trends and competitive landscape details in this niche sector.

Due to the COVID-19 pandemic and Russia-Ukraine War Influence, the global market for TFT LCD Display Modules estimated at USD million in the year 2022, is projected to reach a revised size of USD million by 2028, growing at a growing CAGR during the forecast period 2022-2028.

The USA market for TFT LCD Display Modules is estimated to increase from USD million in 2022 to reach USD million by 2028, at a growing CAGR during the forecast period of 2023 through 2028.

The China market for TFT LCD Display Modules is estimated to increase from USD million in 2022 to reach USD million by 2028, at a growing CAGR during the forecast period of 2023 through 2028.

The Europe market for TFT LCD Display Modules is estimated to increase from USD million in 2022 to reach USD million by 2028, at a growing CAGR during the forecast period of 2023 through 2028.

The global key manufacturers of TFT LCD Display Modules include Panasonic Corporation, Schneider Electric, Siemens AG, LG Display, HannStar Display Corporation, AU Optronics Corp., Chi Mei Corporation, SAMSUNG Display and SHARP CORPORATION, etc. In 2021, the global top five players had a share approximately % in terms of revenue.

In terms of production side, this report researches the TFT LCD Display Modules production, growth rate, market share by manufacturers and by region (region level and country level), from 2017 to 2022, and forecast to 2028.

In terms of sales side, this report focuses on the sales of TFT LCD Display Modules by region (region level and country level), by company, by Type and by Application. from 2017 to 2022 and forecast to 2028.

This report aims to provide a comprehensive presentation of the global market for TFT LCD Display Modules, with both quantitative and qualitative analysis, to help readers develop business/growth strategies, assess the market competitive situation, analyze their position in the current marketplace, and make informed business decisions regarding TFT LCD Display Modules.

The TFT LCD Display Modules market size, estimations, and forecasts are provided in terms of output/shipments (K Units) and revenue (USD millions), considering 2021 as the base year, with history and forecast data for the period from 2017 to 2028. This report segments the global TFT LCD Display Modules market comprehensively. Regional market sizes, concerning products by types, by application, and by players, are also provided. The influence of COVID-19 and the Russia-Ukraine War were considered while estimating market sizes.

Global markets are presented by TFT LCD Display Modules type, along with growth forecasts through 2028. Estimates on production and value are based on the price in the supply chain at which the TFT LCD Display Modules are procured by the manufacturers.

This report also outlines the market trends of each segment and consumer behaviors impacting the TFT LCD Display Modules market and what implications these may have on the industry"s future. This report can help to understand the relevant market and consumer trends that are driving the TFT LCD Display Modules market.

The readers in the section will understand how the TFT LCD Display Modules market scenario changed across the globe during the pandemic, post-pandemic and Russia-Ukraine War. The study is done keeping in view the changes in aspects such as demand, consumption, transportation, consumer behavior, supply chain management, export and import, and production. The industry experts have also highlighted the key factors that will help create opportunities for players and stabilize the overall industry in the years to come.

Reasons to Buy This Report: ● This report will help the readers to understand the competition within the industries and strategies for the competitive environment to enhance the potential profit. The report also focuses on the competitive landscape of the global TFT LCD Display Modules market, and introduces in detail the market share, industry ranking, competitor ecosystem, market performance, new product development, operation situation, expansion, and acquisition. etc. of the main players, which helps the readers to identify the main competitors and deeply understand the competition pattern of the market.

● This report will help stakeholders to understand the global industry status and trends of TFT LCD Display Modules and provides them with information on key market drivers, restraints, challenges, and opportunities.

The market has been segmented into various major geographies, including North America, Europe, Asia-Pacific, South America. Detailed analysis of major countries such as the USA, Germany, the U.K., Italy, France, China, Japan, South Korea, Southeast Asia, and India will be covered within the regional segment.

Chapter 2:Detailed analysis of TFT LCD Display Modules manufacturers competitive landscape, price, output and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 3:Production/output, value of TFT LCD Display Modules by region/country. It provides a quantitative analysis of the market size and development potential of each region in the next six years.

Chapter 4:Consumption of TFT LCD Display Modules in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and capacity of each country in the world.

Chapter 10:Introduces the market dynamics, latest developments of the market, the driving factors and restrictive factors of the market, the challenges and risks faced by manufacturers in the industry, and the analysis of relevant policies in the industry.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey