china tft lcd panel industry overview for sale

The global TFT-LCD display panel market attained a value of USD 164 billion in 2020. It is expected to grow further in the forecast period of 2022-2027 with a CAGR of 5.2% and is projected to reach a value of USD 223 billion by 2026.

The current global TFT-LCD display panel market is driven by the increasing demand for flat panel TVs, good quality smartphones, tablets, and vehicle monitoring systems along with the growing gaming industry. The global display market is dominated by the flat panel display with TFT-LCD display panel being the most popular flat panel type and is being driven by strong demand from emerging economies, especially those in Asia Pacific like India, China, Korea, and Taiwan, among others. The rising demand for consumer electronics like LCD TVs, PCs, laptops, SLR cameras, navigation equipment and others have been aiding the growth of the industry.

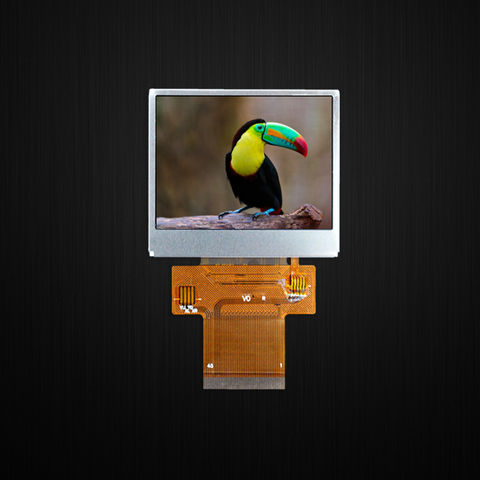

TFT-LCD display panel is a type of liquid crystal display where each pixel is attached to a thin film transistor. Since the early 2000s, all LCD computer screens are TFT as they have a better response time and improved colour quality. With favourable properties like being light weight, slim, high in resolution and low in power consumption, they are in high demand in almost all sectors where displays are needed. Even with their larger dimensions, TFT-LCD display panel are more feasible as they can be viewed from a wider angle, are not susceptible to reflection and are lighter weight than traditional CRT TVs.

The global TFT-LCD display panel market is being driven by the growing household demand for average and large-sized flat panel TVs as well as a growing demand for slim, high-resolution smart phones with large screens. The rising demand for portable and small-sized tablets in the educational and commercial sectors has also been aiding the TFT-LCD display panel market growth. Increasing demand for automotive displays, a growing gaming industry and the emerging popularity of 3D cinema, are all major drivers for the market. Despite the concerns about an over-supply in the market, the shipments of large TFT-LCD display panel again rose in 2020.

North America is the largest market for TFT-LCD display panel, with over one-third of the global share. It is followed closely by the Asia-Pacific region, where countries like India, China, Korea, and Taiwan are significant emerging market for TFT-LCD display panels. China and India are among the fastest growing markets in the region. The growth of the demand in these regions have been assisted by the growth in their economy, a rise in disposable incomes and an increasing demand for consumer electronics.

The report gives a detailed analysis of the following key players in the global TFT-LCD display panel Market, covering their competitive landscape, capacity, and latest developments like mergers, acquisitions, and investments, expansions of capacity, and plant turnarounds:

Global Thin Film Transistor (TFT) Display Market, By Technology (Plasma Display (PDP), Organic Light Emitting Diode (OLED), Other), Type (Twisted Nematic, In-Plane Switching, Advanced Fringe Field Switching, Multi-Domain Vertical Alignment, Advanced Super View, Cell Technology), Panel Type (A_MVA, ASV, MVA, S_PVA, P-IPS), End Use (Domestic Use, Industrial Use) – Industry Trends and Forecast to 2029

Global Thin Film Transistor (TFT) Display Market was valued at USD 270.26 million in 2021 and is expected to reach USD 968.64 million by 2029, registering a CAGR of 17.30% during the forecast period of 2022-2029. Twisted Nematic accounts for the largest type segment in the respective market owing to its low cost. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

A thin-film-transistor display refers to a form of LCD that uses TFT technology for enhancing image quality including addressability and contrast. These displays are commonly utilized in mobile phones, handheld video game systems, projectors, computer monitors, television screens, navigation systems and personal digital assistants.

Technology (Plasma Display (PDP), Organic Light Emitting Diode (OLED), Other), Type (Twisted Nematic, In-Plane Switching, Advanced Fringe Field Switching, Multi-Domain Vertical Alignment, Advanced Super View, Cell Technology), Panel Type (A_MVA, ASV, MVA, S_PVA, P-IPS), End Use (Domestic Use, Industrial Use)

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA).

Panasonic Corporation (Japan), LG Display Co., Ltd (South Korea), HannStar Display Corporation (Taiwan), AU Optronics Corp. (Taiwan), Chi Mei Corporation. (Taiwan), SAMSUNG (South Korea), SHARP CORPORATION (Japan), Schneider Electric (France), Siemens (Germany), Mitsubishi Electric Corporation (Japan), SONY INDIA. (India), FUJITSU (Japan), Chunghwa Picture Tubes, LTD. (Taiwan), Barco.(Belgium), BOE Technology Group Co., Ltd. (China), Innolux Corporation (Taiwan), Advantech Co., Ltd (Taiwan), among others.

The increase in the smartphone and tablet proliferation acts as one of the major factors driving the growth of thin film transistor (TFT) display market. Technological advancements are leading a radical shift from traditional slow, bulky and imprecise resistive mono touch to highly sensitive multi-touch capacitive screen have a positive impact on the industry.

The increase in application areas of large e thin film transistor (TFT) display due to the advantages offered by these paper displays in terms of user experience, manufacturing cost, readability, and energy consumption further influence the market.

Additionally, rapid urbanization, change in lifestyle, surge in investments and increased consumer spending positively impact the thin film transistor (TFT) display market.

On the other hand, high cost associated with the manufacturing is expected to obstruct market growth. Also, lack of awareness and low refresh rate are projected to challenge the thin film transistor (TFT) display market in the forecast period of 2022-2029.

This thin film transistor (TFT) display market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on thin film transistor (TFT) display market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

The COVID-19 has impacted thin film transistor (TFT) display market. The limited investment costs and lack of employees hampered sales and production of electronic paper (e-paper) display technology. However, government and market key players adopted new safety measures for developing the practices. The advancements in the technology escalated the sales rate of the thin film transistor (TFT) display as it targeted the right audience. The increase in sales of devices such as smart phones and tablets across the globe is expected to further drive the market growth in the post-pandemic scenario.

The thin film transistor (TFT) display market is segmented on the basis of technology, type, panel type and end-use. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

The thin film transistor (TFT) display market is analysed and market size insights and trends are provided by country, technology, type, panel type and end-use as referenced above.

The countries covered in the thin film transistor (TFT) display market report are U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA).

North America dominates the thin film transistor (TFT) display market because of the introduction of advanced technology along with rising disposable income of the people within the region.

Asia-Pacific is expected to witness significant growth during the forecast period of 2022 to 2029 because of the rise in demand for consumer electronics, and semiconductor manufacturing industry in the region.

The thin film transistor (TFT) display market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies" focus related to thin film transistor (TFT) display market.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

The primary highlights of the report offer important details pertaining to profit estimations, statistics, and applications of this product. Our report covers regional analysis of the domestic markets, key company profiles, value chain analysis, consumption, demand, and growth areas. The report analyzes major market firms, focusing on their innovative developments, product launches, operations, and emerging market players to implement new business growth strategies. The report focuses on growth prospects, restraints, and trends of the global Tft-LCD Photomask market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the global Tft-LCD Photomask market outlook.

Tft-LCD Photomask uses tracking and customer behavioral analysis to improve corporate operations. Furthermore, when compared to on premise deployment, the deployment paradigm enables the implementation of analytics solutions at a low cost. Executives, data analysts, team leaders, managers, and professionals use business intelligence (BI) tools to collect, analyses, visualize, and report on numerous functions within a company and apply their results to their respective industries.

The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of the future trends and developments of the market. It also examines the role of the leading market players involved in the industry including their corporate overview, financial summary and SWOT analysis.

List of Top Key Players in Tft-LCD Photomask Market Report:The survey describes the qualities of the entire company based on an industry-wide analysis: -

Global Tft-LCD Photomask Market Growth report serves to be an ideal solution for better understanding of the Market. It is helpful in finding out the size of the Market for specific products. These major players operating in this Market are in strong competition in terms of technology, innovation, product development, and product pricing. The Market study aids in making sales forecasts for its products and thereby, establishing harmonious adjustment between demand and supply of its products.

The report gives a comprehensive investigation of the global Tft-LCD Photomask market. The report contains huge data, measurable information focuses, factual reviewing, SWOT analysis, chance assessment, genuine scene, common exploration, and future improvement prospects. The analysis aims to specify market sizes in individual sections and countries in preceding years and forecast the worth in the subsequent years. The report saves valuable time as well as adds credibility to the work that has been done to grow the business.

Global Tft-LCD Photomask Market forecast report provides a holistic evaluation of the market. The report offers a comprehensive analysis of key segments, trends, drivers, restraints, competitive landscape, and factors that are playing a substantial role in the market.

Based on Component, Tft-LCD Photomask is a business solution that provides an in-depth analysis of crowd movement at large gathering locations such as airports and train stations, city malls, retail stores, convention centers, stadiums, and other venues. Data from a variety of sources, including closed-circuit television cameras (CCTV), commercial off-the-shelf cameras, and first- and third-party consumer data, is processed using powerful artificial intelligence approaches to present prediction crowd flow models and customer preference patterns.

Based on the End Use, the Tft-LCD Photomask Market Trend is bifurcated into Aromatic Industries, Automotive, Building and Construction, Paints, Agrochemicals, and others. It is a low-cost solution that outperforms most composite applications in terms of price vs. performance. In the next five years, hydrocarbon resin is expected to remain the second-largest application in the worldwide Tft-LCD Photomask Market, owing to increased usage in adhesives, coatings, printing inks, and rubber goods. Also growing construction activities will help this market is growing.

To know How COVID-19 Pandemic Will Impact This Market/Industry-Request a sample copy of the report-:https://www.researchreportsworld.com/enquiry/request-covid19/21005261

The Tft-LCD Photomask report provides information about the market area, which is further subdivided into sub-regions and countries/regions. In addition to the market share in each country and sub-region, this chapter of this report also contains information on profit opportunities. This chapter of the report mentions the market share and growth rate of each region, country and sub-region during the estimated period. ● North America(USA and Canada)

● The global Tft-LCD Photomask market research report studies the latest global market trends, up-to-date, and thorough competitive analysis, along with various other key features of the worldwide market.

Market Reports Worldis the Credible Source for Gaining the Market Reports that will Provide you with the Lead Your Business Needs. Market is changing rapidly with the ongoing expansion of the industry. Advancement in the technology has provided today’s businesses with multifaceted advantages resulting in daily economic shifts. Thus, it is very important for a company to comprehend the patterns of the market movements in order to strategize better. An efficient strategy offers the companies with a head start in planning and an edge over the competitors.

The new line of 3.5” TFT displays with IPS technology is now available! Three touchscreen options are available: capacitive, resistive, or without a touchscreen.

For over 20 years Newhaven Display has been one of the most trusted suppliers in the digital display industry. We’ve earned this reputation by providing top quality products, services, and custom design solutions to customers worldwide.

Global TFT LCD Display Modules Market Report (114 Pages) provides exclusive vital statistics, data, information, trends and competitive landscape details in this niche sector.

Due to the COVID-19 pandemic and Russia-Ukraine War Influence, the global market for TFT LCD Display Modules estimated at USD million in the year 2022, is projected to reach a revised size of USD million by 2028, growing at a growing CAGR during the forecast period 2022-2028.

The USA market for TFT LCD Display Modules is estimated to increase from USD million in 2022 to reach USD million by 2028, at a growing CAGR during the forecast period of 2023 through 2028.

The China market for TFT LCD Display Modules is estimated to increase from USD million in 2022 to reach USD million by 2028, at a growing CAGR during the forecast period of 2023 through 2028.

The Europe market for TFT LCD Display Modules is estimated to increase from USD million in 2022 to reach USD million by 2028, at a growing CAGR during the forecast period of 2023 through 2028.

The global key manufacturers of TFT LCD Display Modules include Panasonic Corporation, Schneider Electric, Siemens AG, LG Display, HannStar Display Corporation, AU Optronics Corp., Chi Mei Corporation, SAMSUNG Display and SHARP CORPORATION, etc. In 2021, the global top five players had a share approximately % in terms of revenue.

In terms of production side, this report researches the TFT LCD Display Modules production, growth rate, market share by manufacturers and by region (region level and country level), from 2017 to 2022, and forecast to 2028.

In terms of sales side, this report focuses on the sales of TFT LCD Display Modules by region (region level and country level), by company, by Type and by Application. from 2017 to 2022 and forecast to 2028.

This report aims to provide a comprehensive presentation of the global market for TFT LCD Display Modules, with both quantitative and qualitative analysis, to help readers develop business/growth strategies, assess the market competitive situation, analyze their position in the current marketplace, and make informed business decisions regarding TFT LCD Display Modules.

The TFT LCD Display Modules market size, estimations, and forecasts are provided in terms of output/shipments (K Units) and revenue (USD millions), considering 2021 as the base year, with history and forecast data for the period from 2017 to 2028. This report segments the global TFT LCD Display Modules market comprehensively. Regional market sizes, concerning products by types, by application, and by players, are also provided. The influence of COVID-19 and the Russia-Ukraine War were considered while estimating market sizes.

Global markets are presented by TFT LCD Display Modules type, along with growth forecasts through 2028. Estimates on production and value are based on the price in the supply chain at which the TFT LCD Display Modules are procured by the manufacturers.

This report also outlines the market trends of each segment and consumer behaviors impacting the TFT LCD Display Modules market and what implications these may have on the industry"s future. This report can help to understand the relevant market and consumer trends that are driving the TFT LCD Display Modules market.

The readers in the section will understand how the TFT LCD Display Modules market scenario changed across the globe during the pandemic, post-pandemic and Russia-Ukraine War. The study is done keeping in view the changes in aspects such as demand, consumption, transportation, consumer behavior, supply chain management, export and import, and production. The industry experts have also highlighted the key factors that will help create opportunities for players and stabilize the overall industry in the years to come.

Reasons to Buy This Report: ● This report will help the readers to understand the competition within the industries and strategies for the competitive environment to enhance the potential profit. The report also focuses on the competitive landscape of the global TFT LCD Display Modules market, and introduces in detail the market share, industry ranking, competitor ecosystem, market performance, new product development, operation situation, expansion, and acquisition. etc. of the main players, which helps the readers to identify the main competitors and deeply understand the competition pattern of the market.

● This report will help stakeholders to understand the global industry status and trends of TFT LCD Display Modules and provides them with information on key market drivers, restraints, challenges, and opportunities.

The market has been segmented into various major geographies, including North America, Europe, Asia-Pacific, South America. Detailed analysis of major countries such as the USA, Germany, the U.K., Italy, France, China, Japan, South Korea, Southeast Asia, and India will be covered within the regional segment.

Chapter 2:Detailed analysis of TFT LCD Display Modules manufacturers competitive landscape, price, output and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 3:Production/output, value of TFT LCD Display Modules by region/country. It provides a quantitative analysis of the market size and development potential of each region in the next six years.

Chapter 4:Consumption of TFT LCD Display Modules in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and capacity of each country in the world.

Chapter 10:Introduces the market dynamics, latest developments of the market, the driving factors and restrictive factors of the market, the challenges and risks faced by manufacturers in the industry, and the analysis of relevant policies in the industry.

Reports available on Research Reports World incorporate a comprehensive research statistics of all aspects of the market that offer you a thorough business intelligence. Gaining an in-depth predicative and competitive analysis of the market aids your business in dominating the market and that is what we aspire towards. Industry Reports provide you various industry-centric reports that aid your business in augmenting its growth. The reports we sell are integrated with market analysis data of the key players, leading market segments and latest market trends across the globe.

The slowdown in display fab utilization that we predicted earlier this year reached new depths in the third quarter and was even more severe than we expected, according to the latest release of DSCC’s Quarterly All Display Fab Utilization Report issued this week. After more than a full year of panel prices falling to reach all-time lows, and after the entire display supply chain built excessive inventory, panel makers started to reduce utilization in Q2 and the slowdown accelerated in Q3. After a 6% sequential decline in Q2’22, total TFT input for all display makers in the third quarter was down 20% Q/Q and 24% Y/Y at 66.1M square meters, and in the current Q4’22 we expect total TFT input to be flat Q/Q and down 23% Y/Y at 66.1M square meters.

We had expected Q4’22 foldable panel shipments of 5.4M based on supplier surveys, but we are now seeing 2.9M, a 46% reduction as shown in the chart below. Q4’22 foldable panel shipments are expected to be down 54% Q/Q and 26% Y/Y. Sell through of the Z Flip 4 and Z Fold 4 have been below expectations. The iPhone 14 Series has sucked up most of the attention and sell-through and the Z Fold 4 price of $1799 remains too high in this environment. As a result, both the Z Fold 4 and Z Flip 4 are expected to be down Y/Y vs. the Z Fold 3 and Z Flip 3 in Q4, in fact, they are expected to be down big as you can see in the chart below. However, they were up in Q2 and Q3 and should be up for 2022, but only in the mid-single digits. Also weighing on Q4’22 foldable panel shipments are a number of Chinese models ramping slower and/or later than expected.

In the next few weeks, we will see the Q3 earnings announcements for flat panel display makers, starting with LG Display and AUO on Wednesday, October 26th. The heady profits of 2021 seem like a distant memory, and the industry looks poised for its worst quarter since the start of the pandemic. Panel prices started to decline a year ago and have not stopped their decline, and even with lower prices the demand for panels has decreased. After panel makers along with their downstream partners in the display supply chain built a tremendous amount of excess inventory, they slowed their utilization in the third quarter in a bid to reverse the industry oversupply. We expect that panel makers will report another quarter of declining margins for Q3’22 and expect several panel makers to report operating losses.

For the first time in seven months, total revenues for the three Taiwan-based panel makers increased on a M/M basis, as reported by the companies last week, giving a hopeful sign that LCD panel makers may have reached the bottom. Combined revenues increased by 5% M/M and the Y/Y comparison while still severe is slightly improved from August, the first such improvement in the Y/Y trend for nearly two years. September revenues for the three companies of TWD 34.3B (US$1.09B) were down by 47% compared to September 2021.

In September 2022, headline inflation numbers in the US continued their slow but steady decrease from their highest point in more than 40 years, but the concern in financial markets centered on the rise of “core” inflation, which excludes more volatile food and energy costs. Meanwhile, the steep declines in LCD TV panel prices that started in the second half of 2021 are continuing to flow through to retail, although the downward trend took a one-month pause in September.

In the recently released Advanced Smartphone Display Shipment and Technology Report, we reveal additional granularity and insights for the expected 13% Y/Y and 5% Y/Y panel revenue decline for OLED smartphones. OLED smartphone panel revenue is expected to decline to $31B from $33B in 2021. As a result of the continued macroeconomic environment, persistent supply chain issues and weakened consumer demand, major smartphone brands continue to reduce their OLED smartphone panel procurement for 2022 by double-digit percentages.

A recent report by a Hyundai Securities analyst indicated that Samsung may only be able to ship 10M foldable smartphones in 2022, down from previous estimates of 15M, with the Z Flip 4 and Z Fold 4 accounting for 8M. Based on panel forecasts through November, we see Flip 4 and Fold 4 panel shipments up 47% and 46% respectively vs. the Flip 3 and Fold 3 amounting to 9M. However, this is down 8% vs. the figures in our Quarterly Foldable/Rollable Display Shipment and Technology Report, with the Flip 4, 7% below previous expectations and the Fold 4, 12% below our previous forecast. For Q3’22, we believe Flip 4/Fold 4 panel shipments actually came in 0.5% ahead of expectations with the Flip 4 actually 2% ahead of expectations and the Fold 4, 1% below expectations.

Bloomberg reported last week that Apple asked suppliers to get ready for an additional 7% boost to its CY 2022 production targets shortly before launch, but recently decided to cancel those plans. The cause of course is the weakening global economy with Europe headed to a recession on super high energy prices, weaker currencies relative to the $US and even weakness in China due to COVID related shutdowns and economic weakness. Jefferies reported that iPhone sales over the first three days of availability in China were down 11% Y/Y with less scalper activity and shorter lines in retail. Bloomberg said Apple plans to make 90M iPhone 14 Series phones in 2022 with emphasis on the Pro and Pro Max models.

In the recently released Quarterly OLED Shipment Report , we reveal that 2022 OLED panel revenues are expected to decrease 4% Y/Y to $40.3B as a result of slower growth for monitors, notebook PCs and game platforms combined with faster Y/Y declines for smartphones. As macroeconomic concerns persist for battling inflation, monetary policies are enacted to combat it. While balancing a possible recession, weakened consumer demand, persistent supply chain issues, softening commercial demand and inventory buildup have created the perfect storm for Y/Y unit and revenue declines for smartphones, smartwatches and TVs in 2022.

Flat-panel displays are thin panels of glass or plastic used for electronically displaying text, images, or video. Liquid crystal displays (LCD), OLED (organic light emitting diode) and microLED displays are not quite the same; since LCD uses a liquid crystal that reacts to an electric current blocking light or allowing it to pass through the panel, whereas OLED/microLED displays consist of electroluminescent organic/inorganic materials that generate light when a current is passed through the material. LCD, OLED and microLED displays are driven using LTPS, IGZO, LTPO, and A-Si TFT transistor technologies as their backplane using ITO to supply current to the transistors and in turn to the liquid crystal or electroluminescent material. Segment and passive OLED and LCD displays do not use a backplane but use indium tin oxide (ITO), a transparent conductive material, to pass current to the electroluminescent material or liquid crystal. In LCDs, there is an even layer of liquid crystal throughout the panel whereas an OLED display has the electroluminescent material only where it is meant to light up. OLEDs, LCDs and microLEDs can be made flexible and transparent, but LCDs require a backlight because they cannot emit light on their own like OLEDs and microLEDs.

Liquid-crystal display (or LCD) is a thin, flat panel used for electronically displaying information such as text, images, and moving pictures. They are usually made of glass but they can also be made out of plastic. Some manufacturers make transparent LCD panels and special sequential color segment LCDs that have higher than usual refresh rates and an RGB backlight. The backlight is synchronized with the display so that the colors will show up as needed. The list of LCD manufacturers:

Organic light emitting diode (or OLED displays) is a thin, flat panel made of glass or plastic used for electronically displaying information such as text, images, and moving pictures. OLED panels can also take the shape of a light panel, where red, green and blue light emitting materials are stacked to create a white light panel. OLED displays can also be made transparent and/or flexible and these transparent panels are available on the market and are widely used in smartphones with under-display optical fingerprint sensors. LCD and OLED displays are available in different shapes, the most prominent of which is a circular display, which is used in smartwatches. The list of OLED display manufacturers:

MicroLED displays is an emerging flat-panel display technology consisting of arrays of microscopic LEDs forming the individual pixel elements. Like OLED, microLED offers infinite contrast ratio, but unlike OLED, microLED is immune to screen burn-in, and consumes less power while having higher light output, as it uses LEDs instead of organic electroluminescent materials, The list of MicroLED display manufacturers:

LCDs are made in a glass substrate. For OLED, the substrate can also be plastic. The size of the substrates are specified in generations, with each generation using a larger substrate. For example, a 4th generation substrate is larger in size than a 3rd generation substrate. A larger substrate allows for more panels to be cut from a single substrate, or for larger panels to be made, akin to increasing wafer sizes in the semiconductor industry.

"Samsung Display has halted local Gen-8 LCD lines: sources". THE ELEC, Korea Electronics Industry Media. August 16, 2019. Archived from the original on April 3, 2020. Retrieved December 18, 2019.

"TCL to Build World"s Largest Gen 11 LCD Panel Factory". www.businesswire.com. May 19, 2016. Archived from the original on April 2, 2018. Retrieved April 1, 2018.

"Panel Manufacturers Start to Operate Their New 8th Generation LCD Lines". 대한민국 IT포털의 중심! 이티뉴스. June 19, 2017. Archived from the original on June 30, 2019. Retrieved June 30, 2019.

"TCL"s Panel Manufacturer CSOT Commences Production of High Generation Panel Modules". www.businesswire.com. June 14, 2018. Archived from the original on June 30, 2019. Retrieved June 30, 2019.

"Samsung Display Considering Halting Some LCD Production Lines". 비즈니스코리아 - BusinessKorea. August 16, 2019. Archived from the original on April 5, 2020. Retrieved December 19, 2019.

Herald, The Korea (July 6, 2016). "Samsung Display accelerates transition from LCD to OLED". www.koreaherald.com. Archived from the original on April 1, 2018. Retrieved April 1, 2018.

Shilov, Anton. "LG"s New 55+ inch OLED Plant in China Opens: Over 1m+ per Year". www.anandtech.com. Archived from the original on 2019-09-14. Retrieved 2019-12-18.

"China"s BOE to have world"s largest TFT-LCD+AMOLED capacity in 2019". ihsmarkit.com. 2017-03-22. Archived from the original on 2019-08-16. Retrieved 2019-08-17.

Since smartphones can now be connected directly to automobiles owing to technological advancements in the telecommunications industry, the market for car center information displays has witnessed significant growth. Digitalization and connectivity, which guarantee a high level of customization for drivers and passengers, are increasingly influencing the automobile sector by creating more appealing interiors for cars.

OLED is a light-emitting technology that is used to make flexible, thin displays. Several automakers have already incorporated OLED panels into their center information displays. The promise of advanced driver assistance systems (ADAS) is that they increase vehicle safety by making driving easier and removing the sources of driver distraction and inattention, which frequently result in serious accidents.

TFT LCD and OLED dashboard displays are being adopted for controlling the air conditioning, music functionality, temperature, and many other things. Many hybrid and electric vehicles today use screens to show performance functions. Owing to all these factors, the installation of center information displays will increase at a much faster rate over the coming years.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey