first lcd screen pricelist

And thanks to supply finally starting to catch up with demand, combined with the slump in PC sales growth, LCD monitors prices look set to continue to fall.

The steepest price erosion for LCDs is in the 15-inch monitor market, where prices dropped around 30 per cent in 2000, according to IDC. During the year they also grabbed around 30 per cent market share.

A year ago, it seemed LCD manufacturers couldn"t churn the products out fast enough - and most of the supply was gobbled up for laptops, meaning desktop LCD monitors stayed expensive. Now, not only are more countries, such as Taiwan, making them in volume, but overall demand for computers has also fallen.

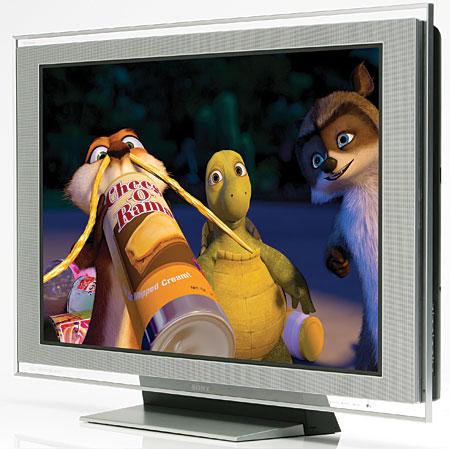

That might soon change as a glut of liquid crystal display flat-panel televisions, called LCDs, enter the market, a result of a boom in new factories. According to several manufacturers and analysts, the prices for LCD flat-panel TVs will drop in the new year, falling by as much as 30 percent by the end of 2005. The prices of plasma flat-panel TVs are also expected to fall significantly.

Flat-panel TVs represent less than 10 percent of the 29-million TV sets to be sold to dealers in 2004. Of the flat-panel sales, 73 percent are LCD sets and 27 percent are the larger plasma models.

Manufacturers, like the makers of other consumer electronics, are investing heavily to expand their production capacity, hoping to capture market share. Earnings, they reason, will come later, although until recently, these sets had proved highly profitable. In the first three quarters of 2004, the LG.Philips LCD Co. made $1.4-billion in profits from LCD televisions, although the company reported a drop in earnings in the third quarter from the year-earlier period. Another manufacturer, AU Optronics, made $900-million in the three quarters, according to DisplaySearch, a technology research company.

This windfall has given them the cash to build next-generation plants capable of creating larger screens at lower per-unit costs. Each new generation LCD plant costs $1-billion to $3-billion.

Next year, AU Optronics and another LCD maker, CPT, both based in Taiwan, will complete new plants for making 32- and 37-inch displays. To cut construction costs, Sony and Samsung are in a $2-billion joint venture to build the world"s first LCD plant designed to produce eight 40-inch or six 46-inch displays cut from one large piece of glass.

Bharath Rajagopalan, general manager for TCL-Thomson Electronics, owner of the RCA brand, said: "LCD production is becoming a commodity game. There is an inordinate amount of competition and price erosion."

Ross Young, president of DisplaySearch, predicts there will be a 53 percent increase in capacity during 2005, and he says that will put a lot of pressure on pricing. A 42-inch LCD set that costs close to $4,500 today will be $3,100 next year and $2,250 in 2006, he says.

Tasso Koken, vice president and general merchandise manager for Sears home electronics, predicts that in 18 months, a 20-inch LCD TV from a well-known manufacturer will be less than $299, down from $700 to $800 today. "The 2005 price drops in LCD will make the 2004 reductions look like a walk in the park," he said.

Average consumers do not seem to care which technology they are buying. "Generally speaking, the consumer has no understanding of the differences between LCD and plasma technology," Koken of Sears said.

Many industry executives expect that later this decade, LCD units, which are typically 3 to 5 inches deep, will completely replace smaller-size picture-tube sets. Next year, Sony expects to double the number of flat-panel TVs it sells in the United States, while decreasing its picture-tube offerings by 20 percent, said Mike Fidler, a Sony senior vice president. The picture-tube business is expected to remain profitable for the company for the next three years, but then decline as the price of LCD TVs falls below $500, Fidler said.

Falling prices for larger screen sizes might force plasma sets to be sold only in sizes around 60 inches, where they maintain their price edge over LCD screens. Plasma panels contain only electrodes and phosphors, so they can be made in larger sizes without a proportionate increase in price, according to Ed Wolff, a vice president at Panasonic.

But some are not so sanguine about the future of plasma. Fidler of Sony says that LCD TVs will drop so much in price that plasma will go away in three to five years.

Given the uncertainty of whether customers will take to mounting their TVs on a wall, some companies like RCA are hoping that a less-expensive large-screen projection TV will remain a viable alternative to LCD or plasma sets. A harbinger of that trend, the company"s recently introduced Projects, a 61-inch projection set, is just 7 inches deep.

Liquid-crystal-display televisions (LCD TVs) are television sets that use liquid-crystal displays to produce images. They are, by far, the most widely produced and sold television display type. LCD TVs are thin and light, but have some disadvantages compared to other display types such as high power consumption, poorer contrast ratio, and inferior color gamut.

LCD TVs rose in popularity in the early years of the 21st century, surpassing sales of cathode ray tube televisions worldwide in 2007.plasma display panels and rear-projection television.

Passive matrix LCDs first became common as portable computer displays in the 1980s, competing for market share with plasma displays. The LCDs had very slow refresh rates that blurred the screen even with scrolling text, but their light weight and low cost were major benefits. Screens using reflective LCDs required no internal light source, making them particularly well suited to laptop computers. Refresh rates of early devices were too slow to be useful for television.

Portable televisions were a target application for LCDs. LCDs consumed far less battery power than even the miniature tubes used in portable televisions of the era. In 1980, Hattori Seiko"s R&D group began development on color LCD pocket televisions. In 1982, Seiko Epson released the first LCD television, the Epson TV Watch, a small wrist-worn active-matrix LCD television. Sharp Corporation introduced the dot matrix TN-LCD in 1983, and Casio introduced its TV-10 portable TV.Citizen Watch introduced the Citizen Pocket TV, a 2.7-inch color LCD TV, with the first commercial TFT LCD display.

Throughout this period, screen sizes over 30" were rare as these formats would start to appear blocky at normal seating distances when viewed on larger screens. LCD projection systems were generally limited to situations where the image had to be viewed by a larger audience. At the same time, plasma displays could easily offer the performance needed to make a high quality display, but suffered from low brightness and very high power consumption. Still, some experimentation with LCD televisions took place during this period. In 1988, Sharp introduced a 14-inch active-matrix full-color full-motion TFT-LCD. These were offered primarily as high-end items, and were not aimed at the general market. This led to Japan launching an LCD industry, which developed larger-size LCDs, including TFT computer monitors and LCD televisions. Epson developed the 3LCD projection technology in the 1980s, and licensed it for use in projectors in 1988. Epson"s VPJ-700, released in January 1989, was the world"s first compact, full-color LCD projector.

In 2006, LCD prices started to fall rapidly and their screen sizes increased, although plasma televisions maintained a slight edge in picture quality and a price advantage for sets at the critical 42" size and larger. By late 2006, several vendors were offering 42" LCDs, albeit at a premium price, encroaching upon plasma"s only stronghold. More decisively, LCDs offered higher resolutions and true 1080p support, while plasmas were stuck at 720p, which made up for the price difference.

Predictions that prices for LCDs would rapidly drop through 2007 led to a "wait and see" attitude in the market, and sales of all large-screen televisions stagnated while customers watched to see if this would happen.Christmas sales season.

When the sales figures for the 2007 Christmas season were finally tallied, analysts were surprised to find that not only had LCD outsold plasma, but CRTs as well, during the same period.Pioneer Electronics was ending production of the plasma screens was widely considered the tipping point in that technology"s history as well.

In spite of LCD"s dominance of the television field, other technologies continued to be developed to address its shortcomings. Whereas LCDs produce an image by selectively blocking a backlight, organic LED, microLED, field-emission display and surface-conduction electron-emitter display technologies all produce an illuminated image directly. In comparison to LCDs all of these technologies offer better viewing angles, much higher brightness and contrast ratio (as much as 5,000,000:1), and better color saturation and accuracy. They also use less power, and in theory they are less complex and less expensive to build.

Manufacturing these screens proved to be more difficult than originally thought, however. Sony abandoned their field-emission display project in March 2009,

That"s because the price of 40- to 42-inch LCD panels fell to $950 this month, the first time such devices have cost less than $1,000, market research firm iSuppli said Thursday.

The falling prices of panels, the most expensive component of the high-tech TVs, could bring the price of the 40- to 42-inch sets down to $2,500 by the end of the year, iSuppli predicted. The most popular size for large, flat-screen sets is 42 inches, according to makers of the generally cheaper plasma version.

Prices for smaller LCD TV sets are likely to drop this year too, iSuppli noted. For instance, the price of 30- to 32-inch LCD panels dipped to $425 this month.

Samsung, in particular, is helping drive down the price of 40- to 42-inch LCD panels, iSuppli said. The company is ramping up production at a new state-of-the-art plant that it

Last year, consumers bought 13.5 million flat-panel monitors, more than double the 6.4 million shipped in 2000, said Rhoda Alexander, director of monitor research at Stanford Resources-iSuppli. In 2002, 23.5 million are expected find their way to consumers and businesses, fueled in part by the cool factor and by efforts of Dell Computer, Apple Computer and others to promote the space- and energy-saving screens.

Bruce Berkoff, executive vice president at LCD maker LG Philips LCD, said that he"s been predicting a shortage for some time and sees it as part of a cycle that consists of two-year periods of oversupply and two-year periods of shortage, causing price fluctuations. Berkoff anticipates an industrywide shortage as early as mid-2002 that will last through 2003.

Berkoff expects prices for 15-inch LCD monitors to increase from around $200 to $300 now to up to--but not over--$500 this year. He also expects 17-inch and 18-inch displays to become more mainstream with prices ranging from $700 to $900.

Although flat-panel displays have been around for years, high prices kept them from the mainstream of the consumer market. A low-end 14-inch flat panel for a desktop computer, for instance, cost about $2,000 in 1997. A shortage of LCD glass, partly driven by growing demand for notebooks and handheld devices in the late 1990s, prompted makers to invest in glass plants in Taiwan and Korea in 1998 and 1999.

"The California energy crisis, whether real or manufactured, had a tremendous impact on LCDs. I received lots of calls from government agencies asking about them," said Alexander, who added that the energy savings "for a large corporate account makes a significant difference."

Although supply still outstrips demand, the LCD glut is expected to begin to dry up and prices are likely to rise. Unlike other PC products, which only go down in price, flat panel prices have jumped occasionally in the past. "LCD is one of the few (markets) where things have actually gone up in price," said Bob O"Donnell, an analyst with IDC.

Driving the demand are notebooks, which are becoming a larger percentage of the overall PC market. Consumer electronics devices that use LCD screens, such as cell phones and handhelds, use small screens and thus haven"t affected supply very much.

Another consumer electronics product category that may affect supply in the future is televisions with LCDs. Berkoff predicts this market will reach seven million units annually by 2005.

Supply, for instance, could be fairly tight in the first part of the year, driving prices up and creating shortages. Or an industrial accident at a major Japanese glass manufacturer could crimp supply during the first quarter and thereby drive prices up.

will not be able to supply LCD glass substrate until February or March, according to reports from Asian newspapers and analysts. The company"s customers include LCD producers Fujitsu, Samsung Electronics, International Display Technology, Chi Mei Optoeletronics and HannStar Display.

At the same time, other variables exist. An expansion of LCD manufacturing facilities in Korea from Sharp, Samsung and LG Philips means that more supply is on the horizon. And like in 2000, an influx of products could depress prices. (Samsung and other LCD panel manufacturers take glass and other components and manufacture the LCD panel. The panels then get shipped to notebook or monitor makers, which can be sister subsidiaries and which incorporate the LCD panel into monitors).

LCD manufacturers are working on other types of display technology, such as organic light-emitting diode displays. But it will be at least 10 years before any of them can replace LCDs.

Thinking of buying an LCD television set? Wait no longer: The price plunge is over. After years of accelerating decline, prices for consumer LCD TVs -- especially those smaller than 32 inches -- have hit bottom, industry insiders say.

That"s because the price of wholesale LCD flat panels -- the display component of your TV set -- has recently reached its lowest point and rebounded, according to numbers released by market data research firm iSuppli. When a TV"s most expensive single component starts getting more expensive, you can kiss retail price cuts goodbye.

"Prices are going up like crazy. We expected it to be a tight supply, but it seems like there is something going on," says Sweta Dash, director of LCD research for iSuppli, about the LCD market. "In just one month the price increase has been really high."

Though April saw the first notable price increase to hit flat panels since their appearance in TV sets and computer displays, the bounce then was barely perceptible compared to massive price drops over the previous six months. In May, however, prices have risen sharply. The prices that TV manufacturers pay for the display screens in their TVs typically account for 50 to 60 percent of a TV"s final consumer price. According to iSuppli, the manufacturer prices for 32-inch and smaller LCD panels rose in May by as much as $5 to $10 over April"s prices (then about $300 for a 32-inch display).

"We anticipate that LCD prices as a whole are stabilizing," says Todd Richardson, a senior vice president at Philips North America. "Smaller screens will stabilize or incrementally go up, due to global supply."

The competitive state of affairs came after LCD makers rushed to maximize production in the early years of the decade, as ultra-thin monitors and televisions overwhelmed older technology unexpectedly quickly in the public imagination. Now manufacturers are culling production capacity and letting stockpiles fall fallow. In fact, screens sized 37 inches and less are now sold out for the year worldwide, sources say.

However, the tight LCD panel market is unlikely to translate into direct price increases at your local electronics store, according to iSuppli"s Dash.

Prices for large-sized LCD panels for notebooks and LCD monitors have begun declining this month, bringing an end to a five-quarter period of consecutive increases.

Panel prices began to increase in April 2003, and rose about 21-28% from that time until last month. The price of 15-inch notebook and LCD monitor panels in the XGA format increased to the US$230 to US$235 range in June, up from US$180 to US$190 last April.

In June, panel buyers’ biggest concerns were component shortages and cost increases, as well as hikes in panel prices. Concern over future supply constraints, combined with worries over further price increases, prompted notebook and LCD monitor makers to keep boosting their orders for panels in the second quarter, even though they had detected signs of a slowdown in demand.

A similar situation is also occurring in the 14-inch notebook panel market, where prices declined on month by US$9 in July. iSuppli/Stanford Resources expects price reductions to continue in August, with declines ranging from US$8 to US$20 for notebook and LCD monitor panels and from US$20 to more than US$50 for TV panels. Average price reductions in the third quarter are expected to be 5-10% for notebook and monitor panels and 10-15% for TV panels.

Large-sized LCD panel supply increased 9% on quarter in the second quarter. Supply is expected to increase 14% by the third quarter because most panel suppliers are expanding their capacity, following establishment of new fifth-generation (5G) and 6G fabs.

The LCD TV market was slow in the first half due to high panel and system prices and the sluggish adoption of LCD TVs by consumers, compared to PDP (plasma display panel) or rear-projection microdisplay televisions (RPTVs) using LCD technology or Texas Instruments’ (TI) digital light processing (DLP).

Prices for 30-inch LCD TVs in the first half were in the same range as 42-inch PDP and 50-inch RPTV sets. Because end-user demand for 30-inch LCD TVs was lower than expected, manufacturers scaled back their expectations for the product and instead increased their focus on smaller-sized panels. Panels in the 20-inch and 26/27-inch range appeared to have better prospects in the market.

In the notebook area, panel demand was slow in the first quarter, following normal seasonal patterns. Although demand improved in the second quarter, lower-than-expected back-to-school sales have dampened the outlook for third-quarter demand.

In LCD monitors, panel demand was notably strong in the first quarter. Although end-user monitor demand declined in the second quarter, panel demand remained very high. However, in the third quarter, demand started to experience a slowdown due to the inventory buildup.

About 53% of large-size LCD panel unit demand and 56% of the area demand still come from monitor applications. Thus, any change in the level of monitor demand has a major impact on the large-size LCD market.

Increasing demand, combined with production adjustments, may bring supply and demand into balance – thus stabilizing prices – by the end of the fourth quarter. iSuppli/Stanford Resources continues to predict higher revenue growth for the LCD market in 2004.

(IDG) -- If you covet a 15-inch LCD monitor, now"s the time to buy one. NEC-Mitsubishi announced Wednesday a price cut on its 15-inch NEC MultiSync LCD1530V to a street price of about $500 -- and it"s just the latest major vendor in a recent flurry to offer a display at that magic price point.

ViewSonic announced last Monday a price drop to $499 on its 15-inch VE150 ViewPanel, the same time Dell began offering its 15-inch LCD for $499 with special system purchases (it costs $549 if you buy it alone).

Add to that Samsung"s March announcement that its 15-inch SyncMaster 570b TFT now sells for $499, and that IBM"s latest LCDs start at $600, and you have a serious LCD market movement.

"This is a very exciting time for the LCD market -- this is a price point we"ve been waiting to see," says Rhoda Alexander, director of monitor research at display market firm Stanford Resources.

Selling at $500, 15-inch LCDs could easily move into volume sales, as more mainstream and corporate customers consider buying them, she says. Even so, don"t expect the prices to stay low forever. The current drop is brought on by a combination of factors that could change -- and while the prices aren"t likely to go much lower, they"ll probably begin creeping upward again by this fall.

A year ago, LCD manufacturers couldn"t make enough products to satisfy demand. With supplies tight, most LCD products went into notebook PCs, so the price of desktop LCD monitors remained high.

Today, more companies in more countries are making LCDs, and those companies are becoming more efficient at making them every day, Alexander says. But just as supply began to ramp up, demand dropped at the end of last year, causing an oversupply today. Analysts predicted lower prices, and now they"re here.

The price differences are staggering. According to Stanford Resources, the average price of a 15-inch LCD in the first quarter of 1998 was $2600. In the first quarter of 1999 it dropped to $1100; it inched up to about $1199 in 2000; and in 2001 it dropped to $750. The second quarter of this year shows the average price at $699, but headed downward as industry leaders such as NEC-Mitsubishi, Dell, ViewSonic, and Samsung lower their prices.

While most buyers will probably consider a 15-inch LCD for their first flat-panel monitor, existing users -- and those using larger CRT-based monitors today -- will want to consider larger screen models. While the prices on larger LCDs haven"t dropped as low as 15-inch units, they too have seen some dramatic cuts.

Unlike traditional CRT monitors that fall into convenient standard sizes such as 15, 17, 19, and 21 inches, LCD sizes are more varied. NEC-Mitsubishi offers an 18-inch LCD because its research shows fonts displayed on an 18-inch screen are 13 percent larger than the same font, at the same resolution, on a 17-inch display, Giazzon says.

Stanford"s Alexander says the screen-size issue is very interesting to watch, but expects that as 15-inch entry-level displays gain prominence, 17, 19, and 21-inch sizes might become more standard, too.

In addition to falling prices, another reason more people and companies may purchase LCDs is for power savings, Alexander notes. LCDs not only save desktop space, but the good ones use much less power than a comparably sized CRT-based monitor, she says.

"Vendors have to get smart about energy savings," she says. Energy savings were a selling point for desktop LCDs when they first appeared years ago, but at the time U.S. buyers weren"t worried about power. Now, with the price of electricity going up, and states such as California facing rolling blackouts, power savings is a popular idea again, she says.

NEC-Mitsubishi"s 18-inch LCD monitor offers about a 35 percent energy savings over a comparable 19-inch CRT, Giazzon says. And its 15-inch LCD product offers a 45 percent savings over a comparable 17-inch CRT.

/GettyImages-953033568-5c7ac218c9e77c00011c838b.jpg)

The LCD flavor of flat-screen TVs are by far the most popular, making up 84% of the market, yet demand for them is waning. Shipments of LCD units declined for the first time ever, dropping 3% to 43 million units in the first quarter, according to an NPD DisplaySearch report released Wednesday.

But things are even worse for other types of TVs like plasma screens. Overall TV shipments around the world, including non-LCD TVs, fell 8% to 51 million units in the first quarter from a year earlier. That drop marked the biggest decline since the second quarter of 2009.

What"s behind the slump? The market has become saturated with flat-screens -- most people already have one or more, said Paul Gagnon, TV analyst at NPD DisplaySearch. Consumers tend to swap out their TVs less frequently than they would their smartphones or computers.

A drop in flat-panel monitor prices over the last several months will continue through the first half of the year until hitting record lows, according to new projections from market researcher DisplaySearch. Flat-panel monitors use LCD (liquid crystal display) glass, which had been in short supply, keeping prices high.

The price reductions are the result of a recent increase in manufacturing capacity. In the late 1990s, growing demand in notebooks, handheld devices and cell phones prompted manufacturers to invest in plants for LCD manufacturing. LCD glass is the main and most expensive component in a flat-panel monitor. Notebooks account for 61.4 percent of the LCD market.

Klopstad said that six months ago a $1,299 notebook in Gateway"s (gtw) 1000 series would have come with a 12.1-inch dual-scan screen. But this year it"s available with a 12.1-inch

A string of new LCD factories being built, combined with slow demand for notebook and desktop PC screens, caused LCD prices to fall during the first three months of the year, and the downward trend is expected to continue, vendors and analysts said.

Falling prices for LCD (liquid crystal display) screens should help ensure that users find bargains for new monitors, laptops and LCD TVs this year, since the screen is among the most-expensive components in those products. The price declines are also causing vendors to improve picture quality to catch users" eyes and draw them away from competitors.

Makers such as LG.Philips and Samsung Electronics, the world"s two largest LCD producers, are ramping up production at state-of-the-art factories, while rivals continue to add lines at existing plants. Other big players, such as AU Optronics in Taiwan, expect to add plants later this year, which should help keep LCD prices tame.

"The biggest impact from the new plants will be in the first part of this year, but there will be some impact throughout the year," said Frank Lee, an LCD industry analyst for Deutsche Securities Asia in Taipei.

The new LCD plants were built largely to keep pace with demand for LCD TVs, which have been among the hottest-selling items this year. Cutthroat competition among LCD makers also has been a boon to users, ensuring steadily falling prices for the past few years, as screen sizes increase.

For example, prices for 42-inch LCD screens that will be delivered to TV makers in the second half of April fell by $35 each since the end of March, to an average of $890, according to WitsView Technology Co., an industry researcher. Prices for 19-inch panels for PC monitors fell $5 to an average $160.

Average selling prices for LCD panels at AU Optronics fell nearly 12% quarter-on-quarter by the end of March, and the company forecast continued declines into the second quarter, according to executives at its first quarter earnings conference Thursday.

"Screen prices have remained weak in April but should stabilize in May or June," said Hsiung Hui, executive vice president of strategic planning at AU.

The company expects the price of screens used in desktops and laptops to drop by about 10% quarter-on-quarter during the April to June period, while LCD-TV screen prices will decline by a smaller percentage, in the mid single digits, it said.

LG.Philips said its sales declined in the first quarter compared to the fourth, because of a decline in the average selling prices in LCDs destined for laptops and desktop monitors, with an overall price decline of around 10% for all LCD screen products.

The South Korean company, a joint venture between LG Electronics Inc. and Koninklijke Philips Electronics, said its average selling prices in the current quarter will drop by a mid- to high-single digit percentage compared to the end of the first quarter.

The company is increasing production at a state-of-the-art LCD factory in Korea, as is rival Samsung. AU is building a similar plant in Taiwan that it expects to be in production by the third quarter of this year. LG said it would produce mainly 42-inch and 47-inch screens at the plant, aimed at the LCD-TV market.

Other LCD industry competitors are also increasing production to keep up with demand for LCD-TVS. On Wednesday, S-LCD Corp., the LCD-panel manufacturing joint venture of Sony and Samsung, said it plans to invest $238 million to expand production at its factory in Tangjeong, South Korea.

The data came from the IHS iSuppli U.S. TV & Specifications Tracker published by market research firm IHS. The report showed that in August the average price of both flat-screen plasma and LCD TVs dropped to $1145. Whilst this was only a small drop of $5 or 0.4 percent on the previous month, it was nevertheless a first drop in prices seen for some time.

The last decline in prices for flat screen TVs in the US was seen in March, when the price drop was considerably higher than this time around, falling by $21.60 compared to February. iSuppli’s analysts said that the price drops were particularly prevalent with larger flat-screen TV sets, with the 30-39 inch TVs falling by around 1 percent, 50-inch plus TVs falling by around 2 percent, and the 40-49 inch group falling by around 3 percent.

Riddhi Patel, director for television systems and retail services at IHS, said that larger-sized HDTV models in particular have become more difficult to sell in the challenging financial climate which precipitates uncertainty among the public. She said that there needs to be a big enough price decrease with larger screen televisions to motivate consumers to buy.

After months of price cuts, manufacturers of large-size liquid-crystal displays (LCDs) are under pressure to reduce panel prices further, following a major build-up of inventory. A recent report from US business analyst iSuppli revealed that the second quarter of 2010 saw the manufacture of 52 million large (ten inches and above) LCD television panel shipments, but the sale of only 38.7 million LCD television sets. The resulting imbalance between supply and demand is having a strong impact on the sector.

“This gap is higher than anything seen in 2009. Over-supply persisted in the first two months of the third quarter as buyers cut orders in July and August,” says iSuppli analyst Sweta Dash. “LCD television brands are expected to lower prices more aggressively to reduce their inventory levels, thus putting mounting pressure on panel suppliers to reduce prices further.”

Dash points out that manufacturers of monitor and notebook panels have been reducing supply to mitigate excessive inventory levels, and that panel prices are now stabilizing as a result. In contrast, high depreciation costs at relatively new LCD television panel fabrication plants mean suppliers have been less willing to reduce production.

However, Dash predicts that the potentially strong sales of LCD television sets in China could reduce inventory levels and help to steady panel prices by the end of the fourth quarter of 2010.

At the same time, rapidly rising sales of smart phones and tablet PCs are predicted to see the global market for small- and medium-size thin-film transistor (TFT) LCDs expanding at its fastest pace for three years. According to analyst Vinita Jakhanwal, also from iSuppli, global shipments of TFT LCD panels are set to rise by 28.1% in 2010, from 1.8 billion to 2.3 billion units.

“Sales of smart phones and tablets are booming thanks to the iPhone, iPad and other competing products,” explains Jakhanwal. “Smart phone manufacturers are now adopting TFT LCDs that use in-plane switching technology, which supports a wider viewing angle and better picture quality than a conventional LCD.” But the fast-paced market expansion probably won"t last, predicts Jakhanwal. “Growth in TFT LCD shipments will slow in 2011 and beyond as the expansion of smart phone and tablet markets cools to more normal levels.”

The adoption of touch-screen technology in the mobile phone industry is fuelling the demand for active-matrix organic light-emitting diode (AMOLED) displays, reports US market research firm DisplaySearch. AMOLED displays have been the only technology in the mobile phone display market to increase revenues every quarter this year, as both unit shipments and average prices have risen. “With an average worldwide market penetration of mobile phones at 70%, manufacturers are eager to introduce new features such as touch-screens to ensure continued growth this year,” says Calvin Hsieh, research director at DisplaySearch. “The success that AMOLED displays are finding in high-end smart phones reflects these trends.”

AMOLED technology rose in popularity after its integration into mobile phones manufactured by Samsung and HTC. In the first quarter of 2010, the average screen size for an AMOLED display exceeded three inches, which is larger than that of competing TFT LCDs. Taiwan-based display manufacturers AUO and Chimei Innolux are scheduled to start mass-producing AMOLED displays in 2011. Hsieh believes AMOLED technology will now see increased year-on-year growth, although TFT LCDs will still ship more units.

At present, TFT LCD touch panel prices rebounded, after six months of continuous decline, TFT LCD touch panel prices began to rebound at the end of July. Global TFT LCD panel prices have rebounded since August, according to Displaysearch, an international market-research firm. The price of a 17-inch LCD touch panel rose 6.6% to $112 in August, up from $105 in July, and fell from $140 in March to $105 in July. At the same time, 15 – inch, 19 – inch LCD touch panel prices also showed a different range of recovery. The price of a 17-inch LCD touch panel rose 5.8 percent, to $110, from $104 in late July, according to early August quotes from consulting firm with a view. Analysts believe the rebound will continue through the third quarter; LCDS will see seasonal growth in the third quarter, driven by back-to-school sales in us and the completion of inventory liquidation in the first half of the year. Dell and Hewlett-Packard (HPQ) started placing orders for monitors in the third quarter, and display makers Samsungelectronics (SXG) and TPV (TPV) are expected to increase production by 25% and 18% respectively.

It seems that due to the increasing demand in the market, the production capacity of the display panel production line has been released. Domestic TFT-LCD touch panel makers boe and Shanghai guardian said their production schedules have been set for September, and their production capacity may reach full capacity by the end of the year. Jd will produce 85,000 glass substrates per month (with a designed capacity of 90,000), according to boe and Shanghai guardian. Previously, panel makers have been hit by falling prices, with boe, SFT, and even international panel giant LG Philips all reporting losses. If the rebound continues into the fourth quarter, boe, Shanghai radio and television and other panel makers will use the rebound to reverse the decline, according to industry analysts.

It is understood that the first quarter of the boe financial results show that the company’s main business income of 2.44 billion yuan, a loss of 490 million yuan.Jd.com attributed the loss to a drop in the price of 17-inch TFT-LCD displays made by its Beijing TFT-LCD fifth-generation production line of Beijing boe photoelectric technology co., LTD., a subsidiary. Boe has issued the announcement of pre-loss in the first half of the year in April. Due to the influence of the off-season of TFT-LCD business operation in the first quarter of 2006, the company has suffered a large operating loss, and the low price in the TFT-LCD market has continued till now. Therefore, it is expected that the operating loss will still occur in the first half of 2006.LG Philips, the world’s largest TFT LCD maker, reported a won322bn ($340m) loss in July, compared with a won41.1bn profit a year earlier.LG Philips attributed the loss to fierce price competition and market demand did not meet expectations.

LCD panel prices have risen for 4 months in a row because of your home gaming? Since this year, the whole LCD panel market has smoked. Whether after the outbreak of the epidemic, LCD panel market prices rose for four months, or the panel giants in Japan and South Korea successively sold production lines, or the Chinese mainland listed companies frequently integrated acquisition, investment, and plant construction, all make the industry full of interesting.

LCD panel prices are already a fact. Since May this year, LCD panel prices have risen for four months in a row, making the whole industry chain dynamic. Why are LCD panels going up in price in a volatile 2020? The key factor lies in the imbalance between supply and demand.

The price of LCDS for large-size TVs of 70 inches or more hasn’t budged much. In addition, LTPS screens and AMOLED screens used in high-end phones have seen little or no increase in price.

As for October, LCD panel price increases are expected to moderate. The data shows that in October 32 inches or 2 dollars; Gains of 39.5 to 43 inches will shrink to $3;55 inches will fall back below $10; The 65-inch gain will narrow to $5.

During the epidemic, people stayed at home and had no way to go out for entertainment. They relied on TV sets, PCS, and game consoles for entertainment. After the resumption of economic work and production, the market of traditional home appliances picked up rapidly, and LCD production capacity was quickly digested.

However, due to the shutdown of most factories lasting 1-2 months during the epidemic period, LCD panel production capacity was limited, leading to insufficient production capacity in the face of the market outbreak, which eventually led to the market shortage and price increase for 4 consecutive months.

In fact, the last round of price rise of LCD panels was from 2016 to 2017, and its overall market price has continued to fall since 2018. Even in 2019, individual types have fallen below the material cost, and the whole industry has experienced a general operating loss. As a result, LCD makers have been looking for ways to improve margins since last year.

A return to a reasonable price range is the most talked about topic among panel makers in 2019, according to one practitioner. Some manufacturers for the serious loss of the product made the decision to reduce production or even stop production; Some manufacturers planned to raise the price, but due to the epidemic in 2020, the downstream demand was temporarily suppressed and the price increase was postponed. After the outbreak was contained in April, LCD prices began to rise in mid-to-late May.

In fact, the market price of LCD panels continued to decline in 2018-2019 because of the accelerated rise of China’s LCD industry and the influx of a large number of local manufacturers, which doubled the global LCD panel production capacity within a few years, but there was no suitable application market to absorb it. The result of excess capacity is oversupply, ultimately making LCD panel prices remain depressed.

Against this background, combined with the impact of the epidemic in 2020, the operating burden of LCD companies in Japan and South Korea has been further aggravated, and it is difficult to make profits in the production of LCD panels, so they have to announce the withdrawal of LCD business.

business in June 2022. In August, Sharp bought JDI Baishan, a plant in Ishikawa prefecture that makes liquid crystal display panels for smartphones. In early September, Samsung Display sold a majority stake in its SUZHOU LCD production plant to Starlight Electronics Technology, a unit of TCL Technology Group. LGD has not only pulled out of some of its production capacity but has announced that it will close its local production line in 2020. According to DSCC, a consultancy, the share of LCD production capacity in South Korea alone will fall from 19% to 7% between 2020 and 2021.

It is worth mentioning that in industry analysis, in view of the fact that Korean companies are good at using “dig through old bonus – selling high price – the development of new technology” the cycle of development mode, another 2020 out of the LCD production capacity, the main reason may be: taking the advantage of China’s expanding aggressively LCD manufacturers, Korean companies will own LCD panel production line hot sell, eliminating capacity liquid to extract its final value, and turning to the more profitable advantage of a new generation of display technologies, such as thinner, color display better OLED, etc. Samsung, for example, has captured more than 80% of the OLED market with its first-mover advantage.

From the perspective of production capacity, the launch of LCD tracks by major manufacturers in Japan and South Korea must reduce some production capacity in the short term, which to some extent induces market price fluctuations. In the long run, some of the Japanese and Korean LCD production capacity has been bought by Chinese manufacturers, coupled with frequent investment in recent years, the overall capacity is sure to recover as before, or even more than before. But now it will take time to expand the production layout, which more or less will cause supply imbalance, the industry needs to be cautious.

The LCD panel industry started in the United States and then gradually moved to Japan, South Korea, China, and Taiwan. At present, the proportion of production capacity in The Chinese mainland has reached 52% in 2020, and there are leading LCD panel products in China represented by BOE, Huxing Optoelectronics. Meanwhile, the production capacity layout of BOE, Huike, Huxing Optoelectronics, and other manufacturers has been basically completed, making industrial integration a necessity.

On the one hand, South Korean enterprises out of the LCD track, the domestic factory horse enclosure, plant expansion action. While LCDs may not sell as well as “upstart” flexible screens, respondents believe they are still strong enough in the traditional home appliance market to warrant continued investment. Zhao Bin, general manager of TCL Huaxing Development Center, has said publicly that the next-generation display technology will be mature in four to five years, but the commercialization of products may not take place until a decade later. “LCD will still be the mainstream in this decade,” he said.

On the other hand, there is no risk of neck jam in China’s LCD panel industry, which is generally controllable. In mainland China, there will be 21 production lines capable of producing 32-inch or larger LCD panels by 2021, accounting for about two-thirds of the global total. In terms of the proportion of production capacity, the Chinese mainland accounted for 42% of the global LCD panel in 2019, 51% this year, and will continue to climb to 63% next year.

Of course, building factories and expanding production cannot be accomplished overnight. In the process of production capacity recovery, it is predicted that there will be several price fluctuations, and the cost may be passed on to the downstream LCD panel manufacturers or consumers when the price rises greatly, which requires continuous attention.

The increase in liquid crystal display (LCD) TV panel prices that started last year has slowed down in July this year, according to data from market research firm WitsView.

The price of 75-inch (100 and 120Hz) panel in the first half of July was US$407, an increase of 0.2% from the second half of June. 65-inch panel price increased 0.3% to US$297 over the same time period.

Analyst firm Display Supply Chain Consultants has estimated that LCD price hike will halt starting in the second half of the year from oversupply and drop in demand for TVs in the US. Despite this, LCD companies will operate their factories at a high rate due to high margins from LCD panels, the firm had said.

Meanwhile, price increase of LCD monitor and notebook panels also slowed down. Price of 27-inch monitor panel in the first half of July only increased up to 0.5% from the second half of June. Other smaller sizes increased by up to 1.4%. Prices of notebook panels over the same time period only increased up to 1.4%.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey