tft display technology in stock

Tripp Lite"s instant-read CT120 circuit tester detects wiring stability in standard 120 volt AC wall sockets. Simply plug the circuit tester into a receptacle and view the lighted 3 lamp status display for verification of correct wiring, open ground, open neutral, open hot, hot-ground reversal and hot-neutral reversal fault conditions. Sticker on the tester offers lighting combinations for each wiring condition. Ultra-portable design and easy to read lighted display makes the CT120 an excellent addition to any laptop carrying case, tool belt or workbench. Low cost design saves the expense of hiring an electrician to determine wiring stability.

The adoption of LCD technology in vehicular displays has happened quite quickly and smart displays have by now pretty much replaced the mechanical dashboards of yesteryears in cars. In an interview with our team, Rei Tjoeng from Sharp Devices revealed some interesting information regarding automotive-grade LCDs, the recent trends, and specific characteristics that make some LCD displays different from the others available in the market.

A. Adoption of TFT in 2-wheeler cluster applications has increased in a big way. The global automotive industry is widely believed to be on the cusp of tremendous change in terms of manufacturing, sales, and the overall business model, owing to the rapid advances in new-age technologies such as autonomous driving, augmented reality, and big data.

Advanced driver-assistance systems (ADAS)—such as parking assistance, forward collision, lane-departure warnings, and blind-spot monitoring—are frequently hailed as the technologies that will usher us into an age of autonomous transportation, but drivers are still either untrusting or too trusting of these features. This has led to an evolution of sorts in the in-car user experience interfaces, and more so with the way automotive display makers are developing new products.

The future for ergonomic conformal displays, display-based dash, central console, in-door wing mirrors, and transparent displays that offer unobtrusive visual information during journeys is bright. Head-up displays are fast gaining popularity as an ideal interface for disseminating crucial information such as navigation messages, vehicle speed, and warnings.

A. Yes, reflective LCDs, which use ambient light to reflect in order to read. In 2W cluster applications, where TFT is exposed to direct sunlight, readability is a major issue. Sharp Reflective LCD is a solution as visibility is crystal clear without any glare and is available in colour too. Equipped with a backlight, it can be used at night also.

Normal TFT has to pump more power through the backlight, which results in more power consumption and backlight life also gets affected to a large extent. This reflective LCD consumes very little power and could be the best fit-in product for the EV segment.

Q. One of the first fears that come to one’s mind when we see a large tablet-like display in cars is of its breaking. But what is the actual risk of these screens breaking?

A. The market is now shifting to large-size TFT displays in the automotive segment. These displays are automotive-grade LCDs and are tested for shock, vibration, high and low temperature, etc. For more protection and safety, glass bonding is done over TFT. Glass bonding with a cover glass on the LCD protects it from shock, as the hardened adhesive behind the glass acts as a shock absorber. Shakes and shocks are less likely to damage the display and glass, making this an important benefit for transportation applications. In the unlikely event that the glass is damaged, shards of broken glass will remain stuck to the optical adhesive.

Q. Reflection or glaring sunlight sometimes makes it difficult to read the displays. Any innovation introduced recently, or underway, that may solve this issue?

A. Reflective LCD and Progressive Super View are the two technologies which are effective under high ambient light. In progressive super view technology, internal and external reflection is cut down, which results in a clear view without glare. And the beauty of this technology is that it happens without pumping more power from the backlight. This helps in more lifetime of the backlight and less power consumption.

Reflective LCD is another technology that uses ambient light to reflect in order to read, hence there is more clarity under sunlight and very less power is needed. It is more beneficial for EV applications.

A. The smartphone has become very popular in recent years and it is influencing the engineers’ design. We saw some EV companies use the smartphone LCD as the cluster or GPS display for their first-generation products. The smartphone LCD is nice but, unfortunately, it is not designed for automotive applications, especially not for 2-wheeler outdoor usage. When the 2-wheeler is under the sunshine, the driver can barely see anything from the smartphone LCD. And, also, the smartphone LCD’s lifetime becomes much shorter under the automotive application scenario.

A. Sharp Singapore has been in this region for many years. We understand our customers. First, our team will get the customer’s requirements from both the marketing and engineering sides. We will check the customer’s motherboard’s graphics capability, display interface, and other necessary technical details. We will propose the best suitable LCDs to the customer and explain the reason. We will explain what we observe from the market trend and help the customer to know the best options.

Q. Do you have some form of sampling programme for them to receive samples during their prototyping stages? Do you have development or evaluation kits for your LCD displays?

Get rich colors, detailed images, and bright graphics from an LCD with a TFT screen. Our standard Displaytech TFT screens start at 1” through 7” in diagonal size and have a variety of display resolutions to select from. Displaytech TFT displays meet the needs for products within industrial, medical, and consumer applications.

TFT displays are LCD modules with thin-film transistor technology. The TFT display technology offers full color RGB showcasing a range of colors and hues. These liquid crystal display panels are available with touchscreen capabilities, wide viewing angles, and bright luminance for high contrast.

Our TFT displays have LVDS, RGB, SPI, and MCU interfaces. All Displaytech TFT LCD modules include an LED backlight, FPC, driver ICs, and the LCD panel.

We offer resistive and capacitive touch screens for our 2.8” and larger TFT modules. Our TFT panels have a wide operating temperature range to suit a variety of environments. All Displaytech LCDs are RoHS compliant.

We also offer semi-customization to our standard TFT screens. This is a cost-optimized solution to make a standard product better suit your application’s needs compared to selecting a fully custom TFT LCD. Customizations can focus on cover glass, mounting / enclosures, and more - contact us to discuss your semi-custom TFT solution.

The global TFT-LCD display panel market attained a value of USD 181.67 billion in 2022. It is expected to grow further in the forecast period of 2023-2028 with a CAGR of 5.2% and is projected to reach a value of USD 246.25 billion by 2028.

The current global TFT-LCD display panel market is driven by the increasing demand for flat panel TVs, good quality smartphones, tablets, and vehicle monitoring systems along with the growing gaming industry. The global display market is dominated by the flat panel display with TFT-LCD display panel being the most popular flat panel type and is being driven by strong demand from emerging economies, especially those in Asia Pacific like India, China, Korea, and Taiwan, among others. The rising demand for consumer electronics like LCD TVs, PCs, laptops, SLR cameras, navigation equipment and others have been aiding the growth of the industry.

TFT-LCD display panel is a type of liquid crystal display where each pixel is attached to a thin film transistor. Since the early 2000s, all LCD computer screens are TFT as they have a better response time and improved colour quality. With favourable properties like being light weight, slim, high in resolution and low in power consumption, they are in high demand in almost all sectors where displays are needed. Even with their larger dimensions, TFT-LCD display panel are more feasible as they can be viewed from a wider angle, are not susceptible to reflection and are lighter weight than traditional CRT TVs.

The global TFT-LCD display panel market is being driven by the growing household demand for average and large-sized flat panel TVs as well as a growing demand for slim, high-resolution smart phones with large screens. The rising demand for portable and small-sized tablets in the educational and commercial sectors has also been aiding the TFT-LCD display panel market growth. Increasing demand for automotive displays, a growing gaming industry and the emerging popularity of 3D cinema, are all major drivers for the market. Despite the concerns about an over-supply in the market, the shipments of large TFT-LCD display panel again rose in 2020.

North America is the largest market for TFT-LCD display panel, with over one-third of the global share. It is followed closely by the Asia-Pacific region, where countries like India, China, Korea, and Taiwan are significant emerging market for TFT-LCD display panels. China and India are among the fastest growing markets in the region. The growth of the demand in these regions have been assisted by the growth in their economy, a rise in disposable incomes and an increasing demand for consumer electronics.

The report gives a detailed analysis of the following key players in the global TFT-LCD display panel Market, covering their competitive landscape, capacity, and latest developments like mergers, acquisitions, and investments, expansions of capacity, and plant turnarounds:

The new line of 3.5” TFT displays with IPS technology is now available! Three touchscreen options are available: capacitive, resistive, or without a touchscreen.

1971 – Lechner, F. J. Marlowe, E. O. Nester, and J. Tults demonstrated a 2-by-18 matrix display driven by a hybrid circuit using the dynamic scattering mode of LCDs

2020 – TFT LCD display technology dominants the display market now. Within the last 20 years, it has wiped out the market of CRT (cathode-ray tube) and Plasma. The only challenges are OLED (organic light-emitting diode)and Micro LED (Maybe, still in lab).

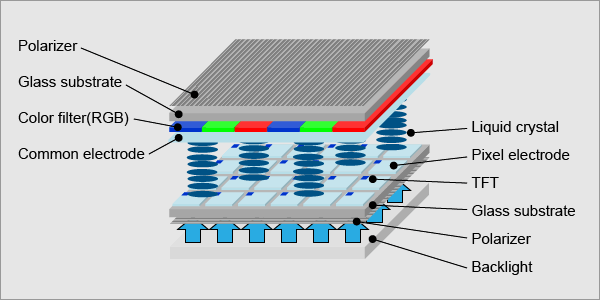

TFT LCD Display (Thin-Film-Transistor Liquid Crystal Display) technology has a sandwich-like structure with liquid crystal material filled between two glass plates. Two polarizer filters, color filters (RGB, red/green/blue) and two alignment layers determine exactly the amount of light is allowed to pass and which colors are created.

Each pixel in an active matrix is paired with a transistor that includes a capacitor which gives each sub-pixel the ability to retain its charge, instead of requiring an electrical charge sent each time it needed to be changed. The TFT layer controls light flow a color filter displays the color and a top layer houses your visible screen.

Utilizing an electrical charge that causes the liquid crystal material to change their molecular structure allowing various wavelengths of backlight to “pass-through”. The active matrix of the TFT display is in constant flux and changes or refreshes rapidly depending upon the incoming signal from the control device.

The pixels of TFT displays are determined by the underlying density (resolution) of the color matrix and TFT layout. The more pixels the higher detail is available.Available screen size, power consumption, resolution, interface (how to connect) define the TFT displays.

The pixels of TFT displays are determined by the underlying density (resolution) of the color matrix and TFT layout. The more pixels the higher detail is available. Available screen size, power consumption, resolution, interface (how to connect) define the TFT displays.

The TFT screen itself can’t emit light like OLED display, it has to be used with a back-light of white bright light to generate the picture. Newer panels utilize LED backlight (light emitting diodes) to generate their light and therefore utilize less power and require less depth by design.

Twisted Nematic (TN) panels are a rather inexpensive display technology in which each pixel consists of rod-shaped liquid crystals that are aligned horizontally to the image layer and allow light from the backlight to pass through. When a voltage is applied to the pixels, the orientation of the liquid crystals changes. The higher the voltage, the more perpendicular the rods are to the image layer, preventing the light from the backlight from "shining through". TN displays can be used, for example, in cash registers or kiosk systems where the user usually looks at the display from the front and for this reason an extended viewing angle from all directions is not required.

A thin-film-transistor liquid-crystal display (TFT LCD) is a variant of a liquid-crystal display that uses thin-film-transistor technologyactive matrix LCD, in contrast to passive matrix LCDs or simple, direct-driven (i.e. with segments directly connected to electronics outside the LCD) LCDs with a few segments.

In February 1957, John Wallmark of RCA filed a patent for a thin film MOSFET. Paul K. Weimer, also of RCA implemented Wallmark"s ideas and developed the thin-film transistor (TFT) in 1962, a type of MOSFET distinct from the standard bulk MOSFET. It was made with thin films of cadmium selenide and cadmium sulfide. The idea of a TFT-based liquid-crystal display (LCD) was conceived by Bernard Lechner of RCA Laboratories in 1968. In 1971, Lechner, F. J. Marlowe, E. O. Nester and J. Tults demonstrated a 2-by-18 matrix display driven by a hybrid circuit using the dynamic scattering mode of LCDs.T. Peter Brody, J. A. Asars and G. D. Dixon at Westinghouse Research Laboratories developed a CdSe (cadmium selenide) TFT, which they used to demonstrate the first CdSe thin-film-transistor liquid-crystal display (TFT LCD).active-matrix liquid-crystal display (AM LCD) using CdSe TFTs in 1974, and then Brody coined the term "active matrix" in 1975.high-resolution and high-quality electronic visual display devices use TFT-based active matrix displays.

The liquid crystal displays used in calculators and other devices with similarly simple displays have direct-driven image elements, and therefore a voltage can be easily applied across just one segment of these types of displays without interfering with the other segments. This would be impractical for a large display, because it would have a large number of (color) picture elements (pixels), and thus it would require millions of connections, both top and bottom for each one of the three colors (red, green and blue) of every pixel. To avoid this issue, the pixels are addressed in rows and columns, reducing the connection count from millions down to thousands. The column and row wires attach to transistor switches, one for each pixel. The one-way current passing characteristic of the transistor prevents the charge that is being applied to each pixel from being drained between refreshes to a display"s image. Each pixel is a small capacitor with a layer of insulating liquid crystal sandwiched between transparent conductive ITO layers.

The circuit layout process of a TFT-LCD is very similar to that of semiconductor products. However, rather than fabricating the transistors from silicon, that is formed into a crystalline silicon wafer, they are made from a thin film of amorphous silicon that is deposited on a glass panel. The silicon layer for TFT-LCDs is typically deposited using the PECVD process.

Polycrystalline silicon is sometimes used in displays requiring higher TFT performance. Examples include small high-resolution displays such as those found in projectors or viewfinders. Amorphous silicon-based TFTs are by far the most common, due to their lower production cost, whereas polycrystalline silicon TFTs are more costly and much more difficult to produce.

The twisted nematic display is one of the oldest and frequently cheapest kind of LCD display technologies available. TN displays benefit from fast pixel response times and less smearing than other LCD display technology, but suffer from poor color reproduction and limited viewing angles, especially in the vertical direction. Colors will shift, potentially to the point of completely inverting, when viewed at an angle that is not perpendicular to the display. Modern, high end consumer products have developed methods to overcome the technology"s shortcomings, such as RTC (Response Time Compensation / Overdrive) technologies. Modern TN displays can look significantly better than older TN displays from decades earlier, but overall TN has inferior viewing angles and poor color in comparison to other technology.

Most TN panels can represent colors using only six bits per RGB channel, or 18 bit in total, and are unable to display the 16.7 million color shades (24-bit truecolor) that are available using 24-bit color. Instead, these panels display interpolated 24-bit color using a dithering method that combines adjacent pixels to simulate the desired shade. They can also use a form of temporal dithering called Frame Rate Control (FRC), which cycles between different shades with each new frame to simulate an intermediate shade. Such 18 bit panels with dithering are sometimes advertised as having "16.2 million colors". These color simulation methods are noticeable to many people and highly bothersome to some.gamut (often referred to as a percentage of the NTSC 1953 color gamut) are also due to backlighting technology. It is not uncommon for older displays to range from 10% to 26% of the NTSC color gamut, whereas other kind of displays, utilizing more complicated CCFL or LED phosphor formulations or RGB LED backlights, may extend past 100% of the NTSC color gamut, a difference quite perceivable by the human eye.

Initial iterations of IPS technology were characterised by slow response time and a low contrast ratio but later revisions have made marked improvements to these shortcomings. Because of its wide viewing angle and accurate color reproduction (with almost no off-angle color shift), IPS is widely employed in high-end monitors aimed at professional graphic artists, although with the recent fall in price it has been seen in the mainstream market as well. IPS technology was sold to Panasonic by Hitachi.

IPS has since been superseded by S-IPS (Super-IPS, Hitachi Ltd. in 1998), which has all the benefits of IPS technology with the addition of improved pixel refresh timing.

In 2004, Hydis Technologies Co., Ltd licensed its AFFS patent to Japan"s Hitachi Displays. Hitachi is using AFFS to manufacture high end panels in their product line. In 2006, Hydis also licensed its AFFS to Sanyo Epson Imaging Devices Corporation.

A technology developed by Samsung is Super PLS, which bears similarities to IPS panels, has wider viewing angles, better image quality, increased brightness, and lower production costs. PLS technology debuted in the PC display market with the release of the Samsung S27A850 and S24A850 monitors in September 2011.

TFT dual-transistor pixel or cell technology is a reflective-display technology for use in very-low-power-consumption applications such as electronic shelf labels (ESL), digital watches, or metering. DTP involves adding a secondary transistor gate in the single TFT cell to maintain the display of a pixel during a period of 1s without loss of image or without degrading the TFT transistors over time. By slowing the refresh rate of the standard frequency from 60 Hz to 1 Hz, DTP claims to increase the power efficiency by multiple orders of magnitude.

Due to the very high cost of building TFT factories, there are few major OEM panel vendors for large display panels. The glass panel suppliers are as follows:

External consumer display devices like a TFT LCD feature one or more analog VGA, DVI, HDMI, or DisplayPort interface, with many featuring a selection of these interfaces. Inside external display devices there is a controller board that will convert the video signal using color mapping and image scaling usually employing the discrete cosine transform (DCT) in order to convert any video source like CVBS, VGA, DVI, HDMI, etc. into digital RGB at the native resolution of the display panel. In a laptop the graphics chip will directly produce a signal suitable for connection to the built-in TFT display. A control mechanism for the backlight is usually included on the same controller board.

The low level interface of STN, DSTN, or TFT display panels use either single ended TTL 5 V signal for older displays or TTL 3.3 V for slightly newer displays that transmits the pixel clock, horizontal sync, vertical sync, digital red, digital green, digital blue in parallel. Some models (for example the AT070TN92) also feature input/display enable, horizontal scan direction and vertical scan direction signals.

New and large (>15") TFT displays often use LVDS signaling that transmits the same contents as the parallel interface (Hsync, Vsync, RGB) but will put control and RGB bits into a number of serial transmission lines synchronized to a clock whose rate is equal to the pixel rate. LVDS transmits seven bits per clock per data line, with six bits being data and one bit used to signal if the other six bits need to be inverted in order to maintain DC balance. Low-cost TFT displays often have three data lines and therefore only directly support 18 bits per pixel. Upscale displays have four or five data lines to support 24 bits per pixel (truecolor) or 30 bits per pixel respectively. Panel manufacturers are slowly replacing LVDS with Internal DisplayPort and Embedded DisplayPort, which allow sixfold reduction of the number of differential pairs.

The bare display panel will only accept a digital video signal at the resolution determined by the panel pixel matrix designed at manufacture. Some screen panels will ignore the LSB bits of the color information to present a consistent interface (8 bit -> 6 bit/color x3).

With analogue signals like VGA, the display controller also needs to perform a high speed analog to digital conversion. With digital input signals like DVI or HDMI some simple reordering of the bits is needed before feeding it to the rescaler if the input resolution doesn"t match the display panel resolution.

Kawamoto, H. (2012). "The Inventors of TFT Active-Matrix LCD Receive the 2011 IEEE Nishizawa Medal". Journal of Display Technology. 8 (1): 3–4. Bibcode:2012JDisT...8....3K. doi:10.1109/JDT.2011.2177740. ISSN 1551-319X.

Brody, T. Peter; Asars, J. A.; Dixon, G. D. (November 1973). "A 6 × 6 inch 20 lines-per-inch liquid-crystal display panel". 20 (11): 995–1001. Bibcode:1973ITED...20..995B. doi:10.1109/T-ED.1973.17780. ISSN 0018-9383.

K. H. Lee; H. Y. Kim; K. H. Park; S. J. Jang; I. C. Park & J. Y. Lee (June 2006). "A Novel Outdoor Readability of Portable TFT-LCD with AFFS Technology". SID Symposium Digest of Technical Papers. AIP. 37 (1): 1079–82. doi:10.1889/1.2433159. S2CID 129569963.

Kim, Sae-Bom; Kim, Woong-Ki; Chounlamany, Vanseng; Seo, Jaehwan; Yoo, Jisu; Jo, Hun-Je; Jung, Jinho (15 August 2012). "Identification of multi-level toxicity of liquid crystal display wastewater toward Daphnia magna and Moina macrocopa". Journal of Hazardous Materials. Seoul, Korea; Laos, Lao. 227–228: 327–333. doi:10.1016/j.jhazmat.2012.05.059. PMID 22677053.

Global Thin Film Transistor (TFT) Display Market, By Technology (Plasma Display (PDP), Organic Light Emitting Diode (OLED), Other), Type (Twisted Nematic, In-Plane Switching, Advanced Fringe Field Switching, Multi-Domain Vertical Alignment, Advanced Super View, Cell Technology), Panel Type (A_MVA, ASV, MVA, S_PVA, P-IPS), End Use (Domestic Use, Industrial Use) – Industry Trends and Forecast to 2029

Liquid crystal are considered highly light valves or electo-optic transducers. These thin film transistors are known to be simple electronic control devices widely fabricated on a large transparent substrates. They enable fabrication of electronic display.

Global Thin Film Transistor (TFT) Display Market was valued at USD 270.26 million in 2021 and is expected to reach USD 968.64 million by 2029, registering a CAGR of 17.30% during the forecast period of 2022-2029. Twisted Nematic accounts for the largest type segment in the respective market owing to its low cost. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

A thin-film-transistor display refers to a form of LCD that uses TFT technology for enhancing image quality including addressability and contrast. These displays are commonly utilized in mobile phones, handheld video game systems, projectors, computer monitors, television screens, navigation systems and personal digital assistants.

Technology (Plasma Display (PDP), Organic Light Emitting Diode (OLED), Other), Type (Twisted Nematic, In-Plane Switching, Advanced Fringe Field Switching, Multi-Domain Vertical Alignment, Advanced Super View, Cell Technology), Panel Type (A_MVA, ASV, MVA, S_PVA, P-IPS), End Use (Domestic Use, Industrial Use)

Panasonic Corporation (Japan), LG Display Co., Ltd (South Korea), HannStar Display Corporation (Taiwan), AU Optronics Corp. (Taiwan), Chi Mei Corporation. (Taiwan), SAMSUNG (South Korea), SHARP CORPORATION (Japan), Schneider Electric (France), Siemens (Germany), Mitsubishi Electric Corporation (Japan), SONY INDIA. (India), FUJITSU (Japan), Chunghwa Picture Tubes, LTD. (Taiwan), Barco.(Belgium), BOE Technology Group Co., Ltd. (China), Innolux Corporation (Taiwan), Advantech Co., Ltd (Taiwan), among others.

The increase in the smartphone and tablet proliferation acts as one of the major factors driving the growth of thin film transistor (TFT) display market. Technological advancements are leading a radical shift from traditional slow, bulky and imprecise resistive mono touch to highly sensitive multi-touch capacitive screen have a positive impact on the industry.

The rise in number of electronic readers and growing demand for on-the-move information accelerate the market growth. The development of easy-to-use display devices drives the growth of the market.

The increase in application areas of large e thin film transistor (TFT) display due to the advantages offered by these paper displays in terms of user experience, manufacturing cost, readability, and energy consumption further influence the market.

Additionally, rapid urbanization, change in lifestyle, surge in investments and increased consumer spending positively impact the thin film transistor (TFT) display market.

On the other hand, high cost associated with the manufacturing is expected to obstruct market growth. Also, lack of awareness and low refresh rate are projected to challenge the thin film transistor (TFT) display market in the forecast period of 2022-2029.

This thin film transistor (TFT) display market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on thin film transistor (TFT) display market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

The COVID-19 has impacted thin film transistor (TFT) display market. The limited investment costs and lack of employees hampered sales and production of electronic paper (e-paper) display technology. However, government and market key players adopted new safety measures for developing the practices. The advancements in the technology escalated the sales rate of the thin film transistor (TFT) display as it targeted the right audience. The increase in sales of devices such as smart phones and tablets across the globe is expected to further drive the market growth in the post-pandemic scenario.

The thin film transistor (TFT) display market is segmented on the basis of technology, type, panel type and end-use. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

The thin film transistor (TFT) display market is analysed and market size insights and trends are provided by country, technology, type, panel type and end-use as referenced above.

The countries covered in the thin film transistor (TFT) display market report are U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA).

North America dominates the thin film transistor (TFT) display market because of the introduction of advanced technology along with rising disposable income of the people within the region.

The thin film transistor (TFT) display market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies" focus related to thin film transistor (TFT) display market.

BOE was the leading manufacturer of large-area TFT LCD display units worldwide in 2020, accounting for approximately 27.7 percent of global unit shipments. LG Display and Innolux Corp. rounded out the top three manufacturing companies that year, with a shipment share of 14.1 and 13.7 percent, respectively.

Thin-film transistor (TFT) displays are flat-panel LCD displays in which each pixel on the screen is individually controlled by one or multiple transistors. These transistors act as individual electronic switches that allow pixels to change state more quickly, resulting in faster response rates, clear resolution, and easily controlled vibrant colors. Global shipments of TFT LCD displays have increased in recent years, reaching an all-time high of over 771 million units in 2019. However, recent data projects a growing oversupply in the years to come, as consumer demand for large TFT LCD TV and monitor devices is not expected to meet production capacity.

BOE Technology has shipped the largest quantities of large-area TFT LCD displays worldwide since 2018. The Chinese company provides interface devices, smart IoT systems and smart medicine technologies, but it is its work in the display industry that has helped the panel maker build a global reputation. With the commissioning of the world’s first gen 10.5 TFT LCD production line in 2018, BOE accelerated the mass production of large TFT LCD panels and surpassed its biggest competitor LG Display for the first time.Read moreShare of global large-area TFT LCD display unit shipments from 2016 to 2020, by manufacturerCharacteristicBOELG DisplayInnolux Corp.AUOSamsungChina StarOthers--------

IHS, & Website (Display Daily). (March 30, 2020). Share of global large-area TFT LCD display unit shipments from 2016 to 2020, by manufacturer [Graph]. In Statista. Retrieved December 22, 2022, from https://www.statista.com/statistics/612991/global-large-area-tft-lcd-display-share/

IHS, und Website (Display Daily). "Share of global large-area TFT LCD display unit shipments from 2016 to 2020, by manufacturer." Chart. March 30, 2020. Statista. Accessed December 22, 2022. https://www.statista.com/statistics/612991/global-large-area-tft-lcd-display-share/

IHS, Website (Display Daily). (2020). Share of global large-area TFT LCD display unit shipments from 2016 to 2020, by manufacturer. Statista. Statista Inc.. Accessed: December 22, 2022. https://www.statista.com/statistics/612991/global-large-area-tft-lcd-display-share/

IHS, and Website (Display Daily). "Share of Global Large-area Tft Lcd Display Unit Shipments from 2016 to 2020, by Manufacturer." Statista, Statista Inc., 30 Mar 2020, https://www.statista.com/statistics/612991/global-large-area-tft-lcd-display-share/

IHS & Website (Display Daily), Share of global large-area TFT LCD display unit shipments from 2016 to 2020, by manufacturer Statista, https://www.statista.com/statistics/612991/global-large-area-tft-lcd-display-share/ (last visited December 22, 2022)

According to IMARC Group’s latest report, titled “TFT LCD Panel Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2022-2027”, the global TFT LCD panel market size reached US$ 157 Billion in 2021. Looking forward, IMARC Group expects the market to reach US$ 207.6 Billion by 2027, exhibiting a growth rate (CAGR) of 4.7% during 2022-2027.

A thin-film-transistor liquid-crystal display (TFT LCD) panel is a liquid crystal display that is generally attached to a thin film transistor. It is an energy-efficient product variant that offers a superior quality viewing experience without straining the eye. Additionally, it is lightweight, less prone to reflection and provides a wider viewing angle and sharp images. Consequently, it is generally utilized in the manufacturing of numerous electronic and handheld devices. Some of the commonly available TFT LCD panels in the market include twisted nematic, in-plane switching, advanced fringe field switching, patterned vertical alignment and an advanced super view.

The global market is primarily driven by continual technological advancements in the display technology. This is supported by the introduction of plasma enhanced chemical vapor deposition (PECVD) technology to manufacture TFT panels that offers uniform thickness and cracking resistance to the product. Along with this, the widespread adoption of the TFT LCD panels in the production of automobiles dashboards that provide high resolution and reliability to the driver is gaining prominence across the globe. Furthermore, the increasing demand for compact-sized display panels and 4K television variants are contributing to the market growth. Moreover, the rising penetration of electronic devices, such as smartphones, tablets and laptops among the masses, is creating a positive outlook for the market. Other factors, including inflating disposable incomes of the masses, changing lifestyle patterns, and increasing investments in research and development (R&D) activities, are further projected to drive the market growth.

The competitive landscape of the TFT LCD panel market has been studied in the report with the detailed profiles of the key players operating in the market.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Large-area TFT LCD panel shipments decreased by 10% Month on Month (MoM) and 5% Year on Year (YoY) in April, to 74.1million units, representing historically low shipment performance since May 2020. Omdia defines large-area TFT LCD displays as larger than 9 inches.

"With continued ramifications from the pandemic, demand for IT panels for monitors and notebook PCs remained strong in 4Q21. But as the market became saturated starting in 2022, IT panel shipments started slowing in 1Q22 and early 2Q22," said Robin Wu, Principal Analyst for Large Area Display & Production, Omdia.

About OmdiaOmdia is a leading research and advisory group focused on the technology industry. With clients operating in over 120 countries, Omdia provides market-critical data, analysis, advice, and custom consulting.

One of the industry’s leading oxide panel makers selected Astra Glass as its backplane glass substrate because it has the inherent fidelity to thrive in high-temperature oxide-TFT glass fabrication for immersive high-performance displays.

One of the industry’s leading oxide panel makers selected Astra Glass as its backplane glass substrate because it has the inherent fidelity to thrive in high-temperature oxide-TFT glass fabrication for immersive high-performance displays.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey