lcd panel market share 2017 in stock

BOE was the leading LCD TV panel vendor during the first half of 2020, having shipped approximately 23.26 million units worldwide. In that period, global shipments of LCD TV panels totaled over 115 million units.

BOE Technology, founded in 1993, has become China’s largest TV panel maker and it continues to make a name for itself in the global consumer electronics market. It was the first company to introduce a gen 10.5 LCD plant in late 2017. Since then, BOE’s LCD panel production capacity has grown annually, surpassing former leading manufacturer LG Display. In recent years, BOE accounted for over 20 percent of large-area TFT LCD display unit shipments worldwide.

Chinese panel makers accelerate worldwide LCD TV panel shipmentsChina became the leading LCD panel producer worldwide in 2017, overtaking powerhouses South Korea and Taiwan. Chinese shipments of LCD TV panels 60-inch and larger have also increased significantly in recent years, with roughly 2.24 million units sold in the first quarter of 2019 worldwide, in comparison to just 117,000 units a year before. This figure is forecast to increase in the future, paving the way for Chinese panel makers’ worldwide success. At the same time, the concurrent specialization on large LCD panels by Chinese and South Korean suppliers will likely push down panel prices.Read moreGlobal LCD TV panel unit shipments from H1 2016 to H1 2020, by vendor(in millions)tablecolumn chartCharacteristicBOELGDInnoluxCSOTSDCAUOCEC GroupOthers1H 202023.2611.7920.3421.312.1310.14-16.17

TrendForce. (July 28, 2020). Global LCD TV panel unit shipments from H1 2016 to H1 2020, by vendor (in millions) [Graph]. In Statista. Retrieved December 22, 2022, from https://www.statista.com/statistics/760270/global-market-share-of-led-lcd-tv-vendors/

TrendForce. "Global LCD TV panel unit shipments from H1 2016 to H1 2020, by vendor (in millions)." Chart. July 28, 2020. Statista. Accessed December 22, 2022. https://www.statista.com/statistics/760270/global-market-share-of-led-lcd-tv-vendors/

TrendForce. (2020). Global LCD TV panel unit shipments from H1 2016 to H1 2020, by vendor (in millions). Statista. Statista Inc.. Accessed: December 22, 2022. https://www.statista.com/statistics/760270/global-market-share-of-led-lcd-tv-vendors/

TrendForce. "Global Lcd Tv Panel Unit Shipments from H1 2016 to H1 2020, by Vendor (in Millions)." Statista, Statista Inc., 28 Jul 2020, https://www.statista.com/statistics/760270/global-market-share-of-led-lcd-tv-vendors/

TrendForce, Global LCD TV panel unit shipments from H1 2016 to H1 2020, by vendor (in millions) Statista, https://www.statista.com/statistics/760270/global-market-share-of-led-lcd-tv-vendors/ (last visited December 22, 2022)

In 2019 and 2020, BOE was the leading manufacturer in the monitor display panel market, holding 25 and 26 percent of the market, respectively. LG Display, the South Korean panel maker, ranked second, with a 21 percent share. The market share of another South Korean company, Samsung Display, was forecast to drop to one percent in 2021.Read moreMonitor display panel market share worldwide from 2019 to 2021, by supplierCharacteristicLGDBOESDCINXAUOCECCSOTHKC---------

TrendForce. (January 11, 2021). Monitor display panel market share worldwide from 2019 to 2021, by supplier [Graph]. In Statista. Retrieved December 22, 2022, from https://www.statista.com/statistics/1124858/global-display-panel-vendor-monitor/

TrendForce. "Monitor display panel market share worldwide from 2019 to 2021, by supplier." Chart. January 11, 2021. Statista. Accessed December 22, 2022. https://www.statista.com/statistics/1124858/global-display-panel-vendor-monitor/

TrendForce. (2021). Monitor display panel market share worldwide from 2019 to 2021, by supplier. Statista. Statista Inc.. Accessed: December 22, 2022. https://www.statista.com/statistics/1124858/global-display-panel-vendor-monitor/

TrendForce. "Monitor Display Panel Market Share Worldwide from 2019 to 2021, by Supplier." Statista, Statista Inc., 11 Jan 2021, https://www.statista.com/statistics/1124858/global-display-panel-vendor-monitor/

TrendForce, Monitor display panel market share worldwide from 2019 to 2021, by supplier Statista, https://www.statista.com/statistics/1124858/global-display-panel-vendor-monitor/ (last visited December 22, 2022)

LCD TV Panel Market is 2022 Research Report on Global professional and comprehensive report on the LCD TV Panel Market. The report monitors the key trends and market drivers in the current scenario and offers on the ground insights. Top Key Players are – Samsung Display, LG Display, Innolux Crop., AUO, CSOT, BOE, Sharp, Panasonic, CEC-Panda.

Global “LCD TV Panel Market” (2022-2028) the report additionally centers around worldwide significant makers of the LCD TV Panel market with important data, such as, company profiles, segmentation information, challenges and limitations, driving factors, value, cost, income and contact data. Upstream primitive materials and hardware, coupled with downstream request examination is likewise completed. The Global LCD TV Panel market improvement patterns and marketing channels are breaking down. In conclusion, the attainability of new speculation ventures is surveyed and in general, the research ends advertised.

Global LCD TV Panel Market Report 2022 is spread across 117 pages and provides exclusive vital statistics, data, information, trends and competitive landscape details in this niche sector.

The information for each competitor includes – Company Profile, Main Business Information, SWOT Analysis, Sales, Revenue, Price and Gross Margin, Market Share.

LCD displays utilize two sheets of polarizing material with a liquid crystal solution between them. An electric current passed through the liquid causes the crystals to align so that light cannot pass through them. Each crystal, therefore, is like a shutter, either allowing light to pass through or blocking the light. LCD panel is the key components of LCD display. And the price trends of LCD panel directly affect the price of liquid crystal displays. LCD panel consists of several components: Glass substrate, drive electronics, polarizers, color filters etc. Only LCD panel applied for TV will be counted in this report.

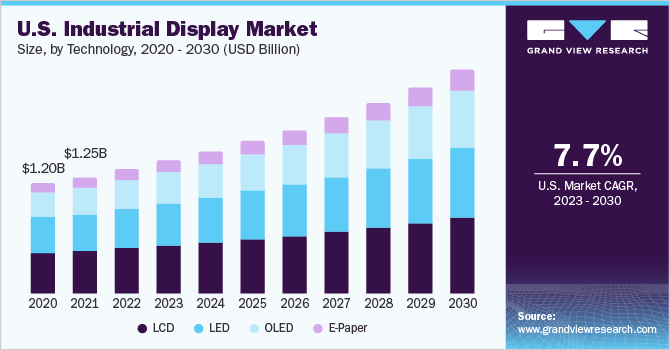

Due to the COVID-19 pandemic, the global LCD TV Panel market size is estimated to be worth USD 53490 million in 2021 and is forecast to a readjusted size of USD 53490 million by 2028 with a CAGR of 2.2% during the review period. Fully considering the economic change by this health crisis, by Size accounting for (%) of the LCD TV Panel global market in 2021, is projected to value USD million by 2028, growing at a revised (%) CAGR in the post-COVID-19 period. While by Size segment is altered to an (%) CAGR throughout this forecast period.

Global LCD TV Panel key players include Samsung Display, LG Display, Innolux Crop, AUO, CSOT, etc. Global top five manufacturers hold a share over 80%.

The global LCD TV Panel market is segmented by company, region (country), by Size and by Application. Players, stakeholders, and other participants in the global LCD TV Panel market will be able to gain the upper hand as they use the report as a powerful resource. The segmental analysis focuses on sales, revenue and forecast by region (country), by Size and by Application for the period 2017-2028.

Global LCD TV Panel market analysis and market size information is provided by regions (countries). Segment by Application, the LCD TV Panel market is segmented into United States, Europe, China, Japan, Southeast Asia, India and Rest of World. The report includes region-wise LCD TV Panel market forecast period from history 2017-2028. It also includes market size and forecast by players, by Type, and by Application segment in terms of sales and revenue for the period 2017-2028.

The report introduced the LCD TV Panel basics: definitions, classifications, applications and market overview; product specifications; manufacturing processes; cost structures, raw materials and so on. Then it analyzed the world’s main region market conditions, including the product price, profit, capacity, production, supply, demand and market growth rate and forecast etc. In the end, the report introduced new project SWOT analysis, investment feasibility analysis, and investment return analysis.

LCD TV Panel market size competitive landscape provides details and data information by players. The report offers comprehensive analysis and accurate statistics on revenue by the player for the period 2017-2021. It also offers detailed analysis supported by reliable statistics on revenue (global and regional level) by players for the period 2017-2021. Details included are company description, major business, company total revenue and the sales, revenue generated in LCD TV Panel business, the date to enter into the LCD TV Panel market, LCD TV Panel product introduction, recent developments, etc.

The report offers detailed coverage of LCD TV Panel industry and main market trends with impact of coronavirus. The market research includes historical and forecast market data, demand, application details, price trends, and company shares of the leading LCD TV Panel by geography. The report splits the market size, by volume and value, on the basis of application type and geography. Report covers the present status and the future prospects of the global LCD TV Panel market for 2017-2028.

Global LCD TV Panel Market report forecast to 2028 is a professional and comprehensive research report on the world’s major regional market conditions, focusing on the main regions (North America, Europe and Asia-Pacific) and the main countries (United States, Germany, United Kingdom, Japan, South Korea and China).

The recent COVID-19 outbreak first began in Wuhan (China) in December 2019, and since then, it has spread around the globe at a fast pace. China, Italy, Iran, Spain, the Republic of Korea, France, Germany, and the US are among the worst-affected countries in terms of positive cases and reported deaths, as of March 2020. The COVID-19 outbreak has affected economies and industries in various countries due to lockdowns, travel bans, and business shutdowns. The global food and beverage industry is one of the major industries facing serious disruptions such as supply chain breaks, technology events cancellations, and office shutdowns as a result of this outbreak. China is the global manufacturing hub, with the presence of and the largest raw material suppliers. The overall market breaks down due to COVID-19 is also affecting the growth of thebaconmarket due to shutting down of factories, obstacle in supply chain, and downturn in world economy.

To Know How COVID-19 Pandemic Will Impact LCD TV Panel Market/Industry- Request a sample copy of the report-https://www.researchreportsworld.com/enquiry/request-covid19/21019731

The report offers exhaustive assessment of different region-wise and country-wise LCD TV Panel market such as U.S., Canada, Germany, France, U.K., Italy, Russia, China, Japan, South Korea, India, Australia, Taiwan, Indonesia, Thailand, Malaysia, Philippines, Vietnam, Mexico, Brazil, Turkey, Saudi Arabia, U.A.E, etc. Key regions covered in the report are North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa.

For the period 2017-2028, the report provides country-wise revenue and volume sales analysis and region-wise revenue and volume analysis of the global LCD TV Panel market. For the period 2017-2021, it provides sales (consumption) analysis and forecast of different regional markets by Application as well as by Type in terms of volume.

What are the market opportunities and threats faced by the vendors in the global LCD TV Panel market? What industrial trends, drivers, and challenges are manipulating its growth?

Comprehensive company profiles covering the product offerings, key financial information, recent developments, SWOT analysis, and strategies employed by the major market players.

With tables and figures helping analyze worldwide Global LCD TV Panel market trends, this research provides key statistics on the state of the industry and is a valuable source of guidance and direction for companies and individuals interested in the market.

Research Reports World – is the credible source for gaining the market reports that will provide you with the lead your business needs. At Research Reports World, our objective is providing a platform for many top-notch market research firms worldwide to publish their research reports, as well as helping the decision makers in finding most suitable market research solutions under one roof. Our aim is to provide the best solution that matches the exact customer requirements. This drives us to provide you with custom or syndicated research reports.

"TFT LCD Panel Market" report presents a comprehensive overview, market shares, and growth opportunities of TFT LCD Panel market by product type, application, key manufacturers and key regions and countries. The global TFT LCD Panel market size is projected to reach Multimillion USD by 2028, in comparision to 2021, at unexpected CAGR during 2022-2028.

TFT LCD PanelMarket Research Report is spread across 100 Pages with 145 Number of Tables and Figures that provides exclusive data, information, vital statistics, trends, and competitive landscape details in this niche sector.

In light of COVID-19, the report includes a range of factors that impacted the market. It also discusses the trends. Based on the upstream and downstream markets, the report precisely covers all factors, including an analysis of the supply chain, consumer behavior, demand, etc. Our report also describes how vigorously COVID-19 has affected diverse regions and significant nations.

The Global TFT LCD Panel market is anticipated to rise at a considerable rate during the forecast period, between 2022 and 2028. In 2020, the market is growing at a steady rate and with the rising adoption of strategies by key players, the market is expected to rise over the projected horizon.

Thin film transistors (TFT) is an active-matrix LCD accompanied by an improved image-quality where one of the transistor for every pixel operates the illumination of the display permitting an easy view even in bright surroundings.

This report focuses on global and United States TFT LCD Panel market, also covers the segmentation data of other regions in regional level and county level.

Due to the COVID-19 pandemic, the global TFT LCD Panel market size is estimated to be worth USD 131490 million in 2022 and is forecast to a readjusted size of USD 174200 million by 2028 with a CAGR of 4.8% during the review period. Fully considering the economic change by this health crisis, by Type, Small-Sized accounting for % of the TFT LCD Panel global market in 2021, is projected to value USD million by 2028, growing at a revised % CAGR in the post-COVID-19 period. While by Application, Televisions was the leading segment, accounting for over percent market share in 2021, and altered to an % CAGR throughout this forecast period.

In United States the TFT LCD Panel market size is expected to grow from USD million in 2021 to USD million by 2028, at a CAGR of % during the forecast period.

TFT LCD Panel market is segmented by region (country), players, by Type and by Application. Players, stakeholders, and other participants in the global TFT LCD Panel market will be able to gain the upper hand as they use the report as a powerful resource. The segmental analysis focuses on revenue and forecast by region (country), by Type and by Application for the period 2017-2028.

For United States market, this report focuses on the TFT LCD Panel market size by players, by Type and by Application, for the period 2017-2028. The key players include the global and local players, which play important roles in United States.

Report further studies the market development status and future TFT LCD Panel Market trend across the world. Also, it splits TFT LCD Panel market Segmentation by Type and by Applications to fully and deeply research and reveal market profile and prospects.

On the basis of the end users/applicationsthis report focuses on the status and outlook for major applications/end users, consumption (sales), market share and growth rate for each application, including:

Geographically, this report is segmented into several key regions, with sales, revenue, market share and growth Rate of TFT LCD Panel in these regions, from 2015 to 2027, covering ● North America (United States, Canada and Mexico)

Some of the key questions answered in this report: ● What is the global (North America, Europe, Asia-Pacific, South America, Middle East and Africa) sales value, production value, consumption value, import and export of TFT LCD Panel?

● Who are the global key manufacturers of the TFT LCD Panel Industry? How is their operating situation (capacity, production, sales, price, cost, gross, and revenue)?

Our research analysts will help you to get customized details for your report, which can be modified in terms of a specific region, application or any statistical details. In addition, we are always willing to comply with the study, which triangulated with your own data to make the market research more comprehensive in your perspective.

Precision Reports is the credible source for gaining the market reports that will provide you with the lead your business needs. At Precision Reports, our objective is providing a platform for many top-notch market research firms worldwide to publish their research reports, as well as helping the decision makers in finding most suitable market research solutions under one roof. Our aim is to provide the best solution that matches the exact customer requirements. This drives us to provide you with custom or syndicated research reports.

Is there a problem with this press release? Contact the source provider Comtex at editorial@comtex.com. You can also contact MarketWatch Customer Service via our Customer Center.

WitsView, a division of TrendForce, reports that global LCD TV panel shipments increased quarter-by-quarter in 2017. The first half of 2017 showed less momentum for holiday sales due to high prices, but shipments rebounded in the second half, as prices declined and TV makers prepared for year-end sales. Moreover, new production capacities at BOE’s 8.5G fab in Fuqing and HKC’s 8.6G fab in Chongqing have been focusing on middle-size TV panels—43" and 32" respectively—bringing annual shipments beyond expectation to 263.83 million pieces, an increase of 1.3% compared with 2016.

Regarding new production capacity, BOE’s 10.5G fab produces mainly large-size TV panels (65" and 75"), but CEC’s two fabs still prioritise medium-sized panels (32" and 50").

Meanwhile, the replacement of CRT TV sets with 32" and 23.6" LCD panels is still ongoing in emerging markets, slowing average panel size growth to 45.8", only 1.3" up from 2017. Overall, global TV panel shipments in 2018 will have the chance to reach 269.49 million pieces, the second-highest figure of all time and an annual increase of 2.2%.

In the global TV panel shipment ranking for 2017, LG Display (LGD) came first place with shipments of around 50.85 million pieces, a decrease of 3.9%. LG expanded its production capacity by 50,000 sheets with its Guangzhou fab but, in terms of panel size, increasing the production capacity share of panels 65" and above has been the trend.

LG"s shipments of 65" and 75" panels have increased significantly by 38.5% and 132.7% respectively, indicating that the company has been making efforts to retain its market share in the large-size TV panel sector before BOE’s 10.5G fab enters mass production.

BOE deliberately slowed down its 32" TV panel production growth in 2017, so shipments increased by only 0.4%, totalling 43.81 million pieces. The company"s total shipments climbed up to second place for the first time, as Samsung’s closure of its L7-1 fab influenced its production. With BOE’s 8.5G fab in Fuqing entering mass production in the second quarter of 2017, BOE’s shipments of 43" TV panels grew by 247.6% last year.

Innolux’s 8.6G fab entered mass production in early 2017, but the yield rate and output were lower than expected in the first half of the year. In the second half, high pricing of panels led to shrinking demand, resulting in excess stocks. In addition, the company announced plans to enter the TV assembly market, which made its clients more conservative with their orders. Fortunately, Innolux figured out solutions for pricing and stock problems, and ended up with shipments of 41.8 million pieces, an increase of 0.2%, ranking third.

Samsung’ Display Corporation"s (SDC) shipments saw a substantial decline of 15.4% last year, since the closure of its L7-1 fab. Its overall TV panel shipments dipped to 39.6 million pieces, the highest decline among the six major panel makers. Although the company has dropped out of the top three, Samsung has improved capacity utilisation by simplifying its product mix, and has invested in production equipment for UHD and large-size panels to increase the value of its products. As for its product portfolio, the company took initiatives to develop UHD panels, which represented 54.6% of all Samsung products, and also remained a major supplier of large-size panels (55", 65" and 75"). Particularly, its market share in the 65" sector was as high as 36.3%.

China Star Optoelectronics Technology (CSOT) increased shipments after the capacity of the second phase of its second 8.5G fab was expanded to 140,000 substrates. The company recorded shipments of 38.64 million pieces, an increase of 16.8% compared with the previous year. Particularly, 55" panels recorded a 19.4% shipment growth, as CSOT’s capacity expansion focused on this size. The company recorded a 19.6% year-on-year increase, the highest among the six major panel makers.

TV panel shipments for AU Optronics (AUO) in 2017 came to around 27.21 million pieces, 0.1% down from the previous year. AUO continued to optimise its product portfolio and increased its proportion of large-size panels, recording a 5.1% growth of shipment area. In addition, the company also focused on increasing its proportion of UHD products up to 44%, the third-highest number following LG and Samsung.

LCD panel market is expecting several new large generation fabs in 2018. BOE has launched the world’s first Gen 10.5 fab, while CEC-CHOT’s Gen 8.6 fab and Gen 8.6+ fab of CEC-Panda Chengdu will also go into operation this year. WitsView, a division of TrendForce, says that there was a 20-40% downward correction in TV panel prices during 2017. While the price decline in the TV panel market will be easing in this year"s first half, this first quarter will still see the price trend on a gradual downward slope.

Falling panel prices will spur promotions in the end product market. Therefore, stock-up demand from TV brands will be warmer in this year’s second half compared with the second half of 2017. The supply and demand of TV panels are also expected to reach a more balanced state. Our latest analysis indicates that the risk of serious oversupply in the TV panel market will most likely to happen later in 2019.

Anita Wang, senior research manager of WitsView, points out that the new fab will have limited input in early stages, and will need time to improve field rate and production capacity. Therefore, Wang estimates that they will only contribute to 3% of the global glass input for large-size LCD panels. And the figure is expected to raise to 6-8% in 2019.

Going into operation on December 20th, 2017, BOE’s Gen 10.5 fab in Hefei is expected to enter mass production in March 2018. The major products will be large-size TV panels of 65" UHD 60Hz and 75" UHD 60Hz, intensifying the competition in large-size (65" or greater) TV panel market.

In the production of 65" TV panels, for instance, current Gen 6 fab cuts per glass substrate into 2 panels, while Gen 8.5 fab cuts into 3. In Gen 10.5 fab, however, the number rises to 8, increasing the productivity of 65" TV panels significantly.

WitsView forecasts that BOE’s Gen 10.5 fab will target at more than 2 million pieces for the production of 65" panels, but whether this goal can be achieved still depends on the improvement in yield rate. The Gen 10.5 fab will not have large-scale influences on the overall supply in the industry this year, but BOE will impact the market in 2019 with its shipments expected to reach 3 to 4 million pieces. In 2020, BOE is even predicted to surpass panel makers in South Korea and record the highest shipments for 65" panels, with its market share reaching around 37%. In comparison, the market share of Taiwanese panel makers for 65" panels will drop to 18% in 2020 without any capacity expansion.

The global retail display market research report provides a detailed analysis of the market by application (touchscreen retail displays and non- touchscreen retail displays), end-user (apparel and footwear, departmental stores, jewelry and watch, bags and luggage, and others), and geography (the Americas, APAC and EMEA). The report also provides an analysis of the market’s competitive landscape and offers information on several retail display companies including 3M, Adflow Networks, AU Optronics, Cisco, HP, Innolux, LG Display, Panasonic, Samsung, and Sharp.

The global retail display market research predicts the market to post a CAGR of more than 15% during the forecast period. The growing adoption of touch-enabled display devices will drive the prospects for retail display market growth for the next few years. It has been noted that most brick-and-mortar retailers have increased their interactions with consumers through IT kiosks and digital signage to remain competitive in the e-commerce sector. These touch-enabled kiosks allow consumers to browse through the available stock and order products. Also, since many outlets use touch-enabled tables to display their product range, a large number of companies have started to focus on introducing new technological advancements for retailers.

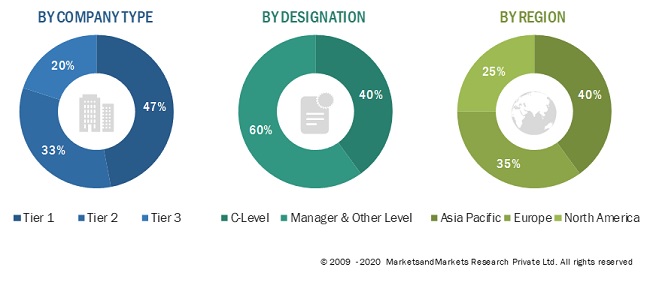

In terms of geography, APAC accounted for the maximum retail display market share during 2015. The increasing presence of a large number of leading vendors is one of the major retail display market drivers. Also, factors such as technological advancements and easy availability of skilledlaborboost the market’s growth across various countries of APAC. It has also been noted that the top three leading countries in the global retail display market are from this region.

The global retail display market is highly diversified and competitive due to the presence of a large number of local and international vendors. Since many local vendors enter the market with low-cost displays, they pose a stiff competition for the existing vendors. Also, since cheaper and conventional TV panels are replacing specialized custom products, the established vendors are coming up with innovations to survive in the market.

Other prominent vendors in the market include Cambridge Display Technology, DuPont Display, Elo Touch Solution, E Ink Holdings, Fujitsu, General Electric, Kent Displays, Mitsubishi Electric, NEC Display Solutions, Plastic Logic, Philips, Sony, Seiko Epson, Toshiba, TPK, and Universal Display.

The touchscreen displays segment in the retail sector accounted for the maximum retail display market share during 2015 and will continue to dominate the market for the next few years. One of the major factors responsible for the market segment’s growth is increasing technological advancements in touchscreen display products.

The departmental store segment accounted for the maximum market share during 2015. The market share is expected to decline during the forecast period due to the decrease in the adoption rate of touchscreen technology in department stores that require large-scale property investment and multi-brand involvement.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey