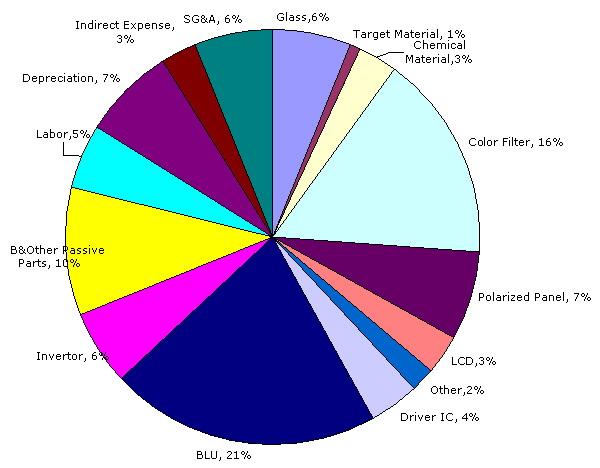

cost for an lcd panel manufacturer

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

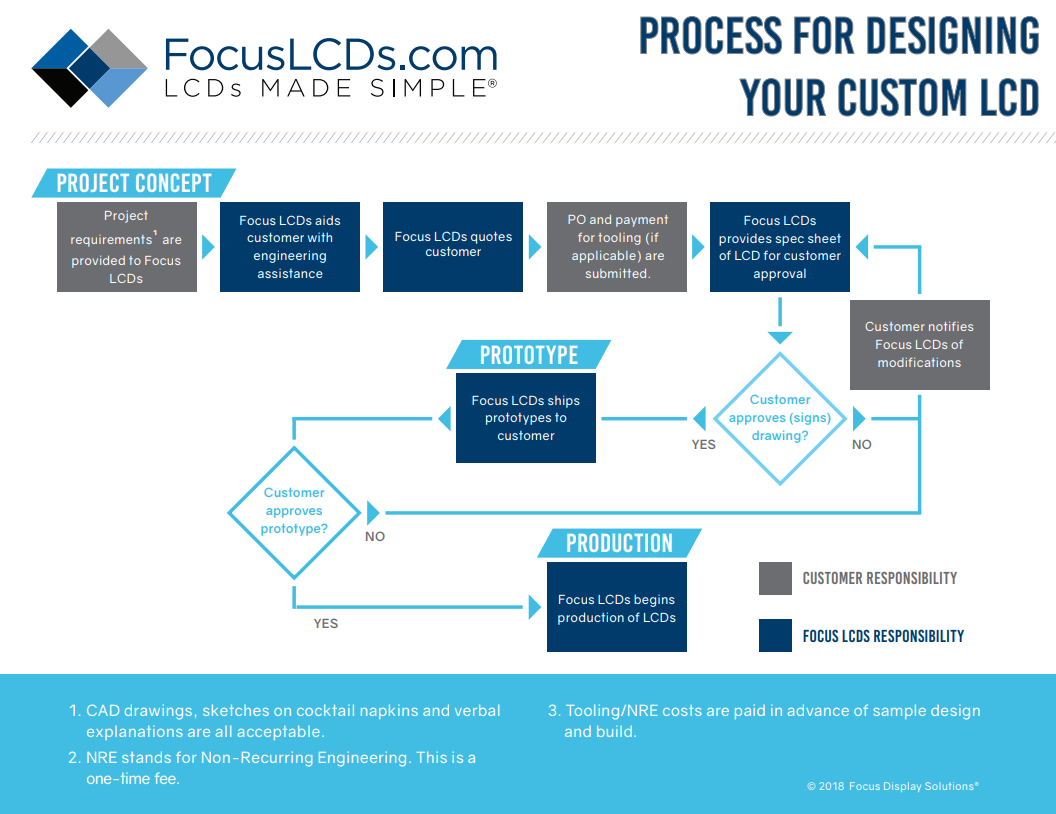

Once it’s recognized that a custom display will be a better design and lead to a lower overall system-level cost it’s time to dive into the actual tooling costs.

There are many factors that go into determining the upfront tooling. There’s also due diligence to be performed prior to making this commitment to ensure that this new custom display supplier will effectively support you over the long term.

Customization can either be semi-custom or fully custom. Semi-custom is where some attributes of a standard product are modified to fit the application. In contrast, fully custom is where the design is started from scratch and each component is designed from the ground up.

Semi-custom is typically the preferred option to start with. And in the case of color TFT, it’s typically the only option, as the TFT panel comes with a significant tooling and minimum order quantity (MOQ) such that the customization costs outweigh the drawbacks of using the closest standard TFT glass platform available.

b) Custom color TFT displays— the bulk of this cost comes from the TFT glass cell at $70K–$200K depending on the type of TFT cell used (standard TN or IPS). The balance of the module is an additional $5,000 – $15,000.

f) Touch panels— resistive touch panels cost approximately $2,500, while capacitive touch panels can range between $4,000 and $10,000. If a standard capacitive touch sensor can be used, and only a custom top surface is customized, the tooling can be reduced to only $1,500.

g) Backlights— monochrome display backlights are less complex and cheaper to tool at $2,000 – $4,000. The color counterpart, due to its high brightness requirement, will run between $4,000 and $10,000.

i) Overlays— this can vary significantly depending on the complexity of the screen printing, as well as any additional features, such as button or LED indicators. The overlay will typically range from $1,500 - $4,500.

Now that we’ve reviewed some of the costs associated with custom displays, here are some tips you can use to make sure that you move forward with the right partner that will then support this custom display for the long term.

Many LCD display manufacturers try to accommodate all order volumes they receive. While this allows them to serve a wider range of customers, it makes them less specialized for serving certain types of customers. As a result, your specific production volumes may be prohibitively expensive.

Seek out a display manufacturer who is optimized to handle your specific production needs for LCD displays. This is necessary to get the display for the right cost and the appropriate level of support.

Always start with a semi-custom approach. Use the available standard products to base the new design on, and then keep modifying as needed. This results in the lowest tooling costs and an easier design process. And in the case of color TFT, unless you are developing the next iPhone, design your display based on one of the standard glass platforms readily available. Then from there, redesign the backlight and the mechanical and electrical interface for your specific application.

Behind every great company are happy customers. Find out whether your supplier has them. Make sure that when this experience is handed off from your supplier’s sales and design team, the production team is just as good and accommodating. This can be accomplished through references and audits.

Initiating a successful relationship for a new custom display is all about having an open and transparent relationship with the right partner. And by designing the ideal custom or semi-custom display with this partner, you can ensure you’re getting the best possible solution for your company.

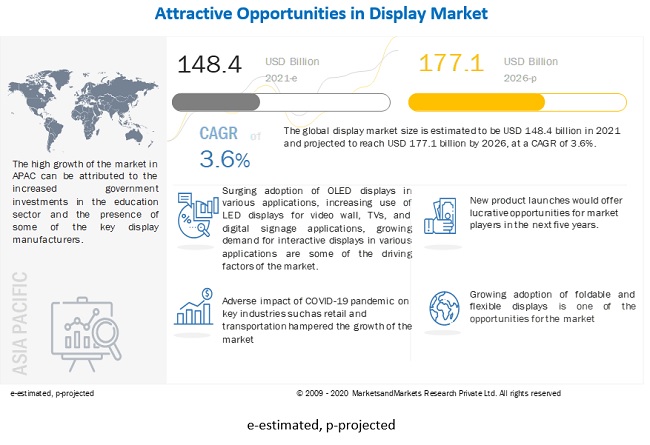

LCD panel prices have risen for 4 months in a row because of your home gaming? Since this year, the whole LCD panel market has smoked. Whether after the outbreak of the epidemic, LCD panel market prices rose for four months, or the panel giants in Japan and South Korea successively sold production lines, or the Chinese mainland listed companies frequently integrated acquisition, investment, and plant construction, all make the industry full of interesting.

LCD panel prices are already a fact. Since May this year, LCD panel prices have risen for four months in a row, making the whole industry chain dynamic. Why are LCD panels going up in price in a volatile 2020? The key factor lies in the imbalance between supply and demand.

The 43 inches and 55 inches rose more than double digits in August, reaching 13.7% each, and rose another $7 and $13, respectively, to $91 and $149, respectively, in September.

For larger sizes, overseas stocks remained strong, with prices for 65 inches and 75 inches rising $10 on average to $200 and $305 respectively in September.

The price of LCDS for large-size TVs of 70 inches or more hasn’t budged much. In addition, LTPS screens and AMOLED screens used in high-end phones have seen little or no increase in price.

As for October, LCD panel price increases are expected to moderate. The data shows that in October 32 inches or 2 dollars; Gains of 39.5 to 43 inches will shrink to $3;55 inches will fall back below $10; The 65-inch gain will narrow to $5.

During the epidemic, people stayed at home and had no way to go out for entertainment. They relied on TV sets, PCS, and game consoles for entertainment. After the resumption of economic work and production, the market of traditional home appliances picked up rapidly, and LCD production capacity was quickly digested.

However, due to the shutdown of most factories lasting 1-2 months during the epidemic period, LCD panel production capacity was limited, leading to insufficient production capacity in the face of the market outbreak, which eventually led to the market shortage and price increase for 4 consecutive months.

In fact, the last round of price rise of LCD panels was from 2016 to 2017, and its overall market price has continued to fall since 2018. Even in 2019, individual types have fallen below the material cost, and the whole industry has experienced a general operating loss. As a result, LCD makers have been looking for ways to improve margins since last year.

A return to a reasonable price range is the most talked about topic among panel makers in 2019, according to one practitioner. Some manufacturers for the serious loss of the product made the decision to reduce production or even stop production; Some manufacturers planned to raise the price, but due to the epidemic in 2020, the downstream demand was temporarily suppressed and the price increase was postponed. After the outbreak was contained in April, LCD prices began to rise in mid-to-late May.

This kind of price correction is in line with the law of industrial development. Only with reasonable profit space can the whole industry be stimulated to move forward.

In fact, the market price of LCD panels continued to decline in 2018-2019 because of the accelerated rise of China’s LCD industry and the influx of a large number of local manufacturers, which doubled the global LCD panel production capacity within a few years, but there was no suitable application market to absorb it. The result of excess capacity is oversupply, ultimately making LCD panel prices remain depressed.

Against this background, combined with the impact of the epidemic in 2020, the operating burden of LCD companies in Japan and South Korea has been further aggravated, and it is difficult to make profits in the production of LCD panels, so they have to announce the withdrawal of LCD business.

business in June 2022. In August, Sharp bought JDI Baishan, a plant in Ishikawa prefecture that makes liquid crystal display panels for smartphones. In early September, Samsung Display sold a majority stake in its SUZHOU LCD production plant to Starlight Electronics Technology, a unit of TCL Technology Group. LGD has not only pulled out of some of its production capacity but has announced that it will close its local production line in 2020. According to DSCC, a consultancy, the share of LCD production capacity in South Korea alone will fall from 19% to 7% between 2020 and 2021.

It is worth mentioning that in industry analysis, in view of the fact that Korean companies are good at using “dig through old bonus – selling high price – the development of new technology” the cycle of development mode, another 2020 out of the LCD production capacity, the main reason may be: taking the advantage of China’s expanding aggressively LCD manufacturers, Korean companies will own LCD panel production line hot sell, eliminating capacity liquid to extract its final value, and turning to the more profitable advantage of a new generation of display technologies, such as thinner, color display better OLED, etc. Samsung, for example, has captured more than 80% of the OLED market with its first-mover advantage.

From the perspective of production capacity, the launch of LCD tracks by major manufacturers in Japan and South Korea must reduce some production capacity in the short term, which to some extent induces market price fluctuations. In the long run, some of the Japanese and Korean LCD production capacity has been bought by Chinese manufacturers, coupled with frequent investment in recent years, the overall capacity is sure to recover as before, or even more than before. But now it will take time to expand the production layout, which more or less will cause supply imbalance, the industry needs to be cautious.

The LCD panel industry started in the United States and then gradually moved to Japan, South Korea, China, and Taiwan. At present, the proportion of production capacity in The Chinese mainland has reached 52% in 2020, and there are leading LCD panel products in China represented by BOE, Huxing Optoelectronics. Meanwhile, the production capacity layout of BOE, Huike, Huxing Optoelectronics, and other manufacturers has been basically completed, making industrial integration a necessity.

On the one hand, South Korean enterprises out of the LCD track, the domestic factory horse enclosure, plant expansion action. While LCDs may not sell as well as “upstart” flexible screens, respondents believe they are still strong enough in the traditional home appliance market to warrant continued investment. Zhao Bin, general manager of TCL Huaxing Development Center, has said publicly that the next-generation display technology will be mature in four to five years, but the commercialization of products may not take place until a decade later. “LCD will still be the mainstream in this decade,” he said.

On the other hand, there is no risk of neck jam in China’s LCD panel industry, which is generally controllable. In mainland China, there will be 21 production lines capable of producing 32-inch or larger LCD panels by 2021, accounting for about two-thirds of the global total. In terms of the proportion of production capacity, the Chinese mainland accounted for 42% of the global LCD panel in 2019, 51% this year, and will continue to climb to 63% next year.

Of course, building factories and expanding production cannot be accomplished overnight. In the process of production capacity recovery, it is predicted that there will be several price fluctuations, and the cost may be passed on to the downstream LCD panel manufacturers or consumers when the price rises greatly, which requires continuous attention.

Prices for all TV panel sizes fluctuated and are forecast to fluctuate between 2020 and 2022. The period from March 2020 to July 2021 saw the biggest price increases, when a 65" UHD panel cost between 171 and 288 U.S. dollars. In the fourth quarter of 2021, such prices fell and are expected to drop to an even lower amount by March 2022.Read moreLCD TV panel prices worldwide from January 2020 to March 2022, by size(in U.S. dollars)Characteristic32" HD43" FHD49"/50" UHD55" UHD65" UHD------

DSCC. (January 10, 2022). LCD TV panel prices worldwide from January 2020 to March 2022, by size (in U.S. dollars) [Graph]. In Statista. Retrieved October 20, 2022, from https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/

DSCC. "LCD TV panel prices worldwide from January 2020 to March 2022, by size (in U.S. dollars)." Chart. January 10, 2022. Statista. Accessed October 20, 2022. https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/

DSCC. (2022). LCD TV panel prices worldwide from January 2020 to March 2022, by size (in U.S. dollars). Statista. Statista Inc.. Accessed: October 20, 2022. https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/

DSCC. "Lcd Tv Panel Prices Worldwide from January 2020 to March 2022, by Size (in U.S. Dollars)." Statista, Statista Inc., 10 Jan 2022, https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/

DSCC, LCD TV panel prices worldwide from January 2020 to March 2022, by size (in U.S. dollars) Statista, https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/ (last visited October 20, 2022)

The statistic shows the manufacturing cost of a 55-inch ultra-high definition (UHD) TV panel from the first quarter of 2015 to the second quarter of 2017, broken down by technology. In the first quarter of 2017, the manufacturing cost of a 55-inch OLED UHD TV panel amounted to around 600 U.S. dollars per unit.Read moreManufacturing cost of a 55-inch UHD TV panel from 1st quarter 2015 to 2nd quarter 2017 (in U.S. dollars), by technologyCharacteristicLCDOLED---

Statista. (March 1, 2018). Manufacturing cost of a 55-inch UHD TV panel from 1st quarter 2015 to 2nd quarter 2017 (in U.S. dollars), by technology [Graph]. In Statista. Retrieved October 20, 2022, from https://www.statista.com/statistics/784279/55-inch-uhd-tv-panel-manufacturing-cost-by-technology/

Statista. "Manufacturing cost of a 55-inch UHD TV panel from 1st quarter 2015 to 2nd quarter 2017 (in U.S. dollars), by technology." Chart. March 1, 2018. Statista. Accessed October 20, 2022. https://www.statista.com/statistics/784279/55-inch-uhd-tv-panel-manufacturing-cost-by-technology/

Statista. (2018). Manufacturing cost of a 55-inch UHD TV panel from 1st quarter 2015 to 2nd quarter 2017 (in U.S. dollars), by technology. Statista. Statista Inc.. Accessed: October 20, 2022. https://www.statista.com/statistics/784279/55-inch-uhd-tv-panel-manufacturing-cost-by-technology/

Statista. "Manufacturing Cost of a 55-inch Uhd Tv Panel from 1st Quarter 2015 to 2nd Quarter 2017 (in U.S. Dollars), by Technology." Statista, Statista Inc., 1 Mar 2018, https://www.statista.com/statistics/784279/55-inch-uhd-tv-panel-manufacturing-cost-by-technology/

Statista, Manufacturing cost of a 55-inch UHD TV panel from 1st quarter 2015 to 2nd quarter 2017 (in U.S. dollars), by technology Statista, https://www.statista.com/statistics/784279/55-inch-uhd-tv-panel-manufacturing-cost-by-technology/ (last visited October 20, 2022)

According to the OLED Display Cost Model by IHS Markit, manufacturing cost of the 5.9-inch organic light-emitting diode (OLED) panel with notch design, as in the Apple iPhone X, is estimated to be $29. It is found to be 25 percent higher than manufacturing cost of full-display OLED panel without the notch design used in the 5.8-inch display for the Samsung Galaxy S9. Similar cost gap is also found in the thin-film transistor liquid crystal display (TFT-LCD). Manufacturing cost of a 6-inch notch TFT-LCD panel is estimated to be $19, 20 percent higher than similar-sized non-notch, full-display LCD panel.

“Notch cutting should accompany yield loss, resulting in increases in manufacturing cost. In case of TFT-LCD, a notch design may push up the manufacturing cost even to the level of rigid, full-screen OLED’s,” said Jimmy Kim, Ph.D. and senior principal analyst for display materials at IHS Markit. “For OLED panels, cost increase caused by notch design seems to be even higher.”

Quarterly shipments of the iPhone X, Apple’s first smartphone model using OLED panels, have reportedly been smaller than previous iPhone models’ so far, mainly due to higher selling price, caused by expensive OLED panels. “Apple seems to be in the middle of manufacturing optimization,” Kim said.

“Eventually, manufacturing cost for notch OLED will fall more rapidly than that for notch TFT-LCD. The plastic substrate for OLED is not as brittle as glass used in TFT-LCD, so it should be easier to cut the notch, theoretically.”

The OLED Display Cost Model by IHS Markit includes manufacturing cost analysis and forecasts of OLED display panels in mass production for smartwatch, smartphone, tablet PC and TV.

According to TrendForce, LCD TV panel quotations bore the brunt of continuous downgrades in the purchase volume of TV brands and pricing for most panel sizes have fallen to record lows.

As Chinese panel makers account for nearly 66% of TV panel shipments, BOE, CSOT, and HKC are industry leaders. When there is an imbalance in supply and demand, a focus on strategic direction is prioritized. According to TrendForce, TV panel production capacity of the three aforementioned companies in 3Q22 is expected to decrease by 15.8% compared with their original planning, and 2% compared with 2Q22. Taiwanese manufacturers account for nearly 20% of TV panel shipments so, under pressure from falling prices, allocation of production capacity is subject to dynamic adjustment. On the other hand, Korean factories have gradually shifted their focus to high-end products such as OLED, QDOLED, and QLED, and are backed by their own brands. However, in the face of continuing price drops, they too must maintain operations amenable to flexible production capacity adjustments.

TrendForce indicates, in order to reflect real demand, Chinese panel makers have successively reduced production capacity. However, facing a situation in which terminal demand has not improved, it may be difficult to reverse the decline of panel pricing in June. However, as TV sizes below 55 inches (inclusive) have fallen below their cash cost in May (which is seen as the last line of defense for panel makers) and is even flirting with the cost of materials, coupled with production capacity reduction from panel makers, the price of TV panels has a chance to bottom out at the end of June and be flat in July. However, demand for large sizes above 65 inches (inclusive) originates primarily from Korean brands. Due to weak terminal demand, TV brands revising their shipment targets for this year downward, and purchase volume in 3Q22 being significantly cut down, it is difficult to see a bottom for large-size panel pricing. TrendForce expects that, optimistically, this price decline may begin to dissipate month by month starting in June but supply has yet to reach equilibrium, so the price of large sizes above 65 inches (inclusive) will continue to decline in 3Q22.

TrendForce states, as panel makers plan to reduce production significantly, the price of TV panels below 55 inches (inclusive) is expected to remain flat in 3Q22. However, panel manufacturers cutting production in the traditional peak season also means that a disappointing 2H22 peak season is a foregone conclusion and it will not be easy for panel prices to reverse. However, it cannot be ruled out, as operating pressure grows, the number and scale of manufacturers participating in production reduction will expand further and it timeframe extended, enacting more effective suppression on the supply side, so as to accumulate greater momentum for a rebound in TV panel quotations.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

![]()

IHS released its LCD and OLED smartphone display cost model for Q3 2018. According to IHS, a 5.7" 2560x1440 rigid OLED costs $18.62 to produce, a full-display flexible curved 5.8" 2880x1440 OLED costs $22.61 and a Notch-type 5.9" 2438x1125 OLED costs $28.18 to produce.

It is not clear how IHS estimates yields - from our information SDC"s production yields are much higher compared to the new makers such as BOE and LG Display - which means that yielded costs are much lower at SDC"s mature OLED fabs.

IHS also details the costs of LCD panels - a 5.7" full-display 2880x1440 LCD costs $15.39 to produce (so a comparable rigid OLED will carry a cost premium of around 20%). A notch-type 6" 3120x1440 LCD costs $18.41 to produce, according to IHS.

According to the report, after SYTECH, the world"s second-largest copper clad laminate manufacturer announced an increase in the price of copper clad laminate (CCL), one of the main raw materials for printed circuit boards (PCB), domestic copper clad laminate manufacturers also followed suit. Copper clad laminate is the main raw material for circuit board (and there is no substitute material at present), which makes the cost and price of "printed circuit board (PCB)" increase, which leads to the price change of LCD panel which is highly dependent on PCB.

In November, the price of LCD panel still did not stop rising, but this has brought a lot of impact on the industry and its subsidiary industries. Samsung, LG, and other Korean manufacturers suspended the LCD production plan, and domestic LCD panel manufacturers headed by BOE had a sharp increase in shipment; the TV industry mainly consumed by the LCD panel, such as Hisense, TCL, Skyworth, Konka, Xiaomi and other domestic well-known TV manufacturers have successively increased the export price of products.

We can see that the price of LCD panels has been rising all the way, and the prices of TV, monitor, commercial computer, tablet, and other products have increased to a certain extent. And with the commercial computer corresponding, the industrial panel PC also inevitably has a certain price change.

In the panel composition of the industrial panel PCS, the LCD screen as an important part is also an important factor to determine the choice of product touch mode. According to the resistance, capacitance, non-touch, infrared touch, and other touch screens technologies, the LCD panel of industrial tablet computer also has a certain distinction. Users can choose the LCD panel according to the actual scene demand.

Generally speaking, the industrial panel PC manufacturers will use different brands of the LCD screen. Taking Touch Think as an example, its LCD suppliers are mainly BOE, Qimei, Qunchuang, sharp, AUO, Mitsubishi, LG, and other well-known brands from domestic and abroad. They all adopt an A + level quality LCD screen. According to the purchase cycle, the LCD panel brands used in each stage of products will be different.

As for the choice of touch screens, just as the BOE will divide LCD display types such as mobile phone, tablet, notebook, monitor, TV, medical treatment, etc., Touch Think industrial tablet PC screen support customized high-resolution screen, full viewing angle screen, explosion-proof screen, anti-glare screen, wide temperature screen, anti-peeping screen and other featured screens, which used to meet the special use applications such as laser machine, ATM, self-service machine, etc.

By the way, when it comes to the screen of industrial tablet PCs, some users may pay attention to the parameters such as resolution, image display contrast, display color, screen brightness, etc. Among them, the resolution is related to the size of the monitor. Touch Think products including a variety of display sizes, such as 7 ", 8", 10.1 ", 10.4", 11.6 ", 12", 12.1", 15", 15.6 ", 17", 17.3 ", 19", 19.1" and 21.5". The standard resolution of each size is different.

In general, the price rise of the LCD panel will lead to the price rise of many products due to the pressure of increasing cost, and the industrial panel PC can not be avoided. What manufacturers should do is to continue to maintain quality and provide users with high-quality products, so as to minimize and eliminate the negative impact of price increases on users.

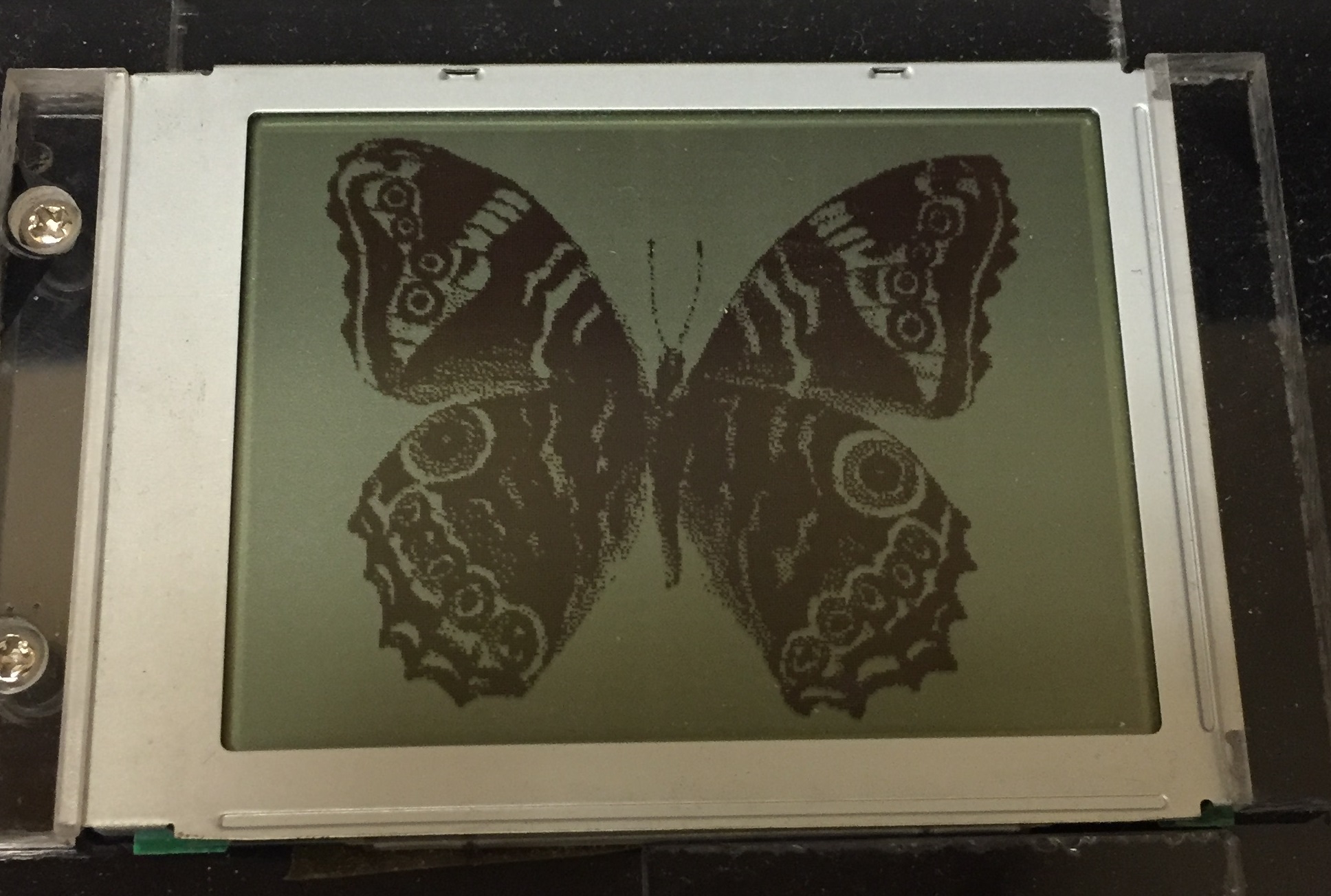

lcd panel (Liquid crystal display) are made of liquid crystals that form digital images made visible through ambient light or through LED backlight. LCDs are used in the place of other displays that are less efficient such as cathode ray tubes (CRTs) and have become the most popular display type on the market.

Lcd panel enable metal and position detection without having to physically contact the metal object. They offer a wide range of applications in robotics, rail, material handling, aerospace, military, as well as heavy machinery. Choose from different lcd panel types, from the shielded versions that have electromagnetic fields concatenated in the front and unshielded versions which allow wider sensing distances. Whether you want to use your sensors for industrial purposes or source for your brand, there is a wide selection of wholesale lcd panels to choose from. will allow you to customize the applications of your parts in the market. Unlike other packaging materials, plastic bottles are durable, cost-effective, and easy to use, enhancing the efficiency of your business. If you are a retailer, you can also order bulk plastic bottles at Alibaba.com and keep your business running smoothly.

Alibaba.com features a broad collection of smart and advanced lcd panel equipped with bright, capacitive screens for the most affordable prices. These lcd panel are made implying the latest technologies for a better, enhanced, and smart viewing experience. These products are of optimal quality and are sustainable so that they can last for a long time. Buy these lcd panel from the leading wholesalers and suppliers at discounted prices and fabulous deals. The smart and capacitive lcd panel offered on the site are applicable for all types of ads displaying, mobile screens, LCD monitors, and many more. You can use them both for commercial as well as residential purposes. These marvellous lcd panel are provided with bright and strong backlights available in distinct colors for a wonderful screen viewing experience. These lcd panel are not just used for LCD screens but also are used for TFT, LED, and other screen variations.

(2 November, 2017) – A major decrease in manufacturing cost gap between organic light-emitting diode (OLED) display and liquid crystal display (LCD) panel is expected to support the expansion of OLED TVs, according to new analysis from

analysis estimates that the total manufacturing cost of a 55-inch OLED ultra-high definition (UHD) TV panel -- at the larger end for OLED TVs -- stood at $582 per unit in the second quarter of 2017, a 55 percent drop from when it was first introduced in the first quarter of 2015. The cost is expected to decline further to $242 by the first quarter of 2021, IHS Markit said.

The manufacturing cost of a 55-inch OLED UHD TV panel has narrowed to 2.5 times that of an LCD TV panel with the same specifications, compared to 4.3 times back in the first quarter of 2015.

“Historically, a new technology takes off when the cost gap between a dominant technology and a new technology gets narrower,” said Jimmy Kim, principal analyst for display materials at IHS Markit. “The narrower gap in the manufacturing cost between the OLED and LCD panel will help the expansion of OLED TVs.”

However, it is not just the material that determines the cost gap. In fact, when the 55-inch UHD OLED TV panel costs were 2.5 times more than LCD TV panel, the gap in the material costs was just 1.7 times. Factors other than direct material costs, such as production yield, utilization rate, depreciation expenses and substrate size, do actually matter, IHS Markit said.

The total manufacturing cost difference will be reduced to 1.8 times from the current 2.5 times, when the yield is increased to a level similar to that of LCD panels. “However, due to the depreciation cost of OLED, there are limitations in cost reduction from just improving yield,” Kim said. “When the depreciation is completed, a 31 percent reduction in cost can be expected from now.”

by IHS Markit provides more detailed cost analysis of OLED panels, including details of boards, arrays, luminescent materials, encapsulants and direct materials such as driver ICs. The report also covers overheads such as occupancy rate, selling, general and depreciation costs. In addition, this report analyzes OLED panels in a wide range of sizes and applications.

IHS Markit (Nasdaq: INFO) is a world leader in critical information, analytics and solutions for the major industries and markets that drive economies worldwide. The company delivers next-generation information, analytics and solutions to customers in business, finance and government, improving their operational efficiency and providing deep insights that lead to well-informed, confident decisions. IHS Markit has more than 50,000 key business and government customers, including 85 percent of the Fortune Global 500 and the world’s leading financial institutions. Headquartered in London, IHS Markit is committed to sustainable, profitable growth.

IHS Markit is a registered trademark of IHS Markit Ltd and/or its affiliates. All other company and product names may be trademarks of their respective owners © 2017 IHS Markit Ltd. All rights reserved.

LCD manufacturers are mainly located in China, Taiwan, Korea, Japan. Almost all the lcd or TFT manufacturers have built or moved their lcd plants to China on the past decades. Top TFT lcd and oled display manufactuers including BOE, COST, Tianma, IVO from China mainland, and Innolux, AUO from Tianwan, but they have established factories in China mainland as well, and other small-middium sizes lcd manufacturers in China.

China flat display revenue has reached to Sixty billion US Dollars from 2020. there are 35 tft lcd lines (higher than 6 generation lines) in China,China is the best place for seeking the lcd manufacturers.

The first half of 2021, BOE revenue has been reached to twenty billion US dollars, increased more than 90% than thesame time of 2020, the main revenue is from TFT LCD, AMoled. BOE flexible amoled screens" output have been reach to 25KK pcs at the first half of 2021.the new display group Micro LED revenue has been increased to 0.25% of the total revenue as well.

Established in 1993 BOE Technology Group Co. Ltd. is the top1 tft lcd manufacturers in China, headquarter in Beijing, China, BOE has 4 lines of G6 AMOLED production lines that can make flexible OLED, BOE is the authorized screen supplier of Apple, Huawei, Xiaomi, etc,the first G10.5 TFT line is made in BOE.BOE main products is in large sizes of tft lcd panel,the maximum lcd sizes what BOE made is up to 110 inch tft panel, 8k resolution. BOE is the bigger supplier for flexible AM OLED in China.

As the market forecast of 2022, iPhone OLED purchasing quantity would reach 223 million pcs, more 40 million than 2021, the main suppliers of iPhone OLED screen are from Samsung display (61%), LG display (25%), BOE (14%). Samsung also plan to purchase 3.5 million pcs AMOLED screen from BOE for their Galaxy"s screen in 2022.

Technology Co., Ltd), established in 2009. CSOT is the company from TCL, CSOT has eight tft LCD panel plants, four tft lcd modules plants in Shenzhen, Wuhan, Huizhou, Suzhou, Guangzhou and in India. CSOTproviding panels and modules for TV and mobile

three decades.Tianma is the leader of small to medium size displays in technologyin China. Tianma have the tft panel factories in Shenzhen, Shanhai, Chendu, Xiamen city, Tianma"s Shenzhen factory could make the monochrome lcd panel and LCD module, TFT LCD module, TFT touch screen module. Tianma is top 1 manufactures in Automotive display screen and LTPS TFT panel.

Tianma and BOE are the top grade lcd manufacturers in China, because they are big lcd manufacturers, their minimum order quantity would be reached 30k pcs MOQ for small sizes lcd panel. price is also top grade, it might be more expensive 50%~80% than the market price.

Panda electronics is established in 1936, located in Nanjing, Jiangshu, China. Panda has a G6 and G8.6 TFT panel lines (bought from Sharp). The TFT panel technologies are mainly from Sharp, but its technology is not compliance to the other tft panels from other tft manufactures, it lead to the capacity efficiency is lower than other tft panel manufacturers. the latest news in 2022, Panda might be bougt to BOE in this year.

Established in 2005, IVO is located in Kunsan,Jiangshu province, China, IVO have more than 3000 employee, 400 R&D employee, IVO have a G-5 tft panel production line, IVO products are including tft panel for notebook, automotive display, smart phone screen. 60% of IVO tft panel is for notebook application (TOP 6 in the worldwide), 23% for smart phone, 11% for automotive.

Besides the lcd manufacturers from China mainland,inGreater China region,there are other lcd manufacturers in Taiwan,even they started from Taiwan, they all have built the lcd plants in China mainland as well,let"s see the lcd manufacturers in Taiwan:

Chimei Innolux Corporation was the successor company, and it initially preserved the Chimei name. In order to differentiate itself from the ChiMei brand, the company was renamed "Innolux Corporation" in December 2012.

Innolux"s 14 plants in Taiwan possess a complete range of 3.5G, 4G, 4.5G, 5G, 6G, 7.5G, and 8.5G-8.6G production line in Taiwan and China mainland, offering a full range of large/medium/small LCD panels and touch-control screens.including 4K2K ultra-high resolution, 3D naked eye, IGZO, LTPS, AMOLED, OLED, and touch-control solutions,full range of TFT LCD panel modules and touch panels, including TV panels, desktop monitors, notebook computer panels, small and medium-sized panels, and medical and automotive panels.

AUO is the tft lcd panel manufacturers in Taiwan,AUO has the lcd factories in Tianma and China mainland,AUOOffer the full range of display products with industry-leading display technology,such as 8K4K resolution TFT lcd panel, wide color gamut, high dynamic range, mini LED backlight, ultra high refresh rate, ultra high brightness and low power consumption. AUO is also actively developing curved, super slim, bezel-less, extreme narrow bezel and free-form technologies that boast aesthetic beauty in terms of design.Micro LED, flexible and foldable AMOLED, and fingerprint sensing technologies were also developed for people to enjoy a new smart living experience.

Hannstar was found in 1998 in Taiwan, Hannstar display hasG5.3 TFT-LCD factory in Tainan and the Nanjing LCM/Touch factories, providing various products and focus on the vertical integration of industrial resources, creating new products for future applications and business models.

driver, backlight etc ,then make it to tft lcd module. so its price is also more expensive than many other lcd module manufacturers in China mainland.

Maclight is a China based display company, located in Shenzhen, China. ISO9001 certified, as a company that more than 10 years working experiences in display, Maclight has the good relationship with top tft panel manufacturers, it guarantee that we could provide a long term stable supply in our products, we commit our products with reliable quality and competitive prices.

Maclight products included monochrome lcd, TFT lcd module and OLED display, touch screen module, Maclight is special in custom lcd display, Sunlight readable tft lcd module, tft lcd with capacitive touch screen. Maclight is the leader of round lcd display. Maclight is also the long term supplier for many lcd companies in USA and Europe.

If you want tobuy lcd moduleorbuy tft screenfrom China with good quality and competitive price, Maclight would be a best choice for your glowing business.

In another ominous sign for global TV industry supply, both demand and prices for TV-sized LCD panels continue to fall at the same time, recent reports from two display market analysts revealed.

Display industry market analysts TrendForce and Omdia each issued potentially troubling LCD TV display panel business updates this week as the global economic outlook continues to impact discretionary spending for non-essential items like TV sets.

The compounding effects of inflation, mounting signs of recessionary conditions ahead and on-going issues with shipping and logistics paint a gloomy picture for those looking to buy or sell a television set in the peak second half of 2022.

According to TrendForce, the outlook for purchases by TV makers of LCD TV display panels — the major component part for LCD-based TVs that represent the vast majority of the TV sets — continues to decline even as prices for most panel sizes have fallen to record lows.

Recently, it was announced that the 32-inch and 43-inch panels fell by approximately $5-$6 in early June, 55-inch panels fell approximately $7, and prices for 65-inch and 75-inch panels, which face mounting overcapacity pressure, were down $12 to $14, TrendForce said.

“In order to alleviate pressure caused by price decline and inventory, panel makers are successively planning to initiate more significant production control in [the third quarter of 2022],” TrendForce said. “..Overall LCD TV panel production capacity in [the third quarter] will be reduced by 12% compared with original planning.”

According Omdia prices for TV-sized LCD display panels have been falling for the first year since Covid-19 appeared, while the increase in display demand area is expected to be up just 3%, half of the previous year.

Similarly, Omdia’s forecast released Thursday showed global display sales this year would decrease by 15% from last year to $133.18 billion. That compares to the global display sales increases of 14% in 2020 and 26% in 2021 due to the surge in demand for LCD panels and TVs generated by lockdowns forced by the pandemic.

LCD TV panel sales this year are expected to drop by 32% from last year ($38.3 billion) to $25.8 billion, according to Omdia’s predictions. The LCD TV panel demand area is expected to increase by 2% this year from last year, but the panel price decline is large.

“When there is an imbalance in supply and demand, a focus on strategic direction is prioritized,” TrendForce said. “TV panel production capacity of the three aforementioned companies in [Q3 2022] is expected to decrease by 15.8% compared with their original planning, and 2% compared with [the second quarter.]

TrendForce said Taiwanese manufacturers account for nearly 20% of TV panel shipments, and allocation of production capacity among those factories is now subject to “dynamic adjustment.”

The firm said TV sizes 55 inches and below have “fallen below their cash cost in May (which is seen as the last line of defense for panel makers) and is even flirting with the cost of materials, coupled with production capacity reduction from panel makers, the price of TV panels has a chance to bottom out at the end of June and be flat in July.”

As for TV sizes 65 inches and larger, which come largely from the Korean brands, TrendForce said declining demand has forced TV brands to revise downward their shipment targets for this year, with purchase volume for the third quarter of 2022 significantly reduced.

However, the firm said, optimistically, “this price decline may begin to dissipate month by month starting in June but supply has yet to reach equilibrium, so the price of large sizes [65 inches and above] will continue to decline in [the third quarter].”

TrendForce said that as panel makers continue to significant reduce production, the price of TV panels 55 inches and under is expected to remain flat in through the third quarter.

“Panel manufacturers cutting production in the traditional peak season also means that a disappointing [second half 2022] peak season is a foregone conclusion and it will not be easy for panel prices to reverse,” according to TrendForce.

It is possible that if the supply/pricing pressures continue, the number, scale and duration of manufacturers cutting panel production output will grow in an effort to generate momentum for a rebound in TV panel quotations, TrendForce said.

As reported by S. Korean technology trade news site The Elec, Omdia said the LCD TV panel shipment targets for BOE were lowered to 60 million units this year from the original 65.5 million units. HKC decreased its targets from 49.5 million to 42 million, CSOT from 45 to 44.8 million, and LG Display from 23.5 million to 18 million. Innolux’s shipment target increased slightly from 34.5 million units to 34.6 million units.

On the other hand, organic light emitting diode (OLED) TV panel sales this year are expected to reach $5.4 billion, up 12% from last year ($4.8 billion), according to Omdia.

OLED TV panels are being mass-produced by LG Display and Samsung Display, as both manufacturers reduce their exposure in LCDs. Samsung Display will end LCD TV panel production entirly this summer. However, LG Display’s OLED panel production forecast is 10 times that of Samsung Display.

Meanwhile, Samsung Display hiked yield rates for its new large-size QD-OLED panels from 30% of capacity initially, 50% in 2021, 75% in April-May 2022 to 80% now, according to South Korea-based publication The Bell.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey