lcd panel shortage manufacturer

Global monitor panel shipments declined in the first quarter of the year, a report showed on Wednesday, mainly due to Samsung Displays exit from the monitor LCD display manufacturing business and a shortage of semiconductors.

The worldwide monitor panel shipments fell 8.6 percent on-quarter to 39.9 million units in the January-March period, according to the latest report from market researcher TrendForce.

"TrendForce indicates that SDC will exit the monitor LCD panel manufacturing business after it reaches its shipment target of 1.2 million panels in 1H21," it said. "This figure represents a staggering 93.8 percent decline compared to the 19.3 million units of LCD panels that SDC shipped throughout last year."

Samsung Display, the world"s top mobile display panel maker, has been focusing on its migration to next-generation quantum-dot (QD) displays, while withdrawing from the LCD business, reports Yonhap news agency.

But for large LCD panels for TVs, the company recently said it is mulling extending its manufacturing for one more year due to soaring demand from TV makers and rising panel prices.

TrendForce said the global monitor panel market also suffered a setback in the first quarter due to a shortage of components, such as integrated circuits and timing controllers.

"In addition, since TV and notebook (laptop) panels have higher profit margins compared to monitor panels, panel suppliers generally allocate less of their production capacities for manufacturing monitor panels relative to other products," it said.

"TrendForce believes that panel suppliers will likely in turn allocate more production capacities to clients in the monitor segment in 4Q21," it said.

"More specifically, the current shortage of components in the upstream supply chain, which has been exerting significant downward pressure on monitor panel shipments, will be gradually alleviated in 2H21."

The lockdowns brought on by this crisis had caused many manufacturers to temporarily shut down. With the increasing amount of products incorporating LCDs and many productions lines down, it has become more difficult to meet

The start of a new year is normally a busy time for computer manufacturers and technology companies, and 2021 has proven no different. What has proven different this year is the availability of some crucial supplies. with the COVID-19 pandemic in full swing, people have made a major shift to working at home. This shift has had a severe impact on computer and component manufacturers worldwide. The workforce has spent much of the past year buying new LCD monitors and laptops while investing in various work-from-home solutions to make it a little easier to keep things running even when they can’t make it to the office.

Outside of business concerns, the demand for leisure devices has also increased. People who cannot go out and socialize are instead purchasing gaming systems, PCs, and TVs, while parents are buying their children tablets and notebooks as entertainment. The pandemic has created an increase in demand and industry-wide shortages of both display panels and power management IC components, including phones. The shortage isn’t just due to the pandemic, of course. Many component manufacturers were already seeing an increase in demand generated by the rollout of 5G technology and the release of two new major game consoles. That the pandemic just happened to hit during a time of significant technological change simply increased existing demand that much more. This sudden demand for all of the components parts in display screens, computers, and TVs brought about a unique situation. Not only is it unnecessary for component manufacturers to market to clients this year, but many are also having to actively turn business away or schedule it for months down the line.

For manufacturers higher up in the supply chain, this is good news. TSMC’s share prices have risen by 50% in 2020 alone; United Microtechnology’s value has more than doubled. While they are working on expanding their capacity, the current demand for new devices and their associated components is likely to continueexceeding supplyfor the rest of the calendar year.However, for people and businesses that need these delayed devices, the shortage is moreserious.

Component and computer shortages affect many more parties than simply the manufacturers. Consumers and businesses at the end of the supply chain see effects as well when it is so difficult to get new machines produced. The problem is that none of these components are used in isolation. The microchips, LCD components, touchscreen elements, and even glass for screens are all utilized in a wide variety of technology, including things that your business may use. Indeed, as demand for phones increases, it becomes harder to source chips for all devices. The result is that it’s simply harder and more expensive to get any type of computing technology. From phones to laptops to desktops, the chip shortage makes it more challenging to find the technology you may need.

IT products like desktop PCs are slightly less impacted by the current shortages than many other products. In general, people who made the switch to working from home have been more likely to purchase a laptop instead of a desktop. Even so, desktop machines are still being affected by shortages and long wait times. In addition, the increased demand for gaming PCs is keeping

When this pressure is combined with the need for functional work laptops, it entails that mobile devices and LCD panels may be facing delivery times as long as three months. It is possible to obtain devices on a shorter timeline, but at present, it appears that end-users like businesses will pay the price. Early estimates suggest that PC prices might rise by as much as 30% in 2021 to account for the shortages. When all these delays and shortages are combined, it spells a clear message: this is not the time to upgrade your hardware. Instead, focus on improving and securing the hardware you already have.

The outlook for your ability to get the 2021 model TV you might have your eyes on, and the price you might have to pay for it isn’t good right now, following reports of component shortages limiting production yields this year.

According to reports out of Asia, widespread component supply shortages could impact availability on LCD TV panels from TCL owned panel maker China Star Optoelectronics Technology (CSoT) and Innolux, two of the world’s largest LCD panel suppliers.

The display panel manufacturers were reported by Korean electronics business news site The Elec on Mondayas warning that supplies of panels are expected to be “tight throughout the year.”

TCL chairman Li Dongsheng used a media briefing last week to announce that panel shortages will continue in the first half of 2021, following conditions already hampered last year during the start of the Covid-19 pandemic.

The Elec article also cited Innolux president James Yang warning of a shortage in LCD panels caused by strong demand for LCD coming out of the global Covid-19 crisis, and he also added the conditions are expected to continue through 2021.

Innolux has seen shortages in LCD components including power semiconductors, driver ICs and glass substrates that have kept production below capacity. Shortages of integrated circuits and semiconductors could continue right up to the first half of 2022, Yan cautioned.

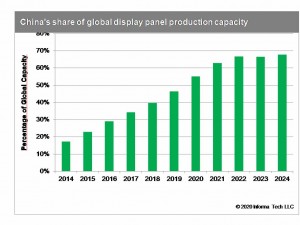

Ironically, prior to the run on LCD panel supplies, manufacturers were also faced with the dilemma of overproduction causing a glut in inventory, which was driving prices artificially lower. This was the result of giant new LCD fabs coming online in China and other areas of Asia.

TV manufacturers reportedly have been moving aggressively to replenish inventories of LCD panels to meet strong sales of TVs and other devices to meeting escalating demand, particularly in the United States and Europe.

At the same time, Samsung Display LCD monitor panel supplies for monitors are on course to terminate by the end of the first quarter 2021, and supply of IT panels overall will only continue to tighten up as demand increases for TVs and notebook panels, according to Asian analyst reports.

China-based Sigmaintell last week estimated the average selling price for a 21.5-inch LCD module for monitors would rise $3 to $55 this month, compared to a $2.50 increase for 23.8-inch panels and $2 increase for 27-inch monitor panels.

COVID-19 has had a dramatic effect on the electronics industry. The worldwide drive for people to work and educate from home and the increase in demand for medical products have taken the supply of electronics components from overcapacity to shortage and extended lead times. This was multiplied by the shutdown of manufacturing and the attempt to catch up with previous demand. The industrial market has also gotten hit by the loss of small gen fab capacity due to the shutting down of older, less competitive fabs.

Before COVID-19, the display market had been in an oversupply with the slowdown in cell phone demand. With the increased demand for laptops, monitors, and even TVs has backfilled this capacity and driven us into a shortage situation. This shortage of electronic components is not only in the display market but extends to basic components like resistors and capacitors.

Why it matters: The global semiconductor industry was worth $439 billion in 2020, and is on track to grow even bigger this year. However, that growth potential is being eroded by a shortage of $1 chips that are essential for every display panel that needs to be manufactured.

A global shortage of chips has wreaked havoc on the supply chains of the tech and auto industries. This has caused many companies to scale back production at a time when demand is soaring for their products. This is the result of a combination of factors, and the current situation will probably not change until the end of next year.

According to a Bloomberg report, there is now a serious shortage of display driver chips that is creating headaches for manufacturers of LCD and OLED panels. This in turn will affect all manner of consumer devices, from the lowly smartwatch to smartphones, tablets, laptops, computer monitors, TVs, smart appliances, and infotainment systems. Every new car or plane comes with one or more display panels, which only adds to the demand.

Nevertheless, the shortage of these driver chips will likely cause further delays and price hikes for products that are currently in high demand, and the manufacturers of these chips don"t see a solution in sight.

The shortfall is already visible in the doubling of prices for large LCD panels over the last year. Himax Technologies CEO Jordan WU told Bloomberg "I have never seen anything like this in the past 20 years since our company"s founding."

Display panel manufacturers TCL and Innolux have said they are expecting supply of liquid crystal display (LCD) panels to be tight throughout the year.

TCL chairman Li Dongsheng said at a media briefing last week that the shortage in panels will continue in the first half of 2021. The situation for the second half of the year remains to be seen but panel supply in 2021 will overall be tight, the chairman said.

Innolux president James Yang made similar comments to Li, saying the shortage in LCD panels caused by strong demand for LCD since the spread of COVID-19 is expected to continue through 2021.

Yang said shortage in LCD components such as power semiconductors, driver ICs and glass substrates have caused companies to manufacture less LCD panels than there actual production capacity. The shortage in IC (integrated circuits, ie semiconductors) was the most serious and may continue up to the first half of 2022, the president said.

Display panel makers in Greater China are also transitioning their Gen 8.5 TV lines for those of IT panels. These company want to manufacture LCD TV panels at their Gen 10.5 lines that will increase productivity for them.

Market research firm Omdia believes many panel makers have targeted panel prices to the levels in the first half of 2017, when prices peaked. This will be especially true for 55-inch panels, the firm said.

Due to the shortage in driver ICs, panel makers are preferring to manufacture the more profitable IT panels over TV panels. For TV panels, they are preferring to produce larger ones.

There also may be changes in the LCD panel supply chain as TV manufacturers won’t continue buying LCD panels as much as they did when the panel price increase is hurting their profitability.

Meanwhile, the tight LCD TV panel supply in the second half of 2020 was caused by companies lowering their production volume and demand being higher than expected.

Panel prices have increased from June to December last year. For 32-inch, the price increased by 94%. Prices of 43-inch panels increased 65%, 50-inch 64%, 55-inch 59% and 65-inch 25%, according to Omdia.

Glass substrate makers NEG and AGC Fine Techno Korea suffered shutdowns of their factories in December and January, respectively, which further intensified the shortage in panels. These companies are yet to normalize production and supply to customers.

– Pandemic:The direct and root cause of causing the crisis is the pandemic. In March 2020, a lot of countries issued executive orders for people to stay at home. The demand for various products dropped sharply. A lot of manufacturers cancelled or pushed out orders. The world 1st and 2nd biggest LCD manufacturers Samsung and LG declared the plan to stop all the LCD production. A lot of LCD panel and IC manufacturers cut the production because of order drop or executive orders to stay at home. They use stock instead of the fresh production to fill the demands.

– Chaos of Executive orders and planning:Because of the pandemic, nobody knew what was ahead. Executive orders were updated monthly, the same as the planning for schools, plants, companies and other organizations. By July, a lot of schools started to realize that it was not practical to open the schools in personal and needed every student to have online classes which suddenly boosted the orders of laptops, monitors, TVs and other entertainment devices. The LCD panel manufacturers couldn’t ramp up for so fast increased demands. The stock was cleared quickly and LCD factories had been running 7/24 starting last fall which still couldn’t keep up the order speed. The price increase followed right after.

– Zero Stock Policies: LCD panel and IC prices had been inclined for more than a decade. There had been a fixed mindset for a lot of commodity executives and managers that the prices will fall ever. Because the competition was tough for suppliers, the big customers demand for OTD (On Time Delivery), especially for automotive makers. They don’t hold much or any stock in order to improve the cost down and cash flow. The result is that they totally rely on suppliers to hold the inventory. With the pandemic, a lot of customers first pushed out orders which made the supplier chill in spine. The suppliers tried to cut their inventory in order to prepare enough cash for industrial winter.

However, you won’t be pleased that the shortage will increase, and it will likely persist until the following year due to some developments that have affected manufacturing.

The actual quantity of the damaged goods and products was not specified, but you’d be impressed to know that AUO’s facility in Taiwan produces millions of panels. It made more than 10 million large modules for TVs and a little less than 9.5 million small to medium screens meant for monitors last month. An hour of stoppage means that several thousand will get delayed, but that doesn’t count the number of broken panels that are already fragile or sensitive, to begin with.

Foundries for other parts such as memory modules or processors aren’t as affected even if they suspended operations as well. TrendForce reported that they were indeed halted by the earthquake, but the damage to their equipment and product was limited since they aren’t as fragile as LCD panels.

It also doesn’t get any better at this point since existing shortages for boards and ICs have already affected supply and pricing. Factor in the effect of the pandemic, and you will get a level of uncertainty for manufacturing and sales in 2021. These two massive disruptions seem like they will make the shortage we are experiencing now worse, so we have no choice but to recommend grabbing what you can as soon as possible.

Half of the ill effects we mentioned are speculation at this point, and even the CEO of AU Optronics has not yet commented regarding the effects on pricing. However, basic economics will dictate that a large-scale shortage like this will lead to price hikes, especially at a time where demand and the growth of the display and monitor market are steadily expanding.

What exactly is short in the market? Your iPhone’s screen is one solid unit made up of several elements that are fused together with OCA (optically clear adhesive). The exterior glass, the digitizer panel (touch sensor), the polarizer and LCD panel. The LCD panel is the key component that is in short supply. Originally Apple had 3 manufacturers to produce LCD panels (LG, Sharp and Toshiba). Apple’s authorized manufacturers have the exclusive technology to produce LCD panels. Other Chinese manufacturers can copy the glass, digitizer, polarizers, OCA, flex cables, backlights, frames and everything except for the main component of the LCD assembly.

How were we getting these parts before? A big leak in Apple’s supply chain. The iPhone 5, 5S and 5C all share most of the same raw components including the LCD panel, the only difference is the flex cable and plastic frame. Independent factories in China can produce these components and can manufacture any 5 series assembly from an LCD panel. Shown on the left is a pulse pressing machine, used to connect the flex cable to the LCD. We use one of these to repair LCDs with damaged flex cables.

So what’s happening?A few things, first Apple has cut off LG and Toshiba, making Sharp their exclusive supplier for iPhone LCD panels and implemented very tight security. Secondly, they have had Foxconn destroy stockpiles of series 5 LCD panels to reduce the parts and material leakage to factories that re-engineer them for the independent repair industry. Along with this strategy, Apple has instructed Foxconn to reduce series 6 materials leakage from their manufacturing centers. Lastly, Apple is working aggressively with US Customs to seize inbound parts.

How long is this shortage going to last? In short,we have no idea. At the time of this writing, LCD prices have been steadily rising for 6 months and replacement iPhone 6S LCDs cost twice what Apple charges for their repair service. Apple does not intend to compete with independent repair shops, instead they are squeezing the profit out of the industry. LCD refurbishing may help shops cut cost but without new LCD panels entering the system it won’t last long.

What does this mean for the independent repair community?Apple is the only repair operation that is immune. Even the Chinese LCD refurbishing plants used by the large chain repair companies are running out of LCDs. Continually rising costs may push out the big chains but with lower overhead and clever problem-solving, the owner-operated shops stand a fighting chance.

Just as many industry people are scratching around trying to find what they need to deliver on work in the midst of technology shortages, there’s word the display part of the business is flipping from shortage to oversupply.

The industry analysts at Display Supply Chain (or DSCC) have pushed out a new report that suggests “the shortage of large LCDs, which has lasted for almost a year and has resulted in the biggest panel price increases in the history of the industry, has begun to turn into an oversupply.”

The demand drivers that led to the shortage, particularly strong TV demand in the USA, are fading away with the spread of vaccination in the United States, and industry supply is filling the pipeline with enough inventory to eliminate any fear of shortage.

With respect to the outlook for LCD panel prices in the second half of 2021, we see a possibility that the panel price for LCD TVs will fall in some sizes starting in July. Since the profit margins of LCD manufacturers are at a very high level, we expect that panel makers will maintain a high utilization rate without adjusting production even if there is an oversupply.

TVs and commercial displays look much the same, but differ in engineering and I am not sure if oversupply in TVs means, with time, plenty of supply on the commercial panel side. Even if display panel availability is improving, there are lots of other electronics elements in a digital signage build – media players, connectivity, audio and so on – that might also be hard to find.

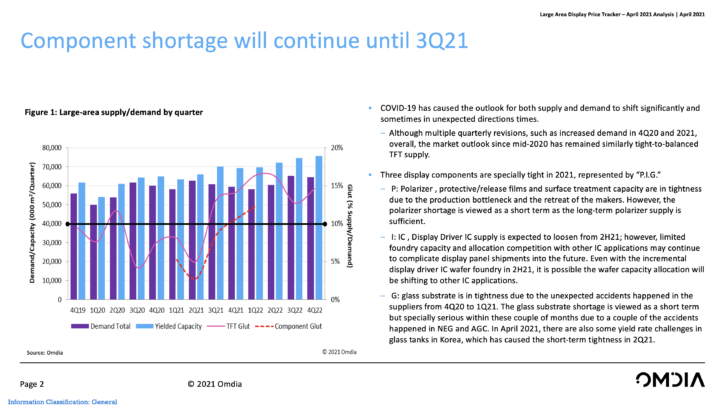

Based on Omdia’s Large Area Display Price Tracker, April 2021, Sanju Khatri, director of consulting for displays, ProAV and consumer devices at research and consultancy firm Omdia, provided some analysis on disruption in the display supply chain due to component shortage and high demand. Impact will be mostly felt on LCD technology, as strong demand and component shortage will lead to the following price cycles for LCD panels.

EDITOR’S NOTE: Three distinct terms are used below. Components (display driver IC, glass, and polarizer); panel (raw LCD panels) and brands/finished sets/device vendors (TV, monitor/laptops/ProAV vendors).

Strong consumer demand for TVs/IT displays. The “at home” trends are including work at home, learn at home, entertain at home and shop at home. The LCD TV, Notebook, LCD monitor, and tablet PC products continue to have the strong demand thanks to the “at home” trends.

Display panel makers are increasing prices sharply to take the fast turnaround on profitability. The LCD TV open cell prices have been increasing by 40%-50% from June 2020 to December 2020. And it is expected there will be another 20% increase from January 2021 to May 2021.

Component shortage(Glass substrate, Display Driver IC, T-con, PMIC, Polarizer films) are frustrating the supply chain from time to time, making the set makers to be more nervous thus giving more orders. Three display components are especially tight in 2021, represented by “P.I.G.”

P: Polarizer, protective/release films and surface treatment capacity are in tightness due to the production bottleneck and the retreat of the makers. However, the polarizer shortage is viewed as a short term as the long-term polarizer supply is sufficient.

I: IC, Display Driver IC supply is expected to loosen from 2H21however, limited foundry capacity and allocation competition with other IC applications may continue to complicate display panel shipments into the future. Even with the incremental display driver IC wafer foundry in the second half of 2021 (2H21), it is possible the wafer capacity allocation will be shifting to other IC applications.

G: Glass substrate is in tightness due to the unexpected accidents happened in the suppliers from 4Q20 to 1Q21. The glass substrate shortage is viewed as a short term but especially serious within these couple of months due to some accidents that happened in NEG and AGC. The recovery schedule is expected to take 6 months in Omdia’s estimation. In April 2021, there were also some yield rate challenges in glass tanks in Korea, which caused the short-term tightness in 2Q21.

In recent weeks, all leading PC makers have complained about the tight supply of LCD panels due to shortages of components and complicated logistics. As it turns out, the situation might get worse in the coming weeks and months due to an earthquake in Taiwan and a power outage in Japan, eventually resulting in higher prices at retail.

Last week an earthquake struck Taiwan. This isn"t an extraordinary event for the country, but it does have repercussions. AU Optronics (AUO), one of the leading makers of LCD panels, said this week that some of its production lines had been impacted by the quake, and it had taken it "at least a few hours" to clean up and repair them before resuming operations. Some of the output was lost because of the disaster, reports DigiTimes, citing Paul Peng, the chairman of AU Optronics.

Mr. Peng did not quantify the company"s losses, but AUO makes hundreds of thousands of LCD panels every day, so the earthquake will clearly impact the supply of display panels. Back in November, AUO produced 10.81 million large-sized panels for LCD TVs, desktops, and notebooks as well as 9.35 million small-and-medium-sized panels. AUO says it has now resumed normal operations.

On November 10, a power outage in Takatsuki, Japan, disrupted operations at Nippon Electric Glass"s Shiga-Takatsuki plant that manufactures glass substrates for flat-panel displays. The outage lasted for five hours and damaged some of NEG"s production equipment, the company revealed in its statement.

NEG owns about 10% of the world"s glass substrate manufacturing capacity and supplies glass substrates for LCD panels to numerous panel makers, according to the chairman of AUO. Consequently, NEG"s production problems will impact the whole market as customers that buy from NEG will have to source components from other suppliers.

The chairman of AU Optronics did not reveal his expectations concerning prices of LCD panels and displays in the coming months. Still, it is evident that shortages usually lead to price hikes. The only question is how significant the hikes will be.

MLA style: "Taiwan"s New TFT-LCD Makers Face Parts Shortage.." The Free Library. 1999 Datamonitor 21 Dec. 2022 https://www.thefreelibrary.com/Taiwan%27s+New+TFT-LCD+Makers+Face+Parts+Shortage.-a056194777

Chicago style: The Free Library. S.v. Taiwan"s New TFT-LCD Makers Face Parts Shortage.." Retrieved Dec 21 2022 from https://www.thefreelibrary.com/Taiwan%27s+New+TFT-LCD+Makers+Face+Parts+Shortage.-a056194777

APA style: Taiwan"s New TFT-LCD Makers Face Parts Shortage.. (n.d.) >The Free Library. (2014). Retrieved Dec 21 2022 from https://www.thefreelibrary.com/Taiwan%27s+New+TFT-LCD+Makers+Face+Parts+Shortage.-a056194777

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey