lcd panel shortage made in china

The escalating coronavirus crisis is impacting production at display panel factories located in the semi-quarantined city of Wuhan, China, spurring a significant near-term reduction in the global supply of panels used in liquid crystal display televisions (LCDs) and other products.

The five factories in the city producing liquid crystal displays (LCDs) and organic light-emitting diode (OLED) panels will experience near-term slowdowns in production compared to expected levels, according to IHS Markit technology research, now a part of Informa Tech.

With the situation evolving quickly, IHS Markit technology research is still assessing the magnitude of the supply shortfall on multiple display types and markets. However, leading Chinese panel makers stated they believe that total capacity utilization for all LCD fabs in the country could fall by at least 10 percent and perhaps by more than 20 percent during the month of February.

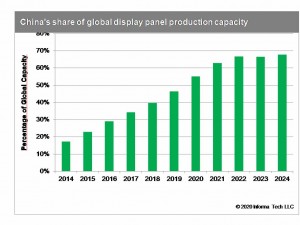

With China expected to own 55 percent of global display manufacturing capacity in 2020, the immediate impact of the production reduction has been a worldwide decrease in availability and an increase in pricing for LCD-TV panels. This has resulted in turmoil throughout the display supply chain as suppliers and purchasers alike scramble to adjust to swiftly changing market conditions.

“Display facilities in Wuhan currently are dealing with the very real impacts of the coronavirus outbreak,” said David Hsieh, senior director, displays, at IHS Markit technology research. “These factories are facing shortages of both labor and key components as a result of mandates designed to limit the contagion’s spread. In the face of these challenges, top display suppliers in China have informed our experts that a near-term production decline is unavoidable.”

The leading Chinese suppliers of LCD panels for TVs, notebook PCs and PC monitors now are planning to raise panel prices more aggressively. For example, the price for an open-cell LCD-TV panel was originally expected to rise by $1 or $2 per month in February. However, the actual increase may be $3 to $5 for the month.

Beyond the immediate production impact at these facilities, the coronavirus is also likely to trigger delays in the ramp-up of manufacturing at new display fabs during the first half of 2020. This will reduce overall panel availability during the next few months. It also could result in further panel supply tightness as TV display buyers hasten the pace of their panel purchases to build stockpiles for future shortfalls.

While major panel makers are rightly concerned about the coronavirus’s impact on consumer sales, demand for their products from TV makers has actually increased. TV makers are pulling in their panel demand and sometimes double-booking orders to shore up their inventories. The panel maker indicated that the demand surge for orders delivered in February is as large as 10 percent above the previous demand forecast.

The labor shortage encountered by fabs in Wuhan is partly the result of the Chinese government’s move to extend the Lunar New Year holiday by three days, with the last day now scheduled for Sunday, February 2. The extension is designed to reduce travel and cut down on public gatherings to contain the spread of the disease.

LCD panel makers outsource much of the production of such modules. However, production at several key third-party module suppliers has now ceased, impacting panel production severely throughout the country. Key module supplier SkyTech is sharply reducing production until mid-February.

Panel makers maintain their own captive LCD module factories. However, these operations are also facing production bottlenecks amid the coronavirus crisis.

The module shortage potentially could expand the impact of the contagion beyond China—with a knock-on effect on production at display manufacturers worldwide.

HSINCHU, Taiwan (Reuters) May 17 - AU Optronics Corp, Taiwan’s No. 2 LCD maker, said an LCD panel shortage is likely to last into the second half of this year on robust demand for PCs and TVs, even though fears linger about a weak euro.A woman walks past an Au Optronics LCD monitor at the company"s headquarters in Hsinchu May 17, 2010. AU Optronics Corp, Taiwan"s No. 2 LCD maker, said an LCD panel shortage is likely to last into the second half of this year on robust demand for PCs and TVs, even though fears linger about a weak euro. REUTERS/Nicky Loh

“Clients have requested a large amount (of panels), but we are not able to deliver,” Lee, 58, said at the company’s headquarters in the Hsinchu science park, Taiwan’s high-tech center.

“Monitor (panel) is tight, and notebook and especially TV (as well),” said Lee, adding that he sees no impact from a weak euro now. AU returned to profit in the first quarter after strong demand boosted sales and prices of its displays.

Major LCD makers in Asia have reported brisk demand recently as economies recover, with China leading the way. However, some analysts say the sector might be saddled with oversupply later this year if display makers aggressively ramp up output.

AU has applied to the Taiwan government for approval to set up a new LCD factory in China, with an investment of about $3 billion, as it aims to strengthen its competitiveness in China, which could soon become the world’s largest TV consumer.

Other LCD rivals, including LG Display of South Korea, also have similar plans to build new plants on the mainland, and relaxed investment laws may help usher high-generation production there.

“Competitors are competing with volume, but we should compete on value. How much value a panel can create is a key,” Lee said, who was named AU’s chairman in 2001 when the company was created by a merger of Acer Display and Unipac Optoelectronics.

Display panel manufacturers TCL and Innolux have said they are expecting supply of liquid crystal display (LCD) panels to be tight throughout the year.

TCL chairman Li Dongsheng said at a media briefing last week that the shortage in panels will continue in the first half of 2021. The situation for the second half of the year remains to be seen but panel supply in 2021 will overall be tight, the chairman said.

Innolux president James Yang made similar comments to Li, saying the shortage in LCD panels caused by strong demand for LCD since the spread of COVID-19 is expected to continue through 2021.

Yang said shortage in LCD components such as power semiconductors, driver ICs and glass substrates have caused companies to manufacture less LCD panels than there actual production capacity. The shortage in IC (integrated circuits, ie semiconductors) was the most serious and may continue up to the first half of 2022, the president said.

Display panel makers in Greater China are also transitioning their Gen 8.5 TV lines for those of IT panels. These company want to manufacture LCD TV panels at their Gen 10.5 lines that will increase productivity for them.

Market research firm Omdia believes many panel makers have targeted panel prices to the levels in the first half of 2017, when prices peaked. This will be especially true for 55-inch panels, the firm said.

Due to the shortage in driver ICs, panel makers are preferring to manufacture the more profitable IT panels over TV panels. For TV panels, they are preferring to produce larger ones.

There also may be changes in the LCD panel supply chain as TV manufacturers won’t continue buying LCD panels as much as they did when the panel price increase is hurting their profitability.

Meanwhile, the tight LCD TV panel supply in the second half of 2020 was caused by companies lowering their production volume and demand being higher than expected.

Panel prices have increased from June to December last year. For 32-inch, the price increased by 94%. Prices of 43-inch panels increased 65%, 50-inch 64%, 55-inch 59% and 65-inch 25%, according to Omdia.

Glass substrate makers NEG and AGC Fine Techno Korea suffered shutdowns of their factories in December and January, respectively, which further intensified the shortage in panels. These companies are yet to normalize production and supply to customers.

Recent observations by market intelligence firm TrendForce suggests that the ongoing expansion of the US semiconductor trade restrictions against China could eventually spread to the display panel industry. Agencies within the US government are taking notice of China’s certain advantages in the development of display technologies and build-up of panel production capacity.

However, the US will unlikely attempt to directly impose control over panel supply with new trade restrictions in the short term. On the other hand, the upstream portion of the supply chain, especially the sections concerning driver ICs and other related semiconductor chips, are starting to react to the tightening of the US sanctions against Chinese semiconductor companies. Furthermore, some electronics OEMs have recently been re-examining their panel supply chains to evaluate the sourcing of semiconductor components. While OEMs have yet to explicitly ban the use of panel-related chips from Chinese suppliers, they are actively developing backup plans that would seek alternative supply sources in case the US further broadens the scope its technology export rules on Chinese companies.

The continuation and strengthening of the restrictions on semiconductor trade is starting to have an effect on the supply chain related to driver ICs. TrendForce’s latest investigation finds signs of decoupling or bifurcation. Specifically, there is a divergence towards both extremes: a supply chain that totally excludes Chinese content versus a counterpart that is “de-Americanized”. Again, looking at OEMs, they have not rejected panels from certain suppliers for now, but they might start to prefer or exclude particular IC design houses that offer driver chips. As for foundries and OSAT providers, decoupling has begun in accordance with the decisions of some downstream customers. In the future, there is a distinct possibility that Chinese IC design houses, foundries and OSAT providers could be barred from participating in the supply chains for the product models targeting the US market.

Presently, Chinese foundries have steadily raised their collective market share for large-sized driver ICs to around 25%. They still have much ground to catch up when compared with the 40% held by Taiwan-based foundries, but this share figure is still significant. If the US government imposes new restrictions seeking to prevent Chinese foundries from using mature semiconductor process technologies to manufacture chips such as driver ICs, then the supply chains for panels and related ICs will likely face another huge wave of capacity crunch and supply shortage.

Nevertheless, since there are no direct orders from the US government targeting panel supply and related components at this moment, TrendForce believes the decoupling process in the supply chain for driver ICs is going to be a slow and drawn-out process. In the long run, decoupling as an overarching trend will make the supply chain more fragmented and inefficient. This development, in turn, will increase the overall cost for all parties involved. Furthermore, due to the need to mitigate the potential risks resulting from the decoupling process, the supply chain could even see an elevation of minimum inventory level and a prolonging of order lead time.

The lockdowns brought on by this crisis had caused many manufacturers to temporarily shut down. With the increasing amount of products incorporating LCDs and many productions lines down, it has become more difficult to meet

The labor shortages in Asia at the liquid crystal display factories are causing the factories to increase their MOQ. MOQ is short for minimum order quantity; this is the minimum amount of LCD products that can be ordered at one time.

Character LCD: Character displays are also known as alphanumeric LCD displays. These are the most popular standard type of an LCD display module. As a general rule the character display manufacturers ask for 500 LCDs per order.

Graphic LCD: Graphic displays are also known as monochrome LCD displays. As a general rule the graphic display manufacturers request a 500 MOQ. These include FSTN, STN and TN. The MOQ is the same for no backlight as it is for LED backlight and EL backlight.

Custom LCD: It is not uncommon to have a large minimum order for a custom LCD display module that is a replacement LCD display or to replace a discontinued LCD monochrome display.

Segment LCD: Segment displays are also known as static displays or glass displays. At this time the MOQ for most segment displays is 2,500. The factory will build as few as 1,000 at a time, but the LCD cost per display will increase.

These include all types of segment displays such as 7 (seven) segment LCD display, 14 (fourteen) segment LCD display, 16 (sixteen) segment LCD display

Both labor and materials are in short supply in a country that churns out more than half the world"s LCD panels. Wuhan, the epicenter of the outbreak, is a major production hub. With panel prices rising and output having yet to recover, TV makers are rethinking plans for new models at a time that was anticipated as a bonanza for the industry.

Chinese manufacturers are expected to raise their market share from 39% this year to 52% next year in the monitor panel market, and 36% to 39% in the notebook panel market

Chinese manufacturers are expected to raise their market share from 39% this year to 52% next year in the monitor panel market, and 36% to 39% in the notebook panel market, according to TrendForce’s preliminary shipment forecast of panel makers for 2021. As such, these manufacturers are expected to maintain their plans of transitioning some production capacities from TV panel manufacturing to IT panel manufacturing in spite of the TV panel shortage in 2H20 caused by various factors such as the closedown of SDC’s LCD panel manufacturing operations, the rise of the stay-at-home economy, and the stimulus policies instituted by governments worldwide.

TrendForce indicates that, with regards to the standing of Chinese manufacturers in the IT panel industry, BOE has long established itself as the market leader, while CSOT and HKC are each also catching up fast. After acquiring SDC’s Suzhou-based Gen 8.5 fab, CSOT will possess even more production capacities for monitor panels. At the same time, HKC currently maintains three Gen 8.6 fabs, located in Chongqing, Chuzhou, and Mianyang, and plans to capture additional shares in the monitor panel and notebook panel markets.

Chinese panel makers have been gradually transitioning their current panel capacities to monitor panel production. Most significantly, as more Gen 10.5 production lines become available, TV panel production will most likely take place in Gen 10.5 fabs instead of Gen 8.5 fabs in the future, while the existing Gen 8.5 and Gen 8.6 production lines will be reallocated to monitor panel production in order to expend the excess capacity made available after TV panel production moves to Gen 10.5 fabs. In addition, after SDC’s forecasted closing of LCD panel manufacturing operations at the end of this year, CSOT and HKC will look to capture the resultant supply share of SDC’s absence in the market. On the other hand, since both TCL, which is CSOT’s parent company, and HKC possess monitor ODM operations, should the two companies decide to vertically integrate by making panels for their own monitor products, they will be able to effectively optimize their cost structures.

Although CSOT’s Wuhan-based T3 LTPS Gen 6 production line is primarily dedicated to smartphone and notebook panel manufacturing, the considerable reduction of LTPS smartphone panel demand from Huawei caused by U.S. sanctions means CSOT is expected to make plans for an increase in notebook panel shipment in order to make up for the shortfall. As well, thanks to high demand for TV panels this year, HKC’s production lines have been operating at maximum capacity utilization rates, in turn slowing down its notebook panel business. However, in light of the fact that the COVID-19 pandemic has brought about a rapid surge in TN notebook panel demand, HKC is therefore looking to TN panels as a new commercial opportunity in the notebook display market and subsequently prioritizing TN panel development over IPS panel development as its product strategy. Not only will this reprioritization allow HKC to align its strategy with the current market trend, but it will also quickly raise the yield rate of HKC’s Mianyang-based fab, which had never manufactured NB panels, by instead having the fab manufacture TN panels, which have a relatively simpler manufacturing process.

TrendForce analyst Jeff Yang indicates that, despite Chinese panel makers’ strong intention to enter the IT panel manufacturing business, success in the IT panel market is not solely decided by a company’s production capacity. For instance, with regards to monitor panels, CSOT’s technical competency is mostly focused on VA panels, meaning the company is constrained in its product mixes due to its lack of mainstream IPS offerings. Although HKC is equipped with both IPS and VA technologies, it lacks experience in manufacturing curved VA panels, leading its clients to take on a wait-and-see approach before placing additional orders. For notebook panels, although CSOT is primarily focusing on the mid-range and high-end LTPS notebook panel market, it faces intense competition from Samsung’s OLED notebook panels, which are gradually extending from the high-end segment to the mid-range segment as well. Likewise, HKC will have to take time in order to make headways in the notebook panel market, since it has not reached any production milestones, and it requires time to cultivate a significant client base.

The five factories in the city producing liquid crystal displays (LCDs) and organic light-emitting diode (OLED) panels will experience near-term slowdowns in production compared to expected levels, according to IHS Markit technology research, now a part of Informa Tech.

With the situation evolving quickly, IHS Markit technology research is still assessing the magnitude of the supply shortfall on multiple display types and markets. However, leading Chinese panel makers stated they believe that total capacity utilization for all LCD fabs in the country could fall by at least 10 percent and perhaps by more than 20 percent during the month of February.

With China expected to own 55 percent of global display manufacturing capacity in 2020, the immediate impact of the production reduction has been a worldwide decrease in availability and an increase in pricing for LCD-TV panels. This has resulted in turmoil throughout the display supply chain as suppliers and purchasers alike scramble to adjust to swiftly changing market conditions.

“Display facilities in Wuhan currently are dealing with the very real impacts of the coronavirus outbreak,” said David Hsieh, senior director, displays, at IHS Markit technology research. “These factories are facing shortages of both labor and key components as a result of mandates designed to limit the contagion’s spread. In the face of these challenges, top display suppliers in China have informed our experts that a near-term production decline is unavoidable.”

The leading Chinese suppliers of LCD panels for TVs, notebook PCs and PC monitors now are planning to raise panel prices more aggressively. For example, the price for an open-cell LCD-TV panel was originally expected to rise by $1 or $2 per month in February. However, the actual increase may be $3 to $5 for the month.

Beyond the immediate production impact at these facilities, the coronavirus is also likely to trigger delays in the ramp-up of manufacturing at new display fabs during the first half of 2020. This will reduce overall panel availability during the next few months. It also could result in further panel supply tightness as TV display buyers hasten the pace of their panel purchases to build stockpiles for future shortfalls.

While major panel makers are rightly concerned about the coronavirus’s impact on consumer sales, demand for their products from TV makers has actually increased. TV makers are pulling in their panel demand and sometimes double-booking orders to shore up their inventories. The panel maker indicated that the demand surge for orders delivered in February is as large as 10 percent above the previous demand forecast.

The labor shortage encountered by fabs in Wuhan is partly the result of the Chinese government’s move to extend the Lunar New Year holiday by three days, with the last day now scheduled for Sunday, February 2. The extension is designed to reduce travel and cut down on public gatherings to contain the spread of the disease.

LCD panel makers outsource much of the production of such modules. However, production at several key third-party module suppliers has now ceased, impacting panel production severely throughout the country. Key module supplier SkyTech is sharply reducing production until mid-February.

Panel makers maintain their own captive LCD module factories. However, these operations are also facing production bottlenecks amid the coronavirus crisis. The module shortage potentially could expand the impact of the contagion beyond China—with a knock-on effect on production at display manufacturers worldwide.

/img/iea/M3OeDvQPwN/coronavirus-main.jpg)

What exactly is short in the market? Your iPhone’s screen is one solid unit made up of several elements that are fused together with OCA (optically clear adhesive). The exterior glass, the digitizer panel (touch sensor), the polarizer and LCD panel. The LCD panel is the key component that is in short supply. Originally Apple had 3 manufacturers to produce LCD panels (LG, Sharp and Toshiba). Apple’s authorized manufacturers have the exclusive technology to produce LCD panels. Other Chinese manufacturers can copy the glass, digitizer, polarizers, OCA, flex cables, backlights, frames and everything except for the main component of the LCD assembly.

How were we getting these parts before? A big leak in Apple’s supply chain. The iPhone 5, 5S and 5C all share most of the same raw components including the LCD panel, the only difference is the flex cable and plastic frame. Independent factories in China can produce these components and can manufacture any 5 series assembly from an LCD panel. Shown on the left is a pulse pressing machine, used to connect the flex cable to the LCD. We use one of these to repair LCDs with damaged flex cables.

So what’s happening?A few things, first Apple has cut off LG and Toshiba, making Sharp their exclusive supplier for iPhone LCD panels and implemented very tight security. Secondly, they have had Foxconn destroy stockpiles of series 5 LCD panels to reduce the parts and material leakage to factories that re-engineer them for the independent repair industry. Along with this strategy, Apple has instructed Foxconn to reduce series 6 materials leakage from their manufacturing centers. Lastly, Apple is working aggressively with US Customs to seize inbound parts.

How long is this shortage going to last? In short,we have no idea. At the time of this writing, LCD prices have been steadily rising for 6 months and replacement iPhone 6S LCDs cost twice what Apple charges for their repair service. Apple does not intend to compete with independent repair shops, instead they are squeezing the profit out of the industry. LCD refurbishing may help shops cut cost but without new LCD panels entering the system it won’t last long.

What does this mean for the independent repair community?Apple is the only repair operation that is immune. Even the Chinese LCD refurbishing plants used by the large chain repair companies are running out of LCDs. Continually rising costs may push out the big chains but with lower overhead and clever problem-solving, the owner-operated shops stand a fighting chance.

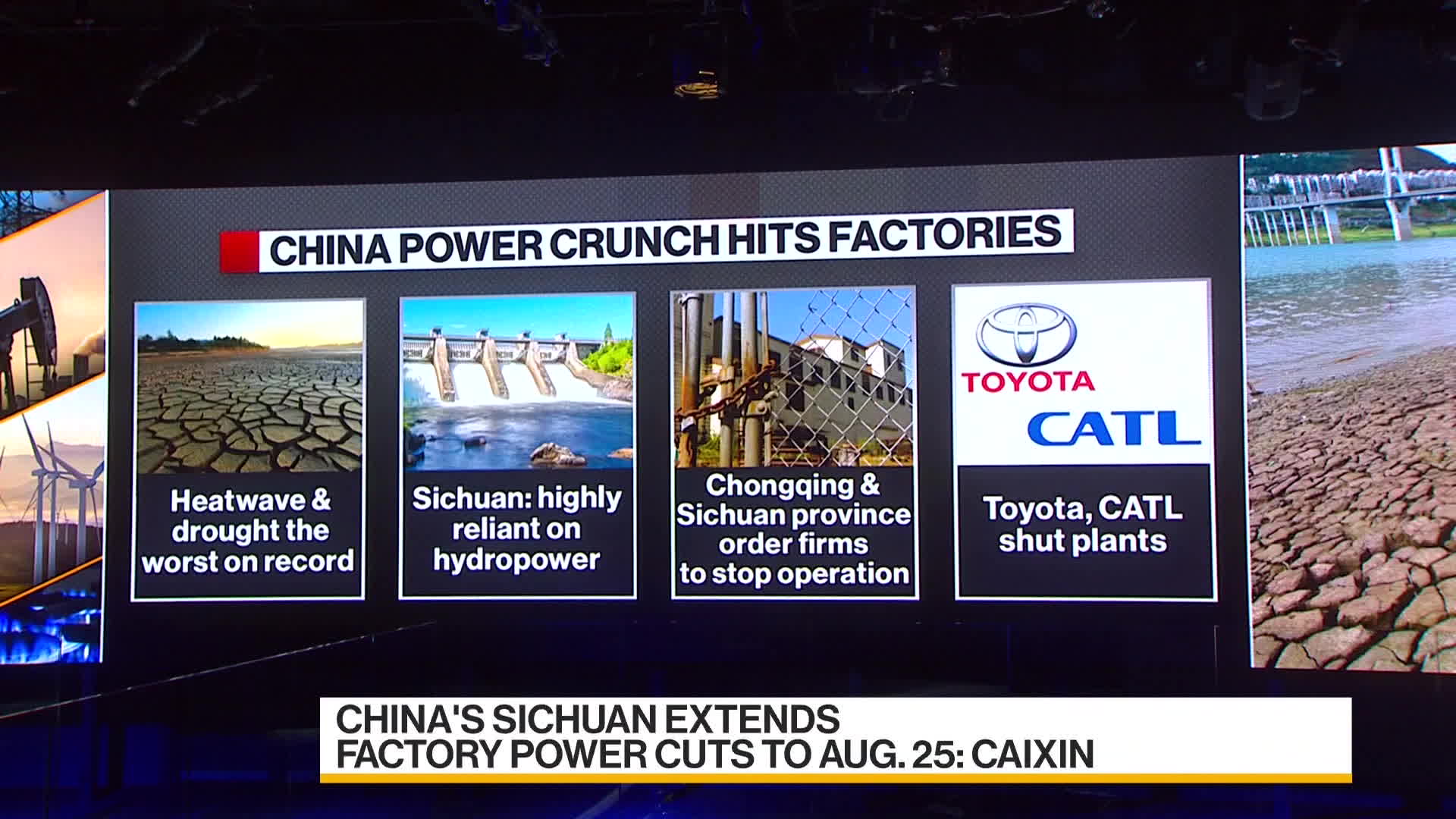

Faced with a reduced workforce caused by travel bans and quarantine conditions, LCD and OLED fabrication plants (fabs) across China struggled to resume normal operations in early‐ to mid‐February. Chinese LCD fabs were only expected to have a capacity utilization of 70 to 75 percent for the month compared to a normal rate of 90 to 95 percent, according to research from Omdia Display.

That labor challenge was exacerbated further in mid‐to‐late February by bottlenecks in chemical materials and key components such as polarizers and printed circuit boards. “Those materials and component companies are facing the same situation—a shortage of labor, a shortage of logistics support, and the quarantine procedures,” says Omdia Display"s Senior Director David Hsieh. The net result could be as much as a 40 to 50 percent drop in overall display production in China for February, he notes.

The biggest impact is in LCD displays for TVs and notebook computers. By late 2019, the prolonged issue of LCD panel over‐supply driven by Chinese fabs had begun to reverse course as Korean manufacturers restructured their capacity, shutting down some fabs and converting others to OLED production. According to Hsieh, concerns about an LCD panel supply going forward already had spurred some TV manufacturers to increase orders, and now that LCD production in China is slowing as a result of the COVID‐19 outbreak, LCD panel makers are seeking sharp price increases from their original equipment manufacturer (OEM) customers, with a month‐to‐month jump of as much as 10 percent in some cases.

Omdia had originally forecast that the price for an open‐cell LCD TV panel was going to rise by $1 or $2 per month in February, but the actual increase may wind up being $3 to $5 for the month. “The problem is the coronavirus is coming so fast [that] the panel maker has been given a very good reason to increase the price radically,” Hsieh says. He also expects prices to increase for notebook displays, for which he predicts a 30–40 percent decrease in production for 2020"s first financial quarter (Q1), because of shortages in LCD modules.

In Wuhan itself, there are five major fabs, with four making smartphone displays. China Star and Tianma each operate a low‐temperature polycrystalline silicon LCD fab and a flexible OLED fab in the city, while BOE has a new Gen 10.5 LCD plant aimed at TV panels. Hsieh says that the China Star and Tianma OLED fabs are both in the ramping‐up stages, and the new BOE fab also is moving slowly. The biggest impact of COVID‐19 in Wuhan may be on the China Star Gen 6 OLED plant. Along with BOE, it"s slated to be a key supplier of flexible OLED panels for Lenovo"s new Motorola Razr foldable phone. “It"s unfortunate timing,” Hsieh says. —Glen Dickson

All told, it"s believed the chip shortage cost automotive OEMs around $210 billion in lost revenues for 2021, with many individual brands continuing to bring in lower-than-expected quarterly results and adjusting their future financial targets as a result throughout 2022.

It"s taken longer, but the smartphone market is also feeling the impact of chip shortages. Smartphone sales were on the rebound throughout 2021 after a 2020 dip, but in Q3, global shipments slid 6% when compared to Q3 of 2020; supply couldn"t meet demand.

Gartner noted that smartphone companies are delaying launches of some of their most in-demand products due to the shortages, but production of basic smartphones is more heavily impacted than premium smartphones (sales of which are actually up). In a report tied to the third-quarter smartphone sales, an IDC analyst explained that supply issues for most smartphone companies won"t be resolved until well into 2022. However, some of the most in-demand phones are expected to become more available by February 2022.

The chip shortage is also slowing or halting IoT projects — including the implementation of IoT modules that use 5G networks. Demand for cellular IoT chipsets and modules had been surging as companies worked to implement 5G technologies, but a 6% drop in shipments in Q3 2021 will hamper that growth. Every connected device, from smart meters to point-of-sales systems at retail stores, uses these chipsets, and this delay could further delay the long-awaited conversion from 4G to 5G.

The full effects of the shortages have yet to be seen on 5G"s rollout. However, a number of telecommunications companies warned the F.C.C. in June 2021 that a lack of chips could have significant impacts on the deployment of 5G connections.

So far, industries have dealt with the chip shortage in mostly short-term ways. The automotive industry has turned to on-the-fly decisions like cutting high-tech features from new car models. Meanwhile, the smartphone industry was able to ride out the early stages of the shortage by using semiconductors they had stockpiled at the beginning of the pandemic — a solution that, as previously mentioned, is no longer viable. Making it through this, or any, component shortage starts with a resilient supply chain strategy built on visibility, predictability and communication.

Perhaps the only thing that can be said with certainty about the global chip shortages is that no one is certain when they will end. If demand holds as expected based on market data and conversations with our customers, we expect the semiconductor market to be tight well into 2023.

There"s no easy way to get around a short supply of semiconductors and rising costs when every company is in the same boat. However, there"s a big difference between a leaky kayak and a powerboat that is capable of navigating rocky waters. Every original equipment manufacturer (OEM) can take a series of steps to ensure they"re in the best position possible as chip shortages persist:

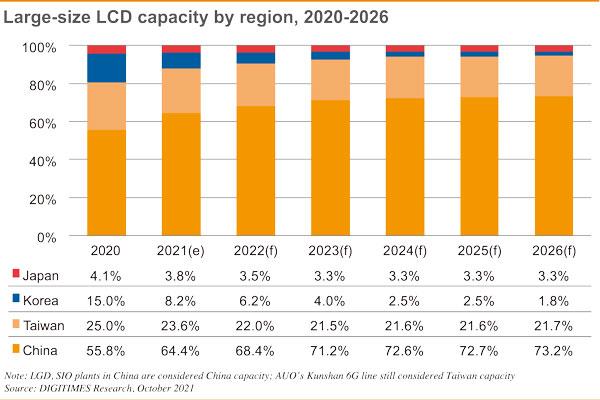

Due to increasing capacity from China, South Korean LCD panel makers are quickly realizing that LCD displays profitability may eventually erode, due to growing capacity and price competition from China, so they are betting their future on organic light-emitting diode (OLED) displays. Because of lower profit margins and slowing market growth, the IT display category has become the first product line that LCD display manufacturers are quitting, according to IHS Markit (Nasdaq: INFO), a world leader in critical information, analytics and solutions.

Samsung Display was the first company to do so, selling a fifth generation (Gen 5) fabrication plant (fab) to a Chinese touch and module maker last year. In the future, more fab restructuring is expected, especially the facilities dedicated to making IT panels.

“Brands like HP and Lenovo expected notebook panels to be in a surplus situation, and they were therefore keeping their panel inventories at very low levels,” said Jason Hsu, senior principal analyst, IHS Markit. “This shift from Samsung Display could cause some brands to experience panel shortages in the third quarter of 2016.”

Samsung Display delivered 30 million notebook panels in 2015, according to the latest information from the IHS Markit Tablet and Notebook Display Market Tracker. With the company’s latest fab reorganization plan, notebook PC LCD panel shipments could fall to 12 million units in 2016 and to 4 million in 2017. There will be an 18 million-unit gap this year, which means brands might not be able to find other sources to keep up with production needs.

When reviewing the supply chain mix in the first quarter of 2016, it is clear that HP has been affected by these changes more than other companies, with shipments from Samsung Display down from 1.1 million units in first quarter to 350,000 units in the second quarter. However, HP has shifted its orders to other panel makers to secure enough panels for its production needs, for example, Innolux.

BOE is another panel maker benefitting from the exit of Samsung Display from this market. Panel shipments from BOE increased from 4.9 million units in the first quarter to 7.2 million in the second quarter. BOE is expected to grow its notebook business to more than 36 million units in 2017. BOE first began to supply panels for notebooks in 2009, and it has now become one of the largest IT panel suppliers. Furthermore, BOE has a Gen8 fab in Chongqing, China — near the world’s largest notebook production base. In fact, notebook panel shipments from the Chongqing fab are expected to grow quickly next year, thanks to the more efficient logistics.

LG Display and Samsung Display used to supply Apple with notebook panels; however, the fab re-organization — especially the reallocation of oxide capacity — has increased Apple’s concerns about a potential panel shortage and possible low yields. For this reason, Apple is expected to add another panel supplier for its new MacBook Pro, to diversify the risk from Samsung Display business changes. For its legacy MacBook Air line of notebook PCs, Apple is considering diversifying its supply chain to Chinese makers, which is the first time Apple will use LCD panels from China.

Samsung Display’s exit from the LCD display business has also affected the supply of wide-view-angle in-plane switching (IPS) and plane-to-line switching (PLS) displays. Samsung Display has been one of the major suppliers to offer wide-view-angle panels, and its shipment volume is second only to LG Display.

In order to source IPS and PLS panels, brands must find other sources to replace Samsung Display, after the company begins to reduce production. AUO is one of the qualified candidates, and apparently it is receiving more orders from notebook PC brands. AUO, Innolux and other Taiwanese manufacturers and BOE and other Chinese suppliers are all expanding IPS panels to respond to increasing panel requirements.

QINGDAO, China — The global chip shortage could persist for another two to three years before ending, the President of Hisense, one of China"s largest TV and household goods makers, told CNBC.

A number of factors have led to the chip shortage including a surge in demand for consumer electronics amid lockdowns around the world after the pandemic began. The U.S. trade war with China also led to companies stockpiling supplies.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey