lcd panel market share factory

The upstream materials or components of the LCD panel industry mainly include liquid crystal materials, glass substrates, polarizing lenses, and backlight LEDs (or CCFL, which accounts for less than 5% of the market).

The middle reaches is the main panel factory processing and manufacturing, through the glass substrate TFT arrays and CF substrate, CF as upper and TFT self-built perfusion liquid crystal and the lower joint, and then put a polaroid, connection driver IC and control circuit board, and a backlight module assembling, eventually forming the whole piece of LCD module. The downstream is a variety of fields of application terminal-based brand, assembly manufacturers. At present, the United States, Japan, and Germany mainly focus on upstream raw materials, while South Korea, Taiwan, and the mainland mainly seek development in mid-stream panel manufacturing.

With the successive production of the high generation line in mainland China, the panel production capacity and technology level have been steadily improved, and the industrial competitiveness has been gradually enhanced. Nowadays, the panel industry is divided into three parts: South Korea, mainland China, and Taiwan, and mainland China is expected to become the no.1 in the world in 2019.

In the past decade, China’s panel display industryhas achieved leapfrog development, and the overall size of the industry has ranked among the top three in the world. Chinese mainland panel production capacity is expanding rapidly, although Japanese panel manufacturers master a large number of key technologies, gradually lose the price competitive advantage, compression panel production capacity. Panel production is concentrated in South Korea, Taiwan, and China, which is poised to become the world’s largest producer of LCD panels.

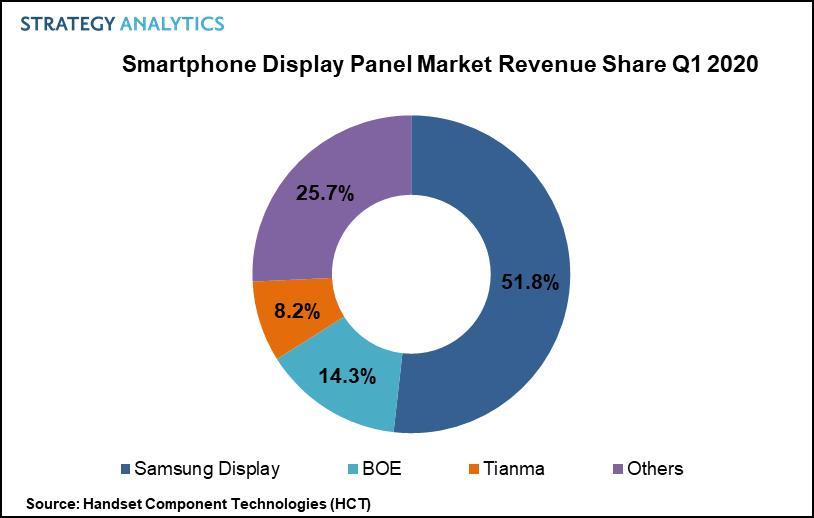

Up to 2016, BOE‘s global market share continued to increase: smartphone LCD, tablet PC display, and laptop display accounted for the world’s first market share, and display screen increased to the world’s second, while TV LCD remained the world’s third. In LCD TV panels, Chinese panel makers have accounted for 30 percent of global shipments to 77 million units, surpassing Taiwan’s 25.5 percent market share for the first time and ranking second only to South Korea.

In terms of the area of shipment, the area of board shipment of JD accounted for only 8.3% in 2015, which has been greatly increased to 13.6% in the first half of 2016, while the area of shipment of hu xing optoelectronics in the first half of 2015 was only 5.1%, which has reached 7.8% in the first half of 2016. The panel factories in mainland China are expanding their capacity at an average rate of double-digit growth and transforming it into actual shipments and areas of shipment. On the other hand, although the market share of South Korea, Japan, and Taiwan is gradually decreasing, some South Korean and Japanese manufacturers have been inclined to the large-size HD panel and AMOLED market, and the production capacity of the high-end LCD panel is further concentrated in mainland China.

Domestic LCD panel production line capacity gradually released, overlay the decline in global economic growth, lead to panel makers from 15 in the second half began, in a low profit or loss, especially small and medium-sized production line, the South Korean manufacturers take the lead in transformation strategy, closed in medium and small size panel production line, South Korea’s 19-panel production line has shut down nine, and part of the production line is to research and development purposes. Some production lines are converted to LTPS production lines through process conversion. Korean manufacturers are turning to OLED panels in a comprehensive way, while Japanese manufacturers are basically giving up the LCD panel manufacturing business and turning to the core equipment and materials side. In addition to the technical direction of the research and judgment, more is the LCD panel business orders and profits have been severely compressed, Korean and Japanese manufacturers have no desire to fight. Since many OLED technologies are still in their infancy in mainland China, it is a priority to move to high-end panels such as OLED as soon as possible. Taiwanese manufacturers have not shut down factories on a large scale, but their advantages in LCD technology and OLED technology have been slowly eroded by the mainland.

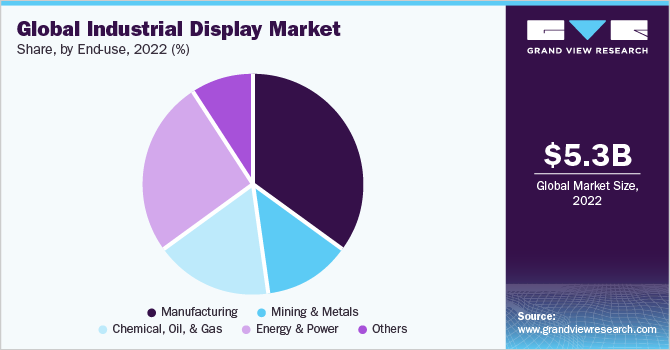

STONE provides a full range of 3.5 inches to 15.1 inches of small and medium-size standard quasi TFT LCD module, LCD display, TFT display module, display industry, industrial LCD screen, under the sunlight visually highlight TFT LCD display, industrial custom TFT screen, TFT LCD screen-wide temperature, industrial TFT LCD screen, touch screen industry. The TFT LCD module is very suitable for industrial control equipment, medical instruments, POS system, electronic consumer products, vehicles, and other products.STONE provides a full range of 3.5 inches to 15.1 inches of small and medium-size standard quasi TFT LCD module, LCD display, TFT display module, display industry, industrial LCD screen, under the sunlight visually highlight TFT LCD display, industrial custom TFT screen, TFT LCD screen-wide temperature, industrial TFT LCD screen, touch screen industry. The TFT LCD module is very suitable for industrial control equipment, medical instruments, POS system, electronic consumer products, vehicles, and other products.

According to IMARC Group’s latest report, titled “TFT LCD Panel Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2022-2027”, the global TFT LCD panel market size reached US$ 157 Billion in 2021. Looking forward, IMARC Group expects the market to reach US$ 207.6 Billion by 2027, exhibiting a growth rate (CAGR) of 4.7% during 2022-2027.

A thin-film-transistor liquid-crystal display (TFT LCD) panel is a liquid crystal display that is generally attached to a thin film transistor. It is an energy-efficient product variant that offers a superior quality viewing experience without straining the eye. Additionally, it is lightweight, less prone to reflection and provides a wider viewing angle and sharp images. Consequently, it is generally utilized in the manufacturing of numerous electronic and handheld devices. Some of the commonly available TFT LCD panels in the market include twisted nematic, in-plane switching, advanced fringe field switching, patterned vertical alignment and an advanced super view.

We are regularly tracking the direct effect of COVID-19 on the market, along with the indirect influence of associated industries. These observations will be integrated into the report.

The global market is primarily driven by continual technological advancements in the display technology. This is supported by the introduction of plasma enhanced chemical vapor deposition (PECVD) technology to manufacture TFT panels that offers uniform thickness and cracking resistance to the product. Along with this, the widespread adoption of the TFT LCD panels in the production of automobiles dashboards that provide high resolution and reliability to the driver is gaining prominence across the globe. Furthermore, the increasing demand for compact-sized display panels and 4K television variants are contributing to the market growth. Moreover, the rising penetration of electronic devices, such as smartphones, tablets and laptops among the masses, is creating a positive outlook for the market. Other factors, including inflating disposable incomes of the masses, changing lifestyle patterns, and increasing investments in research and development (R&D) activities, are further projected to drive the market growth.

The competitive landscape of the TFT LCD panel market has been studied in the report with the detailed profiles of the key players operating in the market.

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

The global TFT-LCD display panel market attained a value of USD 181.67 billion in 2022. It is expected to grow further in the forecast period of 2023-2028 with a CAGR of 5.2% and is projected to reach a value of USD 246.25 billion by 2028.

The current global TFT-LCD display panel market is driven by the increasing demand for flat panel TVs, good quality smartphones, tablets, and vehicle monitoring systems along with the growing gaming industry. The global display market is dominated by the flat panel display with TFT-LCD display panel being the most popular flat panel type and is being driven by strong demand from emerging economies, especially those in Asia Pacific like India, China, Korea, and Taiwan, among others. The rising demand for consumer electronics like LCD TVs, PCs, laptops, SLR cameras, navigation equipment and others have been aiding the growth of the industry.

TFT-LCD display panel is a type of liquid crystal display where each pixel is attached to a thin film transistor. Since the early 2000s, all LCD computer screens are TFT as they have a better response time and improved colour quality. With favourable properties like being light weight, slim, high in resolution and low in power consumption, they are in high demand in almost all sectors where displays are needed. Even with their larger dimensions, TFT-LCD display panel are more feasible as they can be viewed from a wider angle, are not susceptible to reflection and are lighter weight than traditional CRT TVs.

The global TFT-LCD display panel market is being driven by the growing household demand for average and large-sized flat panel TVs as well as a growing demand for slim, high-resolution smart phones with large screens. The rising demand for portable and small-sized tablets in the educational and commercial sectors has also been aiding the TFT-LCD display panel market growth. Increasing demand for automotive displays, a growing gaming industry and the emerging popularity of 3D cinema, are all major drivers for the market. Despite the concerns about an over-supply in the market, the shipments of large TFT-LCD display panel again rose in 2020.

North America is the largest market for TFT-LCD display panel, with over one-third of the global share. It is followed closely by the Asia-Pacific region, where countries like India, China, Korea, and Taiwan are significant emerging market for TFT-LCD display panels. China and India are among the fastest growing markets in the region. The growth of the demand in these regions have been assisted by the growth in their economy, a rise in disposable incomes and an increasing demand for consumer electronics.

The report gives a detailed analysis of the following key players in the global TFT-LCD display panel Market, covering their competitive landscape, capacity, and latest developments like mergers, acquisitions, and investments, expansions of capacity, and plant turnarounds:

*At Expert Market Research, we strive to always give you current and accurate information. The numbers depicted in the description are indicative and may differ from the actual numbers in the final EMR report.

BOE was the leading LCD TV panel vendor during the first half of 2020, having shipped approximately 23.26 million units worldwide. In that period, global shipments of LCD TV panels totaled over 115 million units.

BOE Technology, founded in 1993, has become China’s largest TV panel maker and it continues to make a name for itself in the global consumer electronics market. It was the first company to introduce a gen 10.5 LCD plant in late 2017. Since then, BOE’s LCD panel production capacity has grown annually, surpassing former leading manufacturer LG Display. In recent years, BOE accounted for over 20 percent of large-area TFT LCD display unit shipments worldwide.

Chinese panel makers accelerate worldwide LCD TV panel shipmentsChina became the leading LCD panel producer worldwide in 2017, overtaking powerhouses South Korea and Taiwan. Chinese shipments of LCD TV panels 60-inch and larger have also increased significantly in recent years, with roughly 2.24 million units sold in the first quarter of 2019 worldwide, in comparison to just 117,000 units a year before. This figure is forecast to increase in the future, paving the way for Chinese panel makers’ worldwide success. At the same time, the concurrent specialization on large LCD panels by Chinese and South Korean suppliers will likely push down panel prices.Read moreGlobal LCD TV panel unit shipments from H1 2016 to H1 2020, by vendor(in millions)tablecolumn chartCharacteristicBOELGDInnoluxCSOTSDCAUOCEC GroupOthers1H 202023.2611.7920.3421.312.1310.14-16.17

TrendForce. (July 28, 2020). Global LCD TV panel unit shipments from H1 2016 to H1 2020, by vendor (in millions) [Graph]. In Statista. Retrieved December 20, 2022, from https://www.statista.com/statistics/760270/global-market-share-of-led-lcd-tv-vendors/

TrendForce. "Global LCD TV panel unit shipments from H1 2016 to H1 2020, by vendor (in millions)." Chart. July 28, 2020. Statista. Accessed December 20, 2022. https://www.statista.com/statistics/760270/global-market-share-of-led-lcd-tv-vendors/

TrendForce. (2020). Global LCD TV panel unit shipments from H1 2016 to H1 2020, by vendor (in millions). Statista. Statista Inc.. Accessed: December 20, 2022. https://www.statista.com/statistics/760270/global-market-share-of-led-lcd-tv-vendors/

TrendForce. "Global Lcd Tv Panel Unit Shipments from H1 2016 to H1 2020, by Vendor (in Millions)." Statista, Statista Inc., 28 Jul 2020, https://www.statista.com/statistics/760270/global-market-share-of-led-lcd-tv-vendors/

TrendForce, Global LCD TV panel unit shipments from H1 2016 to H1 2020, by vendor (in millions) Statista, https://www.statista.com/statistics/760270/global-market-share-of-led-lcd-tv-vendors/ (last visited December 20, 2022)

China is the leader in producing LCD display panels, with a forecast capacity share of 56 percent in 2020. China"s share is expected to increase in the coming years, stabilizing at 69 percent from 2023 onwards.Read moreLCD panel production capacity share from 2016 to 2025, by countryCharacteristicChinaJapanSouth KoreaTaiwan-----

DSCC. (June 8, 2020). LCD panel production capacity share from 2016 to 2025, by country [Graph]. In Statista. Retrieved December 20, 2022, from https://www.statista.com/statistics/1056470/lcd-panel-production-capacity-country/

DSCC. "LCD panel production capacity share from 2016 to 2025, by country." Chart. June 8, 2020. Statista. Accessed December 20, 2022. https://www.statista.com/statistics/1056470/lcd-panel-production-capacity-country/

DSCC. (2020). LCD panel production capacity share from 2016 to 2025, by country. Statista. Statista Inc.. Accessed: December 20, 2022. https://www.statista.com/statistics/1056470/lcd-panel-production-capacity-country/

DSCC. "Lcd Panel Production Capacity Share from 2016 to 2025, by Country." Statista, Statista Inc., 8 Jun 2020, https://www.statista.com/statistics/1056470/lcd-panel-production-capacity-country/

DSCC, LCD panel production capacity share from 2016 to 2025, by country Statista, https://www.statista.com/statistics/1056470/lcd-panel-production-capacity-country/ (last visited December 20, 2022)

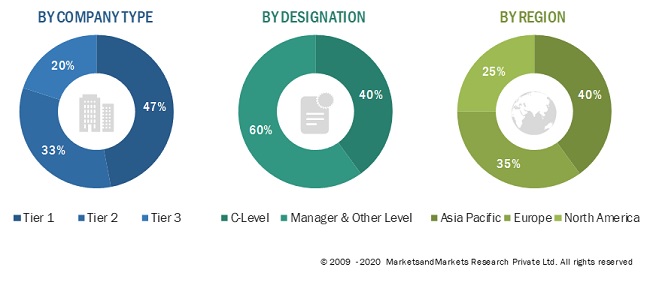

Dublin, July 12, 2022 (GLOBE NEWSWIRE) -- The "Global Display Driver Market (2022-2027) by Display Size & Devices, Display Technology, Driver & Package, Geography, Competitive Analysis, and the Impact of Covid-19 with Ansoff Analysis" report has been added to ResearchAndMarkets.com"s offering.

Market dynamics are forces that impact the prices and behaviors of the Global Display Driver Market stakeholders. These forces create pricing signals which result from the changes in the supply and demand curves for a given product or service. Forces of Market Dynamics may be related to macro-economic and micro-economic factors. There are dynamic market forces other than price, demand, and supply. Human emotions can also drive decisions, influence the market, and create price signals.

As the market dynamics impact the supply and demand curves, decision-makers aim to determine the best way to use various financial tools to stem various strategies for speeding the growth and reducing the risks.

The report provides a detailed analysis of the competitors in the market. It covers the financial performance analysis for the publicly listed companies in the market. The report also offers detailed information on the companies" recent development and competitive scenario. Some of the companies covered in this report are Samsung Electronics, Novatek Microelectronics, Synaptics, Himax Technologies, Silicon Works, Sitronix Technology, Raydium Semiconductor, MagnaChip Semiconductor, FocalTech, MediaTek, Fitipower Integrated Technology, ROHM Semiconductor, Solomon Systech, Microchip Technology, Solasoled, Dialog Semiconductor, Lucid Display Technology, Sinowealth Electronic, Ultrachip, etc.

The report includes Competitive Quadrant, a proprietary tool to analyze and evaluate the position of companies based on their Industry Position score and Market Performance score. The tool uses various factors for categorizing the players into four categories. Some of these factors considered for analysis are financial performance over the last 3 years, growth strategies, innovation score, new product launches, investments, growth in market share, etc.

Ansoff Analysis The report presents a detailed Ansoff matrix analysis for the Global Display Driver Market. Ansoff Matrix, also known as Product/Market Expansion Grid, is a strategic tool used to design strategies for the growth of the company. The matrix can be used to evaluate approaches in four strategies viz. Market Development, Market Penetration, Product Development and Diversification. The matrix is also used for risk analysis to understand the risk involved with each approach.

The report analyses the Global Display Driver Market using the Ansoff Matrix to provide the best approaches a company can take to improve its market position.

Why buy this report? The report offers a comprehensive evaluation of the Global Display Driver Market. The report includes in-depth qualitative analysis, verifiable data from authentic sources, and projections about market size. The projections are calculated using proven research methodologies.

The report includes an in-depth market analysis using Porter"s 5 forces model and the Ansoff Matrix. In addition, the impact of Covid-19 on the market is also featured in the report.

a line of extreme and ultra-narrow bezel LCD displays that provides a video wall solution for demanding requirements of 24x7 mission-critical applications and high ambient light environments

A promotional image of a quantum-dot LED TV (Samsung Electronics)Samsung Display, the display making arm of Samsung Electronics, is poised to fully shut down its unprofitable liquid crystal display panel business for televisions in June, after over 30 years of operation.

“(Samsung Display) will terminate its supply of LCD panels in June,” an industry source said Monday. The company has been manufacturing its lower-end panels in Asan, South Chungcheong Province.

The long-awaited move came as LCD TV panel prices have been on a constant decline. This led to greater losses for Samsung Display, while Chinese competitors have been ramping up their dominance in the global industry supported by state subsidies and tax breaks.

LCD TVs are considered lower-end when compared to those using cutting-edge TV components such as organic light-emitting diode panels and quantum dot display panels.

According to market intelligence firm Omdia‘s estimate compiled by Daishin Securities, 43-inch LCD panel prices fell 46 percent from September 2021 to May this year, while that of 55-inch panels and 65-inch panels both declined 34 percent over the cited period.

This marks the end of Samsung’s three-decade LCD TV panel business. Once the largest LCD TV panel supplier in the world, Samsung Display‘s market share has gradually shrunk from 22 percent in 2014 to around 2 percent this year.

Samsung Display had sought to exit the business from before 2021, but has been hanging on in part due to Samsung Electronics’ LCD panel supply shortage.

Choi Kwon-young, executive vice president of Samsung Display, confirmed the company’s full exit from the LCD TV panel business within this year in a first-quarter conference call in April.

Given that Samsung’s LCD TV panel exit has long been anticipated and carried out gradually, Samsung Electronics will “unlikely be affected by Samsung Display‘s LCD panel exit” in terms of its continuity in the LCD TV set business, noted Kim Hyun-soo, an analyst at Hana Financial Investment on Monday.

Samsung looks to pivot to quantum dot display technologies for its TV panel business, using quantum dot light-emitting diodes or quantum dot organic light-emitting diodes.

As for the anticipated collaboration between TV maker Samsung Electronics and the world‘s sole white-OLED TV panel supplier LG Display, Kim of Hana said the launch of Samsung’s OLED TV is unlikely within this year due to prolonged negotiations.

While conventional speakers are large and heavy due to components such as the voice coil, cone, and magnet, the Thin Actuator Sound Solution is extremely thin and lightweight thanks to LG Display’s film-type exciter technology. The company’s unique technology allows the device to vibrate off display panels and various materials inside the car body to enable a rich, 3D immersive sound experience.

Liquid-crystal-display televisions (LCD TVs) are television sets that use liquid-crystal displays to produce images. They are, by far, the most widely produced and sold television display type. LCD TVs are thin and light, but have some disadvantages compared to other display types such as high power consumption, poorer contrast ratio, and inferior color gamut.

LCD TVs rose in popularity in the early years of the 21st century, surpassing sales of cathode ray tube televisions worldwide in 2007.plasma display panels and rear-projection television.

Passive matrix LCDs first became common as portable computer displays in the 1980s, competing for market share with plasma displays. The LCDs had very slow refresh rates that blurred the screen even with scrolling text, but their light weight and low cost were major benefits. Screens using reflective LCDs required no internal light source, making them particularly well suited to laptop computers. Refresh rates of early devices were too slow to be useful for television.

Portable televisions were a target application for LCDs. LCDs consumed far less battery power than even the miniature tubes used in portable televisions of the era. In 1980, Hattori Seiko"s R&D group began development on color LCD pocket televisions. In 1982, Seiko Epson released the first LCD television, the Epson TV Watch, a small wrist-worn active-matrix LCD television. Sharp Corporation introduced the dot matrix TN-LCD in 1983, and Casio introduced its TV-10 portable TV.Citizen Watch introduced the Citizen Pocket TV, a 2.7-inch color LCD TV, with the first commercial TFT LCD display.

Throughout this period, screen sizes over 30" were rare as these formats would start to appear blocky at normal seating distances when viewed on larger screens. LCD projection systems were generally limited to situations where the image had to be viewed by a larger audience. At the same time, plasma displays could easily offer the performance needed to make a high quality display, but suffered from low brightness and very high power consumption. Still, some experimentation with LCD televisions took place during this period. In 1988, Sharp introduced a 14-inch active-matrix full-color full-motion TFT-LCD. These were offered primarily as high-end items, and were not aimed at the general market. This led to Japan launching an LCD industry, which developed larger-size LCDs, including TFT computer monitors and LCD televisions. Epson developed the 3LCD projection technology in the 1980s, and licensed it for use in projectors in 1988. Epson"s VPJ-700, released in January 1989, was the world"s first compact, full-color LCD projector.

In 2006, LCD prices started to fall rapidly and their screen sizes increased, although plasma televisions maintained a slight edge in picture quality and a price advantage for sets at the critical 42" size and larger. By late 2006, several vendors were offering 42" LCDs, albeit at a premium price, encroaching upon plasma"s only stronghold. More decisively, LCDs offered higher resolutions and true 1080p support, while plasmas were stuck at 720p, which made up for the price difference.

Predictions that prices for LCDs would rapidly drop through 2007 led to a "wait and see" attitude in the market, and sales of all large-screen televisions stagnated while customers watched to see if this would happen.Christmas sales season.

When the sales figures for the 2007 Christmas season were finally tallied, analysts were surprised to find that not only had LCD outsold plasma, but CRTs as well, during the same period.Pioneer Electronics was ending production of the plasma screens was widely considered the tipping point in that technology"s history as well.

In spite of LCD"s dominance of the television field, other technologies continued to be developed to address its shortcomings. Whereas LCDs produce an image by selectively blocking a backlight, organic LED, microLED, field-emission display and surface-conduction electron-emitter display technologies all produce an illuminated image directly. In comparison to LCDs all of these technologies offer better viewing angles, much higher brightness and contrast ratio (as much as 5,000,000:1), and better color saturation and accuracy. They also use less power, and in theory they are less complex and less expensive to build.

Flat-panel displays are thin panels of glass or plastic used for electronically displaying text, images, or video. Liquid crystal displays (LCD), OLED (organic light emitting diode) and microLED displays are not quite the same; since LCD uses a liquid crystal that reacts to an electric current blocking light or allowing it to pass through the panel, whereas OLED/microLED displays consist of electroluminescent organic/inorganic materials that generate light when a current is passed through the material. LCD, OLED and microLED displays are driven using LTPS, IGZO, LTPO, and A-Si TFT transistor technologies as their backplane using ITO to supply current to the transistors and in turn to the liquid crystal or electroluminescent material. Segment and passive OLED and LCD displays do not use a backplane but use indium tin oxide (ITO), a transparent conductive material, to pass current to the electroluminescent material or liquid crystal. In LCDs, there is an even layer of liquid crystal throughout the panel whereas an OLED display has the electroluminescent material only where it is meant to light up. OLEDs, LCDs and microLEDs can be made flexible and transparent, but LCDs require a backlight because they cannot emit light on their own like OLEDs and microLEDs.

Liquid-crystal display (or LCD) is a thin, flat panel used for electronically displaying information such as text, images, and moving pictures. They are usually made of glass but they can also be made out of plastic. Some manufacturers make transparent LCD panels and special sequential color segment LCDs that have higher than usual refresh rates and an RGB backlight. The backlight is synchronized with the display so that the colors will show up as needed. The list of LCD manufacturers:

Organic light emitting diode (or OLED displays) is a thin, flat panel made of glass or plastic used for electronically displaying information such as text, images, and moving pictures. OLED panels can also take the shape of a light panel, where red, green and blue light emitting materials are stacked to create a white light panel. OLED displays can also be made transparent and/or flexible and these transparent panels are available on the market and are widely used in smartphones with under-display optical fingerprint sensors. LCD and OLED displays are available in different shapes, the most prominent of which is a circular display, which is used in smartwatches. The list of OLED display manufacturers:

MicroLED displays is an emerging flat-panel display technology consisting of arrays of microscopic LEDs forming the individual pixel elements. Like OLED, microLED offers infinite contrast ratio, but unlike OLED, microLED is immune to screen burn-in, and consumes less power while having higher light output, as it uses LEDs instead of organic electroluminescent materials, The list of MicroLED display manufacturers:

LCDs are made in a glass substrate. For OLED, the substrate can also be plastic. The size of the substrates are specified in generations, with each generation using a larger substrate. For example, a 4th generation substrate is larger in size than a 3rd generation substrate. A larger substrate allows for more panels to be cut from a single substrate, or for larger panels to be made, akin to increasing wafer sizes in the semiconductor industry.

"Samsung Display has halted local Gen-8 LCD lines: sources". THE ELEC, Korea Electronics Industry Media. August 16, 2019. Archived from the original on April 3, 2020. Retrieved December 18, 2019.

"TCL to Build World"s Largest Gen 11 LCD Panel Factory". www.businesswire.com. May 19, 2016. Archived from the original on April 2, 2018. Retrieved April 1, 2018.

"Panel Manufacturers Start to Operate Their New 8th Generation LCD Lines". 대한민국 IT포털의 중심! 이티뉴스. June 19, 2017. Archived from the original on June 30, 2019. Retrieved June 30, 2019.

"TCL"s Panel Manufacturer CSOT Commences Production of High Generation Panel Modules". www.businesswire.com. June 14, 2018. Archived from the original on June 30, 2019. Retrieved June 30, 2019.

"Samsung Display Considering Halting Some LCD Production Lines". 비즈니스코리아 - BusinessKorea. August 16, 2019. Archived from the original on April 5, 2020. Retrieved December 19, 2019.

Herald, The Korea (July 6, 2016). "Samsung Display accelerates transition from LCD to OLED". www.koreaherald.com. Archived from the original on April 1, 2018. Retrieved April 1, 2018.

"China"s BOE to have world"s largest TFT-LCD+AMOLED capacity in 2019". ihsmarkit.com. 2017-03-22. Archived from the original on 2019-08-16. Retrieved 2019-08-17.

In general, there are two types of displays in the market today: active matrix liquid crystal display (AMLCD) and AMOLED. In its simplicity, the fundamental components required to make up the display are the same for AMLCD and AMOLED. There are four layers of a display device (FIGURE 1): a light source, switches that are the thin-film-transistor and where the gases are mainly used, a shutter to control the color selection, and the RGB (red, green, blue) color filter.

Technology trends TFT-LCD (thin-film-transistor liquid-crystal display) is the baseline technology. MO / White OLED (organic light emitting diode) is used for larger screens. LTPS / AMOLED is used for small / medium screens. The challenges for OLED are the effect of < 1 micron particles on yield, much higher cost compared to a-Si due to increased mask steps, and moisture impact to yield for the OLED step.

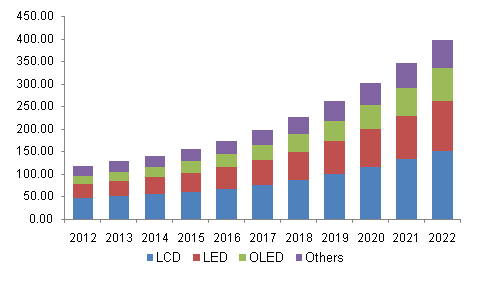

Although AMLCD displays are still dominant in the market today, AMOLED displays are growing quickly. Currently about 25% of smartphones are made with AMOLED displays and this is expected to grow to ~40% by 2021. OLED televisions are also growing rapidly, enjoying double digit growth rate year over year. Based on IHS data, the revenue for display panels with AMOLED technol- ogies is expected to have a CAGR of 18.9% in the next five years while the AMLCD display revenue will have a -2.8% CAGR for the same period with the total display panel revenue CAGR of 2.5%. With the rapid growth of AMOLED display panels, the panel makers have accel- erated their investment in the equipment to produce AMOLED panels.

There are three types of thin-film-transistor devices for display: amorphous silicon (a-Si), low temperature polysilicon (LTPS), and metal oxide (MO), also known as transparent amorphous oxide semiconductor (TAOS). AMLCD panels typically use a-Si for lower-resolution displays and TVs while high-resolution displays use LTPS transistors, but this use is mainly limited to small and medium displays due to its higher costs and scalability limitations. AMOLED panels use LTPS and MO transistors where MO devices are typically used for TV and large displays (FIGURE 3).

This shift in technology also requires a change in the gases used in production of AMOLED panels as compared with the AMLCD panels. As shown in FIGURE 4, display manufacturing today uses a wide variety of gases.

Nitrogen trifluoride: NF3 is the single largest electronic material from spend and volume standpoint for a-Si and LTPS display production while being surpassed by N2O for MO production. NF3 is used for cleaning the PECVD chambers. This gas requires scalability to get the cost advantage necessary for the highly competitive market.

To facilitate these increasing demands, display manufacturers must partner with gas suppliers to identify which can meet their technology needs, globally source electronic materials to provide customers with stable and cost- effective gas solutions, develop local sources of electronic materials, improve productivity, reduce carbon footprint, and increase energy efficiency through on-site gas plants. This is particularly true for the burgeoning China display manufacturing market, which will benefit from investing in on-site bulk gas plants and collaboration with global materials suppliers with local production facilities for high-purity gas and chemical manufacturing.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey