lcd module manufacturing process pricelist

LCD panel prices have risen for 4 months in a row because of your home gaming? Since this year, the whole LCD panel market has smoked. Whether after the outbreak of the epidemic, LCD panel market prices rose for four months, or the panel giants in Japan and South Korea successively sold production lines, or the Chinese mainland listed companies frequently integrated acquisition, investment, and plant construction, all make the industry full of interesting.

LCD panel prices are already a fact. Since May this year, LCD panel prices have risen for four months in a row, making the whole industry chain dynamic. Why are LCD panels going up in price in a volatile 2020? The key factor lies in the imbalance between supply and demand.

The price of LCDS for large-size TVs of 70 inches or more hasn’t budged much. In addition, LTPS screens and AMOLED screens used in high-end phones have seen little or no increase in price.

As for October, LCD panel price increases are expected to moderate. The data shows that in October 32 inches or 2 dollars; Gains of 39.5 to 43 inches will shrink to $3;55 inches will fall back below $10; The 65-inch gain will narrow to $5.

During the epidemic, people stayed at home and had no way to go out for entertainment. They relied on TV sets, PCS, and game consoles for entertainment. After the resumption of economic work and production, the market of traditional home appliances picked up rapidly, and LCD production capacity was quickly digested.

However, due to the shutdown of most factories lasting 1-2 months during the epidemic period, LCD panel production capacity was limited, leading to insufficient production capacity in the face of the market outbreak, which eventually led to the market shortage and price increase for 4 consecutive months.

In fact, the last round of price rise of LCD panels was from 2016 to 2017, and its overall market price has continued to fall since 2018. Even in 2019, individual types have fallen below the material cost, and the whole industry has experienced a general operating loss. As a result, LCD makers have been looking for ways to improve margins since last year.

A return to a reasonable price range is the most talked about topic among panel makers in 2019, according to one practitioner. Some manufacturers for the serious loss of the product made the decision to reduce production or even stop production; Some manufacturers planned to raise the price, but due to the epidemic in 2020, the downstream demand was temporarily suppressed and the price increase was postponed. After the outbreak was contained in April, LCD prices began to rise in mid-to-late May.

In fact, the market price of LCD panels continued to decline in 2018-2019 because of the accelerated rise of China’s LCD industry and the influx of a large number of local manufacturers, which doubled the global LCD panel production capacity within a few years, but there was no suitable application market to absorb it. The result of excess capacity is oversupply, ultimately making LCD panel prices remain depressed.

Against this background, combined with the impact of the epidemic in 2020, the operating burden of LCD companies in Japan and South Korea has been further aggravated, and it is difficult to make profits in the production of LCD panels, so they have to announce the withdrawal of LCD business.

business in June 2022. In August, Sharp bought JDI Baishan, a plant in Ishikawa prefecture that makes liquid crystal display panels for smartphones. In early September, Samsung Display sold a majority stake in its SUZHOU LCD production plant to Starlight Electronics Technology, a unit of TCL Technology Group. LGD has not only pulled out of some of its production capacity but has announced that it will close its local production line in 2020. According to DSCC, a consultancy, the share of LCD production capacity in South Korea alone will fall from 19% to 7% between 2020 and 2021.

It is worth mentioning that in industry analysis, in view of the fact that Korean companies are good at using “dig through old bonus – selling high price – the development of new technology” the cycle of development mode, another 2020 out of the LCD production capacity, the main reason may be: taking the advantage of China’s expanding aggressively LCD manufacturers, Korean companies will own LCD panel production line hot sell, eliminating capacity liquid to extract its final value, and turning to the more profitable advantage of a new generation of display technologies, such as thinner, color display better OLED, etc. Samsung, for example, has captured more than 80% of the OLED market with its first-mover advantage.

From the perspective of production capacity, the launch of LCD tracks by major manufacturers in Japan and South Korea must reduce some production capacity in the short term, which to some extent induces market price fluctuations. In the long run, some of the Japanese and Korean LCD production capacity has been bought by Chinese manufacturers, coupled with frequent investment in recent years, the overall capacity is sure to recover as before, or even more than before. But now it will take time to expand the production layout, which more or less will cause supply imbalance, the industry needs to be cautious.

The LCD panel industry started in the United States and then gradually moved to Japan, South Korea, China, and Taiwan. At present, the proportion of production capacity in The Chinese mainland has reached 52% in 2020, and there are leading LCD panel products in China represented by BOE, Huxing Optoelectronics. Meanwhile, the production capacity layout of BOE, Huike, Huxing Optoelectronics, and other manufacturers has been basically completed, making industrial integration a necessity.

On the one hand, South Korean enterprises out of the LCD track, the domestic factory horse enclosure, plant expansion action. While LCDs may not sell as well as “upstart” flexible screens, respondents believe they are still strong enough in the traditional home appliance market to warrant continued investment. Zhao Bin, general manager of TCL Huaxing Development Center, has said publicly that the next-generation display technology will be mature in four to five years, but the commercialization of products may not take place until a decade later. “LCD will still be the mainstream in this decade,” he said.

On the other hand, there is no risk of neck jam in China’s LCD panel industry, which is generally controllable. In mainland China, there will be 21 production lines capable of producing 32-inch or larger LCD panels by 2021, accounting for about two-thirds of the global total. In terms of the proportion of production capacity, the Chinese mainland accounted for 42% of the global LCD panel in 2019, 51% this year, and will continue to climb to 63% next year.

Of course, building factories and expanding production cannot be accomplished overnight. In the process of production capacity recovery, it is predicted that there will be several price fluctuations, and the cost may be passed on to the downstream LCD panel manufacturers or consumers when the price rises greatly, which requires continuous attention.

Looking to take your project to the next level in terms of functionality and appearance? A custom LCD display might be the thing that gets you there, at least compared to the dot-matrix or seven-segment displays that anyone and their uncle can buy from the usual sources for pennies. But how does one create such a thing, and what are the costs involved? As is so often the case these days, it’s simpler and cheaper than you think, and [Dave Jones] has a great primer on designing and specifying custom LCDs.

The video below is part of an ongoing series; a previous video covered the design process, turning the design into a spec, and choosing a manufacturer; another discussed the manufacturer’s design document approval and developing a test plan for the module. This one shows the testing plan in action on the insanely cheap modules – [Dave] was able to have a small run of five modules made up for only $138, which included $33 shipping. The display is for a custom power supply and has over 200 segments, including four numeric sections, a clock display, a bar graph, and custom icons for volts, amps, millijoules, and watt-hours. It’s a big piece of glass and the quality is remarkable for the price. It’s not perfect – [Dave] noted a group of segments on the same common lines that were a bit dimmer than the rest, but was able to work around it by tweaking the supply voltage a bit.

We’re amazed at how low the barrier to entry into custom electronics has become, and even if you don’t need a custom LCD, at these prices it’s tempting to order one just because you can. Of course, you can also build your own LCD display completely from scratch too.

Prices for large-sized LCD panels for notebooks and LCD monitors have begun declining this month, bringing an end to a five-quarter period of consecutive increases.

Panel prices began to increase in April 2003, and rose about 21-28% from that time until last month. The price of 15-inch notebook and LCD monitor panels in the XGA format increased to the US$230 to US$235 range in June, up from US$180 to US$190 last April.

In June, panel buyers’ biggest concerns were component shortages and cost increases, as well as hikes in panel prices. Concern over future supply constraints, combined with worries over further price increases, prompted notebook and LCD monitor makers to keep boosting their orders for panels in the second quarter, even though they had detected signs of a slowdown in demand.

A similar situation is also occurring in the 14-inch notebook panel market, where prices declined on month by US$9 in July. iSuppli/Stanford Resources expects price reductions to continue in August, with declines ranging from US$8 to US$20 for notebook and LCD monitor panels and from US$20 to more than US$50 for TV panels. Average price reductions in the third quarter are expected to be 5-10% for notebook and monitor panels and 10-15% for TV panels.

Large-sized LCD panel supply increased 9% on quarter in the second quarter. Supply is expected to increase 14% by the third quarter because most panel suppliers are expanding their capacity, following establishment of new fifth-generation (5G) and 6G fabs.

The LCD TV market was slow in the first half due to high panel and system prices and the sluggish adoption of LCD TVs by consumers, compared to PDP (plasma display panel) or rear-projection microdisplay televisions (RPTVs) using LCD technology or Texas Instruments’ (TI) digital light processing (DLP).

Prices for 30-inch LCD TVs in the first half were in the same range as 42-inch PDP and 50-inch RPTV sets. Because end-user demand for 30-inch LCD TVs was lower than expected, manufacturers scaled back their expectations for the product and instead increased their focus on smaller-sized panels. Panels in the 20-inch and 26/27-inch range appeared to have better prospects in the market.

In LCD monitors, panel demand was notably strong in the first quarter. Although end-user monitor demand declined in the second quarter, panel demand remained very high. However, in the third quarter, demand started to experience a slowdown due to the inventory buildup.

About 53% of large-size LCD panel unit demand and 56% of the area demand still come from monitor applications. Thus, any change in the level of monitor demand has a major impact on the large-size LCD market.

Increasing demand, combined with production adjustments, may bring supply and demand into balance – thus stabilizing prices – by the end of the fourth quarter. iSuppli/Stanford Resources continues to predict higher revenue growth for the LCD market in 2004.

According to TrendForce"s latest panel price report, TV panel pricing is expected to arrest its fall in October after five consecutive quarters of decline and the prices of certain panel sizes may even be poised to move up. The price decline of IT panels, whether notebook panels or LCD monitor panels, has also begun showing signs of easing and overall pricing of large-size panels is developing towards bottoming out.

Our company specializes in developing solutions that arerenowned across the globe and meet expectations of the most demanding customers. Orient Display can boast incredibly fast order processing - usually it takes us only 4-5 weeks to produce LCD panels and we do our best to deliver your custom display modules, touch screens or TFT and IPS LCD displays within 5-8 weeks. Thanks to being in the business for such a noteworthy period of time, experts working at our display store have gained valuable experience in the automotive, appliances, industrial, marine, medical and consumer electronics industries. We’ve been able to create top-notch, specialized factories that allow us to manufacture quality custom display solutions at attractive prices. Our products comply with standards such as ISO 9001, ISO 14001, QC 080000, ISO/TS 16949 and PPM Process Control. All of this makes us the finest display manufacturer in the market.

Customer service is another element we are particularly proud of. To facilitate the pre-production and product development process, thousands of standard solutions are stored in our warehouses. This ensures efficient order realization which is a recipe to win the hearts of customers who chose Orient Display. We always go to great lengths to respond to any inquiries and questions in less than 24 hours which proves that we treat buyers with due respect.

Bruce Berkoff, executive vice president at LCD maker LG Philips LCD, said that he"s been predicting a shortage for some time and sees it as part of a cycle that consists of two-year periods of oversupply and two-year periods of shortage, causing price fluctuations. Berkoff anticipates an industrywide shortage as early as mid-2002 that will last through 2003.

The cycles are in two-year intervals mainly because that"s how long it takes to build a manufacturing factory, Berkoff said. Newer factories generally equate to higher manufacturing capacities and lower prices in the market, as well as more large monitors.

Berkoff expects prices for 15-inch LCD monitors to increase from around $200 to $300 now to up to--but not over--$500 this year. He also expects 17-inch and 18-inch displays to become more mainstream with prices ranging from $700 to $900.

Although flat-panel displays have been around for years, high prices kept them from the mainstream of the consumer market. A low-end 14-inch flat panel for a desktop computer, for instance, cost about $2,000 in 1997. A shortage of LCD glass, partly driven by growing demand for notebooks and handheld devices in the late 1990s, prompted makers to invest in glass plants in Taiwan and Korea in 1998 and 1999.

"The California energy crisis, whether real or manufactured, had a tremendous impact on LCDs. I received lots of calls from government agencies asking about them," said Alexander, who added that the energy savings "for a large corporate account makes a significant difference."

Although supply still outstrips demand, the LCD glut is expected to begin to dry up and prices are likely to rise. Unlike other PC products, which only go down in price, flat panel prices have jumped occasionally in the past. "LCD is one of the few (markets) where things have actually gone up in price," said Bob O"Donnell, an analyst with IDC.

Driving the demand are notebooks, which are becoming a larger percentage of the overall PC market. Consumer electronics devices that use LCD screens, such as cell phones and handhelds, use small screens and thus haven"t affected supply very much.

Another consumer electronics product category that may affect supply in the future is televisions with LCDs. Berkoff predicts this market will reach seven million units annually by 2005.

will not be able to supply LCD glass substrate until February or March, according to reports from Asian newspapers and analysts. The company"s customers include LCD producers Fujitsu, Samsung Electronics, International Display Technology, Chi Mei Optoeletronics and HannStar Display.

At the same time, other variables exist. An expansion of LCD manufacturing facilities in Korea from Sharp, Samsung and LG Philips means that more supply is on the horizon. And like in 2000, an influx of products could depress prices. (Samsung and other LCD panel manufacturers take glass and other components and manufacture the LCD panel. The panels then get shipped to notebook or monitor makers, which can be sister subsidiaries and which incorporate the LCD panel into monitors).

LCD manufacturers are working on other types of display technology, such as organic light-emitting diode displays. But it will be at least 10 years before any of them can replace LCDs.

Large LCD panel prices have been continuously increasing for last 10 months due to an increase in demand and tight supply. This has helped the LCD industry to recover from drastic panel price reductions, revenue and profit loss in 2019. It has also contributed to the growth of Quantum Dot and MiniLED LCD TV.

Strong LCD TV panel demand is expected to continue in 2021, but component shortages, supply constraints and very high panel price increase can still create uncertainties.

LCD TV panel capacity increased substantially in 2019 due to the expansion in the number of Gen 10.5 fabs. After growth in 2018, LCD TV demand weakened in 2019 caused by slower economic growth, trade war and tariff rate increases. Capacity expansion and higher production combined with weaker demand resulted in considerable oversupply of LCD TV panels in 2019 leading to drastic panel price reductions. Some panel prices went below cash cost, forcing suppliers to cut production and delay expansion plans to reduce losses.

Panel over-supply also brought down panel prices to way lower level than what was possible through cost improvement. Massive 10.5 Gen capacity that can produce 8-up 65" and 6-up 75" panels from a single mother glass substrate helped to reduce larger size LCD TV panel costs. Also extremely low panel price in 2019 helped TV brands to offer larger size LCD TV (>60-inch size) with better specs and technology (Quantum Dot & MiniLED) at more competitive prices, driving higher shipments and adoption rates in 2019 and 2020.

While WOLED TV had higher shipment share in 2018, Quantum Dot and MiniLED based LCD TV gained higher unit shares both in 2019 and 2020 according to Omdia published data. This trend is expected to continue in 2021 and in the next few years with more proliferation of Quantum Dot and MiniLED TVs.

Panel suppliers’ financial results suffered in 2019 as they lost money. Suppliers from China, Korea and Taiwan all lowered their utilization rates in the second half of 2019 to reduce over-supply. Very low prices combined with lower utilization rates made the revenue and profitability situation for panel suppliers difficult in 2019. BOE and China Star cut the utilization rates of their Gen 10.5 fabs. Sharp delayed the start of production at its 10.5 Gen fab in China. LGD and Samsung display decided to shift away from LCD more towards OLED and QDOLED respectively. Both companies cut utilization rates in their 7, 7.5 and 8.5 Gen fabs. Taiwanese suppliers also cut their 8.5 Gen fab utilization rates.

TV panel prices increased in Q4 2020 and are also expected to increase in the first half of 2021. This can create challenges for brand manufacturers as it reduces their ability to offer more attractive prices in coming months to drive demand. Still, set-price increases up to March have been very mild and only in certain segments. Some brands are still offering price incentives to consumers in spite of the cost increases. For example, in the US market retailers cut prices of big screen LCD and OLED TV to entice basketball fans in March.

Higher LCD price and tight supply helped LCD suppliers to improve their financial performance in the second half of 2020. This caused a number of LCD suppliers especially in China to decide to expand production and increase their investment in 2021.

New opportunities for MiniLED based products that reduce the performance gap with OLED, enabling higher specs and higher prices are also driving higher investment in LCD production. Suppliers from China already have achieved a majority share of TFT-LCD capacity.

BOE has acquired Gen 8.5/8.6 fabs from CEC Panda. ChinaStar has acquired a Gen 8.5 fab in Suzhou from Samsung Display. Recent panel price increases have also resulted in Samsung and LGD delaying their plans to shut down LCD production. These developments can all help to improve supply in the second half of 2021. Fab utilization rates in Taiwan and China stayed high in the second half of 2020 and are expected to stay high in the first half of 2021.

QLED and MiniLED gained share in the premium TV market in 2019, impacting OLED shares and aided by low panel prices. With the LCD panel price increases in 2020 the cost gap between OLED TV and LCD has gone down in recent quarters.

Samsung is also planning to start production of QDOLED in 2021. Higher production and cost reductions for OLED TV may help OLED to gain shares in the premium TV market if the price gap continues to reduce with LCD.

Strong LCD TV demand especially for Quantum Dot and MiniLED TV is expected to continue in 2021. The economic recovery and sports events (UEFA Europe footbal and the Olympics in Japan) are expected to drive demand for TV, but component shortages, supply constraints and too big a price increase could create uncertainties. Panel suppliers have to navigate a delicate balance of capacity management and panel prices to capture the opportunity for higher TV demand. (SD)

Large LCD panel prices have been continuously increasing for last 10 months due to an increase in demand and tight supply. This has helped the LCD industry to recover from drastic panel price reductions, revenue and profit loss in 2019. It has also contributed to the growth of QD and miniLED LCD TV. Strong LCD TV panel demand is expected to continue in 2021, but component shortages, supply constraints, and very high panel price increase can still create uncertainties.

It was earlier anticipated that price increases would decelerate in 2Q, but now the price increase is accelerating compared to 1Q, according to a research by DSCC. Panel prices increased by 27 percent in 4Q20 compared to 3Q and slowed down to 14.5 percent in 1Q21 compared to 4Q, but the current estimate is that average LCD TV panel prices in 2Q21 will increase by another 17 percent. The prices are expected to peak sometime in 3Q21.

The current upturn in the crystal cycle has seen the biggest trough-to-peak price increases for LCD TV panels, and the recent acceleration of prices has further extended this record. Comparing the forecast for June 2021 panel prices with the prices in May 2020, there is a trough-to-peak increases from 34 percent for 75-inch to 181 percent for 32-inch, with an average of 111 percent. In comparison, the average trough-to-peak increase of the 2016 to 2017 cycle was 48 percent, and prior cycles saw smaller increases.

The improved pricing for LCD TV panels has already improved the profitability of panel makers. It will continue to drive their profits even higher, especially the two prominent Taiwanese players, who have Gen 7.5 and Gen 8.5 fabs but no Gen 10.5 fabs. Chinese panel makers HKC and CHOT have a similar industrial profile and stand to benefit greatly as well. The leading companies with Gen 10.5 fabs (BOE, CSOT and Foxconn/Sharp) stand to benefit less because the price increases on the largest sizes are more modest, but every LCD panel maker is doing well.

There is a surge in LCD equipment spending to respond to dramatically improved market conditions in the LCD market. DSCC sees LCD revenues rising 32 percent in 2021 to USD 112 billion on strong unit and area growth with prices and profitability rebounding to or even exceeding the 2017 levels. With LCD suppliers able to sell everything they can make at attractive margins; it should be no surprise that most LCD manufacturers are looking to expand capacity.

However, unlike previous upturns when many new fabs were built, in this upturn panel suppliers are looking to stretch their capacity through smaller investments, simplifying their processes and debottlenecking. Having said that, there will be two new Gen 8.6 mega fabs being built. The result versus last quarter is a 10 percent or a USD 2.2 billion increase in 2020-2024 LCD spending from USD 21.8 billion to USD 24 billion. The 2021 LCD equipment spending forecast is up 15 percent versus last quarter’s forecast to USD 10 billion, with 2021 LCD equipment spending up 125 percent versus 2021. In addition, 2022 was upgraded by 28 percent to USD 3.5 billion.

Although there is a healthy upgrade in LCD equipment spending in 2021 and 2022, the outlook for 2022-2024 spending is still significantly lower than in previous years, resulting in tighter capacity and slower price reductions in the next downturn. In addition, with Korean LCD suppliers expected to reduce their LCD capacity and convert to potentially higher margin OLEDs, the outlook for LCD pricing and profitability looks quite healthy, which may result in even more equipment spending, especially as miniLEDs gain acceptance.

Widespread component supply shortages could impact availability on LCD TV panels from CSOT and Innolux. The display panel manufacturers have warned that supplies of panels are expected to be tight throughout the year.

James Yang, president, Innolux, has warned of a shortage in LCD panels caused by strong demand for LCD coming out of the global crisis and the conditions are expected to continue through 2021. Innolux has seen shortages in LCD components including power semiconductors, driver ICs and glass substrates that have kept production below capacity. Shortages of ICs and semiconductors could continue right up to the 1H22.

Ironically, prior to the run-on LCD panel supplies, manufacturers were faced with the dilemma of overproduction causing a glut in inventory, which was driving prices artificially lower. This was the result of giant new LCD fabs coming online in China and other areas of Asia.

Panel makers, being cognizant of that threat, are expected to produce panels at a more tempered pace to keep margins healthy. LCD panel prices continued to rise in March after moving up in February.

Almost all Chinese panel makers are doing everything they can to incrementally increase their current factories’ capacities through productivity enhancements and new equipment purchases for debottlenecking or capacity expansions. For the same reasons, South Korean panel makers continue to delay shutting down their domestic LCD TV factories.

TV manufacturers have been moving aggressively to replenish inventories of LCD panels to meet strong sales of TVs and other devices to meeting escalating demand, particularly in the United States and Europe.

For 3 years, from 2017 to 2020, LCD panel makers suffered through a continuous pattern of price declines interrupted only with brief respites. With the COVID-19 demand surge assisted by shortages in glass and DDICs, panel prices are spiking. Korean, Taiwanese, and Chinese panel makers are reporting robust margins in 1Q 2021 and the good news is anticipated for panel makers to get even better in 2Q.

For over 20 years we"ve been helping clients worldwide by designing, developing, & manufacturing custom LCD displays, screens, and panels across all industries.

Newhaven Display has extensive experience manufacturing a wide array of digital display products, including TFT, IPS, character displays, graphic displays, LCD modules, COG displays, and LCD panels. Along with these products, we specialize in creating high-quality and affordable custom LCD solutions. While our focus is on high-quality LCD products, we also have a variety of graphic and character OLED displays we manufacture.

As a longtime leader in LCD manufacturing, producing top-quality LCD modules and panels is our highest priority. At Newhaven Display, we’re also incredibly proud to uphold our reputation as a trusted and friendly custom LCD manufacturing company.

As a custom LCD manufacturing company, we ensure complete control of our custom displays" reliability by providing the industry"s highest quality standards. Our design, development, production, and quality engineers work closely to help our clients bring their products to life with a fully custom display solution.

Our excellent in-house support sets Newhaven Display apart from other display manufacturers. Modifications in the customization process are completed at our Illinois facility, allowing us to provide an exceptionally fast turnaround time.

Customer support requests sent by phone, email, or on our support forum will typically receive a response within 24 hours. For custom LCD project inquiries, our response time can take a few days or weeks, depending on the complexity of your display customization requirements. With different production facilities and a robust supply chain, we are able to deliver thefastest turnaround times for display customizations.

Our excellent in-house support and custom display modifications set Newhaven Display apart from other LCD display manufacturers. From TFTs, IPS, sunlight readable displays, HDMI modules, EVE2 modules, to COG, character, and graphic LCDs, our modifications in the customization process are completed at our Illinois facility, allowing us to provide quality and fast turnaround times.

As a display manufacturer, distributor, and wholesaler, we are able to deliver the best quality displays at the best prices. Design, manufacturing, and product assembly are completed at our headquarters in Elgin, Illinois. Newhaven Display International ensures the best quality LCD products in the industry in this newly expanded facility with a renovated production and manufacturing space.

With assembly facilities in the US, manufacturing facilities in China, and distribution channels worldwide, we pride ourselves on delivering high-quality custom display solutions quickly to locations worldwide.

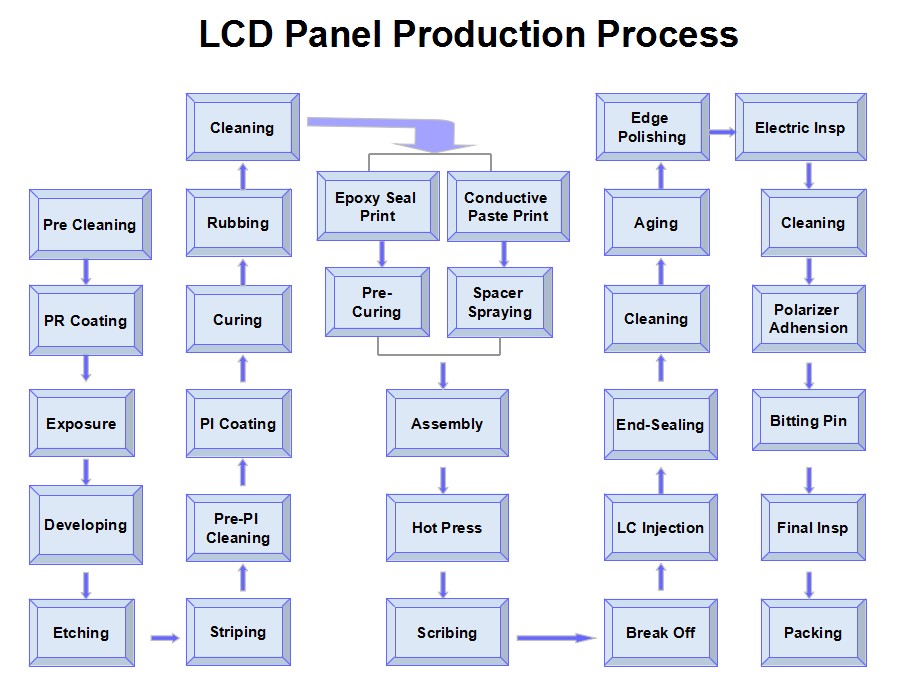

1. A piece of glass with a smooth surface and no impurities is the most important raw material for manufacturing TFT glass substrates. Before making, the glass needs to be washed with a special cleaning liquid, then dehydrated and spin-dried.

6. To form usable thin film transistors, it is necessary to repeat the process of cleaning, coating, photoresist, exposure, development, etching, and photoresist removal. Generally speaking, to manufacture TFT-LCD, it is necessary to repeat 5 to 7 times.

1. After completing the thin-film transistor glass substrate, we will proceed to the combination of the liquid crystal module. The liquid crystal panel is composed of the transistor glass substrate and the color filter. First, we must clean the glass first, and then proceed The next step. The entire manufacturing process of TFT-LCD must be in a clean room, so that there will be no impurities in the display.

3. During the entire assembly process, first we have to coat a layer of chemical film on the glass and color filter covered with transistors, and then perform the alignment action.

5. After sealing the frame, place the LCD panel in the vacuum chamber, and drain the air from the LCD panel through the gap just reserved, and then pour the liquid crystal with the help of atmospheric pressure, and then close the gap. The liquid crystal is a kind of The compound substance between solid and liquid has the characteristic of regular molecular arrangement.

1. After the polarizer is attached, we start to mount DRIVE IC on both sides of the liquid crystal module. DRIVE IC is a very important driving part, which is used to control the color and brightness of the liquid crystal.

3. The light of the LCD module is emitted from the backlight. Before assembling the backlight, we will first check whether the assembled LCD panel is perfect, and then assemble the backlight. The backlight is the source of light behind the LCD panel.

5. After that, we entered the final critical test process. The assembled MODULE was subjected to aging test, and products with poor quality were screened out in the state of electrification and high temperature.

6. The best quality products can be packaged and shipped. In this way, the liquid crystal module undergoes many inspection and testing procedures to deliver the most perfect product to the customer, and this is the real completion of the entire liquid crystal display manufacturing process.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey