lcd panel production 2018 factory

BOE Technology Group, the Chinese electronic components producer, is expected to be the leader in producing LCD display panels in the coming years, with a forecast capacity share of 24 percent by 2022. China is the country that has the largest LCD capacity, with a 56 percent share in 2020.Read moreLCD panel production capacity share from 2016 to 2022, by manufacturerCharacteristicBOEChina StarInnoluxAUOLGDHKCCEC PandaSharpSDCOther-----------

DSCC. (June 8, 2020). LCD panel production capacity share from 2016 to 2022, by manufacturer [Graph]. In Statista. Retrieved December 16, 2022, from https://www.statista.com/statistics/1057455/lcd-panel-production-capacity-manufacturer/

DSCC. "LCD panel production capacity share from 2016 to 2022, by manufacturer." Chart. June 8, 2020. Statista. Accessed December 16, 2022. https://www.statista.com/statistics/1057455/lcd-panel-production-capacity-manufacturer/

DSCC. (2020). LCD panel production capacity share from 2016 to 2022, by manufacturer. Statista. Statista Inc.. Accessed: December 16, 2022. https://www.statista.com/statistics/1057455/lcd-panel-production-capacity-manufacturer/

DSCC. "Lcd Panel Production Capacity Share from 2016 to 2022, by Manufacturer." Statista, Statista Inc., 8 Jun 2020, https://www.statista.com/statistics/1057455/lcd-panel-production-capacity-manufacturer/

DSCC, LCD panel production capacity share from 2016 to 2022, by manufacturer Statista, https://www.statista.com/statistics/1057455/lcd-panel-production-capacity-manufacturer/ (last visited December 16, 2022)

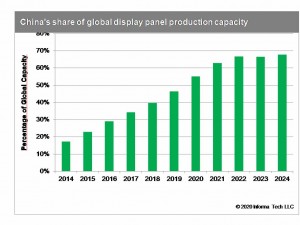

China is the leader in producing LCD display panels, with a forecast capacity share of 56 percent in 2020. China"s share is expected to increase in the coming years, stabilizing at 69 percent from 2023 onwards.Read moreLCD panel production capacity share from 2016 to 2025, by countryCharacteristicChinaJapanSouth KoreaTaiwan-----

DSCC. (June 8, 2020). LCD panel production capacity share from 2016 to 2025, by country [Graph]. In Statista. Retrieved December 16, 2022, from https://www.statista.com/statistics/1056470/lcd-panel-production-capacity-country/

DSCC. "LCD panel production capacity share from 2016 to 2025, by country." Chart. June 8, 2020. Statista. Accessed December 16, 2022. https://www.statista.com/statistics/1056470/lcd-panel-production-capacity-country/

DSCC. (2020). LCD panel production capacity share from 2016 to 2025, by country. Statista. Statista Inc.. Accessed: December 16, 2022. https://www.statista.com/statistics/1056470/lcd-panel-production-capacity-country/

DSCC. "Lcd Panel Production Capacity Share from 2016 to 2025, by Country." Statista, Statista Inc., 8 Jun 2020, https://www.statista.com/statistics/1056470/lcd-panel-production-capacity-country/

DSCC, LCD panel production capacity share from 2016 to 2025, by country Statista, https://www.statista.com/statistics/1056470/lcd-panel-production-capacity-country/ (last visited December 16, 2022)

Flat-panel displays are thin panels of glass or plastic used for electronically displaying text, images, or video. Liquid crystal displays (LCD), OLED (organic light emitting diode) and microLED displays are not quite the same; since LCD uses a liquid crystal that reacts to an electric current blocking light or allowing it to pass through the panel, whereas OLED/microLED displays consist of electroluminescent organic/inorganic materials that generate light when a current is passed through the material. LCD, OLED and microLED displays are driven using LTPS, IGZO, LTPO, and A-Si TFT transistor technologies as their backplane using ITO to supply current to the transistors and in turn to the liquid crystal or electroluminescent material. Segment and passive OLED and LCD displays do not use a backplane but use indium tin oxide (ITO), a transparent conductive material, to pass current to the electroluminescent material or liquid crystal. In LCDs, there is an even layer of liquid crystal throughout the panel whereas an OLED display has the electroluminescent material only where it is meant to light up. OLEDs, LCDs and microLEDs can be made flexible and transparent, but LCDs require a backlight because they cannot emit light on their own like OLEDs and microLEDs.

Liquid-crystal display (or LCD) is a thin, flat panel used for electronically displaying information such as text, images, and moving pictures. They are usually made of glass but they can also be made out of plastic. Some manufacturers make transparent LCD panels and special sequential color segment LCDs that have higher than usual refresh rates and an RGB backlight. The backlight is synchronized with the display so that the colors will show up as needed. The list of LCD manufacturers:

Organic light emitting diode (or OLED displays) is a thin, flat panel made of glass or plastic used for electronically displaying information such as text, images, and moving pictures. OLED panels can also take the shape of a light panel, where red, green and blue light emitting materials are stacked to create a white light panel. OLED displays can also be made transparent and/or flexible and these transparent panels are available on the market and are widely used in smartphones with under-display optical fingerprint sensors. LCD and OLED displays are available in different shapes, the most prominent of which is a circular display, which is used in smartwatches. The list of OLED display manufacturers:

MicroLED displays is an emerging flat-panel display technology consisting of arrays of microscopic LEDs forming the individual pixel elements. Like OLED, microLED offers infinite contrast ratio, but unlike OLED, microLED is immune to screen burn-in, and consumes less power while having higher light output, as it uses LEDs instead of organic electroluminescent materials, The list of MicroLED display manufacturers:

LCDs are made in a glass substrate. For OLED, the substrate can also be plastic. The size of the substrates are specified in generations, with each generation using a larger substrate. For example, a 4th generation substrate is larger in size than a 3rd generation substrate. A larger substrate allows for more panels to be cut from a single substrate, or for larger panels to be made, akin to increasing wafer sizes in the semiconductor industry.

"Samsung Display has halted local Gen-8 LCD lines: sources". THE ELEC, Korea Electronics Industry Media. August 16, 2019. Archived from the original on April 3, 2020. Retrieved December 18, 2019.

"TCL to Build World"s Largest Gen 11 LCD Panel Factory". www.businesswire.com. May 19, 2016. Archived from the original on April 2, 2018. Retrieved April 1, 2018.

"Panel Manufacturers Start to Operate Their New 8th Generation LCD Lines". 대한민국 IT포털의 중심! 이티뉴스. June 19, 2017. Archived from the original on June 30, 2019. Retrieved June 30, 2019.

"TCL"s Panel Manufacturer CSOT Commences Production of High Generation Panel Modules". www.businesswire.com. June 14, 2018. Archived from the original on June 30, 2019. Retrieved June 30, 2019.

"Business Place Information – Global Operation | SAMSUNG DISPLAY". www.samsungdisplay.com. Archived from the original on 2018-03-26. Retrieved 2018-04-01.

"Samsung Display Considering Halting Some LCD Production Lines". 비즈니스코리아 - BusinessKorea. August 16, 2019. Archived from the original on April 5, 2020. Retrieved December 19, 2019.

Herald, The Korea (July 6, 2016). "Samsung Display accelerates transition from LCD to OLED". www.koreaherald.com. Archived from the original on April 1, 2018. Retrieved April 1, 2018.

Byeonghwa, Yeon. "Business Place Information – Global Operation – SAMSUNG DISPLAY". Samsungdisplay.com. Archived from the original on 2018-03-26. Retrieved 2018-04-01.

www.wisechip.com.tw. "WiseChip History – WiseChip Semiconductor Inc". www.wisechip.com.tw. Archived from the original on 2018-02-17. Retrieved 2018-02-17.

"China"s BOE to have world"s largest TFT-LCD+AMOLED capacity in 2019". ihsmarkit.com. 2017-03-22. Archived from the original on 2019-08-16. Retrieved 2019-08-17.

The decision to close the LCD business, by Samsung Display, will be completed by June of 2022 as the company faces tough competition from its Chinese and Taiwanese counterparts, reports GizmoChina. / Representative image | Photo credit: IANS

The decision to close the LCD business, by Samsung Display, will be completed by June of 2022 as the company faces tough competition from its Chinese and Taiwanese counterparts, reports GizmoChina.

The company has decided to focus on manufacturing organic light-emitting diode (OLED) and quantum dot (QD) displays, as OLED panels have started to become the norm in the smartphone market.

A recent Display Supply Chain Consultants (DSCC) revealed that the price of an LCD is 36.6 per cent of what it used to be in January 2014, the component"s peak production period.

No investment plan details have since been announced, and the employees of the LCD business are expected to be transferred to the QD business, the report said.

Samsung Display had decided to close its LCD business in late 2020, but the plans were delayed at Samsung Electronics" request due to a sudden increase in the prices of LCD panels during the COVID-19 pandemic.

At present, markets such as large-screen TVs are still inseparable from LCD panels. Several Chinese panel manufacturers have surpassed Samsung and LG to become the main LCD panel manufacturers in recent years. Korean companies are no longer able to compete. Samsung will stop the production of LCD panels half a year ahead of schedule. Samsung used to be the largest LCD panel manufacturer, but in recent years, Chinese companies such as BOE and CSOT have rapidly expanded their market shares. Samsung and LG have continued to retreat, making BOE surpass LGD in 2018. As of now, BOE is now the world’s largest manufacturer of LCD panels.

Samsung originally planned to stop the production of LCD panels by the end of 2020. However, the LCD panel market started to increase prices in the past year or so. This made Samsung’s LCD factory continue to operate for another two years. However, the company originally plans to exit the market at the end of 2022. Nevertheless, the LCD panel market has changed since the end of last year. The price has been falling significantly and it is now on a free fall. By January this year, the average price of a 32 -inch panel was only $ 38, a 64% drop relative to January last year.

This situation is making Samsung rethink its initial exit plans. The South Korean manufacturing giant is now planning to withdraw from LCD panel production half a year ahead of schedule. It will stop production in June this year. Samsung Display, a subsidiary of Samsung Electronics, will turn to higher-end QD quantum dot panels. The LCD panels that the company needs will turn to procurement.

According to information released by Samsung Electronics, the company’s three major suppliers of LCD panels are BOE, Huaxing Optoelectronics, and AUO, all of which are Chinese companies. The first two are local companies, and they are the first and second-largest suppliers of LCD.

Due to high demand in South Kore, Samsung Display had to extend its production of Liquid Crystal Display (LCD) panels for TVs and monitors in South Korea. Its exit from the LCD market will give the company room to concentrate on more advanced technologies.

Samsung’s delay in closing the LCD panel plant will increase the production area and there is the risk of material shortages. Thus, the dipping price of LCD panels gives the company all the reasons it needs to quit the market.

In general, there are two types of displays in the market today: active matrix liquid crystal display (AMLCD) and AMOLED. In its simplicity, the fundamental components required to make up the display are the same for AMLCD and AMOLED. There are four layers of a display device (FIGURE 1): a light source, switches that are the thin-film-transistor and where the gases are mainly used, a shutter to control the color selection, and the RGB (red, green, blue) color filter.

Technology trends TFT-LCD (thin-film-transistor liquid-crystal display) is the baseline technology. MO / White OLED (organic light emitting diode) is used for larger screens. LTPS / AMOLED is used for small / medium screens. The challenges for OLED are the effect of < 1 micron particles on yield, much higher cost compared to a-Si due to increased mask steps, and moisture impact to yield for the OLED step.

Although AMLCD displays are still dominant in the market today, AMOLED displays are growing quickly. Currently about 25% of smartphones are made with AMOLED displays and this is expected to grow to ~40% by 2021. OLED televisions are also growing rapidly, enjoying double digit growth rate year over year. Based on IHS data, the revenue for display panels with AMOLED technol- ogies is expected to have a CAGR of 18.9% in the next five years while the AMLCD display revenue will have a -2.8% CAGR for the same period with the total display panel revenue CAGR of 2.5%. With the rapid growth of AMOLED display panels, the panel makers have accel- erated their investment in the equipment to produce AMOLED panels.

There are three types of thin-film-transistor devices for display: amorphous silicon (a-Si), low temperature polysilicon (LTPS), and metal oxide (MO), also known as transparent amorphous oxide semiconductor (TAOS). AMLCD panels typically use a-Si for lower-resolution displays and TVs while high-resolution displays use LTPS transistors, but this use is mainly limited to small and medium displays due to its higher costs and scalability limitations. AMOLED panels use LTPS and MO transistors where MO devices are typically used for TV and large displays (FIGURE 3).

This shift in technology also requires a change in the gases used in production of AMOLED panels as compared with the AMLCD panels. As shown in FIGURE 4, display manufacturing today uses a wide variety of gases.

The key ga susage driver in the manufacturing of displays is PECVD (plasma-enhanced chemical vapor deposition), which accounts for 75% of the ESG spending, while dry etch is driving helium usage. LTPS and MO transistor production is driving nitrous oxide usage. The ESG usage for MO transistor production differs from what is shown in FIGURE 4: nitrous oxide makes up 63% of gas spend, nitrogen trifluoride 26%, silane 7%, and sulfur hexafluoride and ammonia together around 4%. Laser gases are used not only for lithography, but also for excimer laser annealing application in LTPS.

Nitrogen trifluoride: NF3 is the single largest electronic material from spend and volume standpoint for a-Si and LTPS display production while being surpassed by N2O for MO production. NF3 is used for cleaning the PECVD chambers. This gas requires scalability to get the cost advantage necessary for the highly competitive market.

Nitrous oxide: Used in both LTPS and MO display production, N2O has surpassed NF3 to become the largest electronic material from spend and volume standpoint for MO production. N2O is a regional and localized product due to its low cost, making long supply chains with high logistic costs unfeasible. Averaging approximately 2 kg per 5.5 m2 of mother glass area, it requires around 240 tons per month for a typical 120K per month capacity generation 8.5 MO display production. The largest N2O compressed gas trailer can only deliver six tons of N2O each time and thus it becomes both costly and risky

In-fab distribution: Gas supply does not end with the delivery or production of the material of the fab. Rather, the materials are further regulated with additional filtration, purification, and on-line analysis before delivery to individual production tools.

The consumer demand for displays that offer increas- ingly vivid color, higher resolution, and lower power consumption will challenge display makers to step up the technologies they employ and to develop newer displays such as flexible and transparent displays. The transistors to support these new displays will either be LTPS and / or MO, which means the gases currently being used in these processes will continue to grow. Considering the current a-Si display production, the gas consumption per area of the glass will increase by 25% for LTPS and ~ 50% for MO productions.

To facilitate these increasing demands, display manufacturers must partner with gas suppliers to identify which can meet their technology needs, globally source electronic materials to provide customers with stable and cost- effective gas solutions, develop local sources of electronic materials, improve productivity, reduce carbon footprint, and increase energy efficiency through on-site gas plants. This is particularly true for the burgeoning China display manufacturing market, which will benefit from investing in on-site bulk gas plants and collaboration with global materials suppliers with local production facilities for high-purity gas and chemical manufacturing.

Large thin-film transistor liquid crystal display (TFT LCD) panel makers are expected to reduce production of comparatively smaller sized 32-, 40- and 43-inch panels, helping to stabilize panel prices in the third quarter of 2018. In the longer term, however, the oversupply issue still remains, eventually causing older TFT LCD fabs to be restructured, according to IHS Markit (Nasdaq: INFO).

According to the latest AMOLED and LCD Supply Demand & Equipment Tracker by IHS Markit, currently planned new factories will increase large display panel production capacity by 31 percent or 77.7M square meters from 2018 to 2021. However, based on the current demand forecast, there will be about 49 million square meters of capacity in the pipeline more than the market requires in 2021. The supply/demand glut level is expected to continue to increase from 12 percent in 2018 to 23 percent in 2021, remaining well above 10 percent or what is modeled to be a balanced market.

Between 2019 and 2021, there will be a great amount of LCD TV panel capacity built, mainly from generation Gen10.5/11 factories in China, according to IHS Markit.

“Some panel makers may be forced to reduce utilization rates, while some planned capacity may never be built,” said David Hsieh, senior director of displays at IHS Markit. “Furthermore, in the next few years, legacy factory restructuring will likely accelerate. For the TFT LCD industry to return to a balanced supply/demand level, multiple Gen 5, Gen 6 and even Gen 8 factories will likely need to be shut down.”

For example, shutting down half of all Gen 5 and Gen 6 amorphous silicon (a-Si) capacity in Taiwan would remove about 18 million square meters of production capacity, according to IHS Markit. Larger glass substrate capacity, such as Gen 8, will also likely need to be closed to bring the market back toward balance.

Possible restructuring of legacy factories may include fab shutdown, facility consolidation, or conversion to other technologies, such as active-matrix organic light-emitting diode (AMOLED) panels, ePaper backplanes and sensors.

According to the Display Production & Inventory Tracker by IHS Markit, fab restructuring can be attributed to multiple reasons, such as no longer competitive, old equipment, shifts in panel makers’ business focus, excessive overhead from under-utilized facilities and pressure on profitability.

“Oversupply is not the end of the crystal cycle. The industry has a long history of dynamically adjusting itself to balance supply and demand,” Hsieh said. “The process may create many challenges for supply chain companies. However, the delayed expansion of new factories, the restructuring of legacy fabs and the potential for faster demand growth spurred by lower panel prices will help the LCD industry to eventually return to equilibrium.”

LCD panel prices have risen for 4 months in a row because of your home gaming? Since this year, the whole LCD panel market has smoked. Whether after the outbreak of the epidemic, LCD panel market prices rose for four months, or the panel giants in Japan and South Korea successively sold production lines, or the Chinese mainland listed companies frequently integrated acquisition, investment, and plant construction, all make the industry full of interesting.

LCD panel prices are already a fact. Since May this year, LCD panel prices have risen for four months in a row, making the whole industry chain dynamic. Why are LCD panels going up in price in a volatile 2020? The key factor lies in the imbalance between supply and demand.

The price of LCDS for large-size TVs of 70 inches or more hasn’t budged much. In addition, LTPS screens and AMOLED screens used in high-end phones have seen little or no increase in price.

As for October, LCD panel price increases are expected to moderate. The data shows that in October 32 inches or 2 dollars; Gains of 39.5 to 43 inches will shrink to $3;55 inches will fall back below $10; The 65-inch gain will narrow to $5.

During the epidemic, people stayed at home and had no way to go out for entertainment. They relied on TV sets, PCS, and game consoles for entertainment. After the resumption of economic work and production, the market of traditional home appliances picked up rapidly, and LCD production capacity was quickly digested.

However, due to the shutdown of most factories lasting 1-2 months during the epidemic period, LCD panel production capacity was limited, leading to insufficient production capacity in the face of the market outbreak, which eventually led to the market shortage and price increase for 4 consecutive months.

In fact, the last round of price rise of LCD panels was from 2016 to 2017, and its overall market price has continued to fall since 2018. Even in 2019, individual types have fallen below the material cost, and the whole industry has experienced a general operating loss. As a result, LCD makers have been looking for ways to improve margins since last year.

A return to a reasonable price range is the most talked about topic among panel makers in 2019, according to one practitioner. Some manufacturers for the serious loss of the product made the decision to reduce production or even stop production; Some manufacturers planned to raise the price, but due to the epidemic in 2020, the downstream demand was temporarily suppressed and the price increase was postponed. After the outbreak was contained in April, LCD prices began to rise in mid-to-late May.

In fact, the market price of LCD panels continued to decline in 2018-2019 because of the accelerated rise of China’s LCD industry and the influx of a large number of local manufacturers, which doubled the global LCD panel production capacity within a few years, but there was no suitable application market to absorb it. The result of excess capacity is oversupply, ultimately making LCD panel prices remain depressed.

Against this background, combined with the impact of the epidemic in 2020, the operating burden of LCD companies in Japan and South Korea has been further aggravated, and it is difficult to make profits in the production of LCD panels, so they have to announce the withdrawal of LCD business.

business in June 2022. In August, Sharp bought JDI Baishan, a plant in Ishikawa prefecture that makes liquid crystal display panels for smartphones. In early September, Samsung Display sold a majority stake in its SUZHOU LCD production plant to Starlight Electronics Technology, a unit of TCL Technology Group. LGD has not only pulled out of some of its production capacity but has announced that it will close its local production line in 2020. According to DSCC, a consultancy, the share of LCD production capacity in South Korea alone will fall from 19% to 7% between 2020 and 2021.

It is worth mentioning that in industry analysis, in view of the fact that Korean companies are good at using “dig through old bonus – selling high price – the development of new technology” the cycle of development mode, another 2020 out of the LCD production capacity, the main reason may be: taking the advantage of China’s expanding aggressively LCD manufacturers, Korean companies will own LCD panel production line hot sell, eliminating capacity liquid to extract its final value, and turning to the more profitable advantage of a new generation of display technologies, such as thinner, color display better OLED, etc. Samsung, for example, has captured more than 80% of the OLED market with its first-mover advantage.

From the perspective of production capacity, the launch of LCD tracks by major manufacturers in Japan and South Korea must reduce some production capacity in the short term, which to some extent induces market price fluctuations. In the long run, some of the Japanese and Korean LCD production capacity has been bought by Chinese manufacturers, coupled with frequent investment in recent years, the overall capacity is sure to recover as before, or even more than before. But now it will take time to expand the production layout, which more or less will cause supply imbalance, the industry needs to be cautious.

The LCD panel industry started in the United States and then gradually moved to Japan, South Korea, China, and Taiwan. At present, the proportion of production capacity in The Chinese mainland has reached 52% in 2020, and there are leading LCD panel products in China represented by BOE, Huxing Optoelectronics. Meanwhile, the production capacity layout of BOE, Huike, Huxing Optoelectronics, and other manufacturers has been basically completed, making industrial integration a necessity.

On the one hand, South Korean enterprises out of the LCD track, the domestic factory horse enclosure, plant expansion action. While LCDs may not sell as well as “upstart” flexible screens, respondents believe they are still strong enough in the traditional home appliance market to warrant continued investment. Zhao Bin, general manager of TCL Huaxing Development Center, has said publicly that the next-generation display technology will be mature in four to five years, but the commercialization of products may not take place until a decade later. “LCD will still be the mainstream in this decade,” he said.

On the other hand, there is no risk of neck jam in China’s LCD panel industry, which is generally controllable. In mainland China, there will be 21 production lines capable of producing 32-inch or larger LCD panels by 2021, accounting for about two-thirds of the global total. In terms of the proportion of production capacity, the Chinese mainland accounted for 42% of the global LCD panel in 2019, 51% this year, and will continue to climb to 63% next year.

Of course, building factories and expanding production cannot be accomplished overnight. In the process of production capacity recovery, it is predicted that there will be several price fluctuations, and the cost may be passed on to the downstream LCD panel manufacturers or consumers when the price rises greatly, which requires continuous attention.

[Introduction]: This paper analyzes the competitive pattern of the panel display industry from both supply and demand sides. On the supply side, the optimization of the industry competition pattern by accelerating the withdrawal of Samsung’s production capacity is deeply discussed. Demand-side focuses on tracking global sales data and industry inventory changes.

Since April 2020, the display device sector rose 4.81%, ranking 11th in the electronic subsectors, 3.39 percentage points behind the SW electronic sector, 0.65 percentage points ahead of the Shanghai and Shenzhen 300 Index. Of the top two domestic panel display companies, TCL Technology is up 11.35 percent in April and BOE is up 4.85 percent.

Specific to the panel display plate, we still do the analysis from both ends of supply and demand: supply-side: February operating rate is insufficient, especially panel display module segment grain rate is not good, limited capacity to boost the panel display price. Since March, effective progress has been made in the prevention and control of the epidemic in China. Except for some production lines in Wuhan that have been delayed, other domestic panels show that the production lines have returned to normal. In South Korea, Samsung announced recently that it would accelerate its withdrawal from all LCD production lines. This round of output withdrawal exceeded market expectations both in terms of pace and amplitude. We will make a detailed analysis of it in Chapter 2.

Demand-side: We believe that people spend more time at home under the epidemic situation, and TV, as an important facility for family entertainment, has strong demand resilience. In our preliminary report, we have interpreted the pick-up trend of domestic TV market demand in February, which also showed a good performance in March. At present, the online market in China maintains a year-on-year growth of about 30% every week, while the offline market is still weak, but its proportion has been greatly reduced. At present, people are more concerned about the impact of the epidemic overseas. According to the research of Cinda Electronics Industry Chain, in the first week, after Italy was closed down, local TV sales dropped by about 45% from the previous week. In addition, Media Markt, Europe’s largest offline consumer electronics chain, also closed in mid-March, which will affect terminal sales to some extent, and panel display prices will continue to be under pressure in April and May. However, we believe that as the epidemic is brought under control, overseas market demand is expected to return to the pace of China’s recovery.

From a price perspective, the panel shows that prices have risen every month through March since the bottom of December 19 reversed. However, according to AVC’s price bulletin of TV panel display in early April, the price of TV panel display in April will decrease slightly, and the price of 32 “, 39.5 “, 43 “, 50 “and 55” panels will all decrease by 1 USD.65 “panel shows price down $2; The 75 “panel shows the price down by $3.The specific reasons have been described above, along with the domestic panel display production line stalling rate recovery, supply-side capacity release; The epidemic spread rapidly in Europe and the United States, sports events were postponed, local blockades were gradually rolled out, and the demand side declined to a certain extent.

Looking ahead to Q2, we think prices will remain under pressure in May, but prices are expected to pick up in June as Samsung’s capacity is being taken out and the outbreak is under control overseas. At the same time, from the perspective of channel inventory, the current all-channel inventory, including the inventory of all panel display factories, has fallen to a historical low. The industry as a whole has more flexibility to cope with market uncertainties. At the same time, low inventory is also the next epidemic warming panel show price foreshadowing.

In terms of valuation level, due to the low concentration and fierce competition in the panel display industry in the past ten years, the performance of sector companies is cyclical to a certain extent. Therefore, PE, PB, and other methods should be comprehensively adopted for valuation. On the other hand, the domestic panel shows that the leading companies in the past years have sustained large-scale capital investment, high depreciation, and a long period of poor profitability, leading to the inflated TTM PE in the first half of 2014 to 2017. Therefore, we will display the valuation level of the sector mainly through the PB-band analysis panel in this paper.

In 2017, due to the combined impact of panel display price rise and OLED production, the valuation of the plate continued to expand, with the highest PB reaching 2.8 times. Then, with the price falling, the panel shows that PB bottomed out at the end of January 2019 at only 1.11 times. From the end of 2019 to February, the panel shows that rising prices have driven PB all the way up, the peak PB reached 2.23 times. Since entering March, affected by the epidemic, in the short term panel prices under pressure, the valuation of the plate once again fell back to 1.62 times. In April, the epidemic situation in the epidemic country was gradually under control, and the valuation of the sector rebounded to 1.68 times.

We believe the sector is still at the bottom of the stage as Samsung accelerates its exit from LCD capacity and industry inventories remain low. Therefore, once the overseas epidemic is under control and the domestic demand picks up, the panel shows that prices will rise sharply. In addition, the plate will also benefit from Ultra HD drive in the long term. Panel display plate medium – and long-term growth logic is still clear. Coupled with the optimization of the competitive pattern, industry volatility will be greatly weakened. The current plate PB compared to the historical high has sufficient space, optimistic about the plate leading company’s investment value.

Revenue at Innolux and AU Optronics has been sluggish for several months and improved in March. Since the third quarter of 2017, Innolux’s monthly revenue growth has been negative, while AU Optronics has only experienced revenue growth in a very few months.AU Optronics recorded a record low revenue in January and increased in February and March. Innolux’s revenue returned to growth in March after falling to its lowest in recent years in February. However, because the panel display manufacturers in Taiwan have not put in new production capacity for many years, the production process of the existing production line is relatively backward, and the competitiveness is not strong.

On March 31, Samsung Display China officially sent a notice to customers, deciding to terminate the supply of all LCD products by the end of 2020.LGD had earlier announced that it would close its local LCDTV panel display production by the end of this year. In the following, we will analyze the impact of the accelerated introduction of the Korean factory on the supply pattern of the panel display industry from the perspective of the supply side.

The early market on the panel display plate is controversial, mainly worried about the exit of Korean manufacturers, such as LCD display panel price rise, or will slow down the pace of capacity exit as in 17 years. And we believe that this round of LCD panel prices and 2017 prices are essentially different, the LCD production capacity of South Korean manufacturers exit is an established strategy, will not be transferred because of price warming. Investigating the reasons, we believe that there are mainly the following three factors driving:

(1) Under the localization, scale effect, and aggregation effect, the Chinese panel leader has lower cost and stronger profitability than the Japanese and Korean manufacturers. In terms of cost structure, according to IHS data, material cost accounts for 70% of the cost displayed by the LCD panel, while depreciation accounts for 17%, so the material cost has a significant impact on it. At present, the upstream LCD, polarizer, PCB, mold, and key target material line of the mainland panel display manufacturers are fully imported into the domestic, effectively reducing the material cost. In addition, at the beginning of the factory, manufacturers not only consider the upstream glass and polarizer factory but also consider the synergy between the downstream complete machine factory, so as to reduce the labor cost, transportation cost, etc., forming a certain industrial clustering effect. The growing volume of shipments also makes the economies of scale increasingly obvious. In the long run, the profit gap between the South Korean plant and the mainland plant will become even wider.

(2) The 7 and 8 generation production lines of the Korean plant cannot adapt to the increasing demand for TV in average size. Traditionally, the 8 generation line can only cut the 32 “, 46 “, and 60” panel displays. In order to cut the other size panel displays economically and effectively, the panel display factory has made small adjustments to the 8 generation line size, so there are the 8.5, 8.6, 8.6+, and 8.7 generation lines. But from the cutting scheme, 55 inches and above the size of the panel display only part of the generation can support, and the production efficiency is low, hindering the development of large size TV. Driven by the strong demand for large-size TV, the panel display generation line is also constantly breaking through. In 2018, BOE put into operation the world’s first 10.5 generation line, the Hefei B9 plant, with a designed capacity of 120K/ month. The birth of the 10.5 generation line is epoch-making. It solves the cutting problem of large-size panel displays and lays the foundation for the outbreak of large-size TV. From the cutting method, one 10.5 generation line panel display can effectively cut 18 43 inches, 8 65 inches, 6 75 inches panel display, and can be more efficient in hybrid mode cutting, with half of the panel display 65 inches, the other half of the panel display 75 inches, the yield is also guaranteed. Currently, there are a total of five 10.5 generation lines in the world, including two for domestic panel display companies BOE and Huaxing Optoelectronics. Sharp has a 10.5 generation line in Guangzhou, which is mainly used to produce its own TV. Korean manufacturers do not have the 10.5 generation line. In the context of the increasing size of the TV, Korean manufacturers are obviously at a disadvantage in competitiveness.

(3) As the large-size OLED panel display technology has become increasingly mature, Samsung and LGD hope to transfer production to large-size OLED with better profit prospects as soon as possible. Apart from the price factor, the reason why South Korean manufacturers are exiting LCD production is more because the large-size OLED panel display technology is becoming mature, and Samsung and LGD hope to switch to large-size OLED production as soon as possible, which has better profit prospects. At present, there are three major large-scale OLED solutions including WOLED, QD OLED, and printed OLED, while there is only WOLED with a mass production line at present.

According to statistics, shipments of OLED TVs totaled 2.8 million in 2018 and increased to 3.5 million in 2019, up 25 percent year on year. But it accounted for only 1.58% of global shipments. The capacity gap has greatly limited the volume of OLED TV.LG alone consumes about 47% of the world’s OLED TV panel display capacity, thanks to its own capacity. Other manufacturers can only purchase at a high price. According to the industry chain survey, the current price of a 65-inch OLED panel is around $800-900, while the price of the same size LCD panel is currently only $171.There is a significant price difference between the two.

Samsung and LGD began to shut down LCD production lines in Q3 last year, leading to the recovery of the panel display sector. Entering 2020, the two major South Korean plants have announced further capacity withdrawal planning. In the following section, we will focus on its capacity exit plan and compare it with the original plan. It can be seen that the pace and magnitude of Samsung’s exit this round is much higher than the market expectation:

(1) LGD: LGD currently has three large LCD production lines of P7, P8, and P9 in China, with a designed capacity of 230K, 240K, and 90K respectively. At the CES exhibition at the beginning of this year, the company announced that IT would shut down all TV panel display production capacity in South Korea in 2020, mainly P7 and P8 lines, while P9 is not included in the exit plan because IT supplies IT panel display for Apple.

According to our latest industry chain survey, by the end of Q1 in 2020, P7 production capacity remains 140K; P8 has 100K of capacity left.P7 is expected to shut down by the end of the year, and P8 will shut down all TV production capacity at the end of the year, but there is still 40KIT production capacity to continue.

(2) Samsung: At present, Samsung has L8-1, L8-2, and L7-2 large-size LCD production lines in South Korea, with designed production capacities of 200K, 150K, and 160K respectively. At the same time in Suzhou has a 70K capacity of 8 generation line.

Samsung had planned to retire all L8-1 and L8-2 capacity by the end of 2021, while L7-2 would retain 50K of IT capacity. This time, it is planned to withdraw all production capacity by the end of 2020, among which the production line in South Korea will be converted to Qdoled, and the production line in Suzhou will be sold.

This round of capacity withdrawal of South Korean plants began in June 2019. Based on the global total production capacity in June 2019, Samsung will withdraw 1,386,900 square meters of production capacity in 2019-2020, equivalent to 9.69% of the global production capacity, according to the previous two-year withdrawal expectation. In 2021, 697,200 square meters of production capacity will be withdrawn, which is equivalent to 4.87% of the global production capacity, and a total of 14.56% will be withdrawn in three years. After the implementation of the new plan, Samsung will eliminate 2.422 million square meters of production capacity by the end of 2020, equivalent to 16.92 percent of the global capacity. This round of production plans from the pace and range are far beyond the market expectations.

Global shipments of TV panel displays totaled 281 million in 2019, down 1.06 percent year on year, according to Insight. In fact, TV panel display shipments have been stable since 2015 at between 250 and 300 million units. At the same time, from the perspective of the structure of sales volume, the period from 2005 to 2010 was the period when the size of China’s TV market grew substantially. Third-world sales also leveled off in 2014. We believe that the sales volume of the TV market has stabilized and there is no big fluctuation. The impact of the epidemic on the overall demand may be more optimistic than the market expectation.

In contrast to the change in volume, we believe that the core driver of the growth in TV panel display demand is actually the increase in TV size. According to the data statistics of Group Intelligence Consulting, the average size of TV panel display in 2014 was 0.47 square meters, equivalent to the size of 41 inches screen. In 2019, the average TV panel size is 0.58 square meters, which is about the size of a 46-inch screen. From 2014 to 2019, the average CAGR of TV panel display size is 4.18%. Meanwhile, the shipment of TV in 2019 also increased compared with that in 2014. Therefore, from 2014 to 2019, the compound growth rate of the total area demand for TV panel displays is 6.37%.

It is assumed that 4K screen and 8K screen will accelerate the penetration and gradually become mainstream products in the next 2-3 years. The pace of screen size increase will accelerate. We have learned through industry chain research that the average size growth rate of TV will increase to 6-8% in 2020. Driven by the growth of the average size, the demand area of global TV panel displays is expected to grow even if TV sales decline, and the upward trend of industry demand remains unchanged.

Meanwhile, the global LCDTV panel display demand will increase significantly in 2021, driven by the recovery of terminal demand and the continued growth of the average TV size. In 2021, the whole year panel display will be in a short supply situation, the mainland panel shows that both males will enjoy the price elasticity.

This paper analyzes the competition pattern of the panel display industry from both supply and demand sides. On the supply side, the optimization of the industry competition pattern by accelerating the withdrawal of Samsung’s production capacity is deeply discussed. Demand-side focuses on tracking global sales data and industry inventory changes. Overall, we believe that the current epidemic has a certain impact on demand, and the panel shows that prices may be under short-term pressure in April or May. But as Samsung’s exit from LCD capacity accelerates, industry inventories remain low. So once the overseas epidemic is contained and domestic demand picks up, the panel suggests prices will surge. We are firmly optimistic about the A-share panel display plate investment value, maintain the industry “optimistic” rating. Suggested attention: BOE A, TCL Technology.

(Reuters) - Foxconn Technology Group is reconsidering plans to make advanced liquid crystal display panels at a $10 billion Wisconsin campus, and said it intends to hire mostly engineers and researchers rather than the manufacturing workforce the project originally promised.

Foxconn, which received controversial state and local incentives for the project, initially planned to manufacture advanced large screen displays for TVs and other consumer and professional products at the facility, which is under construction. It later said it would build smaller LCD screens instead.

Rather than a focus on LCD manufacturing, Foxconn wants to create a “technology hub” in Wisconsin that would largely consist of research facilities along with packaging and assembly operations, Woo said. It would also produce specialized tech products for industrial, healthcare, and professional applications, he added.

Rather than manufacturing LCD panels in the United States, Woo said it would be more profitable to make them in greater China and Japan, ship them to Mexico for final assembly, and import the finished product to the United States.

He said that would represent a supply chain that fits with Foxconn’s current “fluid, good business model.”FILE PHOTO: A shovel and FoxConn logo are seen before the arrival of U.S. President Donald Trump as he participates in the Foxconn Technology Group groundbreaking ceremony for its LCD manufacturing campus, in Mount Pleasant, Wisconsin, U.S., June 28, 2018. REUTERS/Darren Hauck

Currently, to qualify for the tax credits Foxconn must meet certain hiring and capital investment goals. It fell short of the employment goal in 2018 - hiring 178 full-time jobs rather than the 260 targeted - failing to earn a tax credit of up to $9.5 million.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey