lcd panel production 2018 pricelist

Prices for all TV panel sizes fluctuated and are forecast to fluctuate between 2020 and 2022. The period from March 2020 to July 2021 saw the biggest price increases, when a 65" UHD panel cost between 171 and 288 U.S. dollars. In the fourth quarter of 2021, such prices fell and are expected to drop to an even lower amount by March 2022.Read moreLCD TV panel prices worldwide from January 2020 to March 2022, by size(in U.S. dollars)Characteristic32" HD43" FHD49"/50" UHD55" UHD65" UHD------

DSCC. (January 10, 2022). LCD TV panel prices worldwide from January 2020 to March 2022, by size (in U.S. dollars) [Graph]. In Statista. Retrieved December 16, 2022, from https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/

DSCC. "LCD TV panel prices worldwide from January 2020 to March 2022, by size (in U.S. dollars)." Chart. January 10, 2022. Statista. Accessed December 16, 2022. https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/

DSCC. (2022). LCD TV panel prices worldwide from January 2020 to March 2022, by size (in U.S. dollars). Statista. Statista Inc.. Accessed: December 16, 2022. https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/

DSCC. "Lcd Tv Panel Prices Worldwide from January 2020 to March 2022, by Size (in U.S. Dollars)." Statista, Statista Inc., 10 Jan 2022, https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/

DSCC, LCD TV panel prices worldwide from January 2020 to March 2022, by size (in U.S. dollars) Statista, https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/ (last visited December 16, 2022)

LCD panel prices have risen for 4 months in a row because of your home gaming? Since this year, the whole LCD panel market has smoked. Whether after the outbreak of the epidemic, LCD panel market prices rose for four months, or the panel giants in Japan and South Korea successively sold production lines, or the Chinese mainland listed companies frequently integrated acquisition, investment, and plant construction, all make the industry full of interesting.

LCD panel prices are already a fact. Since May this year, LCD panel prices have risen for four months in a row, making the whole industry chain dynamic. Why are LCD panels going up in price in a volatile 2020? The key factor lies in the imbalance between supply and demand.

The price of LCDS for large-size TVs of 70 inches or more hasn’t budged much. In addition, LTPS screens and AMOLED screens used in high-end phones have seen little or no increase in price.

As for October, LCD panel price increases are expected to moderate. The data shows that in October 32 inches or 2 dollars; Gains of 39.5 to 43 inches will shrink to $3;55 inches will fall back below $10; The 65-inch gain will narrow to $5.

During the epidemic, people stayed at home and had no way to go out for entertainment. They relied on TV sets, PCS, and game consoles for entertainment. After the resumption of economic work and production, the market of traditional home appliances picked up rapidly, and LCD production capacity was quickly digested.

However, due to the shutdown of most factories lasting 1-2 months during the epidemic period, LCD panel production capacity was limited, leading to insufficient production capacity in the face of the market outbreak, which eventually led to the market shortage and price increase for 4 consecutive months.

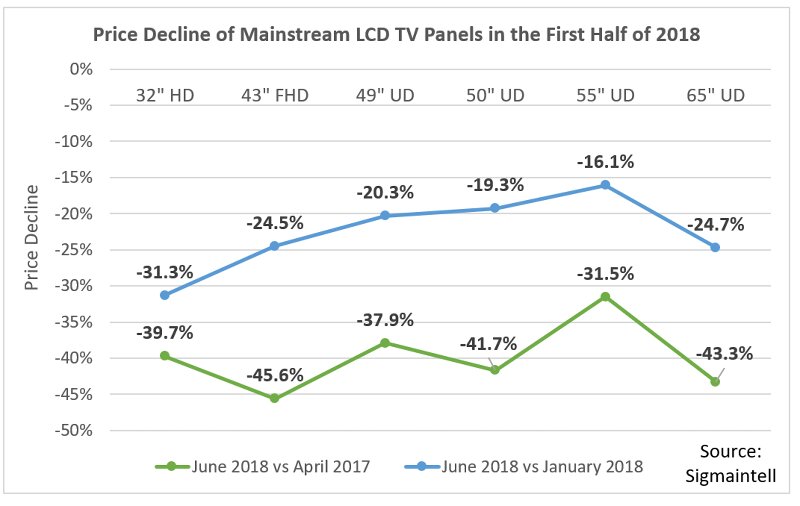

In fact, the last round of price rise of LCD panels was from 2016 to 2017, and its overall market price has continued to fall since 2018. Even in 2019, individual types have fallen below the material cost, and the whole industry has experienced a general operating loss. As a result, LCD makers have been looking for ways to improve margins since last year.

A return to a reasonable price range is the most talked about topic among panel makers in 2019, according to one practitioner. Some manufacturers for the serious loss of the product made the decision to reduce production or even stop production; Some manufacturers planned to raise the price, but due to the epidemic in 2020, the downstream demand was temporarily suppressed and the price increase was postponed. After the outbreak was contained in April, LCD prices began to rise in mid-to-late May.

In fact, the market price of LCD panels continued to decline in 2018-2019 because of the accelerated rise of China’s LCD industry and the influx of a large number of local manufacturers, which doubled the global LCD panel production capacity within a few years, but there was no suitable application market to absorb it. The result of excess capacity is oversupply, ultimately making LCD panel prices remain depressed.

Against this background, combined with the impact of the epidemic in 2020, the operating burden of LCD companies in Japan and South Korea has been further aggravated, and it is difficult to make profits in the production of LCD panels, so they have to announce the withdrawal of LCD business.

business in June 2022. In August, Sharp bought JDI Baishan, a plant in Ishikawa prefecture that makes liquid crystal display panels for smartphones. In early September, Samsung Display sold a majority stake in its SUZHOU LCD production plant to Starlight Electronics Technology, a unit of TCL Technology Group. LGD has not only pulled out of some of its production capacity but has announced that it will close its local production line in 2020. According to DSCC, a consultancy, the share of LCD production capacity in South Korea alone will fall from 19% to 7% between 2020 and 2021.

It is worth mentioning that in industry analysis, in view of the fact that Korean companies are good at using “dig through old bonus – selling high price – the development of new technology” the cycle of development mode, another 2020 out of the LCD production capacity, the main reason may be: taking the advantage of China’s expanding aggressively LCD manufacturers, Korean companies will own LCD panel production line hot sell, eliminating capacity liquid to extract its final value, and turning to the more profitable advantage of a new generation of display technologies, such as thinner, color display better OLED, etc. Samsung, for example, has captured more than 80% of the OLED market with its first-mover advantage.

From the perspective of production capacity, the launch of LCD tracks by major manufacturers in Japan and South Korea must reduce some production capacity in the short term, which to some extent induces market price fluctuations. In the long run, some of the Japanese and Korean LCD production capacity has been bought by Chinese manufacturers, coupled with frequent investment in recent years, the overall capacity is sure to recover as before, or even more than before. But now it will take time to expand the production layout, which more or less will cause supply imbalance, the industry needs to be cautious.

The LCD panel industry started in the United States and then gradually moved to Japan, South Korea, China, and Taiwan. At present, the proportion of production capacity in The Chinese mainland has reached 52% in 2020, and there are leading LCD panel products in China represented by BOE, Huxing Optoelectronics. Meanwhile, the production capacity layout of BOE, Huike, Huxing Optoelectronics, and other manufacturers has been basically completed, making industrial integration a necessity.

On the one hand, South Korean enterprises out of the LCD track, the domestic factory horse enclosure, plant expansion action. While LCDs may not sell as well as “upstart” flexible screens, respondents believe they are still strong enough in the traditional home appliance market to warrant continued investment. Zhao Bin, general manager of TCL Huaxing Development Center, has said publicly that the next-generation display technology will be mature in four to five years, but the commercialization of products may not take place until a decade later. “LCD will still be the mainstream in this decade,” he said.

On the other hand, there is no risk of neck jam in China’s LCD panel industry, which is generally controllable. In mainland China, there will be 21 production lines capable of producing 32-inch or larger LCD panels by 2021, accounting for about two-thirds of the global total. In terms of the proportion of production capacity, the Chinese mainland accounted for 42% of the global LCD panel in 2019, 51% this year, and will continue to climb to 63% next year.

Of course, building factories and expanding production cannot be accomplished overnight. In the process of production capacity recovery, it is predicted that there will be several price fluctuations, and the cost may be passed on to the downstream LCD panel manufacturers or consumers when the price rises greatly, which requires continuous attention.

Continuing strong demand for LCD products coupled with increasing concerns about shortages in key components have driven LCD TV panel prices to significant increases in Q1, and prices show no signs of slowing down in Q2. The widespread problems in the supply of Display Driver ICs (DDICs) and the recent announcement by Corning that glass prices will increase, add to the general logistics problems to create an atmosphere where price increases appear to be not only accepted but expected.

It may seem odd in the face of stalled economies and stalled AV projects, but the costs of LCD display products are on the rise, according to a report from Digital Supply Chain Consulting, or DSCC.

Demand for LCD products remains strong , says DSCC, at the same time as shortages are deepening for glass substrates and driver integrated circuits. Announcements by the Korean panel makers that they will maintain production of LCDs and delay their planned shutdown of LCD lines has not prevented prices from continuing to rise.

I assume, but absolutely don’t know for sure, that panel pricing that affects the much larger consumer market must have a similar impact on commercial displays, or what researchers seem to term public information displays.

Panel prices increased more than 20% for selected TV sizes in Q3 2020 compared to Q2, and by 27% in Q4 2020 compared to Q3, we now expect that average LCD TV panel prices in Q1 2021 will increase by another 12%.

The first chart shows our latest TV panel price update, with prices increasing across the board from a low in May 2020 to an expected peak in May/June of this year. Last month’s update predicted a peak in February/March. However, our forecast for the peak has been increased and pushed out after AGC reported a major accident at a glass plant in Korea and amid continuing problems with driver IC shortages.

The inflection point for this cycle, the month of the most significant M/M price increases, was passed in September 2020, and the price increases have been slowing down each month since then, but the January increase averaged 4.1%. Prices in February 2021 have reached levels last seen exactly three years ago in February 2018.

Prices increased in Q4 for all sizes of TV panels, with massive percentage increases in sizes from 32” to 55” ranging from 28% to 38%. Prices for 65” and 75” increased at a slower rate, by 19% and 8% respectively, as capacity has continued to increase on those sizes with Gen 10.5 expansions.

Prices for every size of TV panel will increase in Q1 at a slower rate, ranging from 5% for 75” to 16% for 43”, and we now expect that prices will continue to increase in Q2, with the increases ranging from 3% to 6% on a Q/Q basis. We now expect that prices will peak in Q2 and will start to decline in Q3, but the situation remains fluid.

All that said, LCD panels are way less costly, way lighter and slimmer, and generally look way better than the ones being used 10 years ago, so prices is a relative problem.

Looking to take your project to the next level in terms of functionality and appearance? A custom LCD display might be the thing that gets you there, at least compared to the dot-matrix or seven-segment displays that anyone and their uncle can buy from the usual sources for pennies. But how does one create such a thing, and what are the costs involved? As is so often the case these days, it’s simpler and cheaper than you think, and [Dave Jones] has a great primer on designing and specifying custom LCDs.

We’re amazed at how low the barrier to entry into custom electronics has become, and even if you don’t need a custom LCD, at these prices it’s tempting to order one just because you can. Of course, you can also build your own LCD display completely from scratch too.

Prior to the Covid-19 pandemic outbreak in early 2020, the flat-panel display (FPD) market was gloomy. Oversupply, falling prices and losses were the common themes in the market.

Cars, industrial equipment, PCs, smartphones and other products all incorporate flat-panel displays in one form or another. The majority of TV screens are based on liquid-crystal displays (LCDs). TVs use other display types, such as organic light-emitting diodes (OLEDs) and quantum dots.

Smartphone displays are based on LCDs and OLEDs. Other display technologies, such as microLEDs and miniLEDs, are in the works. Flat-panel displays are made in giant fabs. Suppliers from China, Korea and Taiwan dominate the display market.

It’s been a roller coaster ride in the arena. “Before Covid, the FPD market in the second half of 2019 was not very pretty,” said Ross Young, CEO of Display Supply Chain Consultants (DSCC), in a presentation at Display Week 2021. “We had declining revenues, declining prices, declining margins, companies announcing their exit in the LCD market, CapEx was falling, and there was little interest from investors.”

Worldwide FPD revenues fell by 5% in 2018, according to DSCC. Then, in 2019, the market declined by 8%, according to the firm. And prior to Covid-19, the FPD outlook was for a mere 2% growth in 2020, they added.

Demand for PCs, TVs and other products fueled renewed growth for displays. In total, the flat-panel display market reached $118 billion in 2020, up 6% over 2019, according to DSCC. That’s above the previous 2% growth forecast.

The numbers include LCDs, OLEDs and other displays. Of those figures, the LCD market reached $84 billion, while OLEDs were $33 billion in 2020, according to DSCC.

Then, the market is projected to hit a record $152 billion in 2021, up 29% over 2020, according to the firm. Of those figures, the LCD market is expected to reach $113 billion, while OLEDs are $39 billion, they said.

Average selling prices are up, but the market is still beset with component shortages. “Panel prices have risen significantly, particularly since August of last year. They’ve more than doubled in some cases,” Young said. “Adding to the pricing pressure have been components shortages in driver ICs, touch controllers, glass substrates compensation film, polarizers and other materials. We do expect prices to peak in Q3 (of 2021) as a result of shortages easing and the impact of double booking, leaving some potential air pockets in demand. We expect panel pricing to fall in the fourth quarter, but we’re not expecting sharp downturns, as in the past, due to slower supply growth.”

Flat-panel displays are thin panels of glass or plastic used for electronically displaying text, images, or video. Liquid crystal displays (LCD), OLED (organic light emitting diode) and microLED displays are not quite the same; since LCD uses a liquid crystal that reacts to an electric current blocking light or allowing it to pass through the panel, whereas OLED/microLED displays consist of electroluminescent organic/inorganic materials that generate light when a current is passed through the material. LCD, OLED and microLED displays are driven using LTPS, IGZO, LTPO, and A-Si TFT transistor technologies as their backplane using ITO to supply current to the transistors and in turn to the liquid crystal or electroluminescent material. Segment and passive OLED and LCD displays do not use a backplane but use indium tin oxide (ITO), a transparent conductive material, to pass current to the electroluminescent material or liquid crystal. In LCDs, there is an even layer of liquid crystal throughout the panel whereas an OLED display has the electroluminescent material only where it is meant to light up. OLEDs, LCDs and microLEDs can be made flexible and transparent, but LCDs require a backlight because they cannot emit light on their own like OLEDs and microLEDs.

Liquid-crystal display (or LCD) is a thin, flat panel used for electronically displaying information such as text, images, and moving pictures. They are usually made of glass but they can also be made out of plastic. Some manufacturers make transparent LCD panels and special sequential color segment LCDs that have higher than usual refresh rates and an RGB backlight. The backlight is synchronized with the display so that the colors will show up as needed. The list of LCD manufacturers:

Organic light emitting diode (or OLED displays) is a thin, flat panel made of glass or plastic used for electronically displaying information such as text, images, and moving pictures. OLED panels can also take the shape of a light panel, where red, green and blue light emitting materials are stacked to create a white light panel. OLED displays can also be made transparent and/or flexible and these transparent panels are available on the market and are widely used in smartphones with under-display optical fingerprint sensors. LCD and OLED displays are available in different shapes, the most prominent of which is a circular display, which is used in smartwatches. The list of OLED display manufacturers:

MicroLED displays is an emerging flat-panel display technology consisting of arrays of microscopic LEDs forming the individual pixel elements. Like OLED, microLED offers infinite contrast ratio, but unlike OLED, microLED is immune to screen burn-in, and consumes less power while having higher light output, as it uses LEDs instead of organic electroluminescent materials, The list of MicroLED display manufacturers:

LCDs are made in a glass substrate. For OLED, the substrate can also be plastic. The size of the substrates are specified in generations, with each generation using a larger substrate. For example, a 4th generation substrate is larger in size than a 3rd generation substrate. A larger substrate allows for more panels to be cut from a single substrate, or for larger panels to be made, akin to increasing wafer sizes in the semiconductor industry.

"Samsung Display has halted local Gen-8 LCD lines: sources". THE ELEC, Korea Electronics Industry Media. August 16, 2019. Archived from the original on April 3, 2020. Retrieved December 18, 2019.

"TCL to Build World"s Largest Gen 11 LCD Panel Factory". www.businesswire.com. May 19, 2016. Archived from the original on April 2, 2018. Retrieved April 1, 2018.

"Panel Manufacturers Start to Operate Their New 8th Generation LCD Lines". 대한민국 IT포털의 중심! 이티뉴스. June 19, 2017. Archived from the original on June 30, 2019. Retrieved June 30, 2019.

"TCL"s Panel Manufacturer CSOT Commences Production of High Generation Panel Modules". www.businesswire.com. June 14, 2018. Archived from the original on June 30, 2019. Retrieved June 30, 2019.

"Business Place Information – Global Operation | SAMSUNG DISPLAY". www.samsungdisplay.com. Archived from the original on 2018-03-26. Retrieved 2018-04-01.

"Samsung Display Considering Halting Some LCD Production Lines". 비즈니스코리아 - BusinessKorea. August 16, 2019. Archived from the original on April 5, 2020. Retrieved December 19, 2019.

Herald, The Korea (July 6, 2016). "Samsung Display accelerates transition from LCD to OLED". www.koreaherald.com. Archived from the original on April 1, 2018. Retrieved April 1, 2018.

Byeonghwa, Yeon. "Business Place Information – Global Operation – SAMSUNG DISPLAY". Samsungdisplay.com. Archived from the original on 2018-03-26. Retrieved 2018-04-01.

www.wisechip.com.tw. "WiseChip History – WiseChip Semiconductor Inc". www.wisechip.com.tw. Archived from the original on 2018-02-17. Retrieved 2018-02-17.

"China"s BOE to have world"s largest TFT-LCD+AMOLED capacity in 2019". ihsmarkit.com. 2017-03-22. Archived from the original on 2019-08-16. Retrieved 2019-08-17.

NEW YORK (CNNMoney) -- LCD TV prices will fall to their lowest levels of all time this Black Friday, as television manufacturers try to use bargains to revive struggling sales.

DisplaySearch predicts that 32-inch LCD TVs will be offered at or below $200. Both 40- and 42-inch sets will be priced in a range of $200-$400, and 55- and 60-inch LCD TVs will be offered below $1,000 for the first time, with the cheapest big-screen TV sets priced as low as $600 on Black Friday.

Bargains for plasma screens, which tend to be more expensive than LCD TVs, will be good, but the discounts won"t be nearly as extreme as those on LCD sets.

One caution for deal hunters: Manufacturers have become much more conservative in their inventories this year, reducing their orders for LCD panels as demand continued to slip. Factories that make TV sets were operating at just 70% this fall, IHS iSuppli said.

Just 11% of LCD TV sales are of sets with 3-D capabilities, though the expensive TVs did make up 27% of manufacturers" revenues this past quarter, according to DisplaySearch.

At present, markets such as large-screen TVs are still inseparable from LCD panels. Several Chinese panel manufacturers have surpassed Samsung and LG to become the main LCD panel manufacturers in recent years. Korean companies are no longer able to compete. Samsung will stop the production of LCD panels half a year ahead of schedule. Samsung used to be the largest LCD panel manufacturer, but in recent years, Chinese companies such as BOE and CSOT have rapidly expanded their market shares. Samsung and LG have continued to retreat, making BOE surpass LGD in 2018. As of now, BOE is now the world’s largest manufacturer of LCD panels.

Samsung originally planned to stop the production of LCD panels by the end of 2020. However, the LCD panel market started to increase prices in the past year or so. This made Samsung’s LCD factory continue to operate for another two years. However, the company originally plans to exit the market at the end of 2022. Nevertheless, the LCD panel market has changed since the end of last year. The price has been falling significantly and it is now on a free fall. By January this year, the average price of a 32 -inch panel was only $ 38, a 64% drop relative to January last year.

This situation is making Samsung rethink its initial exit plans. The South Korean manufacturing giant is now planning to withdraw from LCD panel production half a year ahead of schedule. It will stop production in June this year. Samsung Display, a subsidiary of Samsung Electronics, will turn to higher-end QD quantum dot panels. The LCD panels that the company needs will turn to procurement.

According to information released by Samsung Electronics, the company’s three major suppliers of LCD panels are BOE, Huaxing Optoelectronics, and AUO, all of which are Chinese companies. The first two are local companies, and they are the first and second-largest suppliers of LCD.

Due to high demand in South Kore, Samsung Display had to extend its production of Liquid Crystal Display (LCD) panels for TVs and monitors in South Korea. Its exit from the LCD market will give the company room to concentrate on more advanced technologies.

Samsung’s delay in closing the LCD panel plant will increase the production area and there is the risk of material shortages. Thus, the dipping price of LCD panels gives the company all the reasons it needs to quit the market.

SEOUL, Jan. 26 (Yonhap) -- LG Display Co., a South Korean major display panel maker, said Wednesday that its fourth quarter net income dropped 70.8 percent from a year earlier on declining LCD TV panel prices and one-off cost factors.

For the whole of 2021, the company recorded an operating profit of 2.23 trillion won, swinging to profit for the first time since 2018 on the back of the turnaround in the OLED business and business restructuring.

The company also reported record annual sales of 29.9 trillion won last year, thanks to "the strengthening position of large-sized OLED panels in the premium TV market, solidifying its small and mid-sized OLED businesses, and structural innovation in the LCD business focusing on high-end IT products."

In the fourth quarter, LG Display logged record-high quarterly sales of 8.8 trillion won on the back of increased production of OLEDs and a rise in IT panel shipments.

During the three months, panels for IT devices took up 42 percent of the total sales, followed by mobile device panels with 31 percent and TV panels with 27 percent.

LD Display said it will continue making restructuring efforts to strengthen its profitable OLED and POLED businesses to offset declines in LCD revenue and further boost profit.

LG Display is the world"s sole supplier of large-size OLED panels for TVs, but it showed relatively weak competitiveness in the medium-and-small sized OLED sector. In August last year, the company said it will invest 3.3 trillion won in the sector to boost its production capacity.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey