lcd panel production 2018 quotation

BOE Technology Group, the Chinese electronic components producer, is expected to be the leader in producing LCD display panels in the coming years, with a forecast capacity share of 24 percent by 2022. China is the country that has the largest LCD capacity, with a 56 percent share in 2020.Read moreLCD panel production capacity share from 2016 to 2022, by manufacturerCharacteristicBOEChina StarInnoluxAUOLGDHKCCEC PandaSharpSDCOther-----------

DSCC. (June 8, 2020). LCD panel production capacity share from 2016 to 2022, by manufacturer [Graph]. In Statista. Retrieved December 16, 2022, from https://www.statista.com/statistics/1057455/lcd-panel-production-capacity-manufacturer/

DSCC. "LCD panel production capacity share from 2016 to 2022, by manufacturer." Chart. June 8, 2020. Statista. Accessed December 16, 2022. https://www.statista.com/statistics/1057455/lcd-panel-production-capacity-manufacturer/

DSCC. (2020). LCD panel production capacity share from 2016 to 2022, by manufacturer. Statista. Statista Inc.. Accessed: December 16, 2022. https://www.statista.com/statistics/1057455/lcd-panel-production-capacity-manufacturer/

DSCC. "Lcd Panel Production Capacity Share from 2016 to 2022, by Manufacturer." Statista, Statista Inc., 8 Jun 2020, https://www.statista.com/statistics/1057455/lcd-panel-production-capacity-manufacturer/

DSCC, LCD panel production capacity share from 2016 to 2022, by manufacturer Statista, https://www.statista.com/statistics/1057455/lcd-panel-production-capacity-manufacturer/ (last visited December 16, 2022)

China is the leader in producing LCD display panels, with a forecast capacity share of 56 percent in 2020. China"s share is expected to increase in the coming years, stabilizing at 69 percent from 2023 onwards.Read moreLCD panel production capacity share from 2016 to 2025, by countryCharacteristicChinaJapanSouth KoreaTaiwan-----

DSCC. (June 8, 2020). LCD panel production capacity share from 2016 to 2025, by country [Graph]. In Statista. Retrieved December 16, 2022, from https://www.statista.com/statistics/1056470/lcd-panel-production-capacity-country/

DSCC. "LCD panel production capacity share from 2016 to 2025, by country." Chart. June 8, 2020. Statista. Accessed December 16, 2022. https://www.statista.com/statistics/1056470/lcd-panel-production-capacity-country/

DSCC. (2020). LCD panel production capacity share from 2016 to 2025, by country. Statista. Statista Inc.. Accessed: December 16, 2022. https://www.statista.com/statistics/1056470/lcd-panel-production-capacity-country/

DSCC. "Lcd Panel Production Capacity Share from 2016 to 2025, by Country." Statista, Statista Inc., 8 Jun 2020, https://www.statista.com/statistics/1056470/lcd-panel-production-capacity-country/

DSCC, LCD panel production capacity share from 2016 to 2025, by country Statista, https://www.statista.com/statistics/1056470/lcd-panel-production-capacity-country/ (last visited December 16, 2022)

(January 23, 2019) – Global shipments of large thin-film transistor (TFT) liquid crystal display (LCD) panels rose again in 2018 despite concerns of over-supply in the market. In particular, area shipments increased by 10.6 percent to 197.9 million square meters compared to the previous year, driven by TV and monitor panels, according to

Fierce price competition in large 65- and 75-inch display panels was ignited as Chinese panel maker BOE started the mass production of the panels in 2018 at its B9 10.5-generation facility. “With BOE operating the 10.5-generation line, panel makers have become more aggressive on pricing since early 2018 to digest their capacity,” said

Rising demand for gaming-PC and professional-purpose monitors boosted shipments of high-end, large panels. “Some panel makers have allocated more monitor panels to the fab, replacing existing TV panels, to make up for poor performance of that business,” Wu said.

Demand for other applications, which include public, automotive and industrial displays, recorded the highest growth rates of 17.5 percent by area and 28.6 percent by unit. “Panel makers view these applications as a new cash cow that can compensate for the sharp price erosion in main panels for TVs, monitors and notebook PCs,” Wu said.

LG Display led the area shipments of large display panels, with a 21 percent share in 2018, followed by BOE (17 percent) and Samsung Display (16 percent). BOE boasted the largest unit-shipment share of 23 percent, followed by LG Display (20 percent) and Innolux (17 percent), according to the

Large TFT LCD panel shipment growth is expected to continue in 2019. The preliminary forecast for unit shipments of three major products indicates that panel makers will continue to focus on the monitor and notebook PC panel businesses, increasing shipments by 5.3 percent and 6.6 percent, respectively, over the year, while shipments of TV panels are forecast to grow just 2.6 percent.

In 2019, three new 10.5-generation fabs – ChinaStar’s T6, BOE’s second fab and Foxconn/Sharp’s Guangzhou line – are expected to start mass production. All of them are assigned to manufacture TV panels, further boosting TV panel supply. “As the TV panel business is predicted to remain tough, panel makers, who enjoyed relatively better outcomes with monitor and notebook PC panels in 2018, will likely focus on the IT panel businesses,” Wu said.

IHS Markit provides information about the entire range of large display panels shipped worldwide and regionally, including monthly and quarterly revenues and shipments by display area, application, size and aspect ratio for each supplier.

China-based flat panel makers Chongqing HKC Optoelectronics Technology (HKC) and China Electronics Corporation (CEC) both reportedly have held off on their original plans to build...

Sharp reportedly will start equipment move-in at its new 10.5G LCD plant in Guangzhou, China in February 2019, with plans to kick off the first phase of the facility in August and...

Foxconn Electronics reportedly plans to scale down its original project to build an advanced 10.5G LCD fab in Wisconsin and instead will set up a 6G line there, according to industry...

After suffering a major tumble in the second quarter of 2018, the quotes for smaller-size TV panels are beginning to rebound in July, likely to pick up further in August, especially...

Taiwan"s LCD panel makers should develop more small- and medium-size panels for emerging applications that will come along with the rapid developments of 5G, IoT and IoV industries,...

LG Display (LGD) has reportedly decided to produce OLED panels directly at its upcoming 10.5G fab (P10) in Paju without going through the production of LCD panels at its early stage...

The price trend of large-size LCD TV panels has become increasingly uncertain recently, with some observers believing that quotes for such products will rise soon due to a low yield...

China-based flat panel maker BOE Technology has denied recent market speculations that claimed low yield rates had marred production of its 10.5 line in Hefei and 8.5G line in Fuzh...

HKC is planning to invest CNY40 billion (US$6.36 billion) to build an 11G LCD panel production line in Henan, China, according to industry sources. The China-based HKC"s move comes...

BOE Technology will begin volume production at tits 10.5G LCD fab in Hefei, central China in March, focusing on 65- and 75-inch TV panels initially, according to industry sources.

China-based BOE Technology has announced it has officially kicked off commercial operations at its first, as well as the world"s first, 10.5G line with initial production to focus...

With China"s LCD panel industry emerging as a major supply source worldwide and demand for panels among China brand vendors of ICT products expanding significantly, Taiwan-based LCD...

The overall global production capacity for large-size (9-inch and above) TFT LDC panels is estimated to see an impressive CAGR of 7% in the next five years, driven by robust market...

SEOUL, Dec 29 (Reuters) - Samsung Electronics said on Tuesday it will extend production of liquid crystal display (LCD) panels for TVs and monitors, as stay-at-home trends of the coronavirus pandemic created an uptick in demand.

Samsung Display’s decision to extend LCD production in South Korea for an unspecified period of time overrides its announcement in March that it would end all production by the end of the year to focus on more advanced technology.

Local media outlet IT Chosun reported earlier on Tuesday that production would be extended by a year at the request of Samsung Electronics’ set manufacturing division, citing unnamed tech industry sources.

The stay-at-home trend sparked by the coronavirus pandemic led to a 30% quarter-on-quarter spike in global panel demand in the third quarter of the year amid more TV and notebook demand, according to technology research firm TrendForce.

Samsung had produced LCD panels in both South Korea and China, but it earlier this year sold a majority stake in its Suzhou LCD production unit to TCL Technology Group Corp’s China Star Optoelectronics Technology unit. (Reporting by Joyce Lee; editing by Jane Wardell)

Foxconn, which received controversial state and local incentives for the project, initially planned to manufacture advanced large screen displays for TVs and other consumer and professional products at the facility, which is under construction. It later said it would build smaller LCD screens instead.

Rather than a focus on LCD manufacturing, Foxconn wants to create a "technology hub" in Wisconsin that would largely consist of research facilities along with packaging and assembly operations, Woo said. It would also produce specialized tech products for industrial, healthcare, and professional applications, he added.

Rather than manufacturing LCD panels in the United States, Woo said it would be more profitable to make them in greater China and Japan, ship them to Mexico for final assembly, and import the finished product to the United States.

Currently, to qualify for the tax credits Foxconn must meet certain hiring and capital investment goals. It fell short of the employment goal in 2018 - hiring 178 full-time jobs rather than the 260 targeted - failing to earn a tax credit of up to $9.5 million.

While analyzing the strength properties, slightly smaller values were observed for the concretes with LCD admixture, in relation to the reference concretes CI.0 and CII.0. The differences in the obtained values are differentiated, exhibiting no clear tendency. They are most pronounced in the tensile strength test; however, due to the high coefficient of variation (over 10%), they cannot be subjected to a comparative analysis. Generally, it can be stated that lower values were usually found in the concretes with LCD addition. Such observation can be explained both by a higher air content in the concrete mixtures with LCD admixture (the considered concretes exhibited diversified consistency with low degree of liquidity within two classes), as well as the conchoidal fracture of LCD grains. The conchoidal fracture, due to its glassy and smooth texture, deteriorates the mechanical adhesiveness of cement paste to aggregate granules, despite its low porosity found while examining the interfacial transition zone (ITZ). Nevertheless, the low share of the admixture should reduce its significance. It should also be emphasized that extending the maturation time substantially mitigates the differences in compressive strength values. Following 90 days of maturation, all concretes reached the same class. which is especially prominent while applying the CEM II/B-S 42.5 N cement that is characterized by a slower improvement of the strength parameters in relation to CEM I 42.5 R.

The obtained correlations can be described by the equation y=0.39x2−0.02x−2.23, which is characterized by a coefficient of determination R2 = 0.83 and relatively low errors in the intercept (respectively 28%, 25%, 28%). The higher the water-tightness, the higher the frost resistance and the lower the mass loss. The reference concrete CI.0 is characterized by the lowest water-tightness (deepest water penetration), which corresponds to the highest mass loss during the water tightness test. An increase in LCD admixture to 2% resulted in 3-fold decrease in the mass loss of the samples.

Based on the research of Batayneh et al. [64] concerning the impact of various waste materials on the properties of concretes and hardened concrete, it was found that the use of aggregate made of recycled concrete, due to the shape and texture of the grain surface, significantly reduces the workability of the concretes. Similar observations were made when using crushed plastics. In our own research, the impact of LCD additive with significantly smaller amounts and completely different mineralogical and chemical characteristics did not significantly affect the consistency of the mixtures.

The use of 20% recycled plastics or concrete aggregate according to Batayneh et al. [64] reduces the compressive strength compared to reference concrete with natural aggregate. Despite the small amounts of LCD addition used in our studies, similar relationships in compressive strength values were observed in the early maturing periods (see Figure 5). However, after a longer maturing period (90 days), the same compressive strength classes of the tested concretes were obtained.

As a result of research of Mahesh and co-workers [65] regarding the impact of waste from polyethylene plastics, it was found that despite the reduction of early compressive strength of tested concretes (5–10% of the used waste), their compressive strengths after 28 days were comparable to the reference concrete [65]. Similar correlations were observed in own research after the use of LCD as an additive (Table 10).

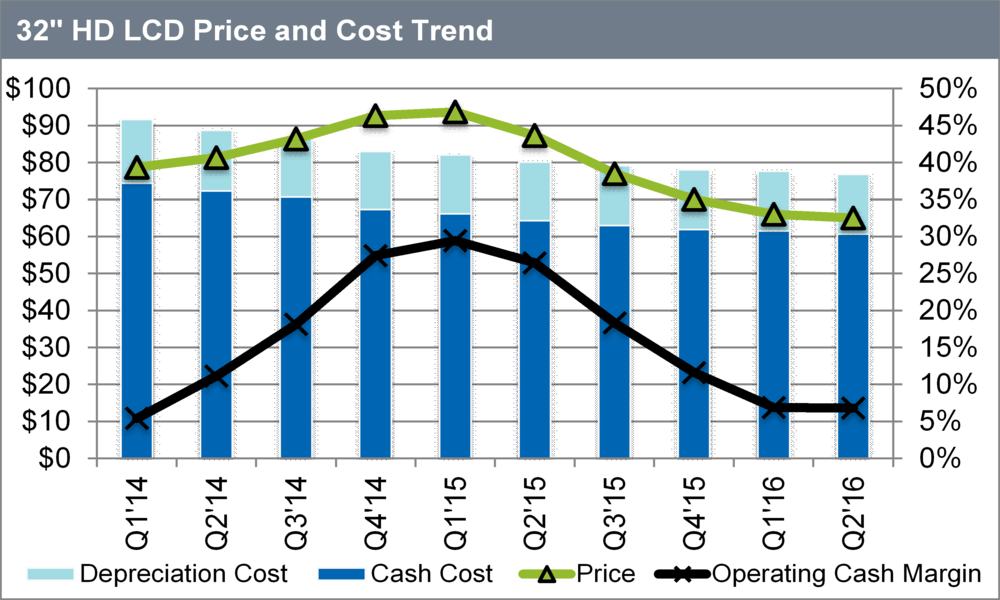

Factors that may influence the price of a certain type of LCD include: screen size, viewing angle, maximum brightness, color display,resolution and frame rate.

Screen size: larger size display more, and larger size cost more, these’re common sense. For example, in last year’s iPhone 8P which used a 5.5-inch LCD screen, the display (including touchscreen) cost 52.5 dollars, while a 43-inch LCD TV cost 128 dollars.

Viewing angle: it’s the maximum angle at which a display can be viewed with acceptable visual performance. It’s measured from one direction to the opposite, giving a maximum of 180° for a flat, one-sided screen. Early LCDs had strikingly narrow viewing angles, for now most of the manufacturers have improved them to more than 160°.

Color display: in early or simple LCDs, only two or very few colors can be displayed. As the technology advances, TFT LCD can display up to 65536 colors.

As the diagram shows above, LCD module covers the most part of the cost of a LCD TV. Within LCD module, there’re still many components. In the following diagram we’ll show you the price breakdown of these components.

The third quarter in the year is usually the demand season of LCD module, as a result the price will be the highest. However, situation varies in different market.

Due to the massive investment and low cost of Chinese mainland manufacturer, the capacity of LCD module for TVs increases significantly, so the price of these modules stay pretty low for the past year.

In another aspect, technology innovations keep push the price of high-end LCD to a higher level. For many users that are planning to replace their old TVs, these high-end LCDs are tempting choices.

Actually, though LCD screen has many advantages, its average price is keep decreasing in the past years. New technology brings lower cost is one reason, a strong competitor called OLED is another.

Main difference between OLED and LCD is OLED can give out light itself, that is to say OLED screen can run at a lower load compared to LCD screen, at least it doesn’t need a backlight system.

A thin-film-transistor liquid-crystal display (TFT LCD) is a variant of a liquid-crystal display that uses thin-film-transistor technologyactive matrix LCD, in contrast to passive matrix LCDs or simple, direct-driven (i.e. with segments directly connected to electronics outside the LCD) LCDs with a few segments.

In February 1957, John Wallmark of RCA filed a patent for a thin film MOSFET. Paul K. Weimer, also of RCA implemented Wallmark"s ideas and developed the thin-film transistor (TFT) in 1962, a type of MOSFET distinct from the standard bulk MOSFET. It was made with thin films of cadmium selenide and cadmium sulfide. The idea of a TFT-based liquid-crystal display (LCD) was conceived by Bernard Lechner of RCA Laboratories in 1968. In 1971, Lechner, F. J. Marlowe, E. O. Nester and J. Tults demonstrated a 2-by-18 matrix display driven by a hybrid circuit using the dynamic scattering mode of LCDs.T. Peter Brody, J. A. Asars and G. D. Dixon at Westinghouse Research Laboratories developed a CdSe (cadmium selenide) TFT, which they used to demonstrate the first CdSe thin-film-transistor liquid-crystal display (TFT LCD).active-matrix liquid-crystal display (AM LCD) using CdSe TFTs in 1974, and then Brody coined the term "active matrix" in 1975.high-resolution and high-quality electronic visual display devices use TFT-based active matrix displays.

The circuit layout process of a TFT-LCD is very similar to that of semiconductor products. However, rather than fabricating the transistors from silicon, that is formed into a crystalline silicon wafer, they are made from a thin film of amorphous silicon that is deposited on a glass panel. The silicon layer for TFT-LCDs is typically deposited using the PECVD process.

Polycrystalline silicon is sometimes used in displays requiring higher TFT performance. Examples include small high-resolution displays such as those found in projectors or viewfinders. Amorphous silicon-based TFTs are by far the most common, due to their lower production cost, whereas polycrystalline silicon TFTs are more costly and much more difficult to produce.

The twisted nematic display is one of the oldest and frequently cheapest kind of LCD display technologies available. TN displays benefit from fast pixel response times and less smearing than other LCD display technology, but suffer from poor color reproduction and limited viewing angles, especially in the vertical direction. Colors will shift, potentially to the point of completely inverting, when viewed at an angle that is not perpendicular to the display. Modern, high end consumer products have developed methods to overcome the technology"s shortcomings, such as RTC (Response Time Compensation / Overdrive) technologies. Modern TN displays can look significantly better than older TN displays from decades earlier, but overall TN has inferior viewing angles and poor color in comparison to other technology.

Most TN panels can represent colors using only six bits per RGB channel, or 18 bit in total, and are unable to display the 16.7 million color shades (24-bit truecolor) that are available using 24-bit color. Instead, these panels display interpolated 24-bit color using a dithering method that combines adjacent pixels to simulate the desired shade. They can also use a form of temporal dithering called Frame Rate Control (FRC), which cycles between different shades with each new frame to simulate an intermediate shade. Such 18 bit panels with dithering are sometimes advertised as having "16.2 million colors". These color simulation methods are noticeable to many people and highly bothersome to some.gamut (often referred to as a percentage of the NTSC 1953 color gamut) are also due to backlighting technology. It is not uncommon for older displays to range from 10% to 26% of the NTSC color gamut, whereas other kind of displays, utilizing more complicated CCFL or LED phosphor formulations or RGB LED backlights, may extend past 100% of the NTSC color gamut, a difference quite perceivable by the human eye.

The transmittance of a pixel of an LCD panel typically does not change linearly with the applied voltage,sRGB standard for computer monitors requires a specific nonlinear dependence of the amount of emitted light as a function of the RGB value.

In-plane switching was developed by Hitachi Ltd. in 1996 to improve on the poor viewing angle and the poor color reproduction of TN panels at that time.

Initial iterations of IPS technology were characterised by slow response time and a low contrast ratio but later revisions have made marked improvements to these shortcomings. Because of its wide viewing angle and accurate color reproduction (with almost no off-angle color shift), IPS is widely employed in high-end monitors aimed at professional graphic artists, although with the recent fall in price it has been seen in the mainstream market as well. IPS technology was sold to Panasonic by Hitachi.

Most panels also support true 8-bit per channel color. These improvements came at the cost of a higher response time, initially about 50 ms. IPS panels were also extremely expensive.

In 2004, Hydis Technologies Co., Ltd licensed its AFFS patent to Japan"s Hitachi Displays. Hitachi is using AFFS to manufacture high end panels in their product line. In 2006, Hydis also licensed its AFFS to Sanyo Epson Imaging Devices Corporation.

It achieved pixel response which was fast for its time, wide viewing angles, and high contrast at the cost of brightness and color reproduction.Response Time Compensation) technologies.

Less expensive PVA panels often use dithering and FRC, whereas super-PVA (S-PVA) panels all use at least 8 bits per color component and do not use color simulation methods.BRAVIA LCD TVs offer 10-bit and xvYCC color support, for example, the Bravia X4500 series. S-PVA also offers fast response times using modern RTC technologies.

A technology developed by Samsung is Super PLS, which bears similarities to IPS panels, has wider viewing angles, better image quality, increased brightness, and lower production costs. PLS technology debuted in the PC display market with the release of the Samsung S27A850 and S24A850 monitors in September 2011.

Due to the very high cost of building TFT factories, there are few major OEM panel vendors for large display panels. The glass panel suppliers are as follows:

External consumer display devices like a TFT LCD feature one or more analog VGA, DVI, HDMI, or DisplayPort interface, with many featuring a selection of these interfaces. Inside external display devices there is a controller board that will convert the video signal using color mapping and image scaling usually employing the discrete cosine transform (DCT) in order to convert any video source like CVBS, VGA, DVI, HDMI, etc. into digital RGB at the native resolution of the display panel. In a laptop the graphics chip will directly produce a signal suitable for connection to the built-in TFT display. A control mechanism for the backlight is usually included on the same controller board.

The low level interface of STN, DSTN, or TFT display panels use either single ended TTL 5 V signal for older displays or TTL 3.3 V for slightly newer displays that transmits the pixel clock, horizontal sync, vertical sync, digital red, digital green, digital blue in parallel. Some models (for example the AT070TN92) also feature input/display enable, horizontal scan direction and vertical scan direction signals.

New and large (>15") TFT displays often use LVDS signaling that transmits the same contents as the parallel interface (Hsync, Vsync, RGB) but will put control and RGB bits into a number of serial transmission lines synchronized to a clock whose rate is equal to the pixel rate. LVDS transmits seven bits per clock per data line, with six bits being data and one bit used to signal if the other six bits need to be inverted in order to maintain DC balance. Low-cost TFT displays often have three data lines and therefore only directly support 18 bits per pixel. Upscale displays have four or five data lines to support 24 bits per pixel (truecolor) or 30 bits per pixel respectively. Panel manufacturers are slowly replacing LVDS with Internal DisplayPort and Embedded DisplayPort, which allow sixfold reduction of the number of differential pairs.

The bare display panel will only accept a digital video signal at the resolution determined by the panel pixel matrix designed at manufacture. Some screen panels will ignore the LSB bits of the color information to present a consistent interface (8 bit -> 6 bit/color x3).

With analogue signals like VGA, the display controller also needs to perform a high speed analog to digital conversion. With digital input signals like DVI or HDMI some simple reordering of the bits is needed before feeding it to the rescaler if the input resolution doesn"t match the display panel resolution.

Kawamoto, H. (2012). "The Inventors of TFT Active-Matrix LCD Receive the 2011 IEEE Nishizawa Medal". Journal of Display Technology. 8 (1): 3–4. Bibcode:2012JDisT...8....3K. doi:10.1109/JDT.2011.2177740. ISSN 1551-319X.

Brody, T. Peter; Asars, J. A.; Dixon, G. D. (November 1973). "A 6 × 6 inch 20 lines-per-inch liquid-crystal display panel". 20 (11): 995–1001. Bibcode:1973ITED...20..995B. doi:10.1109/T-ED.1973.17780. ISSN 0018-9383.

K. H. Lee; H. Y. Kim; K. H. Park; S. J. Jang; I. C. Park & J. Y. Lee (June 2006). "A Novel Outdoor Readability of Portable TFT-LCD with AFFS Technology". SID Symposium Digest of Technical Papers. AIP. 37 (1): 1079–82. doi:10.1889/1.2433159. S2CID 129569963.

Carbon fiber-framed indoor LED video wall and floor displays with exceptional on-camera visual properties and deployment versatility for various installations including virtual production and extended reality.

a line of extreme and ultra-narrow bezel LCD displays that provides a video wall solution for demanding requirements of 24x7 mission-critical applications and high ambient light environments

Liquid crystal display (LCD) screens are present in a variety of electronic devices including televisions, computers, cell phones, global positioning system (GPS) devices, and others. On a vitreous layer of their inner surface these screens contain the chemical element indium. The presence of this element, considered a critical raw material due to its economic importance and scarce availability, renders the recycling of these screens increasingly attractive. The present study therefore was undertaken with the aim of extracting indium present in LCD screens. Damaged or obsolete monitors with LCD screens were collected and dismantled manually to remove the glass layer containing indium, and subsequently, the glass layer was ground in a ball mill. After grinding, leaching tests for indium extraction were performed. Hydrochloric acid (HCl), at different temperatures and concentrations, was tested as a leaching agent at solid/liquid ratios of 1/100 and 1/10. The results obtained reveal the possibility of extracting indium, with the best result being obtained with HCl 6 M, 60°C, s/l ratio 1/100, with 298 mg In/kg.

Dias P., Schmidt L., Gomes L.B., Bettanin A., Veit H., Bernardes A.M. (2018) Recycling Waste Crystalline Silicon Photovoltaic Modules by Electrostatic Separation. Journal of Sustainable Metallurgy. Volume 4, Issue 2, pp 176–186.

Savvilotidou V.,,Hahladakis J.N., Gidarakos E. (2015) Leaching capacity of metals–metalloids and recovery of valuable materials from waste LCDs. Waste Management 45 314–324.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey