lcd panel production 2018 for sale

As per recent data, in the fourth quarter of 2019, Samsung Display Company accumulated around six billion U.S. dollars in revenue through the sale of OLED panels and another 884 million through the sale of LCD display panels.Read moreSamsung Display Company"s display panel revenues worldwide from 2016 to 2019, by type(in million U.S. dollars)CharacteristicOLEDLCD---

DSCC, & Statista. (February 3, 2020). Samsung Display Company"s display panel revenues worldwide from 2016 to 2019, by type (in million U.S. dollars) [Graph]. In Statista. Retrieved December 16, 2022, from https://www.statista.com/statistics/987430/worldwide-samsung-display-panel-revenue-by-type/

DSCC, und Statista. "Samsung Display Company"s display panel revenues worldwide from 2016 to 2019, by type (in million U.S. dollars)." Chart. February 3, 2020. Statista. Accessed December 16, 2022. https://www.statista.com/statistics/987430/worldwide-samsung-display-panel-revenue-by-type/

DSCC, Statista. (2020). Samsung Display Company"s display panel revenues worldwide from 2016 to 2019, by type (in million U.S. dollars). Statista. Statista Inc.. Accessed: December 16, 2022. https://www.statista.com/statistics/987430/worldwide-samsung-display-panel-revenue-by-type/

DSCC, and Statista. "Samsung Display Company"s Display Panel Revenues Worldwide from 2016 to 2019, by Type (in Million U.S. Dollars)." Statista, Statista Inc., 3 Feb 2020, https://www.statista.com/statistics/987430/worldwide-samsung-display-panel-revenue-by-type/

DSCC & Statista, Samsung Display Company"s display panel revenues worldwide from 2016 to 2019, by type (in million U.S. dollars) Statista, https://www.statista.com/statistics/987430/worldwide-samsung-display-panel-revenue-by-type/ (last visited December 16, 2022)

This statistic shows the production capacity in area for large-size LCD panels worldwide from 2015 to 2020. In 2016, the global production capacity in area for large-size panels reached 243.4 million square meters.Read moreProduction capacity in area for large-size LCD panels worldwide from 2015 to 2020(in million square meters)CharacteristicProduction capacity in million square meters--

TrendForce. (September 4, 2017). Production capacity in area for large-size LCD panels worldwide from 2015 to 2020 (in million square meters) [Graph]. In Statista. Retrieved December 16, 2022, from https://www.statista.com/statistics/760180/large-size-lcd-panel-production-capacity-worldwide/

TrendForce. "Production capacity in area for large-size LCD panels worldwide from 2015 to 2020 (in million square meters)." Chart. September 4, 2017. Statista. Accessed December 16, 2022. https://www.statista.com/statistics/760180/large-size-lcd-panel-production-capacity-worldwide/

TrendForce. (2017). Production capacity in area for large-size LCD panels worldwide from 2015 to 2020 (in million square meters). Statista. Statista Inc.. Accessed: December 16, 2022. https://www.statista.com/statistics/760180/large-size-lcd-panel-production-capacity-worldwide/

TrendForce. "Production Capacity in Area for Large-size Lcd Panels Worldwide from 2015 to 2020 (in Million Square Meters)." Statista, Statista Inc., 4 Sep 2017, https://www.statista.com/statistics/760180/large-size-lcd-panel-production-capacity-worldwide/

TrendForce, Production capacity in area for large-size LCD panels worldwide from 2015 to 2020 (in million square meters) Statista, https://www.statista.com/statistics/760180/large-size-lcd-panel-production-capacity-worldwide/ (last visited December 16, 2022)

The market for equipment to manufacture LCD and OLED displays for smartphones and TVs grew 28% in 2018 following a growth of 33% in 2017. Applied Materials" (NASDAQ:AMAT) revenues grew 36%. A key driver for AMAT"s strong performance was the sale of equipment to Chinese LCD manufacturers BOE Technology and China Star Optoelectronics Technology to manufacture 10.5G panels for the production of 75-inch LCD TVs.

While the 10.5G market will be strong again in 2019, AMAT will face headwinds in sectors that utilize equipment for the production of smaller displays, primarily smartphones.

During Applied Materials’ recent Q1 earnings call, CEO Gary Dickerson noted: "In display, weakness in emerging markets is also impacting the timing of customers’ investment plans. We see some TV factory projects pushing out of year and into 2020. As a result, we now believe our display equipment revenue in 2019 will decline by about a third from 2018"s record levels. We also expect revenue in the second fiscal quarter to be significantly lower than our average run rate for the year."

Providing more granularity, market share growth ofAMAT and Nikon is primarily attributed to the investments by BOE in its 10.5G LCD. Both equipment companies are the only suppliers of equipment (AMAT for deposition and Nikon for lithography) that can fabricate the large 10.5G panels. So even though AMAT is a deposition company, its tool, acquired about 20 years ago from the acquisition of AKT, is the only one on the market big enough to accommodate 10.5G panels.

The display market can be segmented into three general segments – (1) LCD panels for TVs, (2) OLED panels for smartphones, and (3) LCD panels for Smartphones. Each of these has its own headwinds and tailwinds, which are impacting capital equipment expenditures. These issues I detail below. There are numerous ways to segment this industry, but I am detailing this segmentation for this article.

A driving force for 10.5G plant construction is that a 10.5G mother glass is 1.8 times larger than an 8.5G one in area and can be cut into six 75-inch panels. In comparison, a 7.5G glass substrate can be cut into only two 75-inch TV panels. Thus, there is a significant cost benefit of moving to the larger substrates.

AMAT’s deposition tools are used to form the backplane for LCD displays. The company’s deposition tools are the only ones capable of uniform coating of panels this size, which measure 3370mm x 2940mm. AMAT’s equipment can deposit various materials for the backplane.

Shown in Table 1 are the number of 10.5G panels being manufactured through 2018, with forecasts for panel production in 2019 and 2020, according to The Information Network’s report “OLED and LCD Markets: Technology, Directions and Market Analysis.”

10.5G represented a strong tailwind for AMAT and Nikon in 2018. For example, Nikon sold 13, 10.5G lithography systems in CY2018 representing 18% of systems sold. This compares to only one 10.5G system sold in CY2017.

BOE Technology’s first 10.5G fab, located in Hefei, entered volume production in the first half of 2018. China Star Optoelectronics Technology (CSOT) plans to build to kick off commercial operations of its 10.5G plant in March 2019, having installed equipment in 2018. Capex spends by these companies for these plants provided a significant portion of AMAT"s revenues for 2018.

For 2019, BOE’s second 10.5G line, to be located in Wuhan, is slated for volume production in 2020, with equipment installation in mid-2019. Sharp (OTCPK:SHCAY) will start equipment install at its new 10.5G LCD plant in Guangzhou in early 2019, with plans to kick off the first phase of the facility in Aug 2019 and to begin volume production in October 2019. LG Display (LPL) is building its 10.5G OLED P10 fab in Paju, Korea, but volume production is now scheduled at the beginning of 2021. Originally, the company planned to install equipment in 3Q 2018, but it may be pushed back to the beginning of 2020. With an oversupply of 10.5G panels as a result of BOE and CSOT production, display manufacturers are closely monitoring the market.

In addition to 10.5G mother glass for TVs, most LCD TVs are made using 8G glass. In 2018, LCD panel shipments increased 9% while TV area increased 11%, meaning that the average size of a TV is increasing. While some of the increase was due to shipments from BOE’s 10.5G plant, 8G plants were responsible for most of the growth. LG Display, for example, which makes LCD TVs from 8G mother glass, witnessed a 21% increase in area shipments, whereas Innolux, also without a 10.5G plant, reported an increase of 17% in area shipments. BOE, with both 8G and 10.5G plants, reported an area shipment increase of 17%.

I am neutral on AMAT in the OLED panel for smartphones. There are two issues. One is that AMAT’s equipment used in the production of OLEDs is being supplanted by competitor’s differentiating technology.

A second factor contributing to my neutral stance for AMAT in this OLED market is a sluggish smartphone market – the largest application for 6G OLED panels. Investment was minimal in 2018 as shown in Table 3. Also tied to sluggish smartphone sales is product distinction. Rigid OLED panels are not significantly better than lower-cost LTPS-LCD panels. With the capacity built up through 2018, utilization rates averaged 60%.

Table 4 presents The Information Network’s forecast of 6G OLED panel output to 2020. Again, panel output only increased 32,000 panels per month in 2018, but is expected to increase 138,000 panels per month in 2019, followed by a more moderate growth of 121,000 panels per month in 2020.

Flexible smartphones will drive the 6G market in 2019 and 2020. Samsung Electronics (OTCPK:SSNLF) introduced its Galaxy Fold and Huawei its Mate X in February 2018. Details of the two smartphones are described here. A significant difference between the two is the display.

I am bearish for AMAT on LCD panels for smartphones. Table 2 illustrates the drop in 6G plant expansion in 2018 showing Nikon’s lithography system sales by panel generation in 2017 and 2018. 6G systems dropped from 42 units in 2017 to 18 in 2018

Although flexible OLED has been gaining market share in the smartphone market in the last few years for its thinner form factor, higher performance, and differentiating design, the high utilization rates of 90% is minimizing the need for plant expansion and resulting in an oversupply of 20% for LCDs. Combined, these contribute to a 20% discount in LCD cost per smartphone compared to a rigid OLED display. Tianma is the top supplier of LTPS TFT-LCDs for smartphones with shipments of 149 million units in 2018, an increase of 49% YoY.

High-end smartphones like Apple"s current iPhone XS and iPhone XS Max use OLED screens to deliver better image quality, faster pixel response times. The XR uses an LCD display. It is likely we will see a similar lineup in 2019 - a continuation of both the iPhone XS and XR devices, with rumors suggesting 5.8 and 6.5-inch OLED iPhones along with a 6.1-inch LCD iPhone.

AMAT capitalized on the size of its deposition tools to generate strong revenue growth in the 10.5G market. In the other segments of the display production market (6G and 8G), its deposition tools for backplane and OLED encapsulation do not offer any advantages over competitors. In fact, the company is losing share to better technology.

The primary claim for AMAT"s display tools is its size. If 6G LCD factory expansion is dropping and 10.5G factories make panels with better economies of scale than 8G factories to make TVs, then it is only a matter of time before a competitor makes equipment that can deposit the backplanes on 10.5G panels.

Flat-panel displays are thin panels of glass or plastic used for electronically displaying text, images, or video. Liquid crystal displays (LCD), OLED (organic light emitting diode) and microLED displays are not quite the same; since LCD uses a liquid crystal that reacts to an electric current blocking light or allowing it to pass through the panel, whereas OLED/microLED displays consist of electroluminescent organic/inorganic materials that generate light when a current is passed through the material. LCD, OLED and microLED displays are driven using LTPS, IGZO, LTPO, and A-Si TFT transistor technologies as their backplane using ITO to supply current to the transistors and in turn to the liquid crystal or electroluminescent material. Segment and passive OLED and LCD displays do not use a backplane but use indium tin oxide (ITO), a transparent conductive material, to pass current to the electroluminescent material or liquid crystal. In LCDs, there is an even layer of liquid crystal throughout the panel whereas an OLED display has the electroluminescent material only where it is meant to light up. OLEDs, LCDs and microLEDs can be made flexible and transparent, but LCDs require a backlight because they cannot emit light on their own like OLEDs and microLEDs.

Liquid-crystal display (or LCD) is a thin, flat panel used for electronically displaying information such as text, images, and moving pictures. They are usually made of glass but they can also be made out of plastic. Some manufacturers make transparent LCD panels and special sequential color segment LCDs that have higher than usual refresh rates and an RGB backlight. The backlight is synchronized with the display so that the colors will show up as needed. The list of LCD manufacturers:

Organic light emitting diode (or OLED displays) is a thin, flat panel made of glass or plastic used for electronically displaying information such as text, images, and moving pictures. OLED panels can also take the shape of a light panel, where red, green and blue light emitting materials are stacked to create a white light panel. OLED displays can also be made transparent and/or flexible and these transparent panels are available on the market and are widely used in smartphones with under-display optical fingerprint sensors. LCD and OLED displays are available in different shapes, the most prominent of which is a circular display, which is used in smartwatches. The list of OLED display manufacturers:

MicroLED displays is an emerging flat-panel display technology consisting of arrays of microscopic LEDs forming the individual pixel elements. Like OLED, microLED offers infinite contrast ratio, but unlike OLED, microLED is immune to screen burn-in, and consumes less power while having higher light output, as it uses LEDs instead of organic electroluminescent materials, The list of MicroLED display manufacturers:

LCDs are made in a glass substrate. For OLED, the substrate can also be plastic. The size of the substrates are specified in generations, with each generation using a larger substrate. For example, a 4th generation substrate is larger in size than a 3rd generation substrate. A larger substrate allows for more panels to be cut from a single substrate, or for larger panels to be made, akin to increasing wafer sizes in the semiconductor industry.

"Samsung Display has halted local Gen-8 LCD lines: sources". THE ELEC, Korea Electronics Industry Media. August 16, 2019. Archived from the original on April 3, 2020. Retrieved December 18, 2019.

"TCL to Build World"s Largest Gen 11 LCD Panel Factory". www.businesswire.com. May 19, 2016. Archived from the original on April 2, 2018. Retrieved April 1, 2018.

"Panel Manufacturers Start to Operate Their New 8th Generation LCD Lines". 대한민국 IT포털의 중심! 이티뉴스. June 19, 2017. Archived from the original on June 30, 2019. Retrieved June 30, 2019.

"TCL"s Panel Manufacturer CSOT Commences Production of High Generation Panel Modules". www.businesswire.com. June 14, 2018. Archived from the original on June 30, 2019. Retrieved June 30, 2019.

"Business Place Information – Global Operation | SAMSUNG DISPLAY". www.samsungdisplay.com. Archived from the original on 2018-03-26. Retrieved 2018-04-01.

"Samsung Display Considering Halting Some LCD Production Lines". 비즈니스코리아 - BusinessKorea. August 16, 2019. Archived from the original on April 5, 2020. Retrieved December 19, 2019.

Herald, The Korea (July 6, 2016). "Samsung Display accelerates transition from LCD to OLED". www.koreaherald.com. Archived from the original on April 1, 2018. Retrieved April 1, 2018.

Byeonghwa, Yeon. "Business Place Information – Global Operation – SAMSUNG DISPLAY". Samsungdisplay.com. Archived from the original on 2018-03-26. Retrieved 2018-04-01.

www.wisechip.com.tw. "WiseChip History – WiseChip Semiconductor Inc". www.wisechip.com.tw. Archived from the original on 2018-02-17. Retrieved 2018-02-17.

"China"s BOE to have world"s largest TFT-LCD+AMOLED capacity in 2019". ihsmarkit.com. 2017-03-22. Archived from the original on 2019-08-16. Retrieved 2019-08-17.

[Introduction]: This paper analyzes the competitive pattern of the panel display industry from both supply and demand sides. On the supply side, the optimization of the industry competition pattern by accelerating the withdrawal of Samsung’s production capacity is deeply discussed. Demand-side focuses on tracking global sales data and industry inventory changes.

Since April 2020, the display device sector rose 4.81%, ranking 11th in the electronic subsectors, 3.39 percentage points behind the SW electronic sector, 0.65 percentage points ahead of the Shanghai and Shenzhen 300 Index. Of the top two domestic panel display companies, TCL Technology is up 11.35 percent in April and BOE is up 4.85 percent.

Specific to the panel display plate, we still do the analysis from both ends of supply and demand: supply-side: February operating rate is insufficient, especially panel display module segment grain rate is not good, limited capacity to boost the panel display price. Since March, effective progress has been made in the prevention and control of the epidemic in China. Except for some production lines in Wuhan that have been delayed, other domestic panels show that the production lines have returned to normal. In South Korea, Samsung announced recently that it would accelerate its withdrawal from all LCD production lines. This round of output withdrawal exceeded market expectations both in terms of pace and amplitude. We will make a detailed analysis of it in Chapter 2.

Demand-side: We believe that people spend more time at home under the epidemic situation, and TV, as an important facility for family entertainment, has strong demand resilience. In our preliminary report, we have interpreted the pick-up trend of domestic TV market demand in February, which also showed a good performance in March. At present, the online market in China maintains a year-on-year growth of about 30% every week, while the offline market is still weak, but its proportion has been greatly reduced. At present, people are more concerned about the impact of the epidemic overseas. According to the research of Cinda Electronics Industry Chain, in the first week, after Italy was closed down, local TV sales dropped by about 45% from the previous week. In addition, Media Markt, Europe’s largest offline consumer electronics chain, also closed in mid-March, which will affect terminal sales to some extent, and panel display prices will continue to be under pressure in April and May. However, we believe that as the epidemic is brought under control, overseas market demand is expected to return to the pace of China’s recovery.

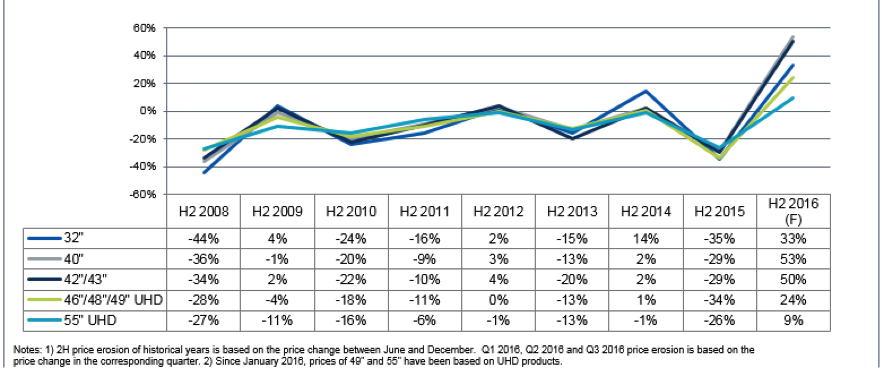

From a price perspective, the panel shows that prices have risen every month through March since the bottom of December 19 reversed. However, according to AVC’s price bulletin of TV panel display in early April, the price of TV panel display in April will decrease slightly, and the price of 32 “, 39.5 “, 43 “, 50 “and 55” panels will all decrease by 1 USD.65 “panel shows price down $2; The 75 “panel shows the price down by $3.The specific reasons have been described above, along with the domestic panel display production line stalling rate recovery, supply-side capacity release; The epidemic spread rapidly in Europe and the United States, sports events were postponed, local blockades were gradually rolled out, and the demand side declined to a certain extent.

Looking ahead to Q2, we think prices will remain under pressure in May, but prices are expected to pick up in June as Samsung’s capacity is being taken out and the outbreak is under control overseas. At the same time, from the perspective of channel inventory, the current all-channel inventory, including the inventory of all panel display factories, has fallen to a historical low. The industry as a whole has more flexibility to cope with market uncertainties. At the same time, low inventory is also the next epidemic warming panel show price foreshadowing.

In terms of valuation level, due to the low concentration and fierce competition in the panel display industry in the past ten years, the performance of sector companies is cyclical to a certain extent. Therefore, PE, PB, and other methods should be comprehensively adopted for valuation. On the other hand, the domestic panel shows that the leading companies in the past years have sustained large-scale capital investment, high depreciation, and a long period of poor profitability, leading to the inflated TTM PE in the first half of 2014 to 2017. Therefore, we will display the valuation level of the sector mainly through the PB-band analysis panel in this paper.

In 2017, due to the combined impact of panel display price rise and OLED production, the valuation of the plate continued to expand, with the highest PB reaching 2.8 times. Then, with the price falling, the panel shows that PB bottomed out at the end of January 2019 at only 1.11 times. From the end of 2019 to February, the panel shows that rising prices have driven PB all the way up, the peak PB reached 2.23 times. Since entering March, affected by the epidemic, in the short term panel prices under pressure, the valuation of the plate once again fell back to 1.62 times. In April, the epidemic situation in the epidemic country was gradually under control, and the valuation of the sector rebounded to 1.68 times.

We believe the sector is still at the bottom of the stage as Samsung accelerates its exit from LCD capacity and industry inventories remain low. Therefore, once the overseas epidemic is under control and the domestic demand picks up, the panel shows that prices will rise sharply. In addition, the plate will also benefit from Ultra HD drive in the long term. Panel display plate medium – and long-term growth logic is still clear. Coupled with the optimization of the competitive pattern, industry volatility will be greatly weakened. The current plate PB compared to the historical high has sufficient space, optimistic about the plate leading company’s investment value.

Revenue at Innolux and AU Optronics has been sluggish for several months and improved in March. Since the third quarter of 2017, Innolux’s monthly revenue growth has been negative, while AU Optronics has only experienced revenue growth in a very few months.AU Optronics recorded a record low revenue in January and increased in February and March. Innolux’s revenue returned to growth in March after falling to its lowest in recent years in February. However, because the panel display manufacturers in Taiwan have not put in new production capacity for many years, the production process of the existing production line is relatively backward, and the competitiveness is not strong.

On March 31, Samsung Display China officially sent a notice to customers, deciding to terminate the supply of all LCD products by the end of 2020.LGD had earlier announced that it would close its local LCDTV panel display production by the end of this year. In the following, we will analyze the impact of the accelerated introduction of the Korean factory on the supply pattern of the panel display industry from the perspective of the supply side.

The early market on the panel display plate is controversial, mainly worried about the exit of Korean manufacturers, such as LCD display panel price rise, or will slow down the pace of capacity exit as in 17 years. And we believe that this round of LCD panel prices and 2017 prices are essentially different, the LCD production capacity of South Korean manufacturers exit is an established strategy, will not be transferred because of price warming. Investigating the reasons, we believe that there are mainly the following three factors driving:

(1) Under the localization, scale effect, and aggregation effect, the Chinese panel leader has lower cost and stronger profitability than the Japanese and Korean manufacturers. In terms of cost structure, according to IHS data, material cost accounts for 70% of the cost displayed by the LCD panel, while depreciation accounts for 17%, so the material cost has a significant impact on it. At present, the upstream LCD, polarizer, PCB, mold, and key target material line of the mainland panel display manufacturers are fully imported into the domestic, effectively reducing the material cost. In addition, at the beginning of the factory, manufacturers not only consider the upstream glass and polarizer factory but also consider the synergy between the downstream complete machine factory, so as to reduce the labor cost, transportation cost, etc., forming a certain industrial clustering effect. The growing volume of shipments also makes the economies of scale increasingly obvious. In the long run, the profit gap between the South Korean plant and the mainland plant will become even wider.

(2) The 7 and 8 generation production lines of the Korean plant cannot adapt to the increasing demand for TV in average size. Traditionally, the 8 generation line can only cut the 32 “, 46 “, and 60” panel displays. In order to cut the other size panel displays economically and effectively, the panel display factory has made small adjustments to the 8 generation line size, so there are the 8.5, 8.6, 8.6+, and 8.7 generation lines. But from the cutting scheme, 55 inches and above the size of the panel display only part of the generation can support, and the production efficiency is low, hindering the development of large size TV. Driven by the strong demand for large-size TV, the panel display generation line is also constantly breaking through. In 2018, BOE put into operation the world’s first 10.5 generation line, the Hefei B9 plant, with a designed capacity of 120K/ month. The birth of the 10.5 generation line is epoch-making. It solves the cutting problem of large-size panel displays and lays the foundation for the outbreak of large-size TV. From the cutting method, one 10.5 generation line panel display can effectively cut 18 43 inches, 8 65 inches, 6 75 inches panel display, and can be more efficient in hybrid mode cutting, with half of the panel display 65 inches, the other half of the panel display 75 inches, the yield is also guaranteed. Currently, there are a total of five 10.5 generation lines in the world, including two for domestic panel display companies BOE and Huaxing Optoelectronics. Sharp has a 10.5 generation line in Guangzhou, which is mainly used to produce its own TV. Korean manufacturers do not have the 10.5 generation line. In the context of the increasing size of the TV, Korean manufacturers are obviously at a disadvantage in competitiveness.

(3) As the large-size OLED panel display technology has become increasingly mature, Samsung and LGD hope to transfer production to large-size OLED with better profit prospects as soon as possible. Apart from the price factor, the reason why South Korean manufacturers are exiting LCD production is more because the large-size OLED panel display technology is becoming mature, and Samsung and LGD hope to switch to large-size OLED production as soon as possible, which has better profit prospects. At present, there are three major large-scale OLED solutions including WOLED, QD OLED, and printed OLED, while there is only WOLED with a mass production line at present.

According to statistics, shipments of OLED TVs totaled 2.8 million in 2018 and increased to 3.5 million in 2019, up 25 percent year on year. But it accounted for only 1.58% of global shipments. The capacity gap has greatly limited the volume of OLED TV.LG alone consumes about 47% of the world’s OLED TV panel display capacity, thanks to its own capacity. Other manufacturers can only purchase at a high price. According to the industry chain survey, the current price of a 65-inch OLED panel is around $800-900, while the price of the same size LCD panel is currently only $171.There is a significant price difference between the two.

Samsung and LGD began to shut down LCD production lines in Q3 last year, leading to the recovery of the panel display sector. Entering 2020, the two major South Korean plants have announced further capacity withdrawal planning. In the following section, we will focus on its capacity exit plan and compare it with the original plan. It can be seen that the pace and magnitude of Samsung’s exit this round is much higher than the market expectation:

(1) LGD: LGD currently has three large LCD production lines of P7, P8, and P9 in China, with a designed capacity of 230K, 240K, and 90K respectively. At the CES exhibition at the beginning of this year, the company announced that IT would shut down all TV panel display production capacity in South Korea in 2020, mainly P7 and P8 lines, while P9 is not included in the exit plan because IT supplies IT panel display for Apple.

According to our latest industry chain survey, by the end of Q1 in 2020, P7 production capacity remains 140K; P8 has 100K of capacity left.P7 is expected to shut down by the end of the year, and P8 will shut down all TV production capacity at the end of the year, but there is still 40KIT production capacity to continue.

(2) Samsung: At present, Samsung has L8-1, L8-2, and L7-2 large-size LCD production lines in South Korea, with designed production capacities of 200K, 150K, and 160K respectively. At the same time in Suzhou has a 70K capacity of 8 generation line.

Samsung had planned to retire all L8-1 and L8-2 capacity by the end of 2021, while L7-2 would retain 50K of IT capacity. This time, it is planned to withdraw all production capacity by the end of 2020, among which the production line in South Korea will be converted to Qdoled, and the production line in Suzhou will be sold.

This round of capacity withdrawal of South Korean plants began in June 2019. Based on the global total production capacity in June 2019, Samsung will withdraw 1,386,900 square meters of production capacity in 2019-2020, equivalent to 9.69% of the global production capacity, according to the previous two-year withdrawal expectation. In 2021, 697,200 square meters of production capacity will be withdrawn, which is equivalent to 4.87% of the global production capacity, and a total of 14.56% will be withdrawn in three years. After the implementation of the new plan, Samsung will eliminate 2.422 million square meters of production capacity by the end of 2020, equivalent to 16.92 percent of the global capacity. This round of production plans from the pace and range are far beyond the market expectations.

Global shipments of TV panel displays totaled 281 million in 2019, down 1.06 percent year on year, according to Insight. In fact, TV panel display shipments have been stable since 2015 at between 250 and 300 million units. At the same time, from the perspective of the structure of sales volume, the period from 2005 to 2010 was the period when the size of China’s TV market grew substantially. Third-world sales also leveled off in 2014. We believe that the sales volume of the TV market has stabilized and there is no big fluctuation. The impact of the epidemic on the overall demand may be more optimistic than the market expectation.

In contrast to the change in volume, we believe that the core driver of the growth in TV panel display demand is actually the increase in TV size. According to the data statistics of Group Intelligence Consulting, the average size of TV panel display in 2014 was 0.47 square meters, equivalent to the size of 41 inches screen. In 2019, the average TV panel size is 0.58 square meters, which is about the size of a 46-inch screen. From 2014 to 2019, the average CAGR of TV panel display size is 4.18%. Meanwhile, the shipment of TV in 2019 also increased compared with that in 2014. Therefore, from 2014 to 2019, the compound growth rate of the total area demand for TV panel displays is 6.37%.

It is assumed that 4K screen and 8K screen will accelerate the penetration and gradually become mainstream products in the next 2-3 years. The pace of screen size increase will accelerate. We have learned through industry chain research that the average size growth rate of TV will increase to 6-8% in 2020. Driven by the growth of the average size, the demand area of global TV panel displays is expected to grow even if TV sales decline, and the upward trend of industry demand remains unchanged.

Meanwhile, the global LCDTV panel display demand will increase significantly in 2021, driven by the recovery of terminal demand and the continued growth of the average TV size. In 2021, the whole year panel display will be in a short supply situation, the mainland panel shows that both males will enjoy the price elasticity.

This paper analyzes the competition pattern of the panel display industry from both supply and demand sides. On the supply side, the optimization of the industry competition pattern by accelerating the withdrawal of Samsung’s production capacity is deeply discussed. Demand-side focuses on tracking global sales data and industry inventory changes. Overall, we believe that the current epidemic has a certain impact on demand, and the panel shows that prices may be under short-term pressure in April or May. But as Samsung’s exit from LCD capacity accelerates, industry inventories remain low. So once the overseas epidemic is contained and domestic demand picks up, the panel suggests prices will surge. We are firmly optimistic about the A-share panel display plate investment value, maintain the industry “optimistic” rating. Suggested attention: BOE A, TCL Technology.

TOKYO, Dec 12 (Reuters) - Sharp Corpsaid on Friday it would close two LCD output lines making small and mid-sized panels in Japan, and move production to a newer and more cost-efficient plant as the global downturn hits demand for electronic goods.

Sharp plans to cut about 380 temporary workers due to the shift in production, but said it was unclear at the moment how much costs will be reduced through the planned move.

This is the latest in a series of restructuring steps in the electronics sector as companies try to adjust production and boost efficiency in the face of slowing demand and falling prices.

Sharp said the LCD lines set to be closed in January were built more than 10 years ago, while its Kameyama No.1 plant, which will shift from production of TV panels to output of smaller displays, is one of Sharp’s flagship factories.

The world’s third-largest LCD TV maker said it is on track to bring onstream its advanced LCD panel factory in the western Japan city of Sakai by March 2010.

(Reuters) - Foxconn Technology Group is reconsidering plans to make advanced liquid crystal display panels at a $10 billion Wisconsin campus, and said it intends to hire mostly engineers and researchers rather than the manufacturing workforce the project originally promised.

Foxconn, which received controversial state and local incentives for the project, initially planned to manufacture advanced large screen displays for TVs and other consumer and professional products at the facility, which is under construction. It later said it would build smaller LCD screens instead.

Rather than a focus on LCD manufacturing, Foxconn wants to create a “technology hub” in Wisconsin that would largely consist of research facilities along with packaging and assembly operations, Woo said. It would also produce specialized tech products for industrial, healthcare, and professional applications, he added.

Rather than manufacturing LCD panels in the United States, Woo said it would be more profitable to make them in greater China and Japan, ship them to Mexico for final assembly, and import the finished product to the United States.

He said that would represent a supply chain that fits with Foxconn’s current “fluid, good business model.”FILE PHOTO: A shovel and FoxConn logo are seen before the arrival of U.S. President Donald Trump as he participates in the Foxconn Technology Group groundbreaking ceremony for its LCD manufacturing campus, in Mount Pleasant, Wisconsin, U.S., June 28, 2018. REUTERS/Darren Hauck

Currently, to qualify for the tax credits Foxconn must meet certain hiring and capital investment goals. It fell short of the employment goal in 2018 - hiring 178 full-time jobs rather than the 260 targeted - failing to earn a tax credit of up to $9.5 million.

The nation has invested 800 billion yuan ($120.6 billion) in flat-panel display production lines, with investment in liquid crystal display (LCD) panel production exceeding 500 billion yuan, according to the China Video Industry Association and China Optics and Optoelectronics Manufacturers Association.

Statistics also showed that revenue from the country"s display industry topped 200 billion yuan last year, and shipments of display panels reached around 57 million square meters in the first half of 2017, accounting for one-third of global shipments, second only to South Korea.

"With production lines reaching mass output in the fourth quarter, the shipment of display panels will continue to grow," said Yi Xianjing, deputy research director of display device and system department at consultancy All View Cloud in Beijing.

"We are confident that Chinese display manufacturers will break the monopoly of South Korean companies in the area of flexible display panels for smartphones this year."

An earlier report from research and analytics firm IHS Markit said China will dominate flat panel display manufacturing by 2018, taking up 35 percent of the global market.

In a move to break South Korea"s stranglehold in AMOLED, or active matrix/organic light-emitting diode technology, which is used in high-end smartphone screens, such as the iPhone X and Samsung"s Note 8 series, Chinese panel manufacturers are pressing ahead with ambitious expansion plans, investing heavily in new flexible display panels.

BOE Technology Group Co Ltd, the country"s biggest display producer, is muscling into the market. The company invested 46.5 billion yuan in a sixth generation AMOLED production line, which was rolled out in May, at its Chengdu factory. It can turn out 48,000 glass substrate panels per month.

Shenzhen China Star Optoelectronics Technology Co Ltd, another Chinese display panel manufacturer, started construction of a sixth-generation LTPS-AMOLED display panel production line in June in Wuhan, Hubei province.

Chen Lijuan, an analyst at Sigmaintell, said panel manufacturers should not just invest in production lines, but also pay more attention to the establishment of a whole industry chain, including raw materials, equipment and technology.

To support the growing demand for new F-16 Fighting Falcon from partner nations, the U.S. Air Force has teamed with Lockheed Martin Corp. to open a new production line to build the F-16 Block 70/72 fighter aircraft at the company’s facility in Greenville, South Carolina.

Launched on Veterans Day 2019, the line is the only production facility for F-16s in the world, opening three years after the company’s long-time F-16 line in Fort Worth, Texas, wrapped up production.

“This new production line is very significant,” said Col. Brian Pearson, integrated product team lead for F-16 foreign military sales, with the Air Force Life Cycle Management Center’s Fighters and Advanced Aircraft Directorate, which is leading the effort to build and deliver the new F-16s. “There are 25 nations operating F-16s today, and they have a lot of expertise with the airframe. The line helps us meet the global demand that a number of nations have for [F-16] aircraft and gives us the additional capability to provide the aircraft to countries interested in purchasing it for the first time.”

The first F-16s are expected to roll off the production line in 2022, and production is expected to increase after the first year. The aircraft will be delivered to multiple foreign military partners, including Bahrain, Slovakia, Bulgaria, Taiwan, and others, many of whom have expressed interest beyond the first deliveries.

“Since the LM production line opened, AFSAC [AFLCMC’s Air Force Security Assistance and Cooperation Directorate] has seen an uptick of our partner nations requesting detailed information and requests for U.S. government sales,” said Col. Anthony Walker, International Division senior materiel leader. “We are excited about the new workload and increased opportunity to deliver airpower capabilities that strengthen international partnerships and advance national security.”

In addition to leading efforts to field new F-16s, the Fighters and Advanced Aircraft Directorate is also modernizing 405 F-16s – operated by four partner nations – with the V-Configuration, which consists of new radar and other upgrades to make them similar to the aircraft that will come off the production line.

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey