lcd panel price trend 2020 factory

The current oversupply of liquid crystal display (LCD) panels is expected to continue through 2023, analyst firm TrendForce said in its latest forecast.

LCD panel prices had increased from June 2020 through the first half of 2021, the firm said, spurned by high demand for consumer electronics from Covid-19.

In supply, while LG Display could halt production at its P7 factory in Paju during the first quarter of next year, CSOT’s start of operation of its Gen 8.6 T9 factory could increase panel supply further than the current state, TrendForce said.

The analyst firm also said that LCD factories that use Gen 5 substrate or above could see their operation rate drop to 60% during the fourth quarter, which will be the lowest in ten years.

Prices for all TV panel sizes fluctuated and are forecast to fluctuate between 2020 and 2022. The period from March 2020 to July 2021 saw the biggest price increases, when a 65" UHD panel cost between 171 and 288 U.S. dollars. In the fourth quarter of 2021, such prices fell and are expected to drop to an even lower amount by March 2022.Read moreLCD TV panel prices worldwide from January 2020 to March 2022, by size(in U.S. dollars)Characteristic32" HD43" FHD49"/50" UHD55" UHD65" UHD------

DSCC. (January 10, 2022). LCD TV panel prices worldwide from January 2020 to March 2022, by size (in U.S. dollars) [Graph]. In Statista. Retrieved December 15, 2022, from https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/

DSCC. "LCD TV panel prices worldwide from January 2020 to March 2022, by size (in U.S. dollars)." Chart. January 10, 2022. Statista. Accessed December 15, 2022. https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/

DSCC. (2022). LCD TV panel prices worldwide from January 2020 to March 2022, by size (in U.S. dollars). Statista. Statista Inc.. Accessed: December 15, 2022. https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/

DSCC. "Lcd Tv Panel Prices Worldwide from January 2020 to March 2022, by Size (in U.S. Dollars)." Statista, Statista Inc., 10 Jan 2022, https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/

DSCC, LCD TV panel prices worldwide from January 2020 to March 2022, by size (in U.S. dollars) Statista, https://www.statista.com/statistics/1288400/lcd-tv-panel-price-by-size/ (last visited December 15, 2022)

LCD panel prices have risen for 4 months in a row because of your home gaming? Since this year, the whole LCD panel market has smoked. Whether after the outbreak of the epidemic, LCD panel market prices rose for four months, or the panel giants in Japan and South Korea successively sold production lines, or the Chinese mainland listed companies frequently integrated acquisition, investment, and plant construction, all make the industry full of interesting.

LCD panel prices are already a fact. Since May this year, LCD panel prices have risen for four months in a row, making the whole industry chain dynamic. Why are LCD panels going up in price in a volatile 2020? The key factor lies in the imbalance between supply and demand.

For larger sizes, overseas stocks remained strong, with prices for 65 inches and 75 inches rising $10 on average to $200 and $305 respectively in September.

The price of LCDS for large-size TVs of 70 inches or more hasn’t budged much. In addition, LTPS screens and AMOLED screens used in high-end phones have seen little or no increase in price.

As for October, LCD panel price increases are expected to moderate. The data shows that in October 32 inches or 2 dollars; Gains of 39.5 to 43 inches will shrink to $3;55 inches will fall back below $10; The 65-inch gain will narrow to $5.

During the epidemic, people stayed at home and had no way to go out for entertainment. They relied on TV sets, PCS, and game consoles for entertainment. After the resumption of economic work and production, the market of traditional home appliances picked up rapidly, and LCD production capacity was quickly digested.

However, due to the shutdown of most factories lasting 1-2 months during the epidemic period, LCD panel production capacity was limited, leading to insufficient production capacity in the face of the market outbreak, which eventually led to the market shortage and price increase for 4 consecutive months.

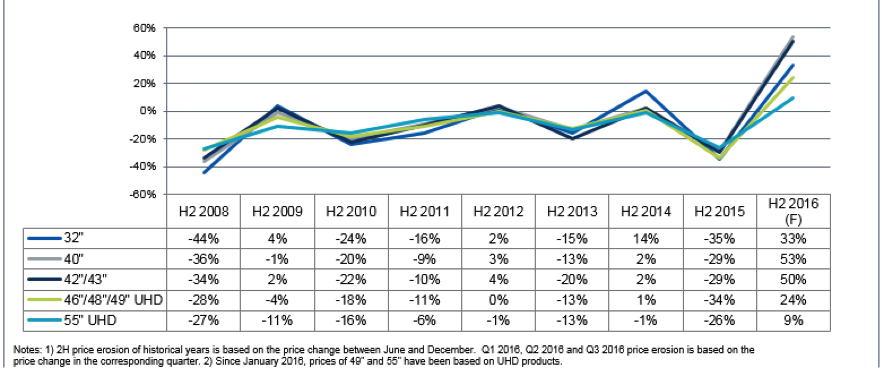

In fact, the last round of price rise of LCD panels was from 2016 to 2017, and its overall market price has continued to fall since 2018. Even in 2019, individual types have fallen below the material cost, and the whole industry has experienced a general operating loss. As a result, LCD makers have been looking for ways to improve margins since last year.

A return to a reasonable price range is the most talked about topic among panel makers in 2019, according to one practitioner. Some manufacturers for the serious loss of the product made the decision to reduce production or even stop production; Some manufacturers planned to raise the price, but due to the epidemic in 2020, the downstream demand was temporarily suppressed and the price increase was postponed. After the outbreak was contained in April, LCD prices began to rise in mid-to-late May.

This kind of price correction is in line with the law of industrial development. Only with reasonable profit space can the whole industry be stimulated to move forward.

In fact, the market price of LCD panels continued to decline in 2018-2019 because of the accelerated rise of China’s LCD industry and the influx of a large number of local manufacturers, which doubled the global LCD panel production capacity within a few years, but there was no suitable application market to absorb it. The result of excess capacity is oversupply, ultimately making LCD panel prices remain depressed.

Against this background, combined with the impact of the epidemic in 2020, the operating burden of LCD companies in Japan and South Korea has been further aggravated, and it is difficult to make profits in the production of LCD panels, so they have to announce the withdrawal of LCD business.

business in June 2022. In August, Sharp bought JDI Baishan, a plant in Ishikawa prefecture that makes liquid crystal display panels for smartphones. In early September, Samsung Display sold a majority stake in its SUZHOU LCD production plant to Starlight Electronics Technology, a unit of TCL Technology Group. LGD has not only pulled out of some of its production capacity but has announced that it will close its local production line in 2020. According to DSCC, a consultancy, the share of LCD production capacity in South Korea alone will fall from 19% to 7% between 2020 and 2021.

It is worth mentioning that in industry analysis, in view of the fact that Korean companies are good at using “dig through old bonus – selling high price – the development of new technology” the cycle of development mode, another 2020 out of the LCD production capacity, the main reason may be: taking the advantage of China’s expanding aggressively LCD manufacturers, Korean companies will own LCD panel production line hot sell, eliminating capacity liquid to extract its final value, and turning to the more profitable advantage of a new generation of display technologies, such as thinner, color display better OLED, etc. Samsung, for example, has captured more than 80% of the OLED market with its first-mover advantage.

From the perspective of production capacity, the launch of LCD tracks by major manufacturers in Japan and South Korea must reduce some production capacity in the short term, which to some extent induces market price fluctuations. In the long run, some of the Japanese and Korean LCD production capacity has been bought by Chinese manufacturers, coupled with frequent investment in recent years, the overall capacity is sure to recover as before, or even more than before. But now it will take time to expand the production layout, which more or less will cause supply imbalance, the industry needs to be cautious.

The LCD panel industry started in the United States and then gradually moved to Japan, South Korea, China, and Taiwan. At present, the proportion of production capacity in The Chinese mainland has reached 52% in 2020, and there are leading LCD panel products in China represented by BOE, Huxing Optoelectronics. Meanwhile, the production capacity layout of BOE, Huike, Huxing Optoelectronics, and other manufacturers has been basically completed, making industrial integration a necessity.

On the one hand, South Korean enterprises out of the LCD track, the domestic factory horse enclosure, plant expansion action. While LCDs may not sell as well as “upstart” flexible screens, respondents believe they are still strong enough in the traditional home appliance market to warrant continued investment. Zhao Bin, general manager of TCL Huaxing Development Center, has said publicly that the next-generation display technology will be mature in four to five years, but the commercialization of products may not take place until a decade later. “LCD will still be the mainstream in this decade,” he said.

On the other hand, there is no risk of neck jam in China’s LCD panel industry, which is generally controllable. In mainland China, there will be 21 production lines capable of producing 32-inch or larger LCD panels by 2021, accounting for about two-thirds of the global total. In terms of the proportion of production capacity, the Chinese mainland accounted for 42% of the global LCD panel in 2019, 51% this year, and will continue to climb to 63% next year.

Of course, building factories and expanding production cannot be accomplished overnight. In the process of production capacity recovery, it is predicted that there will be several price fluctuations, and the cost may be passed on to the downstream LCD panel manufacturers or consumers when the price rises greatly, which requires continuous attention.

LCD TV panel prices have stopped falling after sliding below suppliers" cash-cost levels, according to industry sources. Additionally, aggressive production cuts by panel makers also have helped bring a stop to falling prices.

According to Pan Tai-chi, general manager of the TV Business Center of Innolux, TV panel inventories at most TV vendors and channel operators have bottomed out, and correspondent TV panel prices have risen since the second half of October.

Sales dynamics for TVs and monitors with high CP (cost-performance) ratios have started gaining momentum recently as current panel prices have made high CP display products more affordable, Pan said.

It was the supply side that drove the recent price hikes instead of being pushed up by increasing demand, Pan noted, noting that the price increases will sustain for a more extended period only when demand is solid enough to soak up the output.

It is worth observing whether the sales of consumer electronics products during the forthcoming year-end shopping season in China, the US and Europe are robust enough to stir up panel demand in the first quarter of 2023, Pan commented.

Large LCD panel prices have been continuously increasing for last 10 months due to an increase in demand and tight supply. This has helped the LCD industry to recover from drastic panel price reductions, revenue and profit loss in 2019. It has also contributed to the growth of Quantum Dot and MiniLED LCD TV.

Strong LCD TV panel demand is expected to continue in 2021, but component shortages, supply constraints and very high panel price increase can still create uncertainties.

LCD TV panel capacity increased substantially in 2019 due to the expansion in the number of Gen 10.5 fabs. After growth in 2018, LCD TV demand weakened in 2019 caused by slower economic growth, trade war and tariff rate increases. Capacity expansion and higher production combined with weaker demand resulted in considerable oversupply of LCD TV panels in 2019 leading to drastic panel price reductions. Some panel prices went below cash cost, forcing suppliers to cut production and delay expansion plans to reduce losses.

Panel over-supply also brought down panel prices to way lower level than what was possible through cost improvement. Massive 10.5 Gen capacity that can produce 8-up 65" and 6-up 75" panels from a single mother glass substrate helped to reduce larger size LCD TV panel costs. Also extremely low panel price in 2019 helped TV brands to offer larger size LCD TV (>60-inch size) with better specs and technology (Quantum Dot & MiniLED) at more competitive prices, driving higher shipments and adoption rates in 2019 and 2020.

While WOLED TV had higher shipment share in 2018, Quantum Dot and MiniLED based LCD TV gained higher unit shares both in 2019 and 2020 according to Omdia published data. This trend is expected to continue in 2021 and in the next few years with more proliferation of Quantum Dot and MiniLED TVs.

Panel suppliers’ financial results suffered in 2019 as they lost money. Suppliers from China, Korea and Taiwan all lowered their utilization rates in the second half of 2019 to reduce over-supply. Very low prices combined with lower utilization rates made the revenue and profitability situation for panel suppliers difficult in 2019. BOE and China Star cut the utilization rates of their Gen 10.5 fabs. Sharp delayed the start of production at its 10.5 Gen fab in China. LGD and Samsung display decided to shift away from LCD more towards OLED and QDOLED respectively. Both companies cut utilization rates in their 7, 7.5 and 8.5 Gen fabs. Taiwanese suppliers also cut their 8.5 Gen fab utilization rates.

Some suppliers also shifted capacity away from TV to other applications. In summary, drastic price reduction resulted in a cut in utilization rates, delays in fab construction and ramp-ups and the closing down of older fabs, or conversion to OLED or QDOLED fabs. This helped to reduce oversupply.

An increase in demand for larger size TVs in the second half of 2020 combined with component shortages has pushed the market to supply constraint and caused continuous panel price increases from June 2020 to March 2021. Market demand for tablets, notebooks, monitors and TVs increased in 2020 especially in the second half of the year due to the impact of "stay at home" regulations, when work from home, education from home and more focus on home entertainment pushed the demand to higher level.

With stay at home continuing in the firts half of 2021 and expected UEFA Europe football tournaments and the Olympic in Japan (July 23), TV brands are expecting stronger demand in 2021. The panel price increase resulting in higher costs for TV brands. It has also made it difficult for lower priced brands (Tier2/3) to acquire enough panels to offer lower priced TVs. Further, panel suppliers are giving priority to top brands with larger orders during supply constraint. In recent quarters, the top five TV brands including Samsung, LG, and TCL have been gaining higher market share.

From June 2020 to January 2021, the 32" TV panel price has increased more than 100%, whereas 55" TV panel prices have increased more than 75% and the 65" TV panel price has increased more than 38% on average according to DSCC data. Panel prices continued to increase through Q1 and the trend is expected to continue in Q2 2021 due to component shortages.

In last few months top glass suppliers Corning, NEG and AGC have all experienced production problems. A tank failure at Corning, a power outage at NEG and an accident at an AGC glass plant all resulted in glass supply constraints when demand and production has been increasing. In March this year Corning announced its plan to increase glass prices in Q2 2021. Corning has also increased supply by starting glass tank in Korea to supply China’s 10.5 Gen fabs that are ramping up. Most of the growth in capacity is coming from Gen 8.6 and Gen 10.5 fabs in China.

Major increases in panel prices from June 2020, have increased costs and reduced profits for TV brand manufacturers. TV brands are starting to increase TV set prices slowly in certain segments. Notebook brands are also planning to raise prices for new products to reflect increasing costs. Monitor prices are starting to increase in some segments. Despite this, buyers are still unable to fullfill orders due to supply issues.

TV panel prices increased in Q4 2020 and are also expected to increase in the first half of 2021. This can create challenges for brand manufacturers as it reduces their ability to offer more attractive prices in coming months to drive demand. Still, set-price increases up to March have been very mild and only in certain segments. Some brands are still offering price incentives to consumers in spite of the cost increases. For example, in the US market retailers cut prices of big screen LCD and OLED TV to entice basketball fans in March.

Higher LCD price and tight supply helped LCD suppliers to improve their financial performance in the second half of 2020. This caused a number of LCD suppliers especially in China to decide to expand production and increase their investment in 2021.

New opportunities for MiniLED based products that reduce the performance gap with OLED, enabling higher specs and higher prices are also driving higher investment in LCD production. Suppliers from China already have achieved a majority share of TFT-LCD capacity.

BOE has acquired Gen 8.5/8.6 fabs from CEC Panda. ChinaStar has acquired a Gen 8.5 fab in Suzhou from Samsung Display. Recent panel price increases have also resulted in Samsung and LGD delaying their plans to shut down LCD production. These developments can all help to improve supply in the second half of 2021. Fab utilization rates in Taiwan and China stayed high in the second half of 2020 and are expected to stay high in the first half of 2021.

Price increases for TV sets are still not widespread yet and increases do not reflect the full cost increase. However, if set prices continue to increase to even higher levels, there is the potential for an impact on demand.

QLED and MiniLED gained share in the premium TV market in 2019, impacting OLED shares and aided by low panel prices. With the LCD panel price increases in 2020 the cost gap between OLED TV and LCD has gone down in recent quarters.

OLED TV also gained higher market share in the premium TV market especially sets from LG and Sony in the last quarter of 2020, according to industry data. LG Display is implimenting major capacity expansion of its OLED TV panels with its Gen 8.5 fab in China.Strong sales in Q4 2020 and new product sizes such as 48-inch and 88-inch have helped LG Display’s OLED TV fabs to have higher utilization rates.

Samsung is also planning to start production of QDOLED in 2021. Higher production and cost reductions for OLED TV may help OLED to gain shares in the premium TV market if the price gap continues to reduce with LCD.

Lower tier brands are not able to offer aggressive prices due to the supply constraint and panel price increases. If these conditions continue for too long, TV demand could be impacted.

Strong LCD TV demand especially for Quantum Dot and MiniLED TV is expected to continue in 2021. The economic recovery and sports events (UEFA Europe footbal and the Olympics in Japan) are expected to drive demand for TV, but component shortages, supply constraints and too big a price increase could create uncertainties. Panel suppliers have to navigate a delicate balance of capacity management and panel prices to capture the opportunity for higher TV demand. (SD)

It may seem odd in the face of stalled economies and stalled AV projects, but the costs of LCD display products are on the rise, according to a report from Digital Supply Chain Consulting, or DSCC.

Demand for LCD products remains strong , says DSCC, at the same time as shortages are deepening for glass substrates and driver integrated circuits. Announcements by the Korean panel makers that they will maintain production of LCDs and delay their planned shutdown of LCD lines has not prevented prices from continuing to rise.

I assume, but absolutely don’t know for sure, that panel pricing that affects the much larger consumer market must have a similar impact on commercial displays, or what researchers seem to term public information displays.

Panel prices increased more than 20% for selected TV sizes in Q3 2020 compared to Q2, and by 27% in Q4 2020 compared to Q3, we now expect that average LCD TV panel prices in Q1 2021 will increase by another 12%.

The first chart shows our latest TV panel price update, with prices increasing across the board from a low in May 2020 to an expected peak in May/June of this year. Last month’s update predicted a peak in February/March. However, our forecast for the peak has been increased and pushed out after AGC reported a major accident at a glass plant in Korea and amid continuing problems with driver IC shortages.

The inflection point for this cycle, the month of the most significant M/M price increases, was passed in September 2020, and the price increases have been slowing down each month since then, but the January increase averaged 4.1%. Prices in February 2021 have reached levels last seen exactly three years ago in February 2018.

Prices increased in Q4 for all sizes of TV panels, with massive percentage increases in sizes from 32” to 55” ranging from 28% to 38%. Prices for 65” and 75” increased at a slower rate, by 19% and 8% respectively, as capacity has continued to increase on those sizes with Gen 10.5 expansions.

Prices for every size of TV panel will increase in Q1 at a slower rate, ranging from 5% for 75” to 16% for 43”, and we now expect that prices will continue to increase in Q2, with the increases ranging from 3% to 6% on a Q/Q basis. We now expect that prices will peak in Q2 and will start to decline in Q3, but the situation remains fluid.

All that said, LCD panels are way less costly, way lighter and slimmer, and generally look way better than the ones being used 10 years ago, so prices is a relative problem.

The best thing that can be said about LCD TV panel prices in October is that the pattern is not worse than September, which remains the month with the largest single-month decline in panel prices in the history of the industry. The average decline in October among the seven TV sizes we track was “only” 15.5%, almost but not quite matching the 15.8% decline in September. LCD TV panel prices have now lost more than half the gains that they achieved in the long up-cycle from May 2020 to June 2021.

LCD TV Panel Market is 2022 Research Report on Global professional and comprehensive report on the LCD TV Panel Market. The report monitors the key trends and market drivers in the current scenario and offers on the ground insights. Top Key Players are – Samsung Display, LG Display, Innolux Crop., AUO, CSOT, BOE, Sharp, Panasonic, CEC-Panda.

Global “LCD TV Panel Market” (2022-2028) the report additionally centers around worldwide significant makers of the LCD TV Panel market with important data, such as, company profiles, segmentation information, challenges and limitations, driving factors, value, cost, income and contact data. Upstream primitive materials and hardware, coupled with downstream request examination is likewise completed. The Global LCD TV Panel market improvement patterns and marketing channels are breaking down. In conclusion, the attainability of new speculation ventures is surveyed and in general, the research ends advertised.

Global LCD TV Panel Market Report 2022 is spread across 117 pages and provides exclusive vital statistics, data, information, trends and competitive landscape details in this niche sector.

The information for each competitor includes – Company Profile, Main Business Information, SWOT Analysis, Sales, Revenue, Price and Gross Margin, Market Share.

LCD displays utilize two sheets of polarizing material with a liquid crystal solution between them. An electric current passed through the liquid causes the crystals to align so that light cannot pass through them. Each crystal, therefore, is like a shutter, either allowing light to pass through or blocking the light. LCD panel is the key components of LCD display. And the price trends of LCD panel directly affect the price of liquid crystal displays. LCD panel consists of several components: Glass substrate, drive electronics, polarizers, color filters etc. Only LCD panel applied for TV will be counted in this report.

Due to the COVID-19 pandemic, the global LCD TV Panel market size is estimated to be worth USD 53490 million in 2021 and is forecast to a readjusted size of USD 53490 million by 2028 with a CAGR of 2.2% during the review period. Fully considering the economic change by this health crisis, by Size accounting for (%) of the LCD TV Panel global market in 2021, is projected to value USD million by 2028, growing at a revised (%) CAGR in the post-COVID-19 period. While by Size segment is altered to an (%) CAGR throughout this forecast period.

Global LCD TV Panel key players include Samsung Display, LG Display, Innolux Crop, AUO, CSOT, etc. Global top five manufacturers hold a share over 80%.

The global LCD TV Panel market is segmented by company, region (country), by Size and by Application. Players, stakeholders, and other participants in the global LCD TV Panel market will be able to gain the upper hand as they use the report as a powerful resource. The segmental analysis focuses on sales, revenue and forecast by region (country), by Size and by Application for the period 2017-2028.

Global LCD TV Panel market analysis and market size information is provided by regions (countries). Segment by Application, the LCD TV Panel market is segmented into United States, Europe, China, Japan, Southeast Asia, India and Rest of World. The report includes region-wise LCD TV Panel market forecast period from history 2017-2028. It also includes market size and forecast by players, by Type, and by Application segment in terms of sales and revenue for the period 2017-2028.

The report introduced the LCD TV Panel basics: definitions, classifications, applications and market overview; product specifications; manufacturing processes; cost structures, raw materials and so on. Then it analyzed the world’s main region market conditions, including the product price, profit, capacity, production, supply, demand and market growth rate and forecast etc. In the end, the report introduced new project SWOT analysis, investment feasibility analysis, and investment return analysis.

LCD TV Panel market size competitive landscape provides details and data information by players. The report offers comprehensive analysis and accurate statistics on revenue by the player for the period 2017-2021. It also offers detailed analysis supported by reliable statistics on revenue (global and regional level) by players for the period 2017-2021. Details included are company description, major business, company total revenue and the sales, revenue generated in LCD TV Panel business, the date to enter into the LCD TV Panel market, LCD TV Panel product introduction, recent developments, etc.

The report offers detailed coverage of LCD TV Panel industry and main market trends with impact of coronavirus. The market research includes historical and forecast market data, demand, application details, price trends, and company shares of the leading LCD TV Panel by geography. The report splits the market size, by volume and value, on the basis of application type and geography. Report covers the present status and the future prospects of the global LCD TV Panel market for 2017-2028.

Global LCD TV Panel Market report forecast to 2028 is a professional and comprehensive research report on the world’s major regional market conditions, focusing on the main regions (North America, Europe and Asia-Pacific) and the main countries (United States, Germany, United Kingdom, Japan, South Korea and China).

The recent COVID-19 outbreak first began in Wuhan (China) in December 2019, and since then, it has spread around the globe at a fast pace. China, Italy, Iran, Spain, the Republic of Korea, France, Germany, and the US are among the worst-affected countries in terms of positive cases and reported deaths, as of March 2020. The COVID-19 outbreak has affected economies and industries in various countries due to lockdowns, travel bans, and business shutdowns. The global food and beverage industry is one of the major industries facing serious disruptions such as supply chain breaks, technology events cancellations, and office shutdowns as a result of this outbreak. China is the global manufacturing hub, with the presence of and the largest raw material suppliers. The overall market breaks down due to COVID-19 is also affecting the growth of thebaconmarket due to shutting down of factories, obstacle in supply chain, and downturn in world economy.

To Know How COVID-19 Pandemic Will Impact LCD TV Panel Market/Industry- Request a sample copy of the report-https://www.researchreportsworld.com/enquiry/request-covid19/21019731

The report offers exhaustive assessment of different region-wise and country-wise LCD TV Panel market such as U.S., Canada, Germany, France, U.K., Italy, Russia, China, Japan, South Korea, India, Australia, Taiwan, Indonesia, Thailand, Malaysia, Philippines, Vietnam, Mexico, Brazil, Turkey, Saudi Arabia, U.A.E, etc. Key regions covered in the report are North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa.

For the period 2017-2028, the report provides country-wise revenue and volume sales analysis and region-wise revenue and volume analysis of the global LCD TV Panel market. For the period 2017-2021, it provides sales (consumption) analysis and forecast of different regional markets by Application as well as by Type in terms of volume.

What are the market opportunities and threats faced by the vendors in the global LCD TV Panel market? What industrial trends, drivers, and challenges are manipulating its growth?

With tables and figures helping analyze worldwide Global LCD TV Panel market trends, this research provides key statistics on the state of the industry and is a valuable source of guidance and direction for companies and individuals interested in the market.

Large LCD panel prices have been continuously increasing for last 10 months due to an increase in demand and tight supply. This has helped the LCD industry to recover from drastic panel price reductions, revenue and profit loss in 2019. It has also contributed to the growth of QD and miniLED LCD TV. Strong LCD TV panel demand is expected to continue in 2021, but component shortages, supply constraints, and very high panel price increase can still create uncertainties.

It was earlier anticipated that price increases would decelerate in 2Q, but now the price increase is accelerating compared to 1Q, according to a research by DSCC. Panel prices increased by 27 percent in 4Q20 compared to 3Q and slowed down to 14.5 percent in 1Q21 compared to 4Q, but the current estimate is that average LCD TV panel prices in 2Q21 will increase by another 17 percent. The prices are expected to peak sometime in 3Q21.

There has been a surge in prices across the board from a low in May 2020 to a high point in June 2021 which does not represent the peak. There have been multiple inflection points for this cycle: the first inflection point, the month of the biggest MoM price increases, was passed in September 2020, and the price increase slowed down, then started to accelerate again in January 2021, and there is another slowdown starting in May 2021. Prices in May 2021 have reached levels last seen in July 2017.

Prices increased in 1Q21 for all sizes of TV panels, with double-digit percentage increases in sizes from 32- to 65-inch ranging from 12-18 percent. Prices for 75-inch increased by 8 percent as capacity has continued to increase on Gen 10.5 lines, where 75-inch is an efficient six-cut. Prices for every size of TV panel will continue to increase in 2Q at an even faster rate, ranging from 12 percent for 75-inch to 24 percent for 32-inch. The prices are expected to continue to increase in 3Q.

The current upturn in the crystal cycle has seen the biggest trough-to-peak price increases for LCD TV panels, and the recent acceleration of prices has further extended this record. Comparing the forecast for June 2021 panel prices with the prices in May 2020, there is a trough-to-peak increases from 34 percent for 75-inch to 181 percent for 32-inch, with an average of 111 percent. In comparison, the average trough-to-peak increase of the 2016 to 2017 cycle was 48 percent, and prior cycles saw smaller increases.

Before the current upswing, the largest panels sold with an area premium, but the current cycle has flipped that upside down. Whereas in May 2020, 75-inch panels sold at an area premium of USD 77 per square meter higher than the 32-inch panel price, as of May 2021, they are selling at a USD 65 discount on an area basis. This means that those Gen 10.5 fabs could earn higher revenues from making 32-inch panels than from 75-inch panels. The pattern for 65-inch is even more severe, and 65-inch is now selling at a USD 69 per square meter discount (alternately, a 22% area discount) compared to 32-inch.

The improved pricing for LCD TV panels has already improved the profitability of panel makers. It will continue to drive their profits even higher, especially the two prominent Taiwanese players, who have Gen 7.5 and Gen 8.5 fabs but no Gen 10.5 fabs. Chinese panel makers HKC and CHOT have a similar industrial profile and stand to benefit greatly as well. The leading companies with Gen 10.5 fabs (BOE, CSOT and Foxconn/Sharp) stand to benefit less because the price increases on the largest sizes are more modest, but every LCD panel maker is doing well.

TV price index has increased from its all-time low of 42 in May 2020 to 87 in May 2021, and it is expected to reach 89 in June and over 90 in 3Q21 before declining in 4Q. The YoY increase has surpassed 100 percent in May 2021. It will remain at elevated levels throughout the second half of 2021.

In addition to being an exceptionally large upcycle, the current upswing matches some of the longest stretches of increasing prices ever seen, more than a full year from trough to peak. The length of the upswing can be attributed to several factors: glass and driver IC shortages, the pandemic-driven demand or the potential for Korean fab downsizing.

TV makers continued to make strong profits in 1Q21 despite increasing panel prices. The TV market typically slows down in 1Q and 2Q. TV maker revenues declined seasonally in 1Q but less than usual, and the operating margins for both Samsung and LGE increased sequentially. Samsung’s CE division operating profits exceeded USD 1 billion for the quarter for only the second time ever. With demand remaining strong, TV makers have weathered the increase in panel prices and remained very profitable.

There is a surge in LCD equipment spending to respond to dramatically improved market conditions in the LCD market. DSCC sees LCD revenues rising 32 percent in 2021 to USD 112 billion on strong unit and area growth with prices and profitability rebounding to or even exceeding the 2017 levels. With LCD suppliers able to sell everything they can make at attractive margins; it should be no surprise that most LCD manufacturers are looking to expand capacity.

However, unlike previous upturns when many new fabs were built, in this upturn panel suppliers are looking to stretch their capacity through smaller investments, simplifying their processes and debottlenecking. Having said that, there will be two new Gen 8.6 mega fabs being built. The result versus last quarter is a 10 percent or a USD 2.2 billion increase in 2020-2024 LCD spending from USD 21.8 billion to USD 24 billion. The 2021 LCD equipment spending forecast is up 15 percent versus last quarter’s forecast to USD 10 billion, with 2021 LCD equipment spending up 125 percent versus 2021. In addition, 2022 was upgraded by 28 percent to USD 3.5 billion.

Although there is a healthy upgrade in LCD equipment spending in 2021 and 2022, the outlook for 2022-2024 spending is still significantly lower than in previous years, resulting in tighter capacity and slower price reductions in the next downturn. In addition, with Korean LCD suppliers expected to reduce their LCD capacity and convert to potentially higher margin OLEDs, the outlook for LCD pricing and profitability looks quite healthy, which may result in even more equipment spending, especially as miniLEDs gain acceptance.

An unfortunate and untimely string of accidents has created a historic tight glass market and caused a very unusual industry average price increase of several percent. In last few months top glass suppliers Corning, NEG, and AGC have all experienced production problems. A tank failure at Corning, a power outage at NEG, and an accident at an AGC glass plant all resulted in glass supply constraints when demand and production has been increasing.

In March 2021 Corning announced its plan to increase glass prices in 2Q21. Corning has also increased supply by starting glass tank in Korea to supply China’s Gen 10.5 fabs that are ramping up. Most of the growth in capacity is coming from Gen 8.6 and Gen 10.5 fabs in China.

Besides glass there have been other component shortages including driver ICs and polarizers. The lack of investment in polarizers and base films in 2019 caught the industry off guard when demand turned around in 2020. Multiple other materials are also in tight supply and are affecting different makers in different ways, supporting inflationary price trends.

Widespread component supply shortages could impact availability on LCD TV panels from CSOT and Innolux. The display panel manufacturers have warned that supplies of panels are expected to be tight throughout the year.

According to Li Dongsheng, chairman, TCL, panel shortages will continue in 1H21, following conditions already hampered last year during the start of the COVID-19 pandemic. The situation for 2H21 remains to be seen but for 2021 overall panel supply will be tight.

James Yang, president, Innolux, has warned of a shortage in LCD panels caused by strong demand for LCD coming out of the global crisis and the conditions are expected to continue through 2021. Innolux has seen shortages in LCD components including power semiconductors, driver ICs and glass substrates that have kept production below capacity. Shortages of ICs and semiconductors could continue right up to the 1H22.

Ironically, prior to the run-on LCD panel supplies, manufacturers were faced with the dilemma of overproduction causing a glut in inventory, which was driving prices artificially lower. This was the result of giant new LCD fabs coming online in China and other areas of Asia.

Panel makers, being cognizant of that threat, are expected to produce panels at a more tempered pace to keep margins healthy. LCD panel prices continued to rise in March after moving up in February.

Almost all Chinese panel makers are doing everything they can to incrementally increase their current factories’ capacities through productivity enhancements and new equipment purchases for debottlenecking or capacity expansions. For the same reasons, South Korean panel makers continue to delay shutting down their domestic LCD TV factories.

TV manufacturers have been moving aggressively to replenish inventories of LCD panels to meet strong sales of TVs and other devices to meeting escalating demand, particularly in the United States and Europe.

An increase in demand for larger size TVs in 2H20 combined with component shortages has pushed the market to supply constraint and caused continuous panel price increases from June 2020 to March 2021. The panel price increase resulting in higher costs for TV brands. It has also made it difficult for lower priced brands to acquire enough panels to offer lower priced TVs. Further, panel suppliers are giving priority to top brands with larger orders during supply constraint.

For 3 years, from 2017 to 2020, LCD panel makers suffered through a continuous pattern of price declines interrupted only with brief respites. With the COVID-19 demand surge assisted by shortages in glass and DDICs, panel prices are spiking. Korean, Taiwanese, and Chinese panel makers are reporting robust margins in 1Q 2021 and the good news is anticipated for panel makers to get even better in 2Q.

Although multiple caveats remain about how both supply and demand will trend over the coming months, the modeled glut level is a leading indicator that the next cycle is now on its way, which implies falling prices, utilization, and profitability. Industry players should consider the implications when planning business strategies for the next 2 years.

In 2021, LCD panel prices are expected to climb in 1Q, remain flat in 2Q, and decline from 3Q. Backed by ongoing facility expansions, Chinese LCD panel makers should see a continuing rise in M/S. In addition, a recent blackout at the Japanese factory of NEG, a glass substrate maker, should also benefit Chinese firms.

LCD panel prices, which ended high in 2020, are expected to continue rising in 1Q21 on an anticipated decrease in glass substrate supply. On Dec 10, a power outage occurred at NEG’s Takatsuki plant in Japan. With normalization at the Takatsuki plant expected in 1Q21, domestic and Taiwanese panel makers’ sourcing of glass substrate is unlikely to proceed smoothly in the near future. In 2Q21, an acceleration in panel production alongside normalized supply of glass substrate should prevent LCD panel price growth. The rate of glass substrate supply excess is forecast to widen from 0.5% in 1Q21 to 3.6% in 2Q21.

LCD panel prices are forecast to decline from 3Q21, as supply should exceed demand. We expect supply excess for LCD panels to reach 3.2% in 3Q21 and 3.4% in 4Q21 on the back of ongoing production expansion at Chinese manufacturers.

Chinese LCD panel makers are to continue expanding their production capacity, centering on 8G-and-above facilities, in a bid to increase M/S. Given Korea’s withdrawal from the LCD arena, we expect the global number of LCD production facilities (8G or higher) to fall from 32 in 2020 to 31 in 2021 to 30 in 2022. On the other hand, with Chinese panel makers ramping up investment, the portion of Chinese manufacturers is to increase from 63% in 2020 to 68% in 2021 to 78% in 2022, with China coming to claim a market-leading position.

Of note, Chinese panel makers are highly likely to see M/S expansion in 1Q21, as they are insulated from the effects of NEG’s Takatsuki power outage. Chinese companies’ glass substrate supply chain has diversified to encompass Corning, AGC, and NEG (China, Xiamen plant).

Ms.Josey

Ms.Josey

Ms.Josey

Ms.Josey